India Energy as a Service Market Size, Share, Trends and Forecast by Service Type, End User, and Region, 2025-2033

Market Overview:

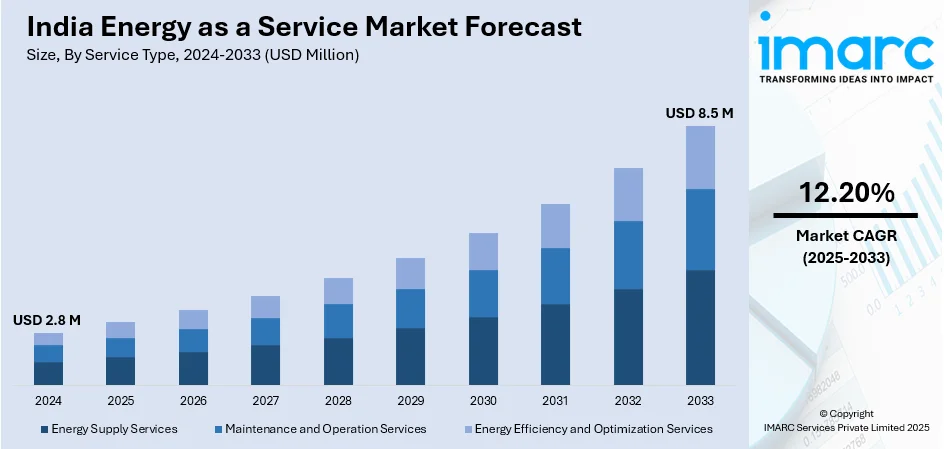

India energy as a service market size reached USD 2.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 8.5 Million by 2033, exhibiting a growth rate (CAGR) of 12.20% during 2025-2033. The inflating need for energy management and the growing consumer environmental concerns are primarily augmenting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.8 Million |

| Market Forecast in 2033 | USD 8.5 Million |

| Market Growth Rate (2025-2033) | 12.20% |

Energy as a service (EaaS) represents a business framework wherein a third-party entity furnishes energy-related services to a client, allowing for a more adaptable and effective strategy in energy administration. The model encompasses various elements, including the provision of energy, the management of infrastructure, and the implementation of measures to enhance energy efficiency. Energy as a service finds widespread application in operations related to microgrids, optimization of buildings, integration of renewable energy sources, management of demand response, deployment of energy storage solutions, and overseeing utility management. This business model is both cost-efficient and scalable, contributing to the enhancement of energy efficiency, the reduction of carbon emissions, the streamlining of operations, and the promotion of sustainable practices.

To get more information on this market, Request Sample

India Energy as a Service Market Trends:

The energy as a service market in India is rapidly evolving, reflecting the country's commitment to adopting innovative energy management solutions. Additionally, the inflating need for flexible and efficient energy utilization is acting as another significant growth-inducing factor. In this market, third-party providers deliver a range of energy-related services to clients, encompassing components such as energy supply, infrastructure management, and energy efficiency measures. Moreover, the multifaceted application of energy as a service in India is particularly notable. It extends to diverse sectors including microgrid operations, building optimization, renewable energy integration, demand response management, energy storage solutions, and utility management. Besides this, the flexibility and scalability inherent in the EaaS model make it particularly appealing for businesses seeking cost-effective and sustainable energy solutions. One of the key advantages of the EaaS market in India lies in its potential to improve energy efficiency. By leveraging the expertise of third-party providers, businesses can optimize their energy consumption, streamline operations, and reduce their carbon footprint. This aligns with India's broader goals of achieving energy sustainability and reducing environmental impact. The renewable energy sector in India stands to benefit significantly from the energy as a service model. Furthermore, as businesses increasingly recognize the advantages of EaaS in enhancing operational efficiency and sustainability, the market is poised for growth over the forecasted period.

India Energy as a Service Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on service type and end user.

Service Type Insights:

- Energy Supply Services

- Maintenance and Operation Services

- Energy Efficiency and Optimization Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes energy supply services, maintenance and operation services, and energy efficiency and optimization services.

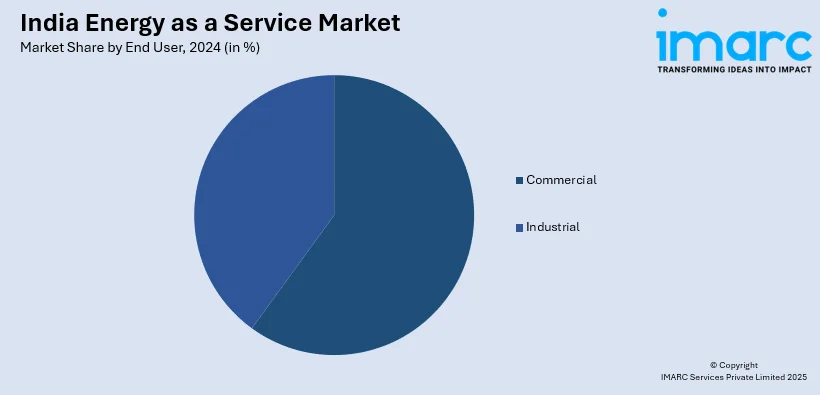

End User Insights:

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes commercial and industrial.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Energy as a Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Energy Supply Services, Maintenance and Operation Services, Energy Efficiency and Optimization Services |

| End Users Covered | Commercial, Industrial |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India energy as a service market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India energy as a service market?

- What is the breakup of the India energy as a service market on the basis of service type?

- What is the breakup of the India energy as a service market on the basis of end user?

- What are the various stages in the value chain of the India energy as a service market?

- What are the key driving factors and challenges in the India energy as a service?

- What is the structure of the India energy as a service market and who are the key players?

- What is the degree of competition in the India energy as a service market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India energy as a service market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India energy as a service market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India energy as a service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)