India Elevator and Escalator Market Size, Share, Trends and Forecast by Type, Service, End Use, and Region, 2025-2033

India Elevator and Escalator Market Size and Share:

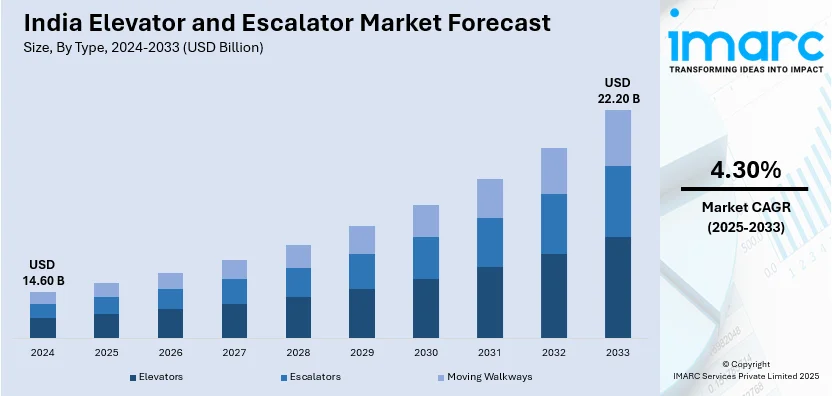

The India elevator and escalator market size reached USD 14.60 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 22.20 Billion by 2033, exhibiting a growth rate (CAGR) of 4.30% during 2025-2033. The increasing high-rise construction, government initiatives like Smart Cities and affordable housing projects, rising demand in metro stations, airports, and commercial spaces, and technological advancements in energy-efficient and IoT-enabled elevators are contributing to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.60 Billion |

| Market Forecast in 2033 | USD 22.20 Billion |

| Market Growth Rate 2025-2033 | 4.30% |

India Elevator and Escalator Market Trends:

Rapid Urbanization and Increased High-Rise Constructions

India's rapid urbanization is driving demand for elevators and escalators, fueled by a surge in high-rise residential and commercial buildings. The United Nations projects that by 2030, 40.76% of India's population will live in urban areas, up from 34.93% in 2020, necessitating vertical infrastructure expansion. Government programs such as the Smart Cities Mission and Pradhan Mantri Awas Yojana (PMAY) are driving rapid urban growth and infrastructure development. The Smart Cities Mission aims to build 100 smart cities, while PMAY targets 20 million affordable houses by 2022, both of which contribute to increased demand for vertical transportation solutions. The Smart Cities initiative has particularly spurred investment in urban mobility and housing, directly boosting the elevator and escalator market. Additionally, India's commercial real estate sector is expanding, with office space absorption reaching 42 million square feet in 2022, reflecting strong demand for elevators in newly constructed office buildings. As urbanization continues, coupled with large-scale infrastructure projects, the elevator and escalator market is poised for significant growth.

To get more information on this market, Request Sample

Integration of Advanced Technologies

By March 2023, Gujarat had approximately 1.10 lakh elevators, with 11,000 added in the 2022-2023 period. Ahmedabad led the state with 41,000 lifts, reflecting the fast growth of India's elevator and escalator industry. The sector is increasingly integrating advanced technologies to improve efficiency, safety, and user experience. IoT and AI-driven predictive maintenance are helping to reduce downtime and operational costs. Energy efficiency is another priority, with manufacturers introducing regenerative drives that lower energy consumption by up to 30%. Since elevators and escalators contribute 2-5% of a building’s total energy use, these innovations support sustainable urban development. Touchless technologies have also gained traction. Mobile-based elevator controls and voice-activated systems are improving user safety and convenience by minimizing physical contact. A survey revealed that 75% of respondents prefer buildings with touchless elevator controls, underscoring a shift in consumer preferences. With these advancements, India's elevator and escalator market is set to grow, driven by urban expansion, government initiatives, and increasing demand for smart, sustainable, and user-friendly infrastructure solutions.

India Elevator and Escalator Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, service and end use.

Type Insights:

- Elevators

- Escalators

- Moving Walkways

The report has provided a detailed breakup and analysis of the market based on the type. This includes elevators, escalators, and moving walkways.

Service Insights:

- New Installation

- Maintenance and Repair

- Modernization

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes new installation, maintenance and repair, and modernization.

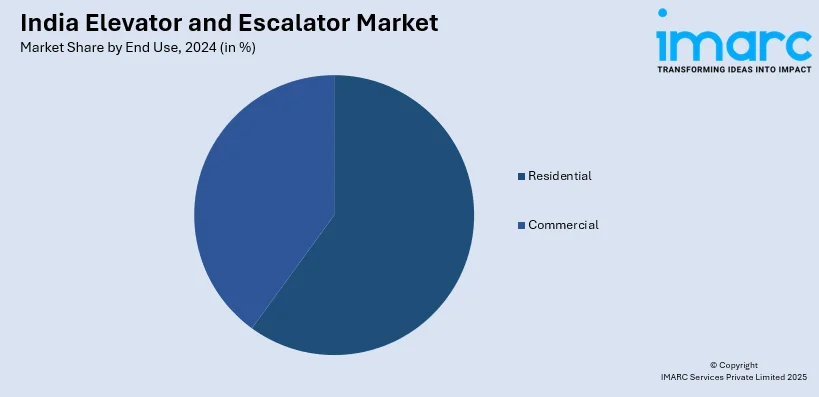

End Use Insights:

- Residential

- Commercial

- Offices

- Hospitality

- Mixed Block

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes residential and commercial (offices, hospitality, mixed block, and others).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Elevator and Escalator Market News:

- March 2025: India's BRIO Elevators revealed the Brio BE360, the country's first hybrid hydraulic elevator with a 360° panoramic view. The hydraulic lift, which utilizes hybrid hydraulic technology, provides smooth and silent rides, a space-saving design, and a 360° panoramic view. It is perfect for residential areas such as duplexes, villas, and penthouses that require both space efficiency and beauty.

- December 2024: KONE India unveiled its new line of SMART elevators at the International Sourcing Exposition for Elevators (ISEE 2024) in Mumbai. These elevators comply with the updated IS 17900 safety standards and incorporate cutting-edge features such as Programmable Electronic System in Safety-Related Applications for Lifts (PESSRAL) technology, tamper-proof safety modules, fail-safe redundancy, high-strength door systems, dual-channel safety controllers, and light curtains.

- February 2024: Hybon Elevators and Escalators announced a Rs 25 crore investment in R&D at its Noida manufacturing facility. The investment seeks to raise the company's yearly output from 900 to 1800 units while also improving the quality and standards of Hybon's technology. Hybon Elevators is devoted to developing revolutionary lift solutions like IoT, Remote Monitoring Systems, and pitless lifts, with the goal of elevating experiences and transforming lives.

- January 2024: TK Elevator introduced a home elevator idea for multi-story mansions and villas to address the need for luxury living space. The elevator can go six floors or 18 meters, has a weight bearing capability of 320-400 kgs, and is supplied by a conventional domestic single-phase power supply. Its automated rescue feature directs people to the nearest floor in the event of a power loss.

India Elevator and Escalator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Elevators, Escalators, Moving Walkways |

| Services Covered | New Installation, Maintenance and Repair, Modernization |

| End Uses Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India elevator and escalator market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India elevator and escalator market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India elevator and escalator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The elevator and escalator market in India was valued at USD 14.60 Billion in 2024.

The India elevator and escalator market is projected to exhibit a CAGR of 4.30% during 2025-2033, reaching a value of USD 22.20 Billion by 2033.

India elevator and escalator market is growing due to urbanization, infrastructure projects, and demand for high-rise buildings. Government initiatives like Smart Cities and affordable housing boost installations. Modernization of aging systems, adoption of energy-efficient and IoT-enabled technologies, and focus on accessibility and safety also drive the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)