India Electric Welding Machine Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Electric Welding Machine Market Overview:

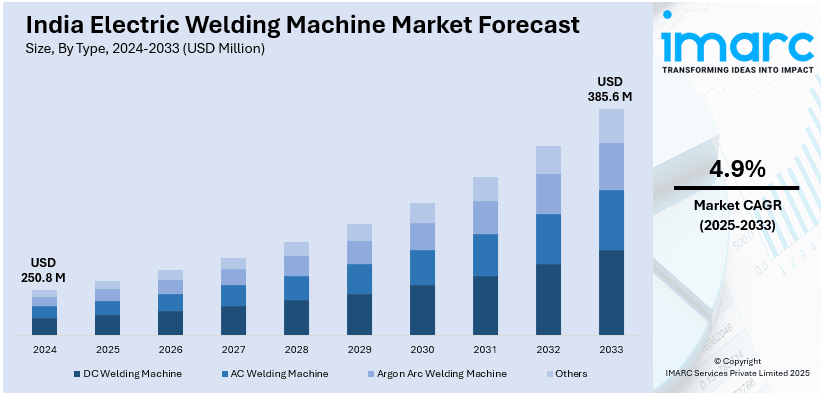

The India electric welding machines market size reached USD 250.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 385.6 Million by 2033, exhibiting a growth rate (CAGR) of 4.9% during 2025-2033. The market is driven by increasing infrastructure development, industrial automation, and rising demand from sectors like construction, automotive, and manufacturing, along with ongoing advancements in energy-efficient and inverter-based welding technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 250.8 Million |

| Market Forecast in 2033 | USD 385.6 Million |

| Market Growth Rate 2025-2033 | 4.9% |

India Electric Welding Machine Market Trends:

Growth in Infrastructure and Industrial Expansion

The India electric welding machine market growth is primarily driven by the fast-paced infrastructure development and industrial growth of the region. In line with this, government initiatives to develop large-scale infrastructure such as highways and railways along with smart cities and industrial corridors drive the high demand for welding equipment in construction and heavy engineering projects. Through the "Make in India" initiative, the government supports local manufacturing, which increases welding machine usage throughout automotive and aerospace sectors and shipbuilding operations. Furthermore, prefabricated construction methods need precise and efficient welding solutions for their success. Also, manufacturers are creating advanced welding technologies with automated welding machines and inverter-based machines that deliver improved weld quality and decreased power usage, and increased efficiency. For instance, Nikit Engineers introduced the Mini Profile Welder at WELDTECH EXPO 2024 in Kolkata. This automated welding machine offers enhanced precision, efficiency, and versatility, streamlining welding operations across various industries. As a result, the electric welding machine market in India is growing steadily because industries adopt automated precision welding solutions along with ongoing technological advancements and policy initiatives in industrial development.

To get more information on this market, Request Sample

Rising Adoption of Energy-Efficient and Smart Welding Technologies

The India electric welding machine market outlook is changing toward energy-efficient and smart welding technologies due to increasing energy consumption and operational efficiency concerns. Traditional welding machines waste substantial power while producing heat waste, which drives up operational expenses. In line with this, the market is adopting inverter-based welding machines because these devices use less power and provide better arc stability and offer enhanced portability. Industrial progress through Industry 4.0 and Internet of Things (IoT) integration within welding machines leads to a transformative impact on the market. For example, the SAMARTH Udyog Bharat 4.0 initiative promotes Industry 4.0 adoption, integrating Industrial Internet of Things (IIoT) in welding for real-time monitoring, automated adjustments, and remote diagnostics, boosting productivity and minimizing downtime in manufacturing. Besides this, smart welding machines with real-time monitoring systems, automated adjustment features, and remote diagnostic capabilities boost both weld precision along with productivity and decrease downtime. Furthermore, robotic welding systems have become standard practice for the automotive as well as heavy machinery sectors because they boost operational consistency and productivity. Apart from this, the increasing demand for eco-friendly intelligent welding solutions driven by government programs, aimed at sustainable manufacturing and energy conservation, thus establishing digital energy-efficient welding technologies as major trends and boosting the India electric welding machines market share.

India Electric Welding Machine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- DC Welding Machine

- AC Welding Machine

- Argon Arc Welding Machine

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes DC welding machine, AC welding machine, argon arc welding machine, and others.

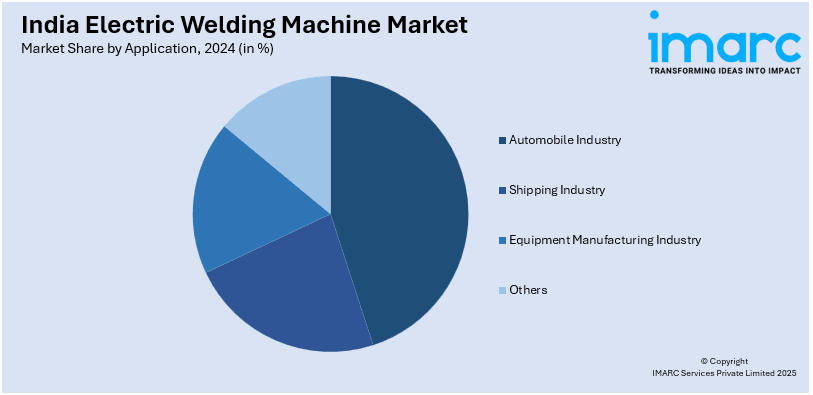

Application Insights:

- Automobile Industry

- Shipping Industry

- Equipment Manufacturing Industry

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automobile industry, shipping industry, equipment manufacturing industry, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Electric Welding Machine Market News:

- In April 2024, Fronius India Private Limited expanded its operations by opening a new regional office and skill center in Hyderabad. The center is equipped with robotic and manual welding booths, and aims to provide training and demonstrations, enhancing the skill set of welding professionals in the region.

- In November 2023, the Leister Group inaugurated Weldy Technologies India Pvt. Ltd. in Coimbatore. The company focuses on developing and producing Weldy-branded hand tools and automatic welding machines tailored for the Indian market, leveraging local suppliers to meet specific requirements.

India Electric Welding Machine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | DC Welding Machine, AC Welding Machine, Argon Arc Welding Machine, Others |

| Applications Covered | Automobile Industry, Shipping Industry, Equipment Manufacturing Industry, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India electric welding machines market performed so far and how will it perform in the coming years?

- What is the breakup of the India electric welding machines market on the basis of type?

- What is the breakup of the India electric welding machines market on the basis of application?

- What is the breakup of the India electric welding machines market on the basis of region?

- What are the various stages in the value chain of the India electric welding machines market?

- What are the key driving factors and challenges in the India electric welding machines?

- What is the structure of the India electric welding machines market and who are the key players?

- What is the degree of competition in the India electric welding machines market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electric welding machines market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India electric welding machines market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electric welding machines industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)