India Electric Vehicle Battery Market Size, Share, Trends and Forecast by Battery Type, Propulsion Type, Vehicle Type, and Region, 2026-2034

India Electric Vehicle Battery Market Summary:

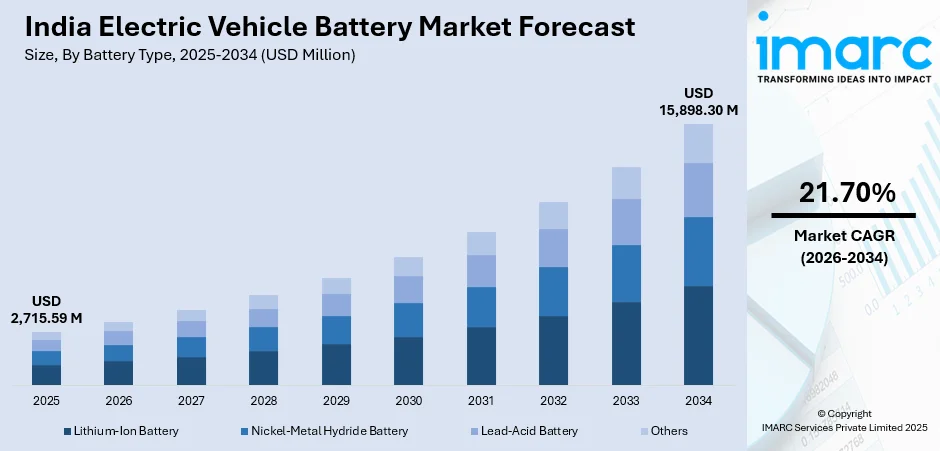

The India electric vehicle battery market size was valued at USD 2,715.59 Million in 2025 and is projected to reach USD 15,898.30 Million by 2034, growing at a compound annual growth rate of 21.70% from 2026-2034.

The India electric vehicle (EV) battery market is experiencing robust growth driven by government initiatives promoting electric mobility, expanding domestic manufacturing capabilities, and increasing environmental awareness among individuals. Supportive policies, including production-linked incentive, schemes for advanced chemistry cells, and dedicated EV promotion programs, are bolstering the market growth. Rising investments in charging infrastructure, declining battery costs, and technological advancements in lithium-ion battery chemistry are reshaping the competitive landscape, positioning India as an emerging hub for EV battery manufacturing.

Key Takeaways and Insights:

- By Battery Type: Lithium-ion battery dominates the market with a share of 58% in 2025, owing to its superior energy density, longer cycle life, faster charging capability, and declining costs.

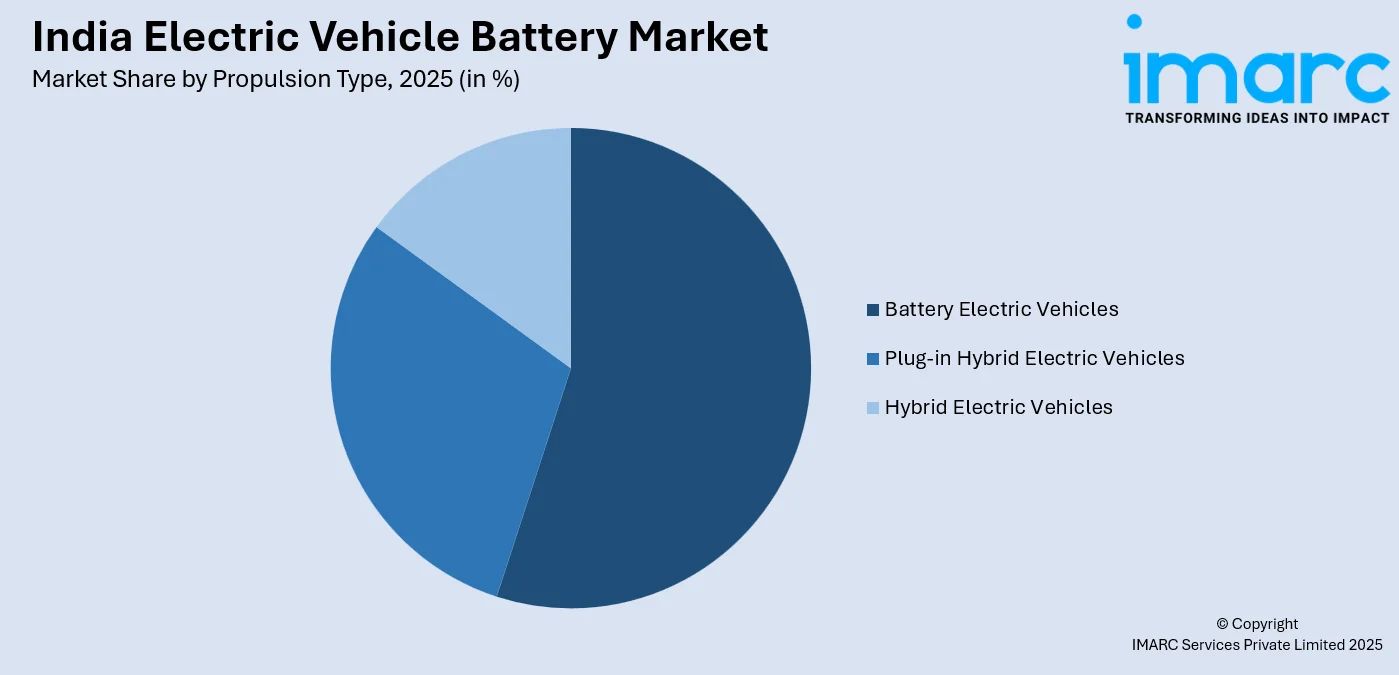

- By Propulsion Type: Battery electric vehicles lead the market with a share of 55% in 2025, reflecting strong user preference for fully electric, zero-emission transportation solutions supported by government incentives and expanding charging networks.

- By Vehicle Type: Passenger car represents the largest segment with a market share of 40% in 2025, driven by increasing user adoption of electric personal vehicles and the availability of diverse model offerings from domestic manufacturers.

- By Region: North India dominates the market with a share of 29% in 2025, supported by strong industrial infrastructure in states like Uttar Pradesh and Delhi, favorable government policies, and high EV registration numbers.

- Key Players: The India electric vehicle battery market exhibits moderate competitive intensity, with domestic manufacturers expanding capacity alongside international partnerships to develop advanced battery technologies and strengthen supply chain capabilities. . Some of the key players operating in the market include Aqueouss, Batteryinc, Battrixx, Bharatcell, EV Battery Solutions, Exicom Energy Systems Pvt. Ltd, Exide Industries Limited, Grinntech Motors & Services Pvt. Ltd., Ipower batteries, and Yuki Electric India Pvt Ltd.

To get more information on this market Request Sample

The India electric vehicle battery market is driven by strong policy support, accelerating EV adoption, and strategic focus on domestic manufacturing and supply chain resilience. Rising demand for clean mobility, expanding charging infrastructure, and cost reduction targets are driving the need for locally produced battery systems. Government initiatives are playing a central role in shaping market direction by encouraging localization of critical components and reducing reliance on imports. In 2024, the Government of India reportedly planned a ₹9,000-crore initiative to boost domestic production of EV battery components, including electrodes, anodes, cathodes, electrolytes, and copper foil, under the leadership of the Ministry of Heavy Industries. This program aimed to attract large-scale investment, strengthen upstream manufacturing, and enhance technological capability. Such measures support long-term capacity building, improve cost competitiveness, and position India as a global hub for electric vehicle battery manufacturing, reinforcing sustained market growth.

India Electric Vehicle Battery Market Trends:

Rising Electric Vehicle Adoption

The growing adoption of electric two-wheelers, three-wheelers, and fleet-based electric cars is directly expanding battery demand across India’s mobility sector. Urban transport needs, higher fuel prices, and wider charging access are steadily shifting buyer preference toward electric options. This trend is reflected in market by IBEF, with India’s EV sales increasing 16.9% in FY25 to 1.97 million units, including 1.15 million electric two-wheelers, nearly 700,000 electric three-wheelers, and over 100,000 electric passenger vehicles. Commercial fleet operators, focused on operating cost savings, are driving bulk battery procurement, while public transport electrification programs add consistent demand, strengthening the domestic battery market.

Strong Government Policies Support

India’s electric vehicle battery market continues to benefit from strong policy backing focused on accelerating electric mobility adoption. Central programs like FAME II and various state incentives lower battery costs through subsidies, tax relief, and demand-side measures, while production-linked incentives promote domestic cell manufacturing. Policy support is also translating into practical market mechanisms, as seen in 2025 when JSW MG Motor India and Axis Bank introduced a dual-loan financing model offering up to 100% on-road funding and battery loan tenures of up to eight years under a Battery-as-a-Service structure. Such initiatives improve affordability, reduce import dependence, and give manufacturers confidence to expand capacity and invest in local battery ecosystems.

Localization of Battery Manufacturing Capacity

India is strengthening its electric vehicle battery market by scaling domestic manufacturing to reduce import dependence and improve supply reliability. Production-linked incentives are supporting investments in gigafactories and localized cell and pack assembly, helping lower logistics costs and stabilize pricing. This shift is visible on the ground, with localization levels reaching up to 92% in 2025, when Hyundai Motor India began assembling EV battery packs at its Chennai facility for use in the Creta Electric. Domestic production also allows better adaptation to Indian climate and driving conditions. As supporting ecosystems for materials, electronics, and thermal systems mature, local battery suppliers are gaining efficiency, reinforcing long-term market growth.

Market Outlook 2026-2034:

The India electric vehicle battery market demonstrates exceptional growth potential over the forecast period, supported by strong policy backing, rapid expansion of domestic manufacturing capacity, and increasing adoption of electric mobility. Government incentives, localization initiatives, and investments in advanced battery technologies are strengthening supply chains and reducing costs. Furthermore, the rising demand for clean transportation is expected to sustain long-term market growth. The market generated a revenue of USD 2,715.59 Million in 2025 and is projected to reach a revenue of USD 15,898.30 Million by 2034, growing at a compound annual growth rate of 21.70% from 2026-2034.

India Electric Vehicle Battery Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Battery Type | Lithium-Ion Battery | 58% |

| Propulsion Type | Battery Electric Vehicles | 55% |

| Vehicle Type | Passenger Car | 40% |

| Region | North India | 29% |

Battery Type Insights:

- Lithium-Ion Battery

- Nickel-Metal Hydride Battery

- Lead-Acid Battery

- Others

Lithium-ion battery dominates with a market share of 58% of the total India electric vehicle battery market in 2025.

Lithium-ion battery holds the biggest market share owing to its high energy density, extended driving range, and steadily declining lifecycle costs. This battery supports faster charging, consistent power delivery, and improved thermal performance across diverse operating conditions. Its adaptability makes it suitable for a wide range of electric vehicles, including passenger cars, two-wheelers, and commercial fleets. Ongoing advancements in cell chemistry and safety features continue to enhance reliability, efficiency, and overall performance, aligning well with evolving user and fleet operator expectations.

The segment is also influenced by strong manufacturer preference and established supply chains. Continuous advances in cell chemistry, thermal management, and safety standards are improving durability and performance. Government incentives and localized manufacturing efforts favor lithium-ion adoption. In 2024, Ola Electric announced a $100 million investment in the initial phase of its gigafactory in Tamil Nadu to manufacture indigenous lithium-ion battery cells. The move aimed to power Ola’s EVs with in-house batteries, reducing reliance on imports.

Propulsion Type Insights:

Access the comprehensive market breakdown Request Sample

- Battery Electric Vehicles

- Plug-in Hybrid Electric Vehicles

- Hybrid Electric Vehicles

Battery electric vehicles lead with a market share of 55% of the total India electric vehicle battery market in 2025.

Battery electric vehicles dominate the market due to their fully electric architecture, which requires higher battery capacity and supports stronger demand for advanced traction batteries. Zero tailpipe emissions, lower operating and maintenance costs, and eligibility for central and state-level incentives make battery electric vehicles more attractive than hybrid alternatives. These advantages align with national clean mobility objectives, encouraging consumers and businesses to adopt fully electric solutions and driving sustained demand for high-capacity battery systems across multiple vehicle categories.

Widespread adoption of battery electric two-wheelers, passenger cars, and commercial fleets is further reinforcing this dominance. Continuous expansion of public and private charging infrastructure, along with improvements in battery efficiency, charging speed, and driving range, is strengthening user confidence. In addition, fleet operators increasingly prefer battery electric vehicles due to predictable operating expenses and lower fuel volatility, accelerating battery demand across urban and intercity transportation networks nationwide.

Vehicle Type Insights:

- Passenger Car

- Commercial Vehicles

- Two-Wheeler

Passenger car exhibits a clear dominance with a 40% share of the total India electric vehicle battery market in 2025.

Passenger cars lead the market due to rapid urbanization, rising environmental awareness, and a growing preference for personal mobility solutions. Government incentives, lower operating costs, and expanding charging infrastructure encourage people to shift from conventional vehicles to electric passenger cars, increasing battery demand. Notably, according to the Federation of Automobile Dealers Associations (FADA), India’s passenger EV retail sales rose 77.04% year-on-year in 2025, reinforcing the leadership of the segment.

The presence of both domestic and global automakers offering a growing range of electric passenger car models is further strengthening segment dominance. Ongoing improvements in battery energy density, driving range, charging efficiency, and overall vehicle performance are enhancing user confidence and acceptance. In addition, attractive financing options, government incentives, and increasing fleet adoption by corporate and shared mobility operators are supporting higher battery demand. These factors collectively support sustained growth of passenger car battery usage across major urban centers in India.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India dominates with a market share of 29% of the total India electric vehicle battery market in 2025.

North India represents the largest segment, supported by effective policy implementation, early adoption of electric mobility, and a strong concentration of automotive manufacturing hubs. States, such as Delhi NCR, Haryana, and Uttar Pradesh, benefit from expanding charging infrastructure, large-scale fleet electrification programs, and supportive state incentives. Proximity to major vehicle OEMs, battery assemblers, and component suppliers enhances supply chain efficiency, accelerates investment, and supports rapid scaling of battery production and deployment across the region.

The region also gains from higher urban income levels, dense commercial activity, and aggressive state-level incentives encouraging EV adoption. Presence of logistics corridors and industrial clusters supports efficient supply chains for battery production and distribution. For instance, as per government data, Uttar Pradesh leads the country in electric vehicle adoption with over 400,000 registered vehicles as of May 2025, primarily driven by e-rickshaw proliferation and supportive state policies.

Market Dynamics:

Growth Drivers:

Why is the India Electric Vehicle Battery Market Growing?

Cost Reduction Through Technology Advancements

Technological progress in battery chemistry, energy density, and manufacturing is steadily reducing battery costs across India. Advances in lithium-ion formulations, thermal management, and battery management software are extending lifespan and improving safety, lowering long-term ownership expenses. These gains are becoming tangible at the industry level, as demonstrated in 2025, when Hyundai Motor India announced next-generation EV batteries offering over 90% capacity retention after 400,000 kilometers, alongside 15% higher energy density and faster charging. The company also indicated a potential 30% cost reduction by 2027. Such improvements enhance affordability and reliability, expanding EV adoption and sustaining battery demand growth nationwide.

Expansion of Charging Infrastructure and Grid Support

Expansion of public and private charging infrastructure is playing a key role in supporting India’s electric vehicle battery market growth. Improved charging access enhances range confidence, raises battery utilization, and shortens replacement cycles, strengthening aftermarket demand. This momentum was reinforced in 2025, when the Government of India issued operational guidelines under the PM E-DRIVE scheme, allocating ₹2,000 crore to develop public charging and battery swapping infrastructure across cities, highways, airports, ports, and public facilities. Grid upgrades and renewable energy integration further support reliable charging operations. As standardized and accessible charging networks spread nationwide, battery demand continues to grow across passenger vehicles, commercial fleets, and public transport systems.

Private Investment and Strategic Industry Partnerships

Rising private investment and strategic collaborations are playing a central role in propelling the India electric vehicle battery market growth. Automotive manufacturers, energy companies, and technology firms are forming partnerships to secure long-term battery supply while accelerating technology development. This trend was evident in 2025, when Suzuki Motor Corporation partnered with Tata Gotion, TDS Lithium-ion Battery Gujarat, FinDreams Battery, and ELIIY Power to support battery supply, R&D, and local manufacturing for electric motorcycles, hybrids, and BEVs. Such alliances attract foreign capital, strengthen domestic capabilities, and enable faster capacity expansion, reinforcing investor confidence and positioning India as a key global growth hub for electric vehicle batteries.

Market Restraints:

What Challenges the India Electric Vehicle Battery Market is Facing?

Heavy Dependence on Imported Raw Materials

India’s electric vehicle battery industry remains heavily dependent on imported raw materials, including lithium, cobalt, and nickel. Limited domestic availability of these critical minerals exposes manufacturers to supply chain disruptions, price volatility, and foreign exchange risks. This reliance increases production costs and constrains large-scale battery manufacturing expansion, highlighting the need for resource diversification and secure long-term sourcing strategies.

High Initial Battery and Vehicle Costs

The high cost of lithium-ion batteries remains a major barrier to wider adoption of electric vehicles in India. Although global battery prices have declined, EVs still carry a price premium compared to internal combustion engine vehicles. This cost gap limits affordability for price-sensitive buyers, particularly within lower and middle-income segments, slowing mass-market penetration and delaying broader consumer transition to electric mobility.

Supply Chain Fragmentation and Technology Gaps

The domestic battery supply chain remains fragmented with limited local manufacturing capabilities for critical cell components, such as cathode materials, anodes, and electrolytes, requiring continued reliance on technology transfer agreements with international partners. Establishing fully integrated cell manufacturing requires substantial capital investments and technical expertise that many domestic players are still developing.

Competitive Landscape:

The India electric vehicle battery market exhibits moderate competitive intensity characterized by the presence of established domestic battery manufacturers alongside emerging technology players and international partnerships. Market dynamics reflect strategic positioning across multiple chemistries including lithium-ion nickel manganese cobalt and lithium iron phosphate formulations, with companies targeting various vehicle segments from two-wheelers to passenger cars and commercial vehicles. The competitive landscape is increasingly shaped by manufacturing scale-up capabilities, technology licensing arrangements, supply chain integration initiatives, and strategic collaborations with automotive original equipment manufacturers seeking localized battery sourcing solutions.

Some of the key players in the market include:

- Aqueouss

- Batteryinc

- Battrixx

- Bharatcell

- EV Battery Solutions

- Exicom Energy Systems Pvt. Ltd

- Exide Industries Limited

- Grinntech Motors & Services Pvt. Ltd.

- Ipower batteries

- Yuki Electric India Pvt Ltd.

Recent Developments:

- December 2025: Maruti Suzuki announced plans to gradually localize EV battery production and key components ahead of the domestic launch of its first electric car, the e-Vitara. The company aimed to strengthen India’s EV ecosystem, improve buyer confidence, and reduce dependence on imported batteries through phased localization.

- June 2025: Neuron Energy launched its Gen 2 lithium-ion battery packs for electric two-wheelers, three-wheelers, and LCVs, with commercial availability from July 2025. The new packs featured improved structural design, better heat dissipation, vibration resistance, and a smart battery management system for Indian operating conditions.

India Electric Vehicle Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Battery Types Covered | Lithium-Ion Battery, Nickel-Metal Hydride Battery, Lead-Acid Battery, Others |

| Propulsion Types Covered | Battery Electric Vehicles, Plug-In Hybrid Electric Vehicles, Hybrid Electric Vehicles |

| Vehicle Types Covered | Passenger Car, Commercial Vehicles, Two-Wheeler |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Aqueouss, Batteryinc, Battrixx, Bharatcell, EV Battery Solutions, Exicom Energy Systems Pvt. Ltd, Exide Industries Limited, Grinntech Motors & Services Pvt. Ltd., Ipower batteries, Yuki Electric India Pvt Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India electric vehicle battery market size was valued at USD 2,715.59 Million in 2025.

The India electric vehicle battery market is expected to grow at a compound annual growth rate of 21.70% from 2026-2034 to reach USD 15,898.30 Million by 2034.

Lithium-ion battery dominates the India electric vehicle battery market with a revenue share of 58%, driven by superior energy density, extended cycle life, rapid charging capabilities, and significant investments in domestic cell manufacturing infrastructure under government incentive schemes.

Key factors driving the India electric vehicle battery market include expansion of domestic battery manufacturing ecosystem. This change is evident with localization rates hitting as high as 92% in 2025, when Hyundai Motor India started assembling EV battery packs at its Chennai plant for the Creta Electric.

Major challenges include heavy dependence on imported raw materials for critical minerals such as lithium and cobalt, high initial battery and vehicle costs limiting mass market adoption, supply chain fragmentation, technology gaps in domestic manufacturing capabilities, and inadequate recycling of infrastructure for end-of-life batteries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)