India Electric Rickshaw Market Size, Share, Trends and Forecast by Motor Power, Battery Capacity, Battery Type, Sales Channel, End User, and Region 2026-2034

India Electric Rickshaw Market Summary:

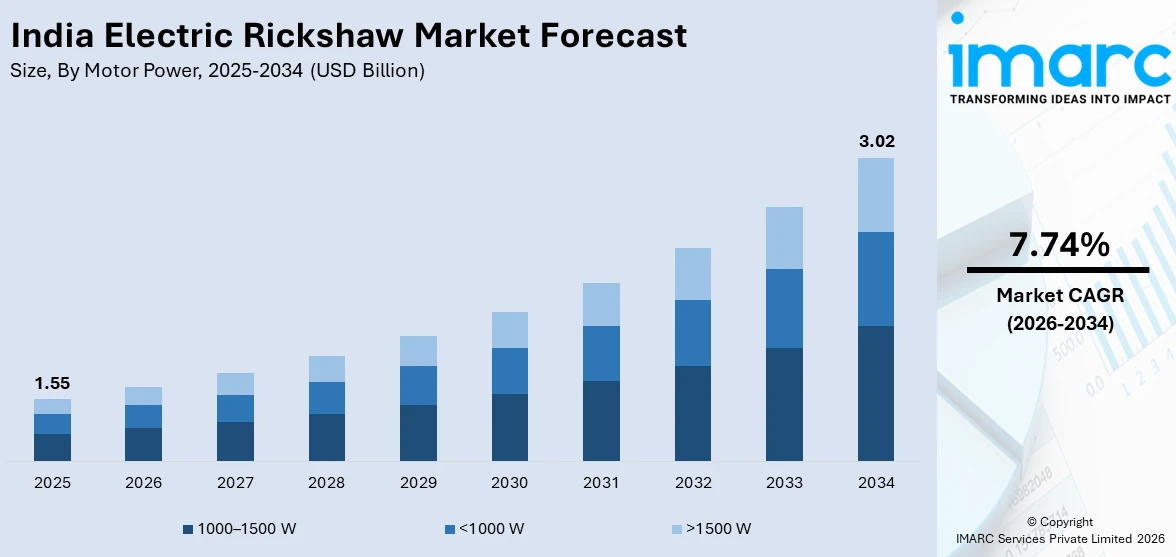

The India electric rickshaw market size was valued at USD 1.55 Billion in 2025 and is projected to reach USD 3.02 Billion by 2034, growing at a compound annual growth rate of 7.74% from 2026-2034.

The India electric rickshaw market is experiencing notable growth driven by supportive government policies, rising fuel costs, and increasing environmental consciousness across urban and semi-urban regions. The growing demand for affordable last-mile connectivity solutions, coupled with substantial operational cost advantages over conventional vehicles, is accelerating adoption. Advancements in battery technologies, expanding organized manufacturing capabilities, and evolving user preferences toward eco-friendly transportation are collectively reshaping the competitive landscape and creating significant opportunities for the key players.

Key Takeaways and Insights:

- By Motor Power: 1000 – 15000 W dominates the market with a share of 60% in 2025, driven by optimal balance between power output and operational efficiency that meets diverse transportation requirements across varied Indian terrains.

- By Battery Capacity: >101 Ah leads the market with a share of 58% in 2025, reflecting the growing preference for extended range capabilities and reduced charging frequency among commercial operators.

- By Battery Type: Li-ion battery represents the largest segment with a market share of 55% in 2025, owing to superior energy density, longer lifecycle, and declining costs that enhance overall vehicle economics.

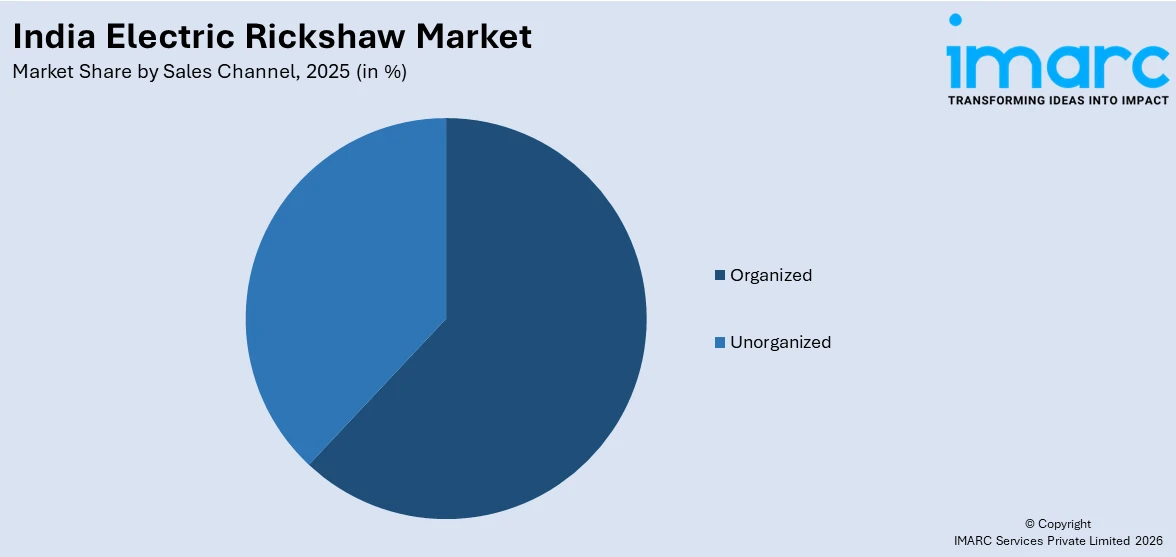

- By Sales Channel: Organised dominates the market with a share of 62% in 2025, benefiting from GST implementation, improved quality standards, and expanded dealership networks across key markets.

- By End User: Passenger carrier leads the market with a share of 70% in 2025, due to the rising demand for affordable shared mobility solutions in densely populated urban and peri-urban areas.

- By Region: North India represents the largest segment with a market share of 29% in 2025, because of concentrated urban populations, robust policy incentives, and well-established distribution infrastructure.

- Key Players: The India electric rickshaw market exhibits moderate competitive intensity, with established automotive manufacturers expanding alongside regional players competing across price segments, focusing on product innovation, after-sales service networks, and financing solutions. Some of the key players include Adapt Motors Private Limited, ATUL Auto Limited, CityLife EV, E-Ashwa Automotive Private Limited, Goenka Electric Motor Vehicles Private Limited, Jezza Motors (Vani Electric Vehicles Pvt. Ltd), Kinetic Green Energy & Power Solutions Ltd, Lohia Auto Industries, Mini Metro EV LLP, Saera Electric Auto Private Limited, Terra Motors India Corp., Thukral Electric Bikes, and Udaan E Rickshaw.

To get more information on this market Request Sample

The India electric rickshaw market represents one of the most dynamic segments within the nation’s electric mobility ecosystem. According to the Government of India’s Vahan vehicle registration dashboard, over 18.1 lakh e-rickshaws were registered across the country as of November 2024, highlighting the substantial adoption of these vehicles for daily transportation needs. Rapid growth in short-distance commuting demand, especially in congested cities and underserved semi-urban regions, is making electric rickshaws a key solution for last-mile connectivity. Lower operating and maintenance costs compared to fuel-based three-wheelers are improving income stability for drivers and encouraging fleet expansion. Government incentives, registration clarity, and electrification targets are further accelerating adoption. Rising environmental concerns and the need to reduce urban air pollution are strengthening acceptance of cleaner transport alternatives. Additionally, increasing participation of established OEMs and private investment is improving product reliability, service support, and market formalization, enabling faster penetration across India’s diverse geographic and economic landscape.

India Electric Rickshaw Market Trends:

Strategic Partnerships

Collaborations between international automakers and domestic manufacturers are bolstering the market growth by strengthening engineering capabilities and accelerating the development of advanced e-rickshaw platforms. Such partnerships support improved safety, accessibility, and design standards while enabling faster commercialization through shared expertise. They also help expand market scale by combining international technology with local manufacturing and distribution strength. In 2025, Hyundai Motor Company announced it is exploring a partnership with TVS Motor to develop advanced electric rickshaws and micro four-wheelers for India’s last-mile mobility needs, showcased at Bharat Mobility Global Expo 2025, with TVS potentially leading production and marketing.

Rise of Shared Mobility Demand

The growing demand for shared mobility and cost-effective last-mile transportation is attracting new electric vehicle (EV) manufacturers to the e-rickshaw segment. Urban and semi-urban regions are increasingly dependent on e-rickshaws to address short-distance commuting requirements, particularly in areas with limited public transport connectivity. This growing reliance is encouraging EV companies to diversify their product portfolios, as exemplified in 2024 by ZELIO Ebikes, a Haryana-based EV company, which entered the e-rickshaw segment by launching its first “Tanga” models at the EV India Expo 2024 in New Delhi. The move reflected the rising demand for shared mobility and last-mile transport solutions in urban and semi-urban areas. ZELIO also planned a dedicated dealership network to support its growing e-rickshaw user base alongside its electric two-wheeler lineup.

Expansion of Charging and Battery Infrastructure

Infrastructure development is supporting adoption by addressing range and operational reliability concerns. Battery swapping models, localized charging hubs, and improved access to affordable battery packs are making electric rickshaws more practical. Informal charging networks are also emerging in dense transport corridors, ensuring operational continuity. In 2024, Jaipur authorities announced plans to identify dedicated e-rickshaw stands and charging stations across six city zones as part of a new segregation policy. The traffic, transport, and municipal departments allocated parking spaces and enforced zone-based movement using color-coded e-rickshaws. This step aimed to reduce congestion and improve regulation of last-mile mobility in the city.

Market Outlook 2026-2034:

The India electric rickshaw market shows strong growth potential over the forecast period, supported by rising urban mobility needs, increasing demand for affordable last-mile transport, and supportive government initiatives promoting EV. Expanding charging infrastructure, lower operating costs, and the rising adoption among small fleet operators further contribute to the market growth. The market generated a revenue of USD 1.55 Billion in 2025 and is projected to reach a revenue of USD 3.02 Billion by 2034, growing at a compound annual growth rate of 7.74% from 2026-2034.

India Electric Rickshaw Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Motor Power |

1000–1500 W |

60% |

|

Battery Capacity |

>101 Ah |

58% |

|

Battery Type |

Li-ion Battery |

55% |

|

Sales Channel |

Organised |

62% |

|

End User |

Passenger Carrier |

70% |

|

Region |

North India |

29% |

Motor Power Insights:

- <1000 W

- 1000–1500 W

- >1500 W

1000–1500 W dominates with a market share of 60% of the total India electric rickshaw market in 2025.

1000–1500 W accounts for the majority of the market share, as it offers a balance between performance, efficiency, and affordability. Motors in this range provide sufficient power for typical urban and semi-urban operations, including carrying passengers and light cargo over short distances. It offers better speed and load-handling capability compared to lower-powered alternatives, making it suitable for daily commercial use. Additionally, this motor category supports energy-efficient operation, helping drivers reduce running costs while maintaining reliable service.

The dominance of 1000–1500 W is also supported by its compatibility with commonly used battery systems and widespread availability among manufacturers. Electric rickshaw operators prefer this range because it performs well on varied road conditions, including congested city streets and moderately uneven rural routes. Regulatory compliance and standardization across vehicle models further encourage adoption of this motor capacity. Moreover, the growing demand for durable, cost-effective last-mile transport solutions continues to strengthen the market position of this motor power segment.

Battery Capacity Insights:

- <101 Ah

- >101 Ah

>101 Ah leads with a market share of 58% of the total India electric rickshaw market in 2025.

>101 Ah exhibits a clear dominance in the market attributed to its ability to provide longer driving range and improved operational efficiency for daily commercial usage. Higher-capacity batteries allow rickshaws to run for extended hours without frequent recharging, which is essential for drivers dependent on continuous income throughout the day. This segment also supports better performance under heavier passenger loads and challenging road conditions. As demand rises for reliable last-mile transport, higher-capacity batteries remain the preferred choice for operators.

The dominance of >101 Ah is further strengthened by advancements in battery technology and increasing availability of durable energy storage solutions. Operators favor this batter capacity because it reduces downtime, improves vehicle productivity, and offers better long-term cost benefits. The growing adoption of electric rickshaws in tier-II and tier-III cities also increases the need for extended range, as charging infrastructure may be limited. Additionally, manufacturers increasingly standardize models with higher-capacity batteries to meet market expectations.

Battery Type Insights:

- Li-ion Battery

- Lead Acid Battery

Li-ion battery exhibits a clear dominance with a 55% share of the total India electric rickshaw market in 2025.

Li-ion battery holds the biggest market share because of its higher energy density, longer lifespan, and improved efficiency compared to traditional lead-acid alternatives. This battery provides better driving range and faster charging, making it highly suitable for commercial electric rickshaw operations. Operators increasingly prefer Li-ion technology because it reduces maintenance requirements and improves overall vehicle performance. As electric mobility adoption accelerates, Li-ion battery is becoming the standard choice for manufacturers aiming to deliver reliable and modern rickshaw models.

The dominance of Li-ion battery is also supported by declining costs, government incentives for cleaner technologies, and rising investment in domestic battery production. Li-ion battery is lighter in weight, which enhances vehicle speed and load capacity while improving energy usage. It also performs better under frequent charging cycles, supporting intensive daily usage by drivers. Expanding charging infrastructure and increasing availability of battery swapping solutions further contribute to the growing preference for Li-ion battery, strengthening its leading position in the market.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Organized

- Unorganized

Organized dominates with a market share of 62% of the total India electric rickshaw market in 2025.

Organized represents the largest segment, driven by its ability to offer standardized products, better quality assurance, and stronger after-sales support. Buyers increasingly prefer purchasing from authorized dealers and established manufacturers, as this channel provide warranty coverage, reliable servicing, and access to genuine spare parts. Organized also comply more effectively with regulatory requirements, ensuring safer and legally approved vehicles. The growing user trust in branded electric rickshaws and the expanding presence of formal distribution networks further strengthen this segment’s dominance.

The dominance of this segment is also supported by improved financing options and partnerships with banks and non-banking financial companies. Many organized dealers provide easy loan availability and structured payment plans, making electric rickshaws more accessible to small-scale operators. Organized channels also benefit from better marketing, showroom presence, and customer outreach in urban and semi-urban markets. As the industry matures and demand rises for durable and compliant vehicles, the organized segment continues to capture a larger share of overall sales.

End User Insights:

- Passenger Carrier

- Load Carrier

Passenger carrier leads with a market share of 70% of the total India electric rickshaw market in 2025.

Passenger carrier dominates the market owing to the growing demand for affordable and efficient last-mile connectivity in urban and semi-urban areas. Electric rickshaws are widely used for short-distance passenger transport, especially in congested city streets where larger vehicles are less practical. Its low operating cost, ease of maneuverability, and ability to serve high-frequency routes make it highly attractive for daily commuting needs. Rising urbanization and increasing reliance on shared mobility options further drive demand in this segment.

The dominance of passenger carrier is also supported by its widespread adoption in public transport networks near metro stations, bus stops, and residential areas. This vehicle provides an economical travel option for commuters while offering stable income opportunities for drivers. Government policies promoting electric mobility and restrictions on conventional three-wheelers in certain cities further encourage its use. Additionally, the rapid expansion of ride-sharing and local transport services continues to strengthen the passenger carrier segment’s leading position in the market.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 29% share of the total India electric rickshaw market in 2025.

North India leads the market due to high population density, strong demand for affordable short-distance transport, and widespread adoption of electric rickshaws across urban and semi-urban centers. States such as Uttar Pradesh, Delhi, and Bihar have significant reliance on e-rickshaws for daily commuting and last-mile connectivity. The region also benefits from favorable operating conditions, including dense road networks and high passenger movement. In 2025, Allfine Industries launched the AF 7 ECO DX Li (2+1) e-rickshaw in Delhi NCR, offering up to 150 km range with a lithium battery and heavy-duty PMSM motor. Built for last-mile connectivity, it included comfort features like LED headlights, FM stereo, fast-charging ports, and reinforced durability for urban traffic.

The dominance of North India is also supported by strong government focus on electric mobility adoption and the presence of a large number of manufacturers and assemblers in the region. Electric rickshaws are widely used near railway stations, bus terminals, and metro corridors, ensuring continuous demand. Limited availability of alternative low-cost transport options in many cities further boosts adoption. Additionally, rising awareness about pollution control and increasing restrictions on diesel-based three-wheelers contribute to sustained regional growth in e-rickshaw deployment. The growing acceptance of electric mobility solutions further reinforces North India’s leading market share.

Market Dynamics:

Growth Drivers:

Why is the India Electric Rickshaw Market Growing?

Manufacturing Ecosystem and Competitive Industry Landscape

India’s expanding base of electric three-wheeler manufacturers is improving market accessibility and supporting nationwide growth. Rising competition among producers is widening vehicle options across different price segments while encouraging higher standards of quality, durability, and performance. Greater localization of parts is also reducing dependence on imports, ensuring more stable supply chains and faster delivery timelines. Dealer and service networks are reaching smaller cities, enhancing maintenance support. This progress was evident in 2025 when Terra Motors announced plans for a new manufacturing plant in Bengaluru as part of its strategy to expand e-rickshaw and electric auto production in India while preparing to resume exports to Africa by end-2025.

Technological Improvements in Vehicle Design and Performance

Continuous product innovation is significantly improving the appeal and performance of electric rickshaws, encouraging wider adoption across urban mobility markets. Advances in battery efficiency, driving range, load capacity, and ergonomic comfort are enhancing vehicle reliability under demanding road conditions. Manufacturers are also introducing stronger chassis structures, improved suspension, and safer braking systems, reducing breakdown frequency and extending operational life. This progress was reflected in 2025 when MASSIMO launched its MileMax lithium-ion batteries for e-rickshaws, offering extended backup, zero maintenance, and a 3-year warranty, with IoT/GPS or Bluetooth monitoring options. Such technological upgrades are strengthening competitiveness and supporting the market growth.

E-Commerce and Goods Transport Applications

The expansion of e-commerce and neighborhood delivery services is driving the demand for electric rickshaws beyond passenger mobility into goods transport. Operators increasingly deploy electric three-wheelers for last-mile deliveries because of their low running costs, compact size, and suitability for dense urban areas. This shift aligns with the rapid scale-up of online retail, as India’s e-commerce industry was valued at INR 10,82,875 Crore (USD 125 Billion) in 2024 and is projected to reach INR 29,88,735 Crore (USD 345 Billion) by 2030, growing at a 15% CAGR, according to IBEF. Rising parcel volumes, retail replenishment needs, and small logistics operations are widening the cargo application base, supporting higher utilization and improving operator earnings.

Market Restraints:

What Challenges the India Electric Rickshaw Market is Facing?

High Initial Costs for Advanced Battery Configurations

Despite declining battery prices, lithium-ion equipped e-rickshaws remain significantly more expensive than lead-acid alternatives, creating affordability barriers for price-sensitive operators. Many e-rickshaw drivers operate on daily rental models rather than ownership due to inadequate financing options. Limited access to affordable credit constrains adoption among economically disadvantaged populations who could benefit most from operational cost savings.

Inadequate Charging Infrastructure in Underserved Areas

While urban centers are developing charging networks, rural and semi-urban areas face significant infrastructure gaps that limit operational flexibility. Range anxiety concerns discourage potential buyers uncertain about charging accessibility for extended routes. Inconsistent electricity supply in certain regions further complicates charging logistics, while limited fast-charging options extend vehicle downtime and reduce daily earning potential.

Quality Standardization and Safety Concerns

The proliferation of unorganized manufacturers has created quality inconsistencies affecting market perception and user confidence. Lack of standardized safety specifications and performance benchmarks allows low-quality products to enter the market, potentially compromising occupant safety and vehicle reliability. Inadequate operational guidelines for vehicles and charging stations create regulatory ambiguity that organized manufacturers must navigate.

Competitive Landscape:

The India electric rickshaw market exhibits moderate competitive intensity characterized by diverse participation from established automotive corporations, specialized EV manufacturers, and regional assembly operations. Market dynamics reflect ongoing consolidation as quality standards tighten and financing accessibility improves, favoring organized players with comprehensive dealer networks and after-sales capabilities. Competition increasingly centers on battery technology advancement, vehicle range optimization, and service ecosystem development, including roadside assistance and component availability. Strategic partnerships between manufacturers, battery suppliers, and financing institutions are reshaping competitive positioning, while entry of major automotive brands signals market maturation and growth expectations.

Some of the key players include:

- Adapt Motors Private Limited

- ATUL Auto Limited

- CityLife EV

- E-Ashwa Automotive Private Limited

- Goenka Electric Motor Vehicles Private Limited

- Jezza Motors (Vani Electric Vehicles Pvt. Ltd)

- Kinetic Green Energy & Power Solutions Ltd

- Lohia Auto Industries

- Mini Metro EV LLP

- Saera Electric Auto Private Limited

- Terra Motors India Corp.

- Thukral Electric Bikes

- Udaan E Rickshaw

Recent Developments:

- November 2025: Bajaj Auto entered India’s growing e-rickshaw market with the launch of the new Bajaj Riki, offering passenger and cargo models with ranges up to 164 km. The company aimed to address safety and reliability gaps through features like monocoque chassis, independent suspension, hydraulic brakes, and fast charging.

- May 2025: Bajaj Auto announced it will launch a new electric rickshaw under its ‘GoGo’ brand to strengthen its position in India’s growing e-rickshaw market. The company aimed to bring better quality and reliability to a highly fragmented segment and expand into a 40,000-unit opportunity.

India Electric Rickshaw Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Motors Power Covered | <1000 W, 1000–1500 W, >1500 W |

| Battery Capacities Covered | <101 Ah, >101 Ah |

| Battery Types Covered | Li-ion Battery, Lead Acid Battery |

| Sales Channels Covered | Organized, Unorganized |

| End Users Covered | Passenger Carrier, Load Carrier |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | Adapt Motors Private Limited, ATUL Auto Limited, CityLife EV, E-Ashwa Automotive Private Limited, Goenka Electric Motor Vehicles Private Limited, Jezza Motors (Vani Electric Vehicles Pvt. Ltd), Kinetic Green Energy & Power Solutions Ltd, Lohia Auto Industries, Mini Metro EV LLP, Saera Electric Auto Private Limited, Terra Motors India Corp., Thukral Electric Bikes and Udaan E Rickshaw |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India electric rickshaw market size was valued at USD 1.55 Billion in 2025.

The India electric rickshaw market is expected to grow at a compound annual growth rate of 7.74% from 2026-2034 to reach USD 3.02 Billion by 2034.

1000–1500 W dominate the market with a 60% share in 2025, driven by optimal balance between performance and efficiency suitable for diverse Indian operating conditions and regulatory requirements.

Key factors driving the India electric rickshaw market include the expansion of charging and battery infrastructure, which is improving range reliability and reducing downtime through swapping and local hubs. In 2024, Jaipur authorities planned dedicated e-rickshaw stands and charging stations across six zones, supporting regulated and congestion-free last-mile operations.

Major challenges include high initial costs for advanced lithium-ion battery configurations, inadequate charging infrastructure in rural and semi-urban areas, quality standardization concerns among unorganized manufacturers, and limited financing accessibility for economically disadvantaged operators.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)