India Electric Kettle Market Size, Share, Trends and Forecast by Raw Material, Application, and Region, 2025-2033

India Electric Kettle Market Overview:

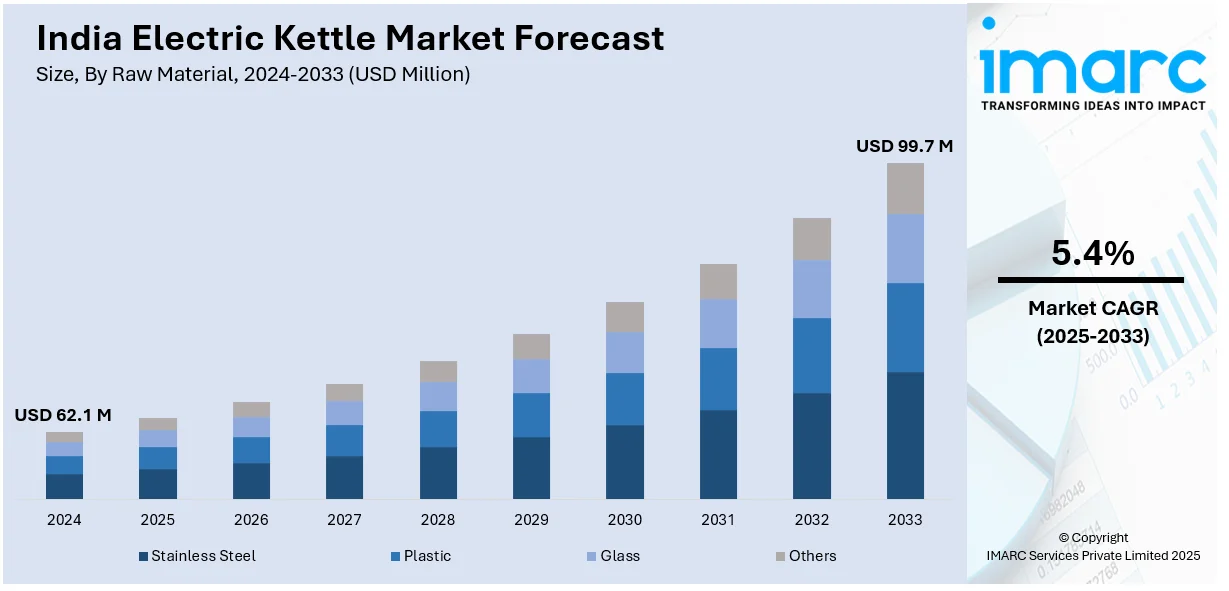

The India electric kettle market size reached USD 62.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 99.7 Million by 2033, exhibiting a growth rate (CAGR) of 5.4% during 2025-2033. The market is driven by rising urbanization, increasing disposable incomes, changing consumer lifestyles, growing demand for energy-efficient kitchen appliances, government initiatives promoting electrical efficiency, expanding e-commerce penetration, and the escalating preference for quick and convenient cooking solutions among working professionals, students, and nuclear families.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 62.1 Million |

| Market Forecast in 2033 | USD 99.7 Million |

| Market Growth Rate (2025-2033) | 5.4% |

India Electric Kettle Market Trends:

Increasing Urbanization and Changing Lifestyles

Urbanization in India at a fast pace has caused a dramatic change in consumers' lifestyles, which has fueled the electric kettle market growth. With a rising number of people moving to cities, there is a greater need for advanced kitchen appliances with ease and efficiency. Electric kettles, which provide fast boiling time and save energy, perfectly suit the busy urban lifestyle. In 2023, India had an estimated urban population of 471 million, and the figure is still on the rise. This urbanization has resulted in reduced living spaces, with compact and multi-functional devices such as electric kettles being greatly appreciated. The quick boiling of water for drinks or instant foods meets the demand for convenience solutions among city residents. In addition, the growing population of working professionals and students in cities has fueled the need for convenient and fast-food preparation techniques. Electric kettles offer a convenient solution to the preparation of hot drinks and instant foods and hence are found in most urban homes. The nuclear family trend and single household trend also drive the market since people look for appliances that are efficient and simple to operate. The urban hospitality sector also puts a demand on the appliance. Guesthouses and hotels frequently have electric kettles in bedrooms to make it more convenient for guests, attesting to the appliance's growing relevance in city life.

To get more information on this market, Request Sample

Government Initiatives Promoting Energy-Efficient Appliances

Indian government's focus on energy efficiency and sustainability has favorably influenced the electric kettle industry. Programs aimed at encouraging the use of energy-efficient appliances have raised consumer demand and usage of products such as electric kettles. Indian government's focus on energy efficiency and sustainability has favorably influenced the electric kettle industry. Programs aimed at encouraging the use of energy-efficient appliances have raised consumer demand and usage of products such as electric kettles. Besides, the pressure from the government to electrify and provide stable power supply in rural and peri-urban regions has widened the market opportunity for electric appliances. With more homes being electrified, the use of electric kettles is possible, thus leading to market growth. In addition, initiatives such as "Make in India" support indigenous production of appliances, with higher availability and lower prices for electric kettles. This follows the vision of the government of encouraging locally manufactured and energy-saving products for boosting economic development and sustainability. Moreover, the synergy of high-paced urbanization, shifting lifestyles of consumers, and encouraging government policies has ensured a suitable background for India's electric kettle market growth. All these drivers together boost demand and promote the use of efficient appliances among various consumer segments.

India Electric Kettle Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on raw material and application.

Raw Material Insights:

- Stainless Steel

- Plastic

- Glass

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes stainless steel, plastic, glass, and others.

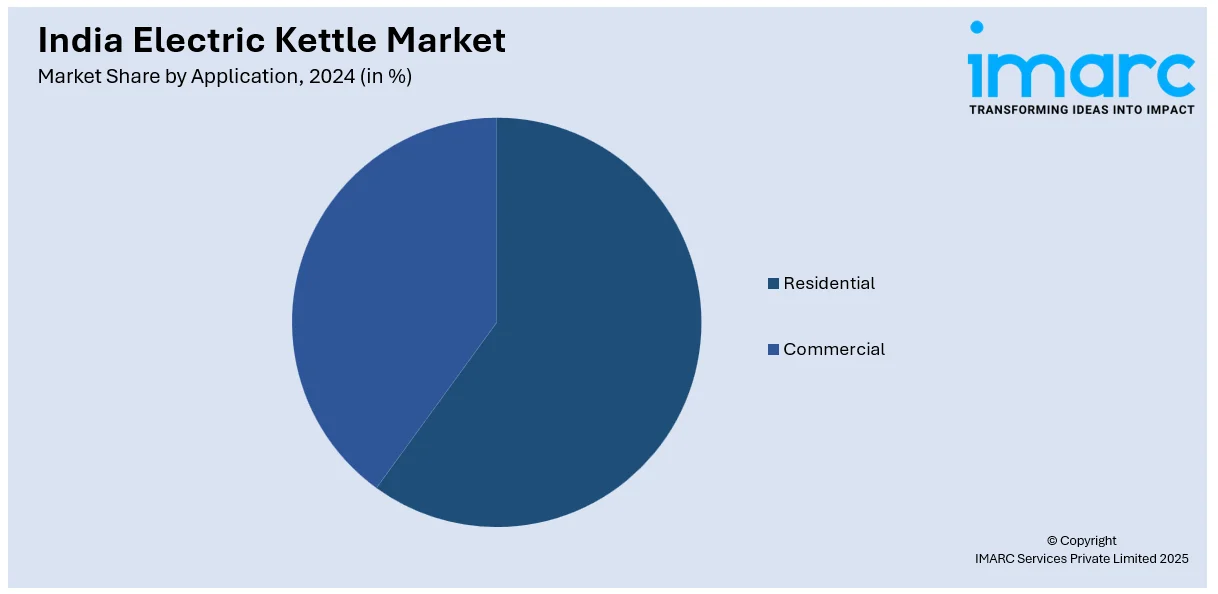

Application Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Electric Kettle Market News:

- February 2025: Portronics ventured into the kitchen appliances segment with its Anymeal Multicook Electric Kettle. The company is looking to meet India's escalating need for multi-functional and energy-saving kitchen appliances. The launch is propelling the India electric kettle market by infusing more competition, innovation, and consumer availability to high-technology kettle models.

- October 2023: Usha has introduced a portfolio of premium kitchen appliances in partnership with Reliance Digital with the aim of providing greater access to high-quality home solutions. The move into premium segments is a response to the growing consumer demand for branded and quality-based products in India.

India Electric Kettle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Stainless Steel, Plastic, Glass, Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electric kettle market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India electric kettle market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electric kettle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric kettle market in India was valued at USD 62.1 Million in 2024.

The India electric kettle market is projected to exhibit a CAGR of 5.4% during 2025-2033, reaching a value of USD 99.7 Million by 2033.

The market is driven by rising urbanization, increasing disposable incomes, and growing demand for energy-efficient and convenient kitchen appliances. Changing lifestyles, government initiatives promoting sustainability, and the expansion of e-commerce are also key growth contributors across residential and commercial segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)