India Electric Fan Market Size, Share, Trends and Forecast by Product Type, End User, Distribution Channel, and Region, 2025-2033

India Electric Fan Market Overview:

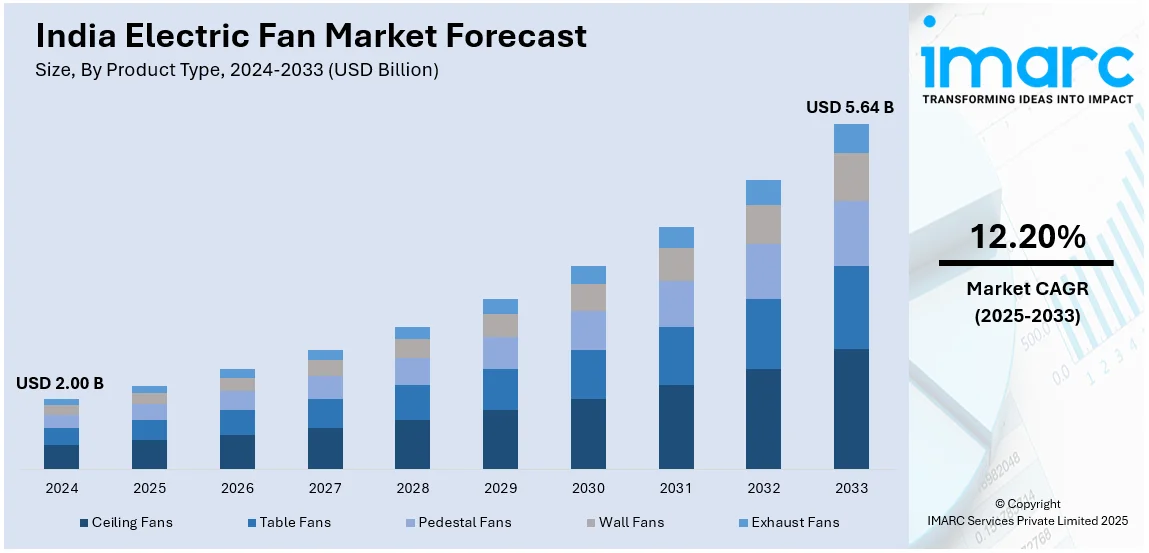

The India electric fan market size reached USD 2.00 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.64 Billion by 2033, exhibiting a growth rate (CAGR) of 12.20% during 2025-2033. Rising temperatures, urbanization, increasing disposable income, affordable pricing, government electrification initiatives, energy-efficient technology adoption, rural demand growth, expanding e-commerce, premiumization trends, smart fan integration, growing real estate sector, and rising consumer preference for branded products are driving India's electric fan market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.00 Billion |

| Market Forecast in 2033 | USD 5.64 Billion |

| Market Growth Rate (2025-2033) | 12.20% |

India Electric Fan Market Trends:

Rising Demand for Energy-Efficient and BLDC Fans

Indian electric fan market is experiencing a transition towards energy-efficient brushless direct current (BLDC) fans as consumers focus on saving electricity and sustainability. As electricity prices are increasing and the government is encouraging energy-efficient appliances, BLDC technology is gaining ground very quickly. BLDC fans use 50-65% less energy compared to traditional induction motor fans, cutting down the consumption of electricity from 75-80W to a mere 28-35W. Government initiatives such as the Bureau of Energy Efficiency (BEE) Standards & Labeling Scheme and incentives through the Unnat Jyoti by Affordable LEDs for All (UJALA) scheme are stimulating the use of energy-efficient appliances. The Indian government's initiative to reduce energy consumption will drive the market penetration of BLDC fans to 30-35% by 2025, up from 10-15% in 2023. Additionally, top players like Crompton, Havells, and Atomberg are spearheading this movement with product innovation. Atomberg, the technology leader in BLDC, clocked more than 200% sales growth in 2023, whereas the high-end energy-efficient fan segment registered a CAGR of 25% from 2023 to 2025. With consumers seeking energy savings over the long term, BLDC fans with IoT-enabled smart controls, remote operation, and variable speed settings are gaining mainstream popularity.

To get more information on this market, Request Sample

Increasing Consumer Preference for Smart and Premium Fans

Increased demand for premium and smart fans is another major trend redefining the Indian electric fan market. Buyers are looking for technologically advanced products that make life more convenient, look better, and perform better. Wi-Fi, IoT-enabled smart fans, voice-controlled ones with Alexa & Google Assistant, and fans that can be operated through mobile apps are in high demand, especially among consumers with urban dwellings. The high-end fan segment, encompassing decorative, anti-dust, silent, and remote fans, recorded a growth of 18-20% in 2023 and is expected to grow at a CAGR of 22% between 2023 and 2025. To address this need, companies such as Havells, Orient Electric, and Usha are producing novel products. For example, Havells' Stealth Air and Enticer Smart+ series accelerated, resulting in a 30% increase in premium fan sales in 2023. Furthermore, rising disposable income and urbanization are fueling this tendency. India's middle-class group is expected to grow by 46% by 2025, resulting in higher expenditure on household goods. Furthermore, online sales of high-end fans increased by 35% in 2023, with platforms such as Amazon and Flipkart becoming significant distribution channels. With the increase in smart home adoption, the demand for premium fans with LED lighting, silent operation, and cutting-edge air delivery technology will continue to rise, further consolidating market growth.

India Electric Fan Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, end user, and distribution channel.

Product Type Insights:

- Ceiling Fans

- Table Fans

- Pedestal Fans

- Wall Fans

- Exhaust Fans

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ceiling fans, table fans, pedestal fans, wall fans, and exhaust fans.

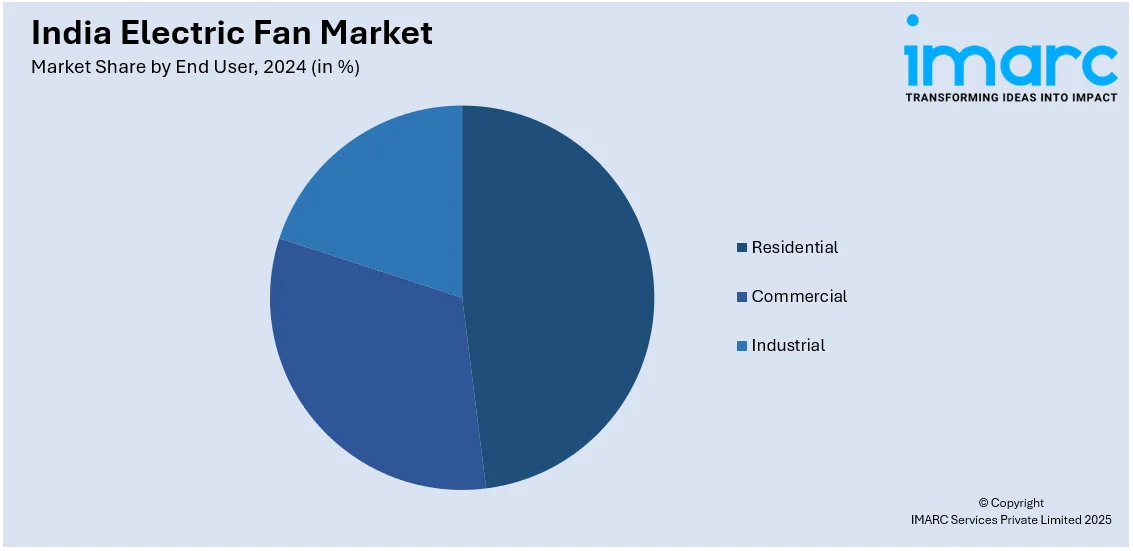

End User Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, and industrial.

Distribution Channel Insights:

- Multi-Branded Stores

- Supermarkets & Hypermarkets

- Online

- Exclusive Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes multi-branded stores, supermarkets & hypermarkets, online, exclusive stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Electric Fan Market News:

- May 2024: Reliance Industries (RIL) launched the Wyzr brand, a consumer durables initiative, to diversify its portfolio and strengthen its presence in the consumer electronics and white goods market. The company will initially manufacture products like irons, fans, refrigerators, and televisions through contract manufacturing, with plans to transition to in-house manufacturing as production scales up.

- April 2024: Nex, a high-performance appliance brand launched by Bajaj Electricals, unveiled its first digital campaign to showcase its IoT and BLDC Ceiling Fans. The Dryft and Glyde series of fans are designed to provide an elevated air experience, offering 20% higher air thrust compared to conventional fans.

India Electric Fan Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ceiling Fans, Table Fans, Pedestal Fans, Wall Fans, Exhaust Fans |

| End Users Covered | Residential, Commercial, Industrial |

| Distribution Channels Covered | Multi-Branded Stores, Supermarkets & Hypermarkets, Online, Exclusive Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electric fan market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India electric fan market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electric fan industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric fan market in India was valued at USD 2.00 Billion in 2024.

The India electric fan market is projected to exhibit a CAGR of 12.20% during 2025-2033, reaching a value of USD 5.64 Billion by 2033.

Key drivers of India electric fan market are escalating temperatures and growing awareness among consumers about energy-efficient cooling mechanisms. Reasonable prices and extensive rural and urban electrification further accelerate demand. Moreover, urbanization and increased residential and commercial building construction, augmented e-commerce channels, and diversified product offerings support India electric fan market growth by making contemporary and feature-driven fans more prevalent.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)