India Elderly Care Products Market Size, Share, Trends and Forecast by Product, Usage, End User, and Region, 2025-2033

India Elderly Care Products Market Overview:

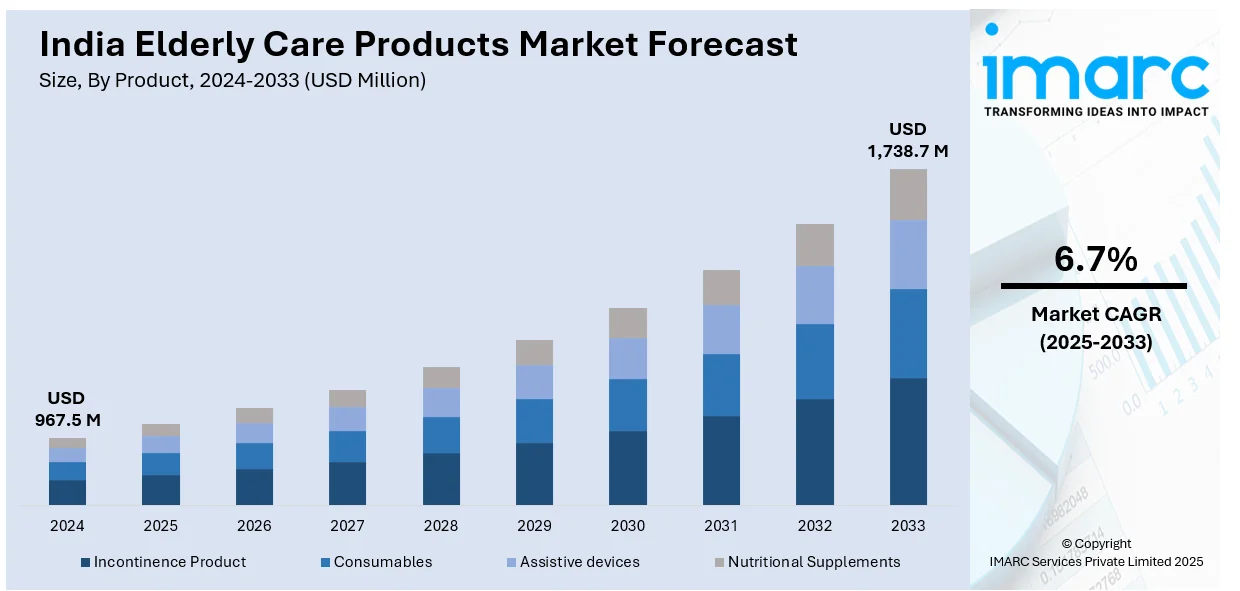

The India elderly care products market size reached USD 967.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,738.7 Million by 2033, exhibiting a growth rate (CAGR) of 6.7% during 2025-2033. The market is driven by a rising aging population, increased healthcare awareness, numerous government initiatives, advancements in assistive technology, home healthcare demand, improved disposable income, insurance coverage, and the expansion of senior living facilities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 967.5 Million |

| Market Forecast in 2033 | USD 1,738.7 Million |

| Market Growth Rate 2025-2033 | 6.7% |

India Elderly Care Products Market Trends:

Expansion of Senior Living Facilities

The increasing demand for specialized housing solutions for the elderly has led to a notable expansion in senior living facilities across India. In 2024, the demand for senior living units in India was estimated to be between 400,000 to 600,000 units, while the current supply stands at approximately 20,000 units, indicating a substantial opportunity for growth in this sector. This trend is driven by the growing aging population seeking comfortable, secure, and community-oriented living environments. The India Aging Report 2023 by the United Nations Population Fund (UNFPA) estimates that India's elderly population will increase from 10.1% in 2021 to 20.8% by 2050. This demographic shift aligns with a declining fertility rate, which has fallen from 6.2 in 1950 to 2 in 2021, and an increase in life expectancy, expected to grow from 36.9 years in 1950 to 75 years by 2050 (CBRE, 2024). This significant demographic shift heightens the growing need for elderly care products. Moreover, companies like Ashiana Housing are capitalizing on this trend by focusing on senior housing projects. Ashiana aims to increase its annual profit to 20 billion rupees ($238.8 million) by fiscal year 2029, up from 834 million rupees in 2024, by expanding its senior living offerings. This rapid expansion of senior living facilities is fueling the demand for elderly care products.

To get more information on this market, Request Sample

Growing Adoption of Smart and Assistive Technologies in Elderly Care

The India elderly care products market is witnessing significant growth due to the rising adoption of smart and assistive technologies aimed at enhancing the quality of life for senior citizens. One key driver behind this trend is the increasing penetration of smart home devices tailored for elderly care. According to industry estimates, India's smart home market is projected to reach USD 7.3 Billion in 2025, with a significant portion of this expansion attributed to elderly-friendly devices, such as smart voice assistants, remote monitoring systems, and fall detection sensors. These devices enable real-time health tracking, emergency response mechanisms, and remote caregiving solutions, reducing the dependency on traditional home care services. Another major factor accelerating this trend is the rise of wearable health monitoring devices. The India wearable technology market size reached USD 2,369.7 Million in 2024, with a growing share catering to elderly users requiring continuous health tracking for chronic conditions like hypertension, diabetes, and cardiovascular diseases. Innovations such as artificial intelligence (AI)-powered alert systems, medication reminders, and telemedicine integrations are further propelling market growth. Additionally, the adoption of these technologies, reinforced by government initiatives like the National Digital Health Mission (NDHM) to improve telemedicine accessibility for senior citizens, is aiding in market expansion.

India Elderly Care Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, usage, and end user.

Product Insights:

- Incontinence Product

- Consumables

- Assistive devices

- Nutritional Supplements

The report has provided a detailed breakup and analysis of the market based on the product. This includes incontinence product, consumables, assistive devices, and nutritional supplements.

Usage Insights:

- Home Care

- Chronic Illness Care

A detailed breakup and analysis of the market based on the usage have also been provided in the report. This includes home care and chronic illness care.

End User Insights:

.webp)

- Hospital

- Nursing Care Facilities

- Home Health Care

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospital, nursing care facilities, and home health care.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Elderly Care Products Market News:

- September 2024: The Asian Institute of Nephrology and Urology (AINU) introduced JOGO's AI-powered device to treat urinary incontinence, particularly in elder individuals, by strengthening pelvic muscles. This non-invasive technology tracks muscle movements, offers real-time feedback and aids conditions like stroke, Parkinson’s tremors, chronic pain, migraines, and pelvic dysfunction.

- June 2024: Emoha, an eldercare firm, partnered with alarm monitoring and response services firm VProtect to launch a paid 24/7 emergency response service for senior citizens. The service includes a panic alarm button that the elderly person keeps with them, and the response could be clinical or civil.

India Elderly Care Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Incontinence Product, Consumables, Assistive devices, Nutritional Supplements |

| Usages Covered | Home Care, Chronic Illness Care |

| End Users Covered | Hospital, Nursing Care Facilities, Home Health Care |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India elderly care products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India elderly care products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India elderly care products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India elderly care products market was valued at USD 967.5 Million in 2024.

The India elderly care products market is projected to exhibit a CAGR of 6.7% during 2025-2033, reaching a value of USD 1,738.7 Million by 2033.

The India elderly care products market is driven by a rising senior population, increasing disposable incomes, and growing awareness regarding age-related health needs. Families are investing in mobility aids, incontinence supplies, and home safety devices, which is also escalating the product demand. Urbanization and dual-income households further spur demand for convenient, quality elder care solutions at home.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)