India Egg Powder Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

Market Overview:

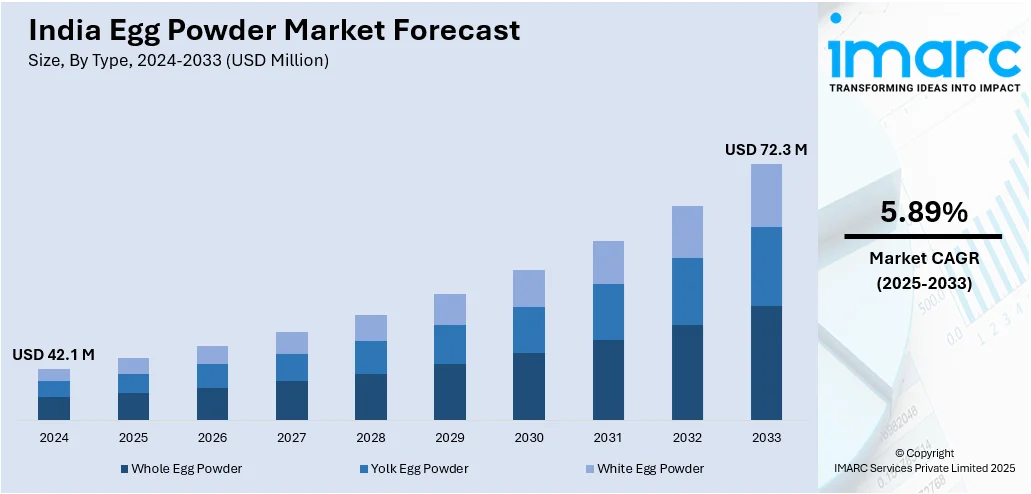

The India egg powder market size reached USD 42.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 72.3 Million by 2033, exhibiting a growth rate (CAGR) of 5.89% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 42.1 Million |

|

Market Forecast in 2033

|

USD 72.3 Million |

| Market Growth Rate 2025-2033 | 5.89% |

Egg powder is prepared by dehydrating eggs via the spray drying process. It consists of the same amounts of proteins as regular eggs and is low in carbohydrates, cholesterol and fats. Powdered eggs have a shelf life of about 5 to 10 years if stored in airtight containers or placed in a cool environment. Egg powder is comparatively easier to transport from one place to another as there is no chance of breakage. In India, egg powder is increasingly preferred by consumers as it is available in a versatile product range, including egg white powder, egg yolk powder, whole egg powder and egg-shell powder, which cater to different needs of people.

To get more information on this market, Request Sample

The India egg powder market is primarily driven by the rising health consciousness that has encouraged consumers to shift from a carbohydrate-rich toward a protein-rich diet. Besides this, improving lifestyles and inflating incomes have led to increased health consciousness, which, in turn, is escalating the demand for egg powder. Egg powder is also highly convenient to use due to its physical form, which leads to low to zero product wastage and generates no residue after usage. Moreover, egg powder is extensively used in health supplements and various skin and hair care products.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India egg powder market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on type and end use.

Breakup by Type:

- Whole Egg Powder

- Yolk Egg Powder

- White Egg Powder

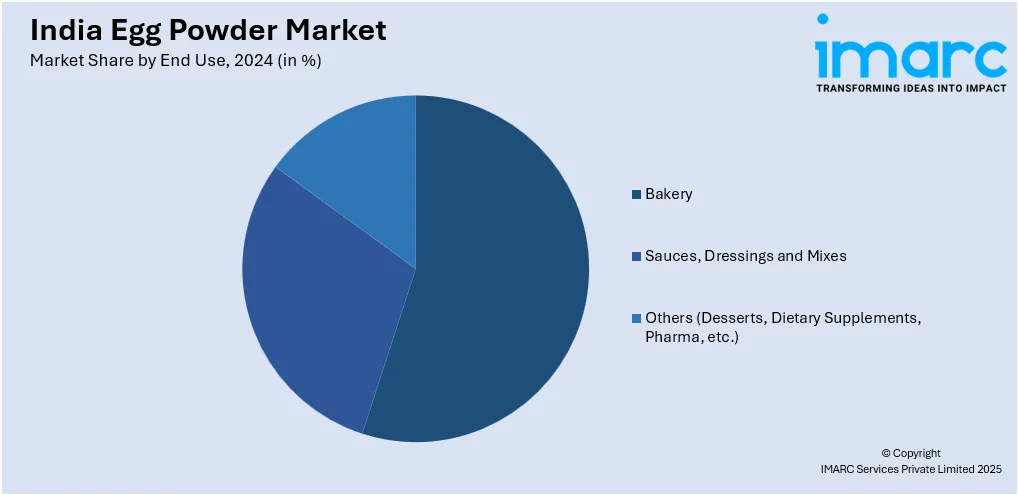

Breakup by End Use:

- Bakery

- Sauces, Dressings and Mixes

- Others (Desserts, Dietary Supplements, Pharma, etc.)

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Type, End Use, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India egg powder market was valued at USD 42.1 Million in 2024.

We expect the India egg powder market to exhibit a CAGR of 5.89% during 2025-2033.

The rising health consciousness among individuals, along with the increasing consumer preferences towards a protein-rich diet, are primarily driving the India egg powder market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of egg powder across the nation.

Based on the type, the India egg powder market has been segregated into whole egg powder, yolk egg powder, and white egg powder. Among these, whole egg powder currently holds the largest market share.

Based on the end use, the India egg powder market can be bifurcated into bakery, sauces, dressings and mixes, and others (desserts, dietary supplements, pharma, etc.). Currently, bakery exhibits a clear dominance in the market.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where West and Central India currently dominates the India egg powder market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)