India e-KYC Market Size, Share, Trends and Forecast by Product, Deployment Mode, End User, and Region, 2025-2033

Market Overview:

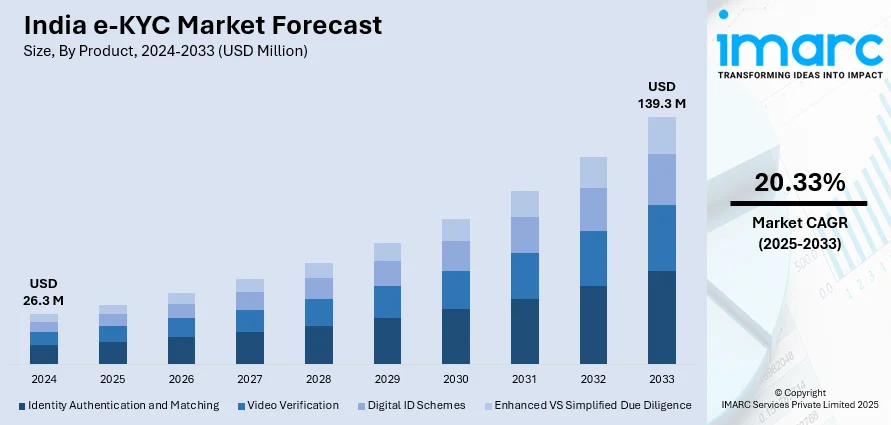

India e-KYC market size reached USD 26.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 139.3 Million by 2033, exhibiting a growth rate (CAGR) of 20.33% during 2025-2033. The widespread adoption of digital payment methods, such as banking cards, unified payments interface (UPI), pre-paid cards, etc., is primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 26.3 Million |

|

Market Forecast in 2033

|

USD 139.3 Million |

| Market Growth Rate 2025-2033 | 20.33% |

e-KYC involves the electronic validation of customer credentials, a mandatory step for accessing the services of any financial institution. This process includes secure customer consent through methods such as biometric fingerprints, electronic keys, and written or electronic licenses. e-KYC ensures the safe and confidential sharing of information, offering immediate verification to thwart fraud. Not only is it cost-effective, but it also contributes to environmental sustainability as it operates as a paperless system for gathering customer data, in contrast to the traditional KYC approach. Moreover, the online registration and authentication process significantly reduces the time required, eliminating the need for physical document submission. Consequently, e-KYC finds extensive application in financial institutions, e-payment services, as well as in telecom and insurance companies.

To get more information on this market, Request Sample

India e-KYC Market Trends:

The India e-KYC market is experiencing a dynamic evolution, driven by various factors that reflect the changing landscape of identity verification in the country. Firstly, the increasing penetration of smartphones and internet connectivity has played a pivotal role. Furthermore, regulatory initiatives have emerged as significant drivers, shaping the trajectory of the e-KYC market in India. Government directives and compliance mandates have compelled businesses to enhance their customer verification processes, favoring electronic methods over traditional approaches. Moreover, biometric technology stands out as a prominent trend within the India e-KYC landscape. Besides this, the elevating integration of biometric identifiers, such as fingerprints and facial recognition, enhances the accuracy and reliability of identity verification processes. Additionally, businesses are increasingly recognizing the value of biometrics in fortifying security measures while simultaneously providing a user-friendly experience for customers. In addition, the ongoing emphasis on sustainability and environmental consciousness has fueled the adoption of paperless e-KYC systems. Apart from this, the shifting preferences among individuals towards digital, secure, and environmentally conscious identity verification solutions are anticipated to fuel the market growth over the forecasted period.

India e-KYC Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, deployment mode, and end user.

Product Insights:

- Identity Authentication and Matching

- Video Verification

- Digital ID Schemes

- Enhanced VS Simplified Due Diligence

The report has provided a detailed breakup and analysis of the market based on the product. This includes identity authentication and matching, video verification, digital ID schemes, and enhanced VS simplified due diligence.

Deployment Mode Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes cloud-based and on-premises.

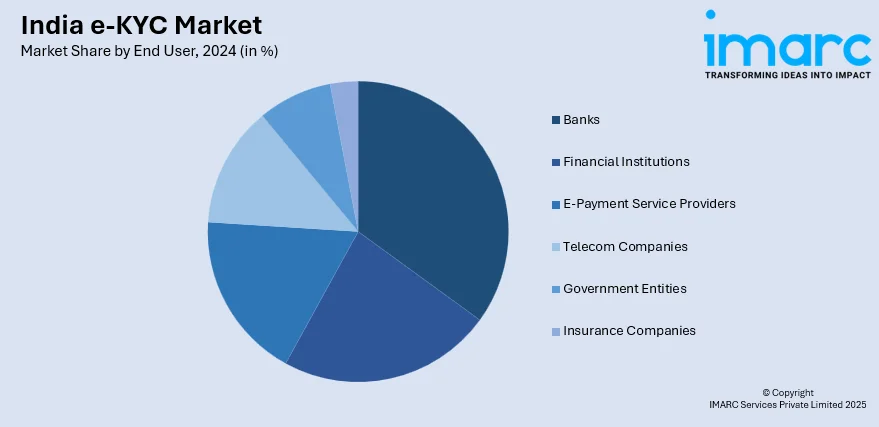

End User Insights:

- Banks

- Financial Institutions

- E-Payment Service Providers

- Telecom Companies

- Government Entities

- Insurance Companies

The report has provided a detailed breakup and analysis of the market based on the end user. This includes banks, financial institutions, E-payment service providers, telecom companies, government entities, and insurance companies.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India e-KYC Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Identity Authentication and Matching, Video Verification, Digital ID Schemes, Enhanced VS Simplified Due Diligence |

| Deployment Modes Covered | Cloud-based, On-premises |

| End Users Covered | Banks, Financial Institutions, E-Payment Service Providers, Telecom Companies, Government Entities, Insurance Companies |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India e-KYC market performed so far and how will it perform in the coming years?

- What is the breakup of the India e-KYC market on the basis of product?

- What is the breakup of the India e-KYC market on the basis of deployment mode?

- What is the breakup of the India e-KYC market on the basis of end user?

- What are the various stages in the value chain of the India e-KYC market?

- What are the key driving factors and challenges in the India e-KYC?

- What is the structure of the India e-KYC market and who are the key players?

- What is the degree of competition in the India e-KYC market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India e-KYC market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India e-KYC market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India e-KYC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)