India E-Health Market Size, Share, Trends and Forecast by Product, Services, End User, and Region, 2025-2033

India E-Health Market Overview:

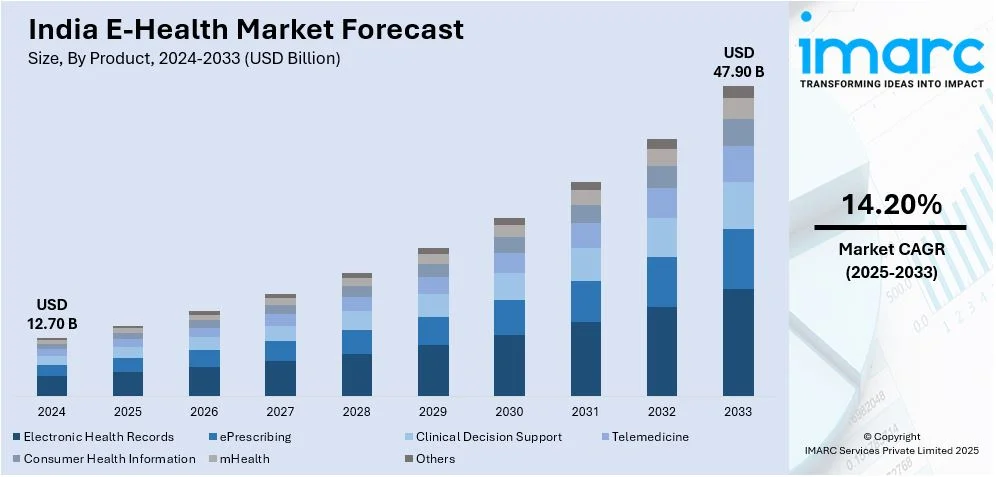

The India E-health market size reached USD 12.70 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 47.90 Billion by 2033, exhibiting a growth rate (CAGR) of 14.20% during 2025-2033. The rising smartphone penetration, increasing internet access, implementation of government initiatives, growing demand for telemedicine, expanding digital health startups, rising chronic disease prevalence, improving healthcare infrastructure, AI and IoT integration, investor interest, and a shift towards preventive, remote, and data-driven healthcare solutions are some of the major factors augmenting the India E-health market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.70 Billion |

| Market Forecast in 2033 | USD 47.90 Billion |

| Market Growth Rate 2025-2033 | 14.20% |

India E-Health Market Trends:

Rapid Growth of Telemedicine and Online Consultations

Telemedicine is expanding rapidly in India, driven by increasing internet access, smartphone penetration, and supportive government regulations. Additionally, the COVID-19 pandemic accelerates telemedicine adoption, making virtual consultations a mainstream healthcare solution. In addition to that, the continual government efforts to provide a legal framework for remote consultations and implementation of government telemedicine services contribute to the India E-health market growth. According to an industry report, eSanjeevani, India's free National Telemedicine Service, has facilitated over 276 Million consultations, demonstrating its potential to reduce systemic disparities in healthcare access. Moreover, major players are expanding teleconsultation services, offering video, audio, and chat-based interactions with general physicians and specialists. Furthermore, rural populations, previously underserved due to limited healthcare infrastructure, now access medical expertise without the burden of travel costs. Also, artificial intelligence (AI) driven chatbots and automated diagnosis tools enhance efficiency, reduce wait times, and improve patient experience, which is a significant growth-inducing factor for the market. Apart from this, insurance providers increasingly cover teleconsultations, improving affordability. As trust in virtual healthcare grows, telemedicine evolves beyond primary care to include mental health support, post-operative monitoring, and chronic disease management, making it a cornerstone of India's digital health ecosystem.

To get more information on this market, Request Sample

Expansion of Digital Health Platforms and E-Pharmacies

Digital health platforms and e-pharmacies are positively impacting the India E-health market outlook. It offers convenience, affordability, and accessibility. In line with this, online platforms such as Tata 1mg, Netmeds, and PharmEasy provide home delivery of medicines, lab tests, and online doctor consultations, revolutionizing how healthcare services are accessed. According to an industry report on July 2023, India has approximately 50 e-pharmacies, accounting for 2-3% of the nation's total pharmacy sales. The e-pharmacies market is projected to expand at a compounded annual growth rate of 44%, reaching USD 4.5 Billion by 2025. Furthermore, regulatory clarity plays a critical role in the market expansion. The government introduces the draft ePharmacy rules, aiming to regulate online medicine sales while ensuring safety and quality. This encourages investments from major corporate players, leading to acquisitions and partnerships, which provides a boost to market growth. In addition to medicine delivery, digital health platforms integrate artificial intelligence (AI) powered recommendations for wellness products, chronic disease management tools, and health tracking applications. Moreover, Subscription-based models offering unlimited consultations and discounted medicines are on the rise. Additionally, tie-ups with diagnostic labs enable users to book home sample collections, reducing dependence on physical visits, which enriches the market appeal. Besides this, the growing preference for doorstep healthcare services fuels long-term market growth, with technology playing a crucial role in optimizing logistics and supply chains.

India E-Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, services, and end user.

Product Insights:

- Electronic Health Records

- ePrescribing

- Clinical Decision Support

- Telemedicine

- Consumer Health Information

- mHealth

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes electronic health records, ePrescribing, clinical decision support, telemedicine, consumer health information, mHealth, and others.

Services Insights:

- Monitoring

- Diagnostic

- Healthcare Strengthening

- Others

A detailed breakup and analysis of the market based on the services have also been provided in the report. This includes monitoring, diagnostic, healthcare strengthening, and others.

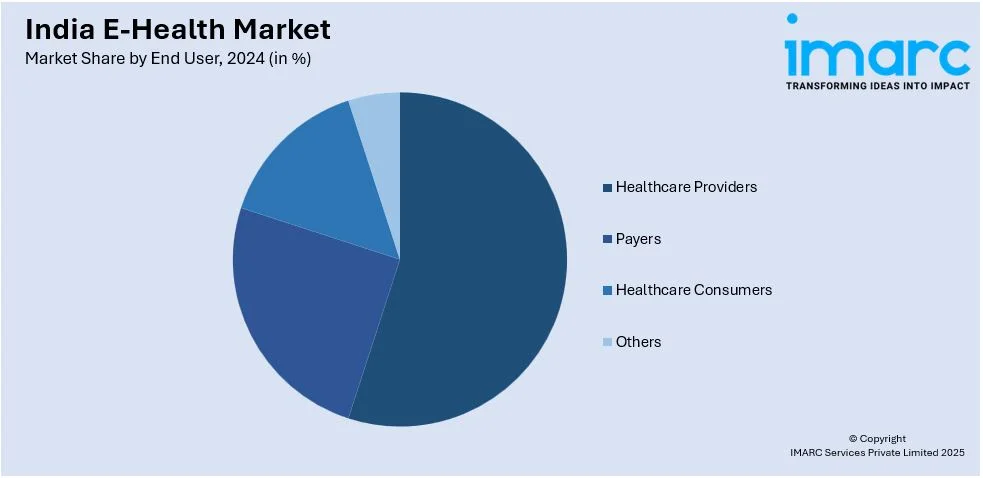

End User Insights:

- Healthcare Providers

- Payers

- Healthcare Consumers

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes healthcare providers, payers, healthcare consumers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India E-Health Market News:

- On December 6, 2024, the Andhra Pradesh government announced plans to launch the AI-based 'Janani Mitra' healthcare application for pregnant women statewide. Currently piloted in Kundair mandal of Anantapur district, the app focuses on key service delivery parameters, including nutrition and overall well-being. The app offers features such as SOS alerts, a food scanner to monitor caloric intake, health and medication tracking, diagnostics, and connectivity to accredited social health activists (ASHAs) and auxiliary nurse midwives (ANMs).

- On March 19, 2025, Zeno Health launched a 50-minute medicine delivery service across Mumbai, Thane, and Navi Mumbai. The service is supported by a network of over 200 offline stores and a fleet of more than 300 delivery partners. The initiative aims to strengthen Zeno Health’s presence in the competitive e-pharmacy market by offering rapid, reliable access to affordable medicines.

India E-Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Electronic Health Records, ePrescribing, Clinical Decision Support, Telemedicine, Consumer Health Information, mHealth, Others |

| Services Covered | Monitoring, Diagnostic, Healthcare Strengthening, Others |

| End Users Covered | Healthcare Providers, Payers, Healthcare Consumers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India E-health market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India E-health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India E-health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The E-health market in India was valued at USD 12.70 Billion in 2024.

The E-health market in India is projected to exhibit a CAGR of 14.20% during 2025-2033, reaching a value of USD 47.90 Billion by 2033.

India’s E-health market is driven by increasing internet and smartphone penetration, government initiatives like Ayushman Bharat Digital Mission, rising chronic diseases, growing awareness of digital healthcare, and the post-COVID-19 shift towards telemedicine. These factors collectively boost demand for remote consultations, digital records, and tech-enabled healthcare solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)