India E-Cigarette Market Size, Share, Trends and Forecast by Product, Flavor, Mode of Operation, Distribution Channel, and Region, 2025-2033

India E-Cigarette Market Overview:

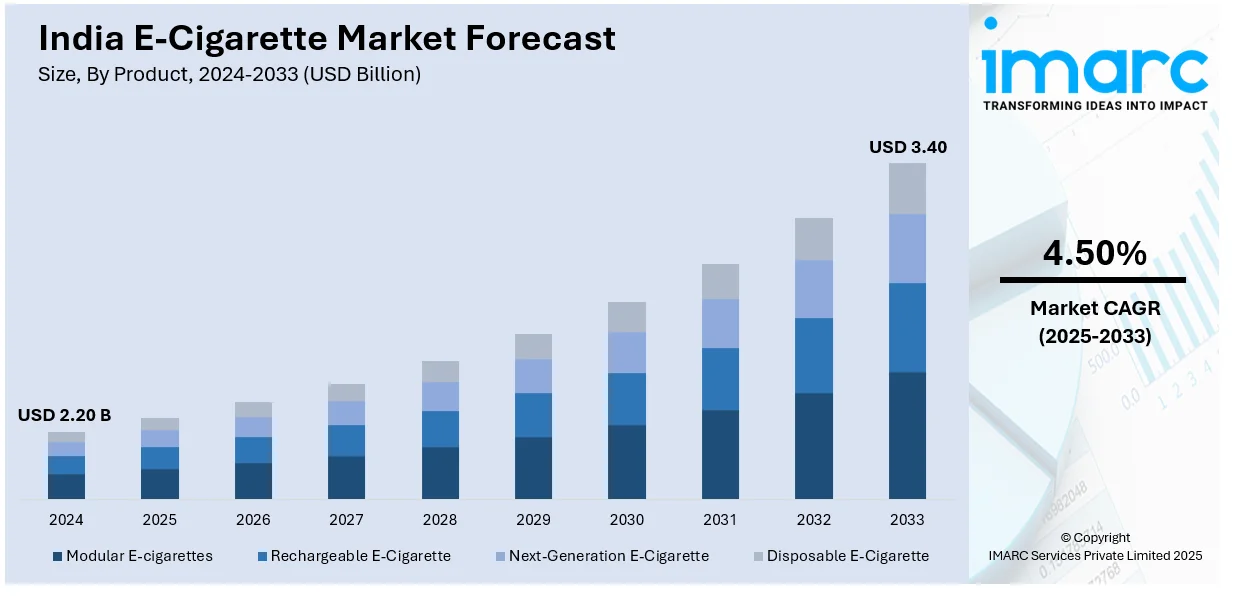

The India e-cigarette market size reached USD 2.20 Billion 2024 in . Looking forward, IMARC Group expects the market to reach USD 3.40 Billion by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The market is driven by increased health consciousness, growing demand for alternatives to tobacco smoking, and rising disposable incomes. Additionally, the trend toward smoke-free living, government regulations on tobacco products, and social media campaigns are also contributing significantly to the India e-cigarette market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.20 Billion |

| Market Forecast in 2033 | USD 3.40 Billion |

| Market Growth Rate 2025-2033 | 4.50% |

India E-Cigarette Market Trends:

Growing Demand for Vape Products

The market is witnessing strong momentum toward vaping products over traditional smoking. With growing health awareness among the masses, a large number of people are switching to e-cigarettes as a perceived safer alternative to smoking tobacco. The trend is also driven by the growth in disposable incomes, particularly among the youth population, who are more prone to try vaping. Moreover, the international popularity of vaping, combined with social media personalities endorsing the product, has triggered increased popularity in cities. The diversity of flavored e-liquid and streamlined device shapes also attract customers, making vaping a greater convenience. Even with the regulatory setbacks, the market for vape products continues to be in high demand, particularly in urban parts of the country where knowledge of smoking alternatives increases. Since e-cigarettes are presented as less harmful, they have an increasing rate of adoption among young adults. These lifestyle shifts, evolving consumer preferences, and increasing acceptance of harm-reduction products are creating a positive India e-cigarette market outlook.

To get more information on this market, Request Sample

Growing Demand for Flavored E-Liquids

Flavored e-liquids are a major factor driving the popularity of e-cigarettes in India especially among young urban consumers. The variety of available flavors—ranging from fruity options like mango and berry to cool mint and dessert-inspired profiles like vanilla or chocolate—enhances the overall vaping experience, making it more appealing than traditional tobacco. These flavors not only mask the harshness of nicotine but also allow users to personalize their experience, which is a key trend among millennials and Gen Z. Many consumers view flavored vaping as a lifestyle choice, supported by sleek, portable devices and social media promotion. The growing preference for customization, coupled with peer influence, has pushed manufacturers and importers to expand their flavor offerings.

Increasing Awareness and Shift Toward Smoking Cessation

One positive trend in the Indian e-cigarette industry is the increasing acceptance of vaping products as smoking cessation tools. As knowledge of the ill effects of smoking grows, more smokers are opting for e-cigarettes as a less harmful substitute. Public health campaigns, combined with scientific research indicating e-cigarettes are less harmful than conventional cigarettes, have had an impact on consumer behavior. Numerous smokers view e-cigarettes as a means of easing nicotine dependence without having to suffer the harsh withdrawal symptoms that come with quitting cold turkey. This is a trend that is very much prevalent among the working class, where there is an emphasis on making healthier lifestyle choices. Vaping is being promoted more and more as part of smoking cessation strategies, with various manufacturers releasing nicotine-strength options for users to regulate their use. With the increasing acceptability of e-cigarettes, they are now a widely accepted choice among individuals desiring to give up smoking. This growing role of e-cigarettes in smoking cessation efforts is positively influencing consumer adoption and steadily contributing to the expansion of the India e-cigarette market share.

India E-Cigarette Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product, flavor, mode of operation, and distribution channel.

Product Insights:

- Modular e-cigarettes

- Rechargeable E-Cigarette

- Next-Generation E-Cigarette

- Disposable E-Cigarette

The report has provided a detailed breakup and analysis of the market based on the product. This includes modular e-cigarette, rechargeable e-cigarette, next-generation e-cigarette, and disposable e-cigarette.

Flavor Insights:

- Tobacco

- Botanical

- Fruit

- Sweet

- Beverage

- Others

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes tobacco, botanical, fruit, sweet, beverage, and others.

Mode of Operation Insights:

- Automatic E-Cigarette

- Manual E-Cigarette

The report has provided a detailed breakup and analysis of the market based on the mode of operation. This includes automatic e-cigarette, and manual e-cigarette.

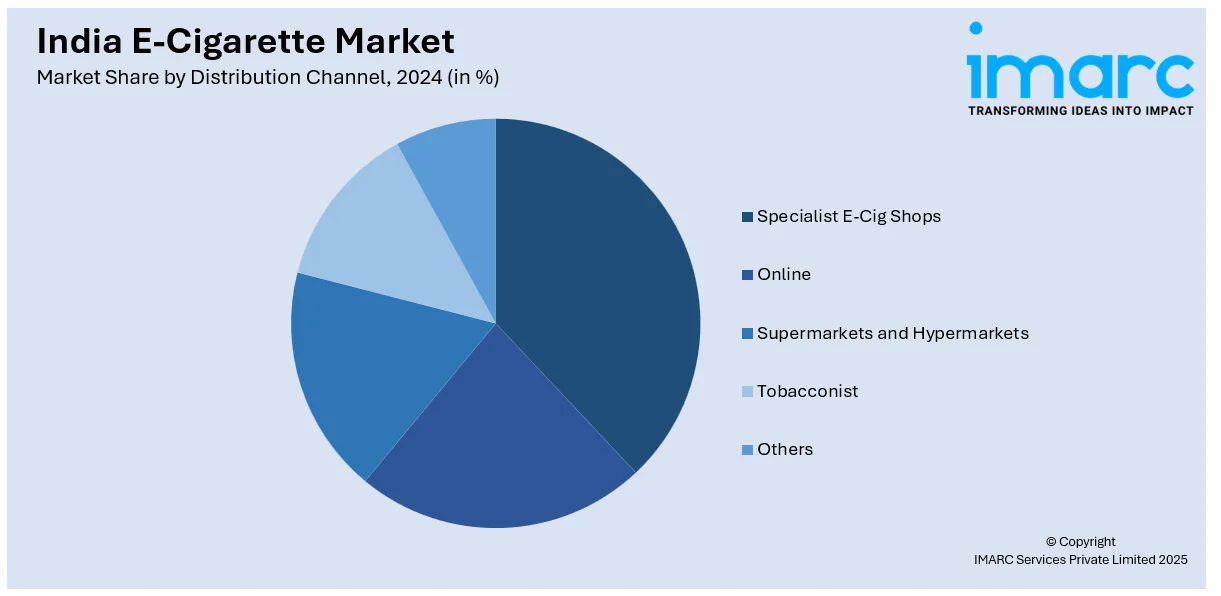

Distribution Channel Insights:

- Specialist E-Cig Shops

- Online

- Supermarkets and Hypermarkets

- Tobacconist

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes specialist e-cig shops, online, supermarkets and hypermarkets, tobacconist, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India E-Cigarette Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Modular E -Cigarette, Rechargeable E-Cigarette, Next-Generation E-Cigarette, Disposable E-Cigarette |

| Flavors Covered | Tobacco, Botanical, Fruit, Sweet, Beverage, Others |

| Modes of Operation Covered | Automatic E-Cigarette, Manual E-Cigarette |

| Distribution Channels Covered | Specialist E-Cig Shops, Online, Supermarkets and Hypermarkets, Tobacconist, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India e-cigarette market performed so far and how will it perform in the coming years?

- What is the breakup of the India e-cigarette market on the basis of product?

- What is the breakup of the India e-cigarette market on the basis of flavor?

- What is the breakup of the India e-cigarette market on the basis of mode of operation?

- What is the breakup of the India e-cigarette market on the basis of distribution channel?

- What is the breakup of the India e-cigarette market on the basis of region?

- What are the various stages in the value chain of the India e-cigarette market?

- What are the key driving factors and challenges in the India e-cigarette market?

- What is the structure of the India e-cigarette market and who are the key players?

- What is the degree of competition in the India e-cigarette market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India e-cigarette market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India e-cigarette market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India e-cigarette industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)