India E-Axle Market Size, Share, Trends and Forecast by Component Type, Vehicle Type, Drive Type, and Region, 2025-2033

India E-Axle Market Overview:

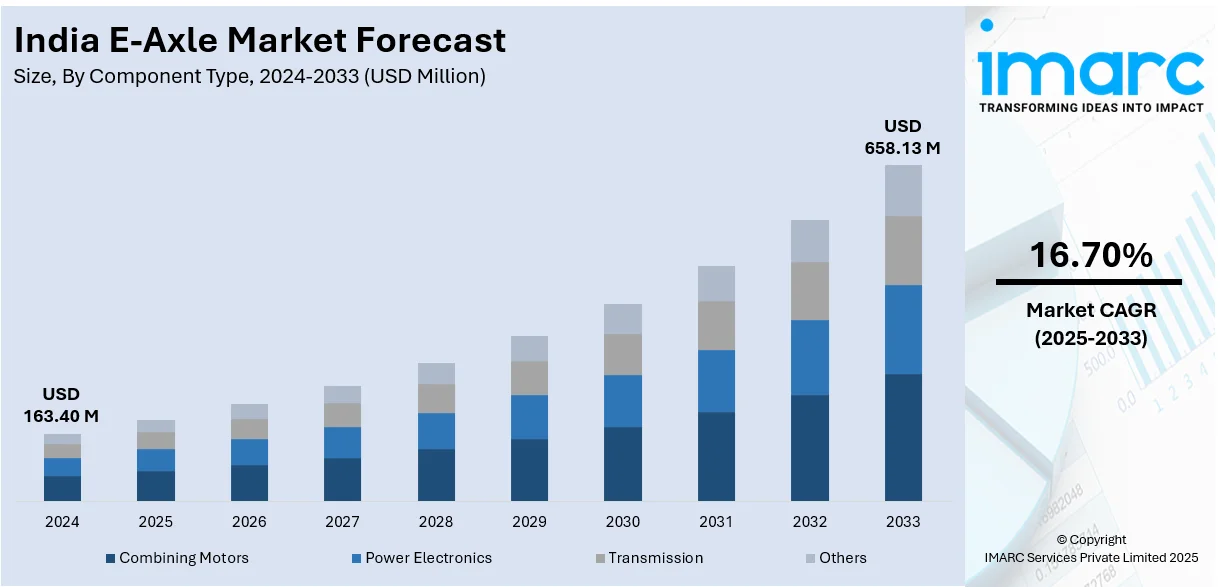

The India e-axle market size reached USD 163.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 658.13 Million by 2033, exhibiting a growth rate (CAGR) of 16.70% during 2025-2033. The India e-axle market share is expanding, driven by the growing demand for electric vehicles (EVs) that require e-axle systems for energy optimization, along with rising investments in research and development (R&D) activities to develop economical and high-performance e-axles.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 163.40 Million |

| Market Forecast in 2033 | USD 658.13 Million |

| Market Growth Rate (2025-2033) | 16.70% |

India E-Axle Market Trends:

Increasing demand for EVs

The rising demand for EVs is impelling the India e-axle market growth. According to industry reports, in 2024, the sales of electric cars in India rose by 20%, hitting almost 100,000 units, which marked an increase from 82,688 in 2023. As people shift towards electric mobility due to high fuel costs, manufacturers focus on enhancing EV performance, range, and efficiency. The e-axle, which combines the motor, transmission, and power electronics into a single unit, helps to optimize space, reduce vehicle weight, and improve energy usage, making it an essential component in modern EVs. Additionally, advancements in battery technology and charging infrastructure support EV penetration, driving the demand for high-performance powertrains. The expansion of domestic EV manufacturing, led by major companies and new startups in the country, also creates the need for advanced e-axle systems. As more automakers focus on cost-effective production, localized manufacturing of e-axles gains momentum, lowering dependence on imports and boosting the Indian EV supply chain. With the rapid electrification of passenger cars, commercial vehicles, and two-wheelers, the demand for e-axles is rising, positioning them as a key driver in India's growing EV ecosystem.

To get more information on this market, Request Sample

Growing adoption of sustainability

The increasing adoption of sustainability is offering a favorable India e-axle market outlook. As concerns about carbon emissions and environmental impact grow, EVs have become a key focus for reducing pollution, and e-axles play a crucial role in making EVs more efficient. These integrated systems improve energy efficiency, minimize vehicle weight, and enhance overall performance, making EVs more sustainable. Government policies and incentives for green technologies further encourage automakers to invest in e-axle solutions. In April 2024, the Government of India inaugurated the 'Electric Mobility Promotion Scheme,’ allocating a total budget of USD 60.18 Million (INR 500 Crores). The goal was to enable eco-friendly transportation and promote the production of EVs within the nation. Besides this, the rise of renewable energy sources like wind and solar power improves the sustainability of EVs, driving the demand for reliable drivetrains. With rapid urbanization and stricter emission norms, fleet operators and logistics companies also shift to electric commercial vehicles, creating the need for effective e-axle systems. Local manufacturers and global players are investing in R&D activities to develop economical and high-performance e-axles, reducing reliance on fossil fuel-based transportation. As more companies focus on net-zero goals and green production, the market in India sees continuous growth. With rising user awareness and technological advancements, e-axles become a key enabler of India’s transition towards eco-friendly mobility, supporting long-term sustainability efforts.

India E-Axle Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component type, vehicle type, and drive type.

Component Type Insights:

- Combining Motors

- Power Electronics

- Transmission

- Others

The report has provided a detailed breakup and analysis of the market based on the component types. This includes combining motors, power electronics, transmission, and others.

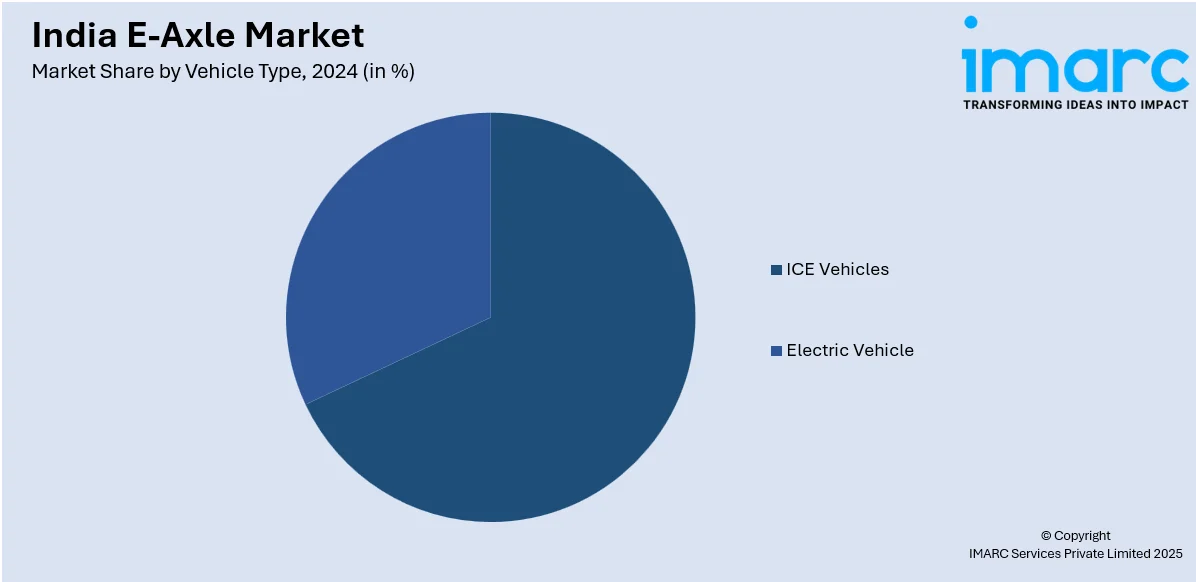

Vehicle Type Insights:

- ICE Vehicles

- Passenger Vehicle

- Commercial Vehicle

- Electric Vehicle

A detailed breakup and analysis of the market based on the vehicle types have also been provided in the report. This includes ICE vehicles (passenger vehicle and commercial vehicle) and electric vehicle.

Drive Type Insights:

- Forward Wheel Drive

- Rear Wheel Drive

- All Wheel Drive

A detailed breakup and analysis of the market based on the drive types have also been provided in the report. This includes forward wheel drive, rear wheel drive, and all wheel drive.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India E-Axle Market News:

- In February 2025, Renault, the well-known car manufacturing company, conducted trial tests on the ‘Renault Duster 4x4’, revealing the electric rear axle for the first time. The vehicle employed a 48V mild-hybrid system and a 1.2-litre three-cylinder turbocharged petrol engine, in addition to a motor on the rear axle. The firm was set to launch the new Duster in India in 2026, with production expected to start in September.

- In June 2024, Musashi Auto Parts India Pvt Ltd. commenced the large-scale production of e-axles for electric two-wheelers at its Bangalore facility, paving the way for the expansion of the EV sector in India. The initial goal was to produce 10,000 e-axles in phase 1, with plans to boost production capacity in subsequent phases. Due to their small and light design, these e-axles could enhance performance, range, and ride comfort.

India E-Axle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Combining Motors, Power Electronics, Transmission, Others |

| Vehicle Types Covered |

|

| Drive Types Covered | Forward Wheel Drive, Rear Wheel Drive, All Wheel Drive |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India e-axle market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India e-axle market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India e-axle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The e-axle market in India was valued at USD 163.40 Million in 2024.

The India e-axle market is projected to exhibit a CAGR of 16.70% during 2025-2033, reaching a value of USD 658.13 Million by 2033.

The market is driven by increasing EV production, demand for compact integrated drivetrains, and focus on energy efficiency. OEMs are reducing mechanical complexity and improving vehicle range with e-axle solutions. Cost reduction through system integration and greater acceptance of electrified platforms across segments are also pushing demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)