India Dry Type Transformer Market Size, Share, Trends and Forecast by Voltage, Application, and Region, 2026-2034

India Dry Type Transformer Market Overview:

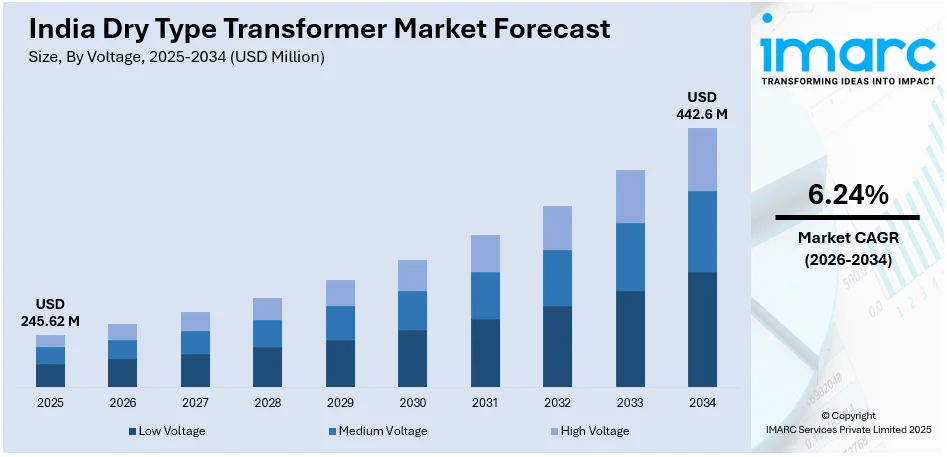

The India dry type transformer market size reached USD 245.62 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 442.6 Million by 2034, exhibiting a growth rate (CAGR) of 6.24% during 2026-2034. The India dry type transformer market share is expanding, driven by the increasing expenditure on renewable energy projects that require reliable and efficient transformers to minimize fire risks, along with the rising utilization in server rooms and power distribution units to ensure stable energy flow.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 245.62 Million |

| Market Forecast in 2034 | USD 442.6 Million |

| Market Growth Rate 2026-2034 | 6.24% |

India Dry Type Transformer Market Trends:

Growing investments in renewable energy

Rising investments in renewable energy projects are impelling the India dry type transformer market growth. In March 2025, Surya International obtained an agreement worth INR 102 Crore to create a 200 kW solar-hydrogen-BESS microgrid in Chushul, India. Granted by National Thermal Power Corporation (NTPC) Renewable Energy Ltd, this project was a partnership between NTPC and the Indian Army aimed at delivering continuous clean energy to distant defense outposts. Dry type transformers are being used in these projects due to their safety, efficiency, and ability to operate without oil, reducing fire risks and environmental concerns. As India continues to wager on large-scale solar parks, wind farms, and hybrid renewable setups, the demand for reliable power distribution equipment like dry type transformers is increasing. These transformers are widely deployed in inverter stations, power substations, and energy storage systems to manage power flow from renewable sources to the grid. Additionally, government initiatives promoting green energy development, such as funding for solar power capacity and offshore wind projects, are further creating the need for dry type transformers. This trend is encouraging transformer manufacturers to develop customized solutions for renewable energy applications, ensuring efficient power conversion and distribution across India.

To get more information on this market Request Sample

Increasing need for data centers

The rising requirement for data centers is offering a favorable India dry type transformer market outlook. Data centers need dependable and effective power distribution systems to maintain continuous tasks and protect sensitive IT equipment. Dry type transformers are becoming a preferred choice in data centers due to their enhanced safety and low maintenance. As India's cloud service providers, tech companies, and enterprises are expanding data storage facilities, the demand for dry type transformers is rising. These transformers are widely employed in server rooms, power distribution units, and backup power systems to guarantee stable power flow and voltage regulation. Additionally, with the Indian government encouraging digitalization and data localization, investments in data center construction are increasing, further enabling the adoption of dry type transformers. This trend is motivating transformer manufacturers to introduce compact and energy-saving solutions tailored to data center needs. In November 2024, Jaybee Industries, a frontrunner in India's electrical equipment manufacturing industry, launched its new series of dry type transformers, aimed at addressing the high requirement for sustainable, dependable, and space-efficient power solutions in India. These transformers served various purposes, such as data centers, healthcare settings, and industrial sites.

India Dry Type Transformer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on voltage and application.

Voltage Insights:

- Low Voltage

- Medium Voltage

- High Voltage

The report has provided a detailed breakup and analysis of the market based on the voltages. This includes low voltage, medium voltage, and high voltage.

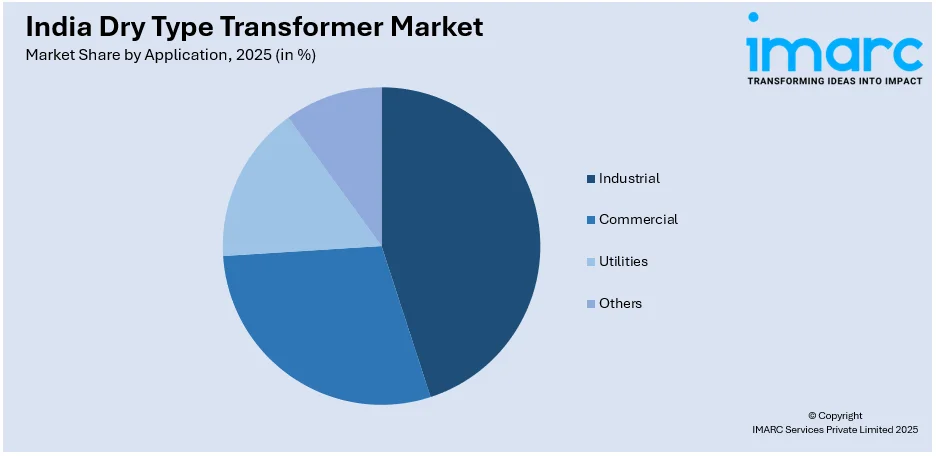

Application Insights:

Access the comprehensive market breakdown Request Sample

- Industrial

- Commercial

- Utilities

- Others

A detailed breakup and analysis of the market based on the applications have also been provided in the report. This includes industrial, commercial, utilities, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Dry Type Transformer Market News:

- In February 2025, Hitachi Energy planned to enlarge its transformer facilities in Karnataka and Vadodara, through a multimillion-dollar investment. It intended to incorporate an impressive additional 20,000 square meters of production and testing space In India. This broadening was aimed at improving the firm’s abilities for dry type transformers, small, medium, and large power transformers, traction transformers, and insulation and components items.

- In December 2024, the power department revealed plans to obtain oil-free transformers to remove the danger of oil theft and explosions. These compact dry type transformers used solid insulation materials, providing improved safety.

India Dry Type Transformer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Voltages Covered | Low Voltage, Medium Voltage, High Voltage |

| Applications Covered | Industrial, Commercial, Utilities, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India dry type transformer market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India dry type transformer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India dry type transformer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dry type transformer market in India was valued at USD 245.62 Million in 2025.

The India dry type transformer market is projected to exhibit a CAGR of 6.24% during 2026-2034, reaching a value of USD 442.6 Million by 2034.

The India dry type transformer market is driven by factors such as increasing urbanization, growing industrial demand, and a push for energy efficiency. Government initiatives promoting renewable energy, alongside a rise in infrastructure development, further support the market growth. The shift towards safer, environment-friendly transformers also plays a significant role in market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)