India Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End Use Industry, and Region, 2026-2034

India Drones Market Summary:

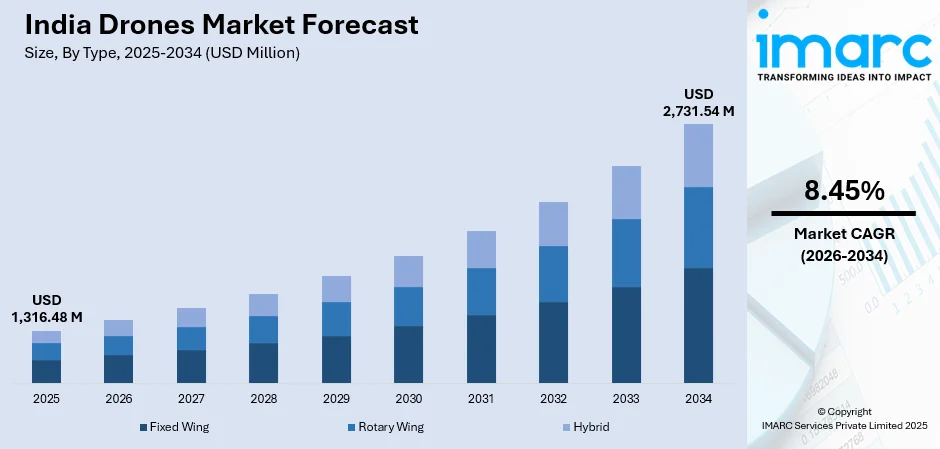

The India drones market size was valued at USD 1,316.48 Million in 2025 and is projected to reach USD 2,731.54 Million by 2034, growing at a compound annual growth rate of 8.45% from 2026-2034.

At present, the Indian drone ecosystem is experiencing remarkable momentum as unmanned aerial systems transition from experimental applications to mission-critical infrastructure across diverse sectors. Apart from this, the growing recognition of operational efficiency gains, coupled with supportive regulatory frameworks and indigenous manufacturing capabilities, positions the market for sustained development throughout the forecast period, thereby expanding the India drones market share.

Key Takeaways and Insights:

- By Type: Rotary wing dominates the market with a share of 51% in 2025, favored for their superior maneuverability and vertical takeoff capabilities in congested operating environments.

- By Component: Hardware leads the market with a share of 54% in 2025, encompassing airframes, propulsion systems, sensors, and navigation equipment essential for operational functionality.

- By Payload: 25-170 kilograms segment represents the largest segment with a market share of 45% in 2025, balancing operational versatility with regulatory compliance for commercial deployments.

- By Point of Sale: Original equipment manufacturers (OEM) lead the market with a share of 70% in 2025, reflecting direct procurement preferences and integrated service requirements across institutional buyers.

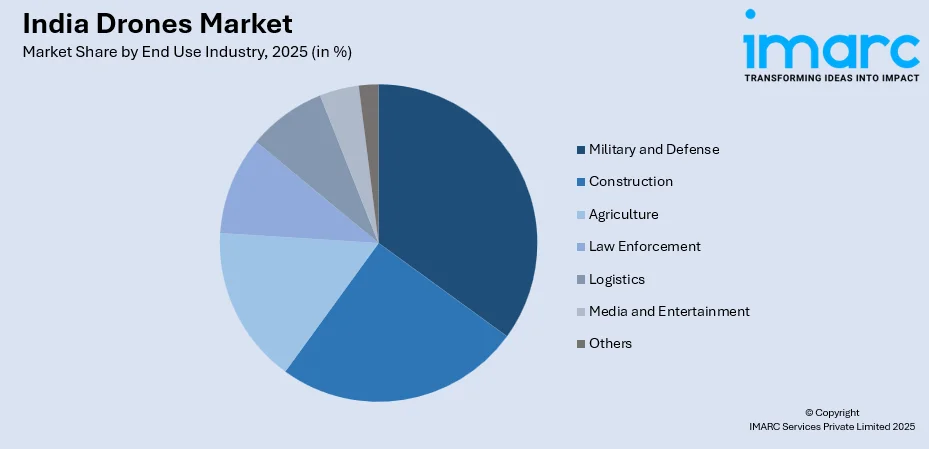

- By End Use Industry: Military and defense lead with 31% market share in 2025, driven by strategic surveillance requirements and border monitoring imperatives.

- By Region: South India represents the largest regional segment with 30% market share in 2025, benefiting from concentrated technology hubs and progressive state-level adoption policies.

- Key Players: The competitive landscape features established defense contractors collaborating with emerging technology startups, creating hybrid business models that combine manufacturing capabilities with specialized application development expertise across surveillance, mapping, delivery, and agricultural monitoring domains.

To get more information on this market Request Sample

The transformation of India's drone sector reflects converging forces of technological maturity, regulatory clarity, and commercial viability. As of January 2025, India had 29,501 registered drones, with Delhi leading at 4,882 units, followed by Tamil Nadu and Maharashtra. Agricultural cooperatives deploy swarms for precision crop management across fragmented landholdings, while logistics providers establish autonomous delivery corridors connecting urban centers. State governments increasingly integrate aerial platforms into disaster response protocols, with drones carrying 40 kg payloads deployed in Vijayawada city during 2024 flood operations for efficient delivery of essential supplies in areas inaccessible by conventional means. Drones have become an important resource in India's disaster management initiatives, providing quick access to regions isolated by floods. Their capacity to provide vital resources has been essential in recent flood relief efforts. The state government showed optimism that the issue would be settled shortly, referencing the improved efficiency of aid operations thanks to drone usage.

India Drones Market Trends:

Regulatory Liberalization Accelerating Commercial Deployment

Progressive amendments to unmanned aircraft system regulations have removed historical bottlenecks that previously constrained commercial operations. Simplified type certification processes, expanded visual line-of-sight permissions, and streamlined operator licensing requirements enable businesses to operationalize drone programs with reduced compliance friction. Digital sky platforms now facilitate automated flight authorization, transforming what once required weeks of manual approvals into instantaneous clearances for routine operations. In 2026, India plans to initiate the Drone Shakti Mission. This project seeks to enhance local production of drone parts. The initiative will further encourage research and development for cutting-edge drones. This action is a component of India's plan to attain technological independence. The government is focusing on science and technology to foster national growth. This will promote innovation and independence in essential industries.

Indigenous Manufacturing Ecosystem Maturation

Domestic production capabilities have evolved beyond assembly operations to encompass complete design-to-delivery value chains. In 2024, the government is planning to introduce Production-Linked Incentive (PLI) 2.0 scheme with proposed funding of approximately ₹1,000 crore, targeting reduction in imports to achieve 30% local production of total drone value. Component localization initiatives reduce import dependencies while fostering specialized supplier networks for propulsion systems, sensor integration, and autonomous navigation technologies. In August 2025, Garuda Aerospace inaugurated its Defence Drone Facility in Chennai, unveiling five new UAVs for battlefield and disaster-response use, and announced a Defence Drone Lab with the Army. Manufacturing clusters emerging in technology corridors demonstrate increasing sophistication in producing specialized platforms tailored for Indian operational conditions including extreme temperature variations and monsoon resilience requirements.

Cross-Sector Application Diversification

Traditional use cases in surveying and aerial photography are giving way to specialized applications that leverage unique platform capabilities. Insurance companies deploy drones for rapid damage assessment following natural disasters, reducing claim processing timelines from weeks to days. Infrastructure developers utilize photogrammetry for construction progress monitoring, while telecommunications providers conduct tower inspections that previously required dangerous manual climbs. in 2025, Bengaluru Metro Rail Corporation Ltd shared plans to use artificial intelligence (AI) and drones to monitor the safety of concrete structures like cracks and structural damages. This functional expansion creates self-reinforcing adoption cycles as successful implementations in one sector inspire experimentation in adjacent industries.

Market Outlook 2026-2034:

The trajectory for India's drone sector reflects fundamental shifts in how organizations perceive and deploy unmanned systems across operational environments. Declining hardware costs combined with improving battery technologies and artificial intelligence integration will enable applications previously constrained by economic or technical limitations. The market generated a revenue of USD 1,316.48 Million in 2025 and is projected to reach a revenue of USD 2,731.54 Million by 2034, growing at a compound annual growth rate of 8.45% from 2026-2034. Technological convergence drives this expansion trajectory. Battery technology breakthroughs including solid-state configurations and lithium-sulfur cells promise to double endurance capabilities, addressing one of the sector's most persistent constraints.

India Drones Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Rotary Wing |

51% |

|

Component |

Hardware |

54% |

|

Payload |

25-170 Kilograms |

45% |

|

Point of Sale |

Original Equipment Manufacturers (OEM) |

70% |

|

End Use Industry |

Military and Defense |

31% |

|

Region |

South India |

30% |

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

Rotary wing dominates with a market share of 51% of the total India drones market in 2025.

Rotary wing platforms establish dominance through inherent design advantages that align with India's operational requirements across urban, agricultural, and infrastructure monitoring contexts. Rotary wing drones held major portion of revenue share in India's agricultural drone market in 2024, demonstrating their versatility for precision farming applications. Vertical takeoff and landing capabilities eliminate dependency on prepared surfaces, enabling deployment from confined locations including rooftops, agricultural field margins, and temporary staging areas during emergency response operations. Hovering stability facilitates detailed inspection workflows where sustained observation of specific infrastructure elements or crop conditions provides actionable intelligence that fixed-wing platforms cannot replicate.

The architectural flexibility of multirotor configurations accommodates diverse payload integration requirements ranging from thermal imaging sensors for surveillance applications to multispectral cameras for precision agriculture and LiDAR systems for topographical mapping. Modular design philosophies enable rapid mission reconfiguration, allowing single platforms to serve multiple departmental functions within organizations. This versatility proves particularly valuable for small and medium enterprises making initial drone investments, as rotary systems minimize the need for specialized platforms dedicated to narrow application sets.

Component Insights:

- Hardware

- Software

- Accessories

Hardware leads with a share of 54% of the total India drones market in 2025.

Physical platform components constitute the foundational investment for drone deployment, encompassing airframes engineered for specific operational profiles, propulsion systems balancing endurance against payload capacity, and sensor packages providing mission-critical data acquisition capabilities. Battery technology represents ongoing hardware innovation focus areas, as energy density improvements directly translate to extended flight durations and expanded operational ranges. Navigation systems incorporating differential GPS and inertial measurement units enable precise positioning essential for mapping applications and autonomous flight operations.

Manufacturing quality variations significantly impact total cost of ownership through maintenance requirements and operational reliability. Premium hardware specifications command pricing premiums but deliver extended service intervals and reduced downtime compared to economy alternatives. Buyers increasingly evaluate component sourcing transparency and after-market support availability, recognizing that hardware investments extend beyond initial purchase to encompass multi-year operational lifecycles requiring spare parts availability and technical service access.

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

25-170 kilograms exhibits a clear dominance with a 45% share of the total India drones market in 2025.

This payload classification occupies a strategic position balancing operational capability with regulatory accessibility for commercial operators. Platforms in this range accommodate sophisticated sensor suites including high-resolution cameras, thermal imaging systems, and specialized agricultural applicators while remaining within weight thresholds that simplify certification pathways and operational permissions. The capacity enables meaningful cargo transport for logistics applications including medical supply delivery to remote healthcare facilities and spare parts distribution for infrastructure maintenance operations.

Agricultural applications particularly benefit from this payload range, as precision spraying systems require sufficient capacity for pesticide or fertilizer payloads that enable economically viable field coverage per flight cycle. Survey and mapping operations utilize the weight allowance for LiDAR sensors and advanced photogrammetry equipment that produce centimeter-level accuracy for engineering and cadastral applications. The segment's dominance reflects market concentration in commercial applications where operational requirements exceed hobby-grade platforms but remain below heavy-lift industrial specifications.

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

Original equipment manufacturers (OEM) lead with a share of 70% of the total India drones market in 2025.

Direct manufacturer relationships provide institutional buyers with integrated solutions combining hardware platforms, training programs, maintenance agreements, and technical support frameworks essential for sustainable drone program operations. Organizations prioritize OEM channels when establishing new capabilities or expanding existing fleets, as factory-backed warranties and certified service networks mitigate operational risks associated with complex technology deployments. Government procurement processes particularly favor OEM engagement due to compliance requirements and liability considerations that aftermarket providers may not adequately address.

Manufacturers increasingly bundle value-added services including pilot training certification, operational consulting, and fleet management software as differentiation strategies beyond hardware specifications alone. These comprehensive packages appeal to first-time adopters lacking internal expertise to independently configure and maintain drone operations. OEM relationships also facilitate technology roadmap discussions, enabling customers to align procurement decisions with anticipated capability requirements as applications evolve and regulatory frameworks expand permissible operations.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

Military and defense exhibit a clear dominance with a 31% share of the total India drones market in 2025.

Strategic imperatives driving military drone adoption encompass border surveillance across challenging terrain, tactical reconnaissance supporting ground force operations, and intelligence gathering in contested environments where manned aircraft face unacceptable risk exposure. Extended endurance platforms enable persistent area monitoring that previously required multiple aircraft rotations, while specialized sensors detect intrusions and anomalies across vast geographical expanses. In November 2025, ideaForge won an additional procurement worth approximately ₹100 crore ($11.3 million) for Zolt tactical drone and SWITCH 2 vertical-takeoff UAV, following field evaluations in high-altitude and heavily jammed environments.

Defense procurement emphasizes indigenous development programs aligned with strategic autonomy objectives and technology transfer requirements. Collaborative programs between defense research organizations and private sector manufacturers accelerate capability development while fostering domestic industrial competencies. In October 2024, India and the US concluded a $3.5-billion deal for procurement of 31 MQ-9B armed High Altitude Long Endurance Remotely Piloted Aircraft Systems manufactured by General Atomics. Specialized mission requirements including high-altitude operations, electronic warfare payloads, and adversarial environment survivability drive customization demand that distinguish military platforms from commercial derivatives, sustaining premium market valuations despite lower unit volumes compared to civilian applications.

Region Insights:

- North India

- West and Central India

- South India

- East India

South India leads with a share of 30% of the total India drones market in 2025.

Regional concentration reflects the convergence of aerospace engineering talent pools, established technology corridors, and progressive state government policies supporting innovation ecosystems. Bangalore's position as India's aerospace capital provides manufacturers with access to specialized component suppliers, skilled workforce availability, and proximity to research institutions driving technology advancement. State-level initiatives including drone parks offering testing infrastructure and startup incubators focused on unmanned systems accelerate commercialization timelines for emerging applications.

Agricultural deployment density in southern states contributes significantly to market volumes as farmers adopt precision agriculture techniques for high-value crops including horticulture and plantation commodities. Cooperative societies and farmer producer organizations increasingly procure drone services for collective benefit, creating economies of scale that make advanced agricultural practices accessible to smallholder operations. Infrastructure development momentum including expressway construction, renewable energy installations, and urban expansion projects generates sustained demand for survey, monitoring, and inspection services that regional drone operators fulfill.

Market Dynamics:

Growth Drivers:

Why is the India Drones Market Growing?

Agricultural Modernization Imperatives Driving Precision Farming Adoption

Indian agriculture faces persistent productivity challenges stemming from fragmented land holdings, inefficient input utilization, and limited real-time crop health monitoring capabilities. Drone-enabled precision agriculture addresses these constraints by providing farmers with actionable intelligence on irrigation requirements, pest infestations, and nutrient deficiencies at granular field levels. Precision spraying using drones reduces chemical usage by 30-40% according to the Indian Council of Agricultural Research, with spraying drones saving up to 90% of time compared to manual methods. In 2024, Optiemus Unmanned Systems (OUS) unveiled its latest collection of locally designed and produced drones for agricultural and mapping purposes at the 5th Drone International Expo held at Pragati Maidan, New Delhi.

Infrastructure Development Surge Creating Monitoring and Inspection Demand

Ambitious infrastructure programs spanning highways, railways, renewable energy installations, and urban development generate massive requirements for surveying, progress monitoring, and asset inspection workflows. Traditional methods involving ground surveys and manual inspections face limitations in accuracy, speed, and safety when applied to linear infrastructure spanning thousands of kilometers or vertical structures like transmission towers and wind turbines. Drones equipped with high-resolution cameras and LiDAR sensors produce detailed topographical data and structural condition assessments at fractions of traditional costs while eliminating human exposure to dangerous working conditions. In 2024, the Himachal Pradesh State Disaster Management Authority (HPSDMA) planned to conduct a drone-based light detection and ranging (LiDAR) survey to examine occurrences of landslides and land subsidence in Shimla.

Urban Air Mobility Development and Last-Mile Logistics Innovation

Chronic urban congestion coupled with e-commerce growth drives exploration of aerial logistics solutions that bypass ground transportation bottlenecks. India ended 2025 with over two million drone deliveries, with drones no longer limited to delivering essential items but now servicing higher-value categories such as fashion and beauty products. Medical supply delivery represents an immediate viable application where time-critical pharmaceuticals, blood products, and diagnostic samples benefit from direct aerial routing between healthcare facilities. In 2024, Raminfo Limited launched Kisan Drones Private Limited, planning to establish 100 centers across five states within two years, creating over 1,000 new entrepreneurs.

Market Restraints:

What Challenges the India Drones Market is Facing?

Airspace Coordination Complexity and Security Restrictions

Dense airspace utilization around major metropolitan areas and proximity to military installations create operational constraints limiting where and when commercial drones can fly. Only a limited planned national drone corridors remain operational, with a major number of remote pilot certifications backlogged due to DGCA procedural delays. Security sensitivities around critical infrastructure including power plants, government facilities, and strategic installations result in extensive no-fly zones that fragment available operating areas. Obtaining flight permissions even in approved zones can involve bureaucratic processes that undermine operational flexibility essential for time-sensitive applications, particularly when emergency response situations demand immediate deployment authorizations.

Technical Skills Gap and Training Infrastructure Deficits

Effective drone operations require specialized competencies spanning aviation principles, sensor operation, data processing, and regulatory compliance that exceed capabilities of typical technology users. While pilot training programs exist, comprehensive curricula covering maintenance, advanced flight operations, and application-specific workflows remain underdeveloped. Organizations face challenges recruiting qualified personnel or must invest significantly in developing internal expertise through extended training periods that delay operational deployment and increase total program costs beyond initial hardware investments.

Battery Technology Limitations Constraining Operational Scope

Current energy storage technology restricts practical flight durations to fifteen to thirty minutes for typical commercial platforms, limiting operational ranges and necessitating frequent landing cycles that reduce productivity. Extended missions require multiple battery sets and field charging infrastructure that add logistical complexity to remote deployments. Temperature extremes common across India's geography further degrade battery performance, particularly in high-altitude or desert environments where operational demands are highest. Until breakthrough improvements in energy density or alternative power systems emerge, endurance constraints will continue limiting certain application categories.

Competitive Landscape:

The India drones market exhibits dynamic competitive characteristics as established defense contractors, consumer electronics manufacturers, and specialized startups compete across distinct market segments. Defense-focused players dominate high-value military procurements through existing government relationships and security clearance advantages, while commercial markets see fragmentation among numerous participants offering differentiated capabilities. Technology differentiation increasingly centers on autonomous flight systems, artificial intelligence-enabled data processing, and application-specific sensor integration rather than airframe specifications alone. Vertical integration strategies vary significantly, with some manufacturers controlling complete value chains from component production through end-user services, while others focus on platform assembly and rely on ecosystem partners for specialized capabilities. Service provider models gain traction as businesses prefer operational expenditure arrangements over capital equipment investments, creating opportunities for drone-as-a-service companies managing fleets and delivering turnkey solutions. Strategic partnerships between hardware manufacturers and software developers produce integrated offerings that simplify deployment for end users lacking technical expertise to independently configure complex systems.

Recent Developments:

- In January 2026, The Army deployed counter-Unmanned Aircraft Systems (UAS) or drones along the Line of Control (LoC) after several drone observations in the Rajouri district of Pir Panjal Valley.

- In February 2025, Adani Defence & Aerospace, in partnership with the Defence Research and Development Organisation (DRDO), launched India's Vehicle-Mounted Counter-Drone System based on public-private collaboration at Aero India 2025 today. Dr. B.K. Das, Director General (Electronics & Communication System) of DRDO, launched the platform with notable guests from DRDO, defence specialists, and industry collaborators, highlighting India’s dedication to enhancing domestic defence capabilities.

- In July 2025, India is set to initiate a $234 million incentive initiative for both civil and military drone manufacturers to lessen their dependence on foreign components and to challenge Pakistan's program, which is supported by China and Turkey.

India Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Points of Sales Covered | Original Equipment Manufacturers (OEMs), Aftermarket |

| End Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment and Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India drones market size was valued at USD 1,316.48 Million in 2025.

The India drones market is expected to grow at a compound annual growth rate of 8.45% from 2026-2034 to reach USD 2,731.54 Million by 2034.

Rotary wing dominated with a market share of 51% in 2025, driven by their operational flexibility, vertical takeoff capabilities, and suitability across diverse applications from agricultural monitoring to infrastructure inspection in India's varied geographical terrain.

Key factors driving the India drones market include agricultural modernization initiatives requiring precision crop management solutions, accelerating infrastructure development, and emerging urban logistics applications with a large number of drone deliveries completed in 2025 addressing last-mile delivery challenges.

Major challenges include complex airspace coordination requirements with only a limited planned national drone corridors operational, technical skills shortages with large number of remote pilot certifications backlogged due to DGCA procedural delays, battery technology constraints restricting operational endurance and range, and evolving regulatory frameworks creating compliance uncertainties for commercial deployments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)