India Drilling Equipment Market Size, Share, Trends and Forecast by Type, Category, Power Source, Mount Type, Distribution Channel, End Use, and Region, 2025-2033

India Drilling Equipment Market Overview:

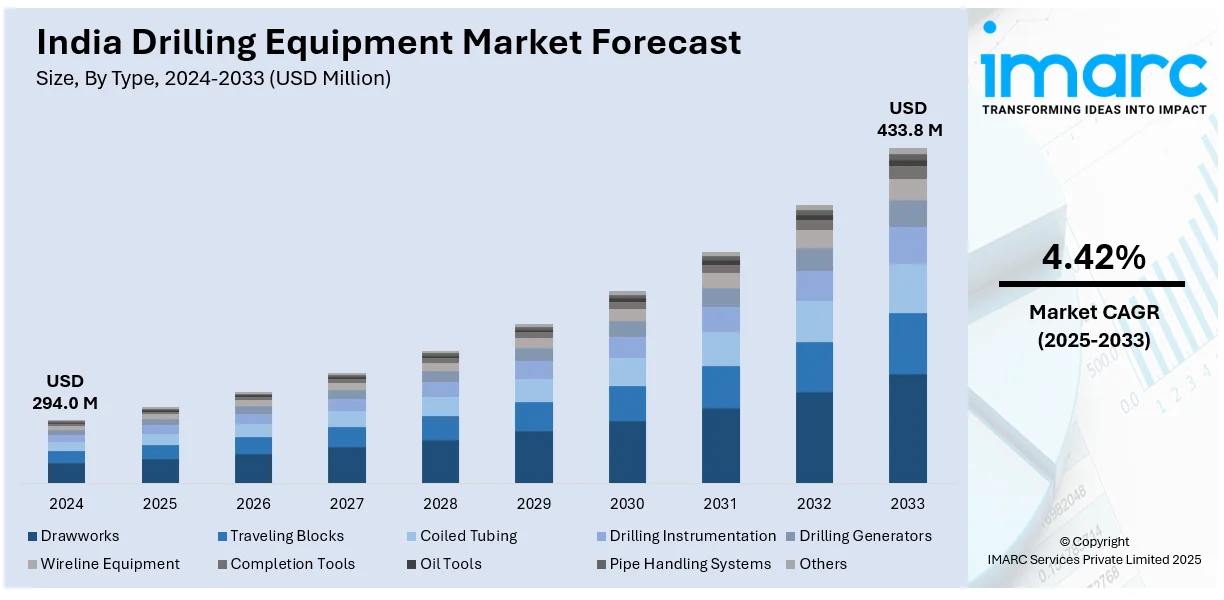

The India drilling equipment market size reached USD 294.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 433.8 Million by 2033, exhibiting a growth rate (CAGR) of 4.42% during 2025-2033. The market is driven by rapid infrastructure development, rising oil and gas exploration activities, and government initiatives like 'Make in India,' which promote domestic manufacturing. Increasing investments in construction, renewable energy, and mining further boost demand, alongside technological advancements enhancing drilling efficiency and operational sustainability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 294.0 Million |

| Market Forecast in 2033 | USD 433.8 Million |

| Market Growth Rate 2025-2033 | 4.42% |

India Drilling Equipment Market Trends:

Surge in Infrastructure Development Projects

India's economic expansion and urbanization at a lightning speed have triggered a record-level demand for developing infrastructure. Construction of highways, bridges, housing complexes, and commercial buildings needs heavy drilling work, thus the adoption of specialized drilling equipment is pushed. Based on the Ministry of Statistics and Programme Implementation's 2021-22 Annual Survey of Industries, the construction industry has registered a high growth rate, which mirrors more infrastructure projects across the country. This boost in construction operations demands effective drilling solutions for groundwork, soil investigation, and the laying of utilities, driving the drilling equipment market directly. In addition, the government's ambitious projects, including the Smart Cities Mission and Bharatmala, target the development of urban infrastructure and connectivity. These initiatives include mass-scale construction projects that are heavily dependent on drilling machinery for activities like piling and foundation work. The focus on timely and quality project completion further leads to a rising demand for efficient and dependable drilling machines. Overall, India's strong infrastructure development and construction growth is the key driver of the drilling equipment market, supported by government statistics in 2021-22 that highlight the growth trend.

To get more information on this market, Request Sample

Growth in the Oil and Gas Exploration Sector

India's energy requirements have been on the rise, and this has resulted in higher oil and gas exploration efforts. The desire to cut down on oil imports has seen the government encourage domestic exploration, thus raising the demand for drilling equipment. Statistics from the Ministry of Petroleum and Natural Gas reveal that the nation has been aggressively awarding new exploration blocks to expand local production. For example, four new Coal Bed Methane (CBM) blocks with an area of 3,862 sq. km were awarded in September 2022 under the Special CBM Bid Round 2021. Such efforts require sophisticated drilling technologies to effectively exploit unconventional hydrocarbon resources. Additionally, government policy changes strive to invite overseas investment in the oil and gas industry, causing a boost in procurement of drilling equipment with the latest technology. Prioritization of strengthening exploration and production infrastructure supports the country's aim of achieving energy security. To conclude, growth of oil and gas exploration activities coupled with government policies and statistics of 2021 and later majorly influences demand for drilling equipment in India.

India Drilling Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, category, power source, mount type, distribution channel, and end use.

Type Insights:

- Drawworks

- Traveling Blocks

- Coiled Tubing

- Drilling Instrumentation

- Drilling Generators

- Wireline Equipment

- Completion Tools

- Oil Tools

- Pipe Handling Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes drawworks, traveling blocks, coiled tubing, drilling instrumentation, drilling generators, wireline equipment, completion tools, oil tools, pipe handling systems, and others.

Category Insights:

- Automatic

- Manual

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes automatic and manual.

Power Source Insights:

- Electric

- Non-Electric

A detailed breakup and analysis of the market based on the power source have also been provided in the report. This includes electric and non-electric.

Mount Type Insights:

- Truck Mounted

- Trailer Mounted

A detailed breakup and analysis of the market based on the mount type have also been provided in the report. This includes truck mounted and trailer mounted.

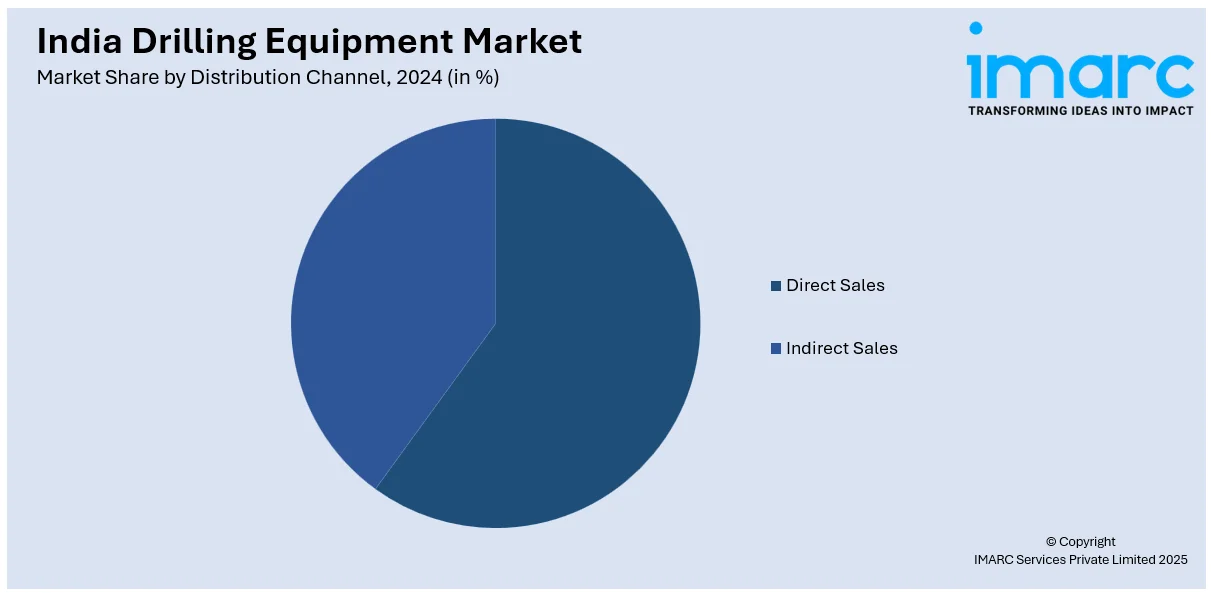

Distribution Channel Insights:

- Direct Sales

- Indirect Sales

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes direct sales and indirect sales.

End Use Insights:

- Construction

- Oil and Gas

- Mining

- Water Management

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes construction, oil and gas, mining, water management, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Drilling Equipment Market News:

- February 2025: Dolphin Drilling's Blackford Dolphin semisubmersible rig commenced operation for Oil India Ltd. in November 2024, adding strength to offshore drilling services demand. Strong rig rates for moored semisubs are expected by the company because of growth in exploration activity. Offshore drilling demand is fueled by this increase, stimulating India's drilling equipment market with greater need for sophisticated rigs and machinery.

- September 2024: Epiroc expanded its Hyderabad plant capacity to produce more rock drilling tools and set up an innovation center to support R&D efforts. This investment supports the 'Make in India' initiative, enhancing domestic manufacturing. All these developments propel the Indian drilling equipment market by driving domestic production and innovation.

India Drilling Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Drawworks, Traveling Blocks, Coiled Tubing, Drilling Instrumentation, Drilling Generators, Wireline Equipment, Completion Tools, Oil Tools, Pipe Handling Systems, Others |

| Categories Covered | Automatic, Manual |

| Power Sources Covered | Electric, Non-Electric |

| Mount Types Covered | Truck Mounted, Trailer Mounted |

| Distribution Channels Covered | Direct Sales, Indirect Sales |

| End Use Industries Covered | Construction, Oil and Gas, Mining, Water Management, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India drilling equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India drilling equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India drilling equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The drilling equipment market in India was valued at USD 294.0 Million in 2024.

The India drilling equipment market is projected to exhibit a CAGR of 4.42% during 2025-2033, reaching a value of USD 433.8 Million by 2033.

Growth is fueled by rising oil and gas exploration, growing mining operations, and increasing infrastructure development. Improved drilling rig technology, automation, and precision tools drive operational efficiency. Incentives from the government, domestic energy production emphasis, and growth in demand for unconventional drilling methods drive growth in industrial and energy segments further.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)