India Dog Food Market Size, Share, Trends and Forecast by Product Type, Pricing Type, Ingredient Type, Distribution Channel, and Region, 2025-2033

India Dog Food Market Size and Share:

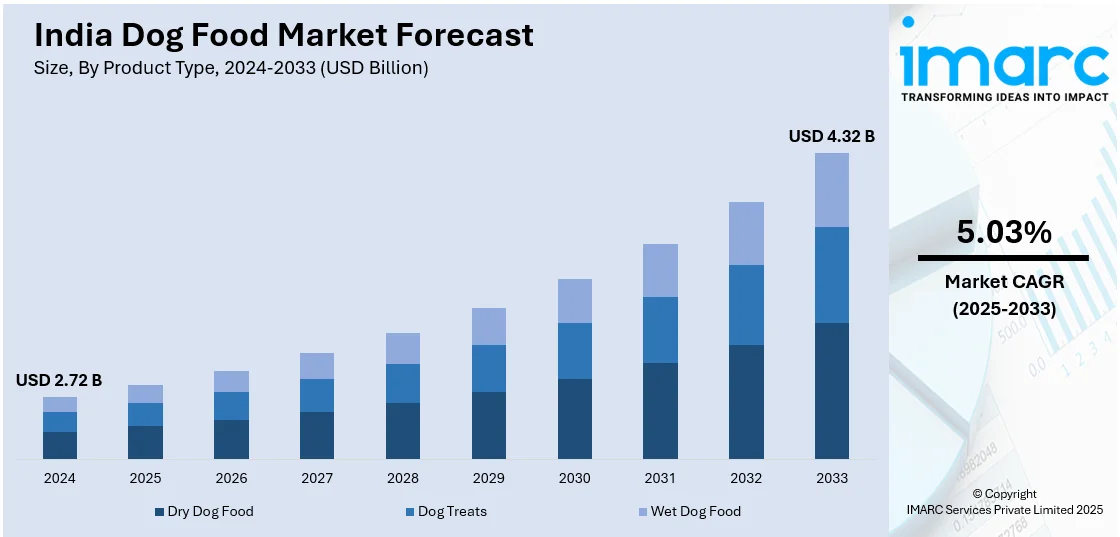

The India dog food market size was valued at USD 2.72 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.32 Billion by 2033, exhibiting a CAGR of 5.03% from 2025-2033. The market is experiencing rapid growth driven by rising pet ownership, increasing consumer spending on premium nutrition, expanding retail channels, growing awareness of pet health, and innovation in product formulations, with a competitive landscape shaped by domestic and global players investing in branding, distribution, and specialized dietary solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.72 Billion |

|

Market Forecast in 2033

|

USD 4.32 Billion |

| Market Growth Rate (2025-2033) | 5.03% |

The growth of dog food in the Indian market can be attributed majorly to a rise in the number of households owning pets. Urban households particularly have observed growing disposable incomes coupled with changing lifestyles, which give way to rising preferences for a companion animal, and this nuclear family trend shifted towards westernized pet care habits has amplified demands for high quality, nutritionally balanced dog foods. For instance, In July, Heads Up For Tails (HUFT) has introduced Hearty, a revolutionary dry pet food made with 100% real, farm-fresh ingredients. Developed with top veterinarians, it features Indian super herbs like Ashwagandha and Moringa, ensuring superior nutrition. Furthermore, the growing awareness among pet owners about canine nutrition, health concerns, and breed-specific dietary needs has further fueled the market. Moreover, the rapid expansion of e-commerce and pet specialty stores has made premium dog food brands more accessible to consumers across the country. A great many pet policies have been embraced with pet-loving influence on social media and other pet-friendly promotion, which may create a mindset toward the value of premium or organic and custom-made, premium dog foods based on personal health and nutrient requirements for each of their individual dogs.

To get more information on this market, Request Sample

Another key driver of the India dog food market growth is the rise in veterinary healthcare advancements and boosted consumer spending on pet well-being, which is shifting away from home-cooked meals to scientifically formulated dog food. The growing concerns over pet allergies, obesity, and digestive issues have encouraged pet owners to opt for specialized diets, such as grain-free, high-protein, and functional foods that enhance overall canine health. The organized chains for pet care expansion, increased private-label food manufacturers of pet foods, available in affordable qualities, have indeed created more intensified competition in markets as well as products. Favorable policies initiated by the government of India pertaining to the establishment of pet food manufacturing and heightening foreign investments within the pet care sector have accelerated market growth in recent times. With rising urbanization and a considerable millennial pet-owning population willing to spend more on their pets' dietary needs, the dog food market in India is expected to witness sustained growth in the coming years.

India Dog Food Market Trends:

Premiumization and Humanization of Pet Food

One of the largest trends in the India dog food market share is that premium pet food is becoming popular because of humanization. As pet owners perceive their dogs as family members, the need to have quality food that is rich in nutrition and gourmet food has become prominent. Brands are thus offering special formulations like grain-free, protein-rich, and organic to fulfill certain dietary requirements. It clearly shows that focus on canine health and longevity are on the hike, as depicted by the proliferation of functional pet foods containing probiotics, omega fatty acids, and joint-supporting ingredients. Brands are launching exotic flavors and breed-specific diets, which represent the diversity found in human food preferences. For example, in January 2024, Dogsee Chew launched a new range of dog chew flavors, including turmeric and coconut, along with fruit and veggie crunch treats and softer puffed treats for dogs. Moreover, the penetration of digital media, social influencers, and vets' endorsements builds consumer awareness towards premium, nutrient-rich dog food. The demand for ethically sourced, non-GMO, and preservative-free options is also propelling.

E-Commerce Boom and Direct-to-Consumer Sales

The rapid digitalization of the Indian retail sector has brought a new era of shopping behavior in pet owners when buying dog food. Online platforms are gaining momentum and become a key channel of distribution for e-commerce sites. This ranges from e-retailers, such as Amazon and Flipkart to pet-focused sites like Heads Up for Tails and Supertails. The advantage of online shopping together with subscription models has prompted more pet owners to seek premium and customized pet food. DTC brands are using data analytics to offer personalized pet food recommendations according to breed, age, and health conditions with tailored nutrition for individual pets. The rise of digital marketing, which includes influencer partnerships and interactive social media campaigns, has also played a very significant role in influencing consumer purchasing decisions. Further, flexible payment options and loyalty rewards offered by online pet retailers have further propelled the e-commerce-driven growth of the dog food market.

Innovation in Pet Food Formulations and Sustainability

Digitalization of the Indian retail sector is understood to be rapid as pet owners now buy dog food in a different manner altogether. Compared to physical retail, e-commerce is one of the largest channels of distribution. The gamut of online markets available includes Amazon, Flipkart, and numerous specialized pet-focused platforms like Heads Up For Tails and Supertails that allow consumers comprehensive choices, competitive pricing, and doorstep delivery. The convenience of online shopping coupled with subscription-based models has prompted more pet owners to choose premium and customized pet food solutions. For instance, in April 2024, Bowlers® from Allana launched Nutrimax, a premium yet affordable dog food range, featuring high-quality proteins, essential nutrients, and vet-approved formulations to meet India’s growing demand for superior pet nutrition. Moreover, DTC brands are using data analytics to customize pet food recommendations based on breed, age, and health conditions, thus offering tailored nutrition to individual pets. In addition to digital marketing, collaborations with influencers, and interactive campaigns on social media have contributed substantially to changing consumers' buying patterns. Further impelling the expansion of the pet food market from the perspective of e-commerce, flexible payment facilities and loyalty incentives from online sellers of dog foods are being received.

India Dog Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India dog food market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, pricing type, ingredient type, and distribution channel.

Analysis by Product Type:

- Dry Dog Food

- Dog Treats

- Wet Dog Food

Dry dog food dominates the Indian pet food market, primarily because it is affordable, convenient, and has a long shelf life. Dry kibble is preferred over wet food because it is easy to store, does not require refrigeration, and provides a balanced diet with all the necessary nutrients. Heightening awareness about pet nutrition helps the segment, with brands formulating breed-specific, age-specific, and health-targeted kibble. Recommendation for dry food by vets is also for dental health. In general, texture of dry food reduces the building of plaque. Large multinational houses and domestic players are developing new high-protein, grain-free, and fortified kibble, in turn. The popularity of premium and functional ingredients, such as probiotics, omega-3 fatty acids, and joint-supporting supplements is bringing new momentum to the segment. It continues to witness high market penetration of the dry dog food segment as disposable income amplifies and urbanization gains ground both in metropolitan and Tier-2 cities.

Analysis by Pricing Type:

- Premium Products

- Mass Products

Mass products are the fastest-growing segment among dog food for the Indian price-sensitive consumer masses. These include products that come in bulk and are affordable in nature, offering a wide outreach to middle-income households and even first-time owners of pets; they are eager to provide healthy nutrition to dogs at affordable cost. Local players and international chains compete in such a segment of products by releasing bulk-packaged food at comparable prices, accessible to a much wider customer segment. There's also a spate of segment growth because private label brands presented by supermarket chains offer an economy alternative to brands. Heightened ownership of street dogs and community feeding programs create mass-market dog food demand. To sell more, some brands aggressively push these products, using TV advertising, digital and veterinary tie-in programs to bring the products out to more consumers. Additionally, government initiatives and NGOs promoting responsible pet ownership contribute to the rising demand for budget-friendly dog food, making mass products the dominant segment in India's pet food industry.

Analysis by Ingredient Type:

- Animal Derived

- Plant Derived

Animal derived dog food formulations have dominated the Indian market because of their high protein content and natural appeal to canine diets. Meat-based products, such as chicken, fish, lamb, and egg protein, are preferred because of their digestibility and essential amino acids that contribute to muscle development and general health. Indian pet owners are highly becoming conscious of the merits of animal-based protein, hence, driving the brands to fortify their portfolios with real meat inclusions and freeze-dried protein options. The segment also gains from accelerating demand for natural, minimally processed ingredients against synthetic alternatives. Companies are focused on sourcing animal proteins of higher quality, assuring ethical and sustainable meat production. Premiumization trends are on the rise, and manufacturers are adding hydrolysed proteins and raw food blends to the market to address pet parents who seek biologically appropriate diets. With pet owners becoming intensely concerned about ingredient quality, the demand for high-protein, animal-derived dog food remains strong.

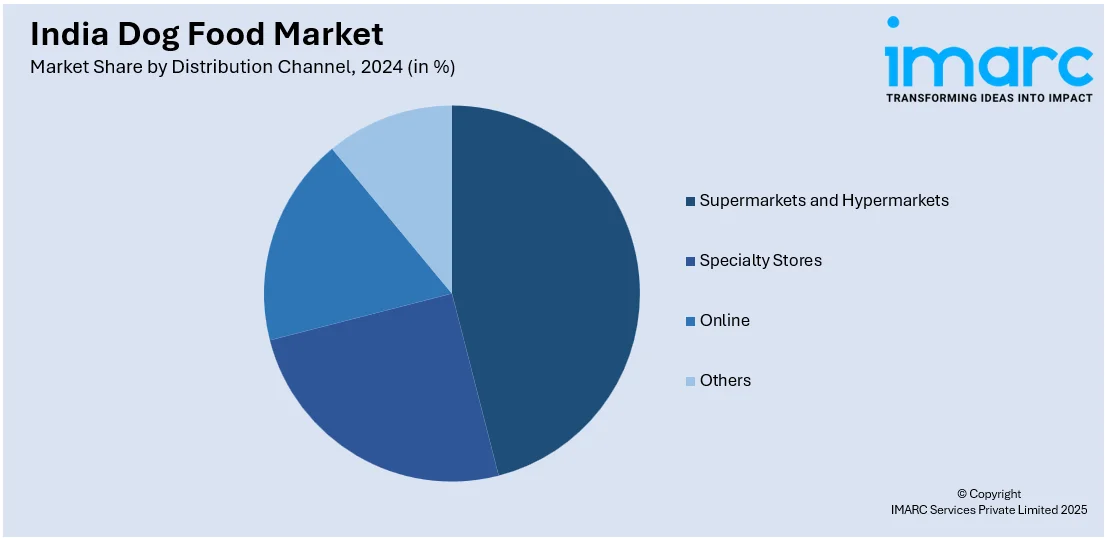

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Others

Supermarkets and hypermarkets are one of the most dominant distribution channels for dog food in India. These retail stores offer easy access to a wide variety of products that pet owners can view and compare different brands and formulations before buying. This channel induces frequent purchases driven by in-store promotions, bulk discounts, and loyalty programs; therefore, this is a key segment for mass and premium pet food brands. Large retail chains like Reliance Fresh, Big Bazaar, and D-Mart are increasingly giving more shelf space to pet food products as demand is growing. Supermarkets also act as important launch points for new products, where brands can introduce innovative offerings and run sampling campaigns. Modern retail environments also offer a platform for brands to educate consumers on pet nutrition through in-store consultants and promotional events. Along with boosting pet ownership across urban and semi-urban regions, it continues to serve the supermarket and hypermarkets by market expansion.

Analysis by Region:

- North India

- West and Central India

- South India

- East India

West and Central India are the largest contributors to the country's pet food market, with rapid urbanization, rising disposable income, and a growing rate of pet adoption. Cities like Mumbai, Pune, Ahmedabad, and Indore are the growth centers where pet ownership has accelerated, and commercial dog food demand has been higher. The well-established retail network, including supermarkets, hypermarkets, and specialty pet stores, supports the growth of the segment. Further, the western pet care trend that has been popularized through social media and digital marketing has also made pet parents in these regions opt for scientifically formulated diets instead of home-cooked meals. Veterinary clinics and pet grooming salons are also contributing to the growth of the market as they recommend good quality pet food brands. The premium, organic, and functional pet food in urban centers also continue to boost consumer spending in these regions. West and Central India would continue to remain important markets for dog food producers as more homes become pet parenting.

Competitive Landscape:

The India dog food market is highly competitive, with many domestic and international players trying to increase their market share by forming innovative products and aggressive marketing along with the expansion of distribution networks. Companies are focusing on premiumization, forming high-protein, grain-free, and breed-specific formulations as per the changes in consumer preferences. Rising awareness of pet nutrition has forced companies to invest in research and development and create functional foods that contain probiotics, omega fatty acids, and other joint-supporting supplements. Price segmentation is another role, with mass-market products dominating the market in volume, while premium and specialty dog food lead the growth in the urban pet owner's market. The battleground now is huge for e-commerce, with brands using online bases to provide doorstep delivery, make subscription models available, and deliver exclusive product lines. Private labels of big retailers and supermarket chains have intensified competition even more by providing budget-friendly alternatives. With growing population of pet owners, brands are also strengthening veterinarian partnerships and going into strategic alliances to create consumer confidence and broader access in the market.

The report provides a comprehensive analysis of the competitive landscape in the India dog food market with detailed profiles of all major companies, including:

- Mars Incorporated

- Nestlé Purina PetCare Company

- Drools Pet Food Pvt. Ltd.

- Venky's (India) Limited

- Royal Canin

- Farmina Pet Foods

- Goa Medicos Private Limited

- Bharat International Pet Foods

- Hausberg (Canine India)

- Charoen Pokphand Group (CP Group)

- Virbac

- General Mills Inc.

Latest News and Developments:

- April 2025: Godrej Consumer Products, through its subsidiary Godrej Pet Care (GPC), launched Godrej Ninja, a scientifically formulated dry dog food brand, in Tamil Nadu, marking its entry into the pet food market. Developed at the Nadir Godrej Centre for Animal Research & Development, Godrej Ninja supports gut health and immunity using probiotics, prebiotics, and polyphenols, containing 37 nutrients including vitamins and omega-3s. The brand targets local Indian dog breeds with balanced nutrition, addressing common gastrointestinal issues. GPC plans to invest Rs. 500 crore over five years, aiming for nationwide expansion in a Rs. 6,000 crore market with low current penetration.

- April 2025: Zigly, the pet care brand from Cosmo First Limited and India’s pioneer in tech-enabled omnichannel pet services, is rapidly expanding to meet the growing and diverse needs of pet owners nationwide. Strengthening its footprint in both Northern and Southern India, Zigly has recently opened four additional stores. Later in 2025, the brand is set to roll out a 90-minute home delivery service for pet food and accessories, alongside the planned launch of a specialized e-commerce platform.

- March 2025: Avanti Group, a branch of Avanti Feeds—among India’s leading aquaculture firms—has unveiled plans to diversify its offerings by introducing a range of cat and dog food, including dry kibble, wet meals, and treat varieties, by the end of 2025. In addition, the company revealed its intention to set up a cutting-edge pet food production facility in Hyderabad, India.

- February 2025: Dogsee Chew, a natural pet treat brand, secured USD 8 million in a Series B funding round led by Ektha, bringing its total funding to USD 22 million. The company plans to use the capital to expand its manufacturing capabilities, including expanding current factories and establishing a new production facility.

- December 2024: Allana Group's Bowler's Nutrimax targets India's pet food market by offering affordable premium dog food, emphasizing human-grade ingredients and cost-effective bulk/economy packs. Competing with Mars and Nestlé, Allana leverages its Asia's largest pet food plant for scalable production, regional partnerships, and eco-friendly packaging.

- November 2024: actress Palak Jain launched Paws for Greens, India's first vegan dog food brand, addressing the rising demand for ethical pet nutrition. Focused on cruelty-free, plant-based ingredients, the brand promotes sustainability and health for pets. This marks Jain’s transition from entertainment to entrepreneurship in the pet food industry.

India Dog Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dry Dog Food, Dog Treats, Wet Dog Food |

| Pricing Types Covered | Premium Products, Mass Products |

| Ingredient Types Covered | Animal Derived, Plant Derived |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Mars Incorporated, Nestlé Purina PetCare Company, Drools Pet Food Pvt. Ltd., Venky's (India) Limited, Royal Canin, Farmina Pet Foods, Goa Medicos Private Limited, Bharat International Pet Foods, Hausberg (Canine India), Charoen Pokphand Group (CP Group), Virbac, General Mills Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India dog food market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India dog food market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India dog food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Dog food market in the India was valued at USD 2.72 Billion in 2024.

The growth of the India dog food market is driven by increasing pet adoption, rising disposable incomes, growing awareness of pet nutrition, expanding urbanization, premiumization of pet food, wider availability through online and offline retail channels, and innovations in breed-specific, organic, and functional pet food formulations catering to diverse consumer preferences.

The India dog food market is projected to exhibit a CAGR of 5.03% during 2025-2033, reaching a value of USD 4.32 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)