India Docking Station Market Size, Share, Trends and Forecast by Type, Technology, Application, Distribution Channel, and Region, 2025-2033

India Docking Station Market Overview:

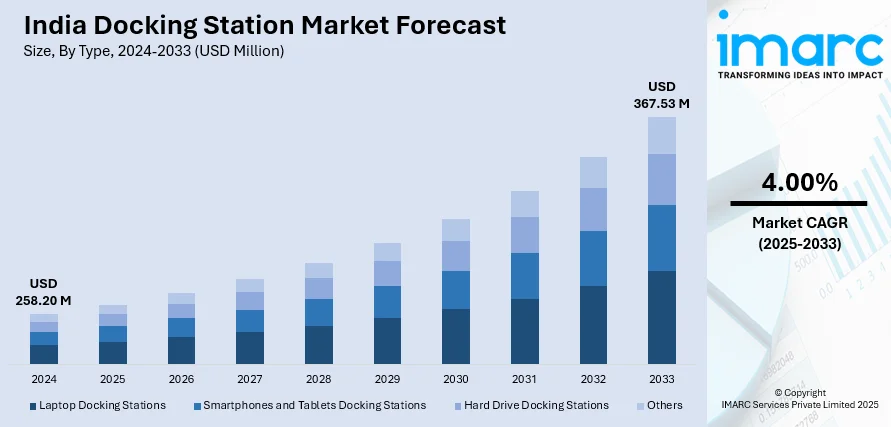

The India docking station market size reached USD 258.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 367.53 Million by 2033, exhibiting a growth rate (CAGR) of 4.00% during 2025-2033. The rising laptop and tablet adoption, increasing remote work trends, growing demand for multi-device connectivity, advancements in USB-C and Thunderbolt technology, expanding gaming and entertainment sectors, and implementation of government initiatives supporting digital infrastructure are some of the major factors augmenting India docking station market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 258.20 Million |

| Market Forecast in 2033 | USD 367.53 Million |

| Market Growth Rate 2025-2033 | 4.00% |

India Docking Station Market Trends:

Growing Remote and Hybrid Work Culture Driving Docking Station Demand

The rapid shift toward remote and hybrid work models in India is fueling demand for docking stations, as professionals require seamless connectivity solutions for efficient workflows. According to an industry report, remote or hybrid roles currently make up more than 20% of job postings in India, which is a substantial increase from 0.9% in 2020. With organizations adopting flexible work models, employees increasingly rely on laptops, tablets, and other portable devices that require enhanced functionality through external displays, keyboards, and networking peripherals. Docking stations serve as a central hub, enabling users to connect multiple devices while reducing clutter. The demand is particularly high among IT, BFSI, and consulting firms, where employees frequently transition between office and home setups. In addition to this, the expansion of e-commerce platforms in India enables easy access to a variety of docking solutions, which is positively impacting India docking station market outlook. Companies are investing in ergonomic and productivity-enhancing accessories, further driving the market for high-speed docking stations with advanced features like USB-C and Thunderbolt 4 support. Moreover, Indian startups and SMEs embracing digital transformation contribute to India docking stations market growth. Consumer preference for compact, multifunctional workstations is also increasing, prompting manufacturers to introduce lightweight, plug-and-play models with universal compatibility.

To get more information on this market, Request Sample

Rising Adoption of Docking Stations in Gaming and Entertainment

India’s gaming and entertainment industry is experiencing rapid growth, with the sector currently valued at approximately USD 3.1 Billion in 2024 and projected to reach USD 8.92 Billion in the next five years. This expansion is driving demand for high-performance docking stations as gamers and content creators seek seamless connectivity for external monitors, controllers, and storage devices. The increasing popularity of PC gaming, esports, and game streaming is propelling the need for docking stations, which is facilitating India docking stations market growth. Gaming laptops, which often have limited port availability, benefit from docking solutions that expand connectivity options without compromising performance. Docking stations with RGB lighting, customizable configurations, and cooling support are emerging as preferred choices among Indian gaming enthusiasts. In addition to this, content creators and video editors are also investing in multi-display docking solutions to streamline workflows and improve editing efficiency. The growing penetration of streaming platforms such as Twitch and YouTube Gaming is fueling the requirement for high-bandwidth, latency-free connections, further accelerating the demand for premium docking stations. As 4K and 8K content production becomes mainstream, manufacturers are focusing on high-resolution output compatibility, making India a key market for innovative, gaming-centric docking solutions.

India Docking Station Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, technology, application, and distribution channel.

Type Insights:

- Laptop Docking Stations

- Smartphones and Tablets Docking Stations

- Hard Drive Docking Stations

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes laptop docking stations, smartphones and tablets docking stations, hard drive docking stations, and others.

Technology Insights:

- Wired Docks

- Wireless Docks

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes wired docks and wireless docks.

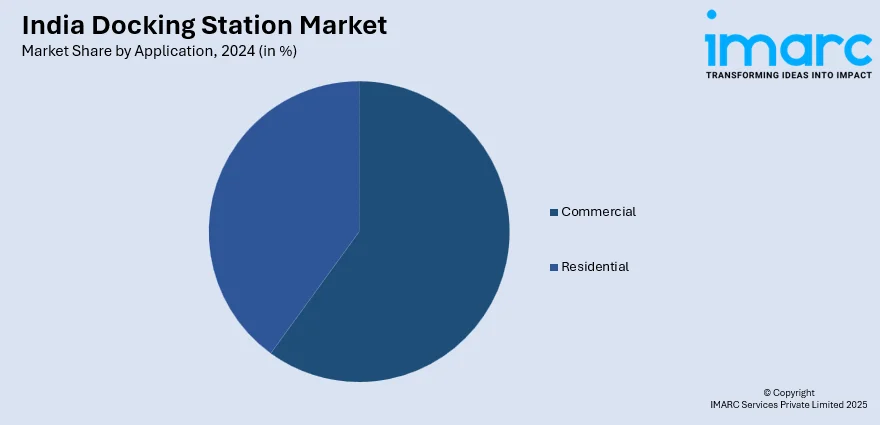

Application Insights:

- Commercial

- Residential

The report has provided a detailed breakup and analysis of the market based on the application. This includes commercial and residential.

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Docking Station Market News:

- On November 17, 2022, Logitech introduced the Logi Dock in India, an all-in-one docking station priced at INR 55,000 (about USD 635.26). This device connects up to five USB peripherals and two monitors, while providing 100W laptop charging. It also features enterprise-grade audio with a built-in speakerphone and noise-cancelling microphones and integrates with the Logi Tune app for calendar synchronization and meeting controls.

India Docking Station Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Laptop Docking Stations, Smartphones, Tablets Docking Stations, Hard Drive Docking Stations, Others |

| Technologies Covered | Wired Docks, Wireless Docks |

| Applications Covered | Commercial, Residential |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India docking station market performed so far and how will it perform in the coming years?

- What is the breakup of the India docking station market on the basis of type?

- What is the breakup of the India docking station market on the basis of technology?

- What is the breakup of the India docking station market on the basis of application?

- What is the breakup of the India docking station market on the basis of distribution channel?

- What is the breakup of the India docking station market on the basis of region?

- What are the various stages in the value chain of the India docking station market?

- What are the key driving factors and challenges in the India docking station market?

- What is the structure of the India docking station market and who are the key players?

- What is the degree of competition in the India docking station market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India docking station market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India docking station market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India docking station industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)