India Display Market Size, Share, Trends and Forecast by Display Type, Technology, Application, Industry Vertical, and Region, 2026-2034

India Display Market Size and Share:

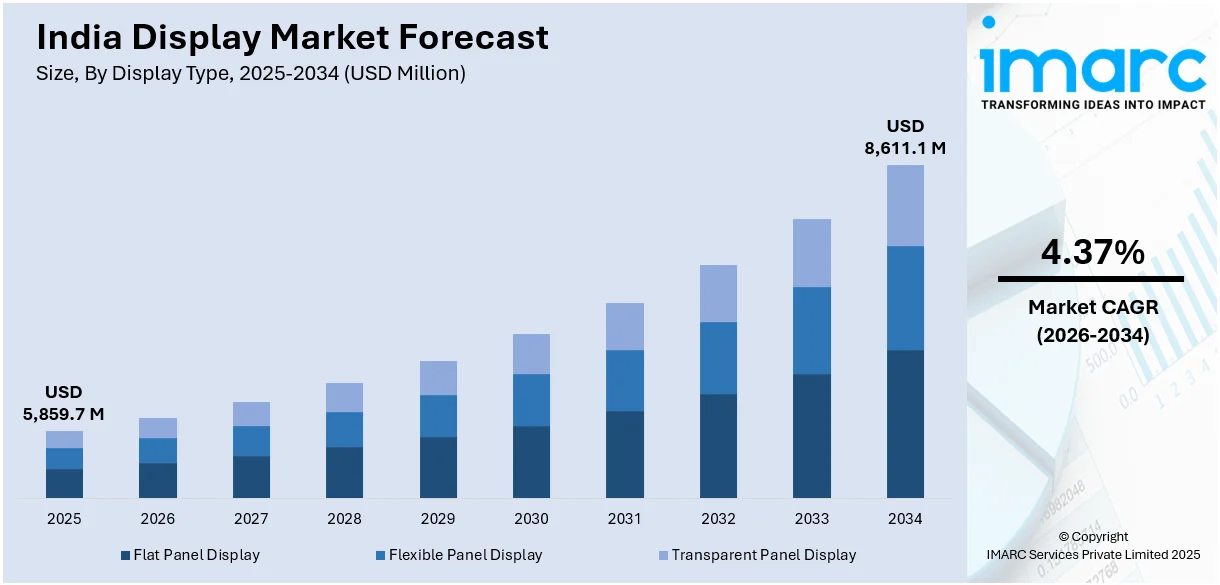

The India display market size was valued at USD 5,859.7 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 8,611.1 Million by 2034, exhibiting a CAGR of 4.37% from 2026-2034. The market is experiencing robust growth driven by the rising demand across consumer electronics, automotive, retail and healthcare sectors. Advancements in OLED, LED, and flexible display technologies fuel innovation while smart devices and digital signage adoption boost the market demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5,859.7 Million |

| Market Forecast in 2034 | USD 8,611.1 Million |

| Market Growth Rate (2026-2034) | 4.37% |

The primary driver for the India display market is the booming consumer electronics sector including smartphones, televisions and tablets. According to the report published by the India Brand Equity Foundation, India's smartphone market is the second largest globally by unit volume accounting for 15.5% of shipments in Q3 2024, capturing 12.3% of market value. The consumer demand for high-quality displays like OLED and QLED has been augmented by rapid urbanization and rising disposable incomes. Advancements in OLED and LED technologies significantly increasing the India display market share. The growth of digital signage in retail, advertising and public spaces aids the market growth. Consumer preferences will be driven upward by the introduction of higher resolution and energy efficient screens, thus leading to the adoption of advanced display technologies across various applications.

To get more information on this market Request Sample

The government initiatives such as "Make in India" which encourage local manufacturing and reduce dependence on imports also contributes positively to the market growth. Another significant driver is the growth of the automotive industry wherein more sophisticated display systems are integrated into vehicles. For instance, in March 2024, Visteon announced its plans to invest USD 20 million to establish a new plant in India focusing on localizing display and backlight manufacturing. This initiative aims to enhance the company's presence in the cockpit electronics segment capitalizing on India's rapidly growing automotive market. The growth of ecommerce platforms increases the demand for attractive high-resolution displays for product showcasing and digital marketing. Investments in research and development, as well as infrastructure improvements continue to support and accelerate the expansion of the display market in India.

India Display Market Trends:

Investments in Research and Development

Investment in R&D is pivotal in advancing India's display market especially on cutting-edge technologies such as touch, augmented reality (AR) and virtual reality (VR) displays. Companies are improving touch sensitivity and multi-touch capabilities to make user interfaces more intuitive. For instance, in November 2024, Vedanta Ltd announced its plans to invest $500 million in AvanStrate Inc focusing on R&D and manufacturing of advanced display glass. This investment aims to enhance product offerings across various sectors including semiconductors and biotechnology. The company also aims to establish a display fabrication unit in Gujarat to support its expansion efforts. In AR and VR the R&D efforts are targeted at developing higher resolution displays reducing latency and improving immersive experiences for applications in gaming, education, and healthcare. Industry leaders, startups and academic institutions are now collaborating to bring innovation and speed up technological breakthroughs. The government support and increased funding have been enabling sustained R&D activities that drive the commercialization of advanced display technologies and position India as a key player in the global display landscape. These developments and investments are creating a positive India display market outlook fostering innovation and accelerating the adoption of advanced technologies across various industries.

Growing Emphasis on High-Resolution and Energy-Efficient Screens

Consumer preference for better quality visuals and ecofriendly solutions is driving the demand for high-resolution and energy efficient screens thus reshaping India's display market. High definition 4K and 8K resolution has become the new standard for premium televisions, monitors, and smartphones with unparalleled clarity and detail. Energy efficient panels such as OLED and MicroLED are increasingly becoming popular because of low power consumption and environmental advantages. These screens appeal to the environment-conscious consumers and industries aiming to reduce their energy expenses. Technological developments combined with the increased penetration of these displays in the entertainment, gaming and professional application segments drive innovation and expansion in the market. For instance, in December 2024, ViewSonic launched its advanced ColorPro 5K monitor and AI-powered Business Monitor in India focusing on professional needs. The monitors feature high-resolution visuals, auto-screen dimming to reduce eye strain and posture check technology aiming to enhance productivity and promote healthy working habits among users.

Advancements in Flexible and Foldable Displays

Flexible and foldable display technologies are revolutionizing the India display market with new designs in smartphones, tablets, and wearable devices. The displays result from the break-through in OLED and AMOLED technologies that can be folded or rolled up. For instance, in august 2024, Motorola announced its plans to launch the Razr 50 foldable smartphone in India. Featuring a 3.6-inch pOLED cover display it supports Gemini AI and Google Photos without opening the device. The smartphone includes a 6.9-inch main display, MediaTek Dimensity processor and dual rear cameras. This feature will make devices smaller, thinner, and more compact to save space with larger screens. The biggest brands are increasingly coming up with foldable smartphones and rollable displays for tech-savvy consumers seeking the latest cutting-edge features. Flexible displays also promote user experience as they provide flexible viewing angles for immersion and offer multitasking opportunities.

India Display Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India display market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on display type, technology, application, and industry vertical.

Analysis by Display Type:

- Flat Panel Display

- Flexible Panel Display

- Transparent Panel Display

The flat panel display segment is gaining significant traction in the Indian display market as it is being used in large numbers across the consumer electronics, automotive and healthcare sectors. Flat panel displays are high resolution, energy efficient and have a long life making them suitable for applications such as televisions, monitors, and smartphones. The demand for advanced display technologies and the rising adoption of smart devices are driving this segment. Cost-effectiveness and continuous technology innovation in flat panel displays are supporting their market demand.

Flexible panel displays are gaining popularity in the Indian market mainly due to their innovative design and versatility. These displays are widely used in foldable smartphones, wearable devices and automotive interiors because of their lightweight and bendable properties. The increasing consumer preference for premium and portable gadgets is fueling demand. Improvements in OLED and AMOLED technologies have enhanced image quality and durability making flexible displays a popular choice among manufacturers who want to offer cutting-edge products.

The transparent panel displays are one of the emerging segments in the Indian display market catering to a futuristic application in retail, automotive and augmented reality. These display systems provide a phenomenon in which viewers can see through the screen while displaying content. It is well-applicable for interactive advertisement and smart glass technology. Acceptance of transparent displays in luxury vehicles and retail showcases is on the rise. The increasing investment in augmented reality applications and innovations in display materials also add to the growth of the segment.

Analysis by Technology:

- OLED

- Quantum Dot

- LED

- LCD

- E-Paper

- Others

The OLED technology segment in the Indian display market is witnessing rapid growth. It provides better image quality, energy efficiency and flexibility which drives demand. Smartphones, smart TVs and wearables all widely use OLED displays which can show vibrant colors, deep contrasts and a fast response. Growth factors are premium consumer electronics and the trend for foldable and curved devices. Advancements in manufacturing processes and cost reductions are making OLED technology more open to a wider market.

Quantum dot technology is gaining traction in the Indian display market particularly in high-end televisions and monitors. This technology enhances color accuracy, brightness and energy efficiency providing an immersive viewing experience. The growing demand for ultra-HD content and advancements in display technology are fueling adoption. Manufacturers are embedding quantum dots into displays to provide high-quality images at affordable prices which attracts the tech-savvy consumer. Its applications in medical imaging and automotive displays also increase its market reach.

LED technology is gaining traction in the Indian display market mainly due to increased consumption in televisions, monitors, digital signage, and lighting solutions. The LED displays exhibit high brightness and very low power consumption and long lifespan which makes them opted by various industries. Due to increasing market for outdoor and indoor digital signage and upcoming mini-LED and micro-LED technologies growth in this market is increasing. The government initiatives for energy-efficient technologies also promote the adoption of LED displays in India.

LCD technology is still a significant portion of the Indian display market as it is relatively affordable and versatile. LCDs are widely used in televisions, laptops, monitors and mobile phones. The technology offers reasonable image quality and energy efficiency making it suitable for budget-conscious consumers. The increasing penetration of smart devices and the growing demand for educational and business displays are contributing to its sustained popularity. Continuous advancements in panel technology such as IPS and VA keep it competitive in the changing display landscape.

E-paper technology is an emerging niche segment in the Indian display market. It is mainly used in e-readers, digital signage, and electronic shelf labels. With paper-like readability, low power consumption and glare-free display e-paper is ideal for applications requiring extended viewing times. The adoption of e-paper by both the retail and education sectors is leading to growth mainly because of increased interest in sustainable solutions that are energy efficient. Color e-paper as well as flex displays will lead to a wider variety of applications across all industries.

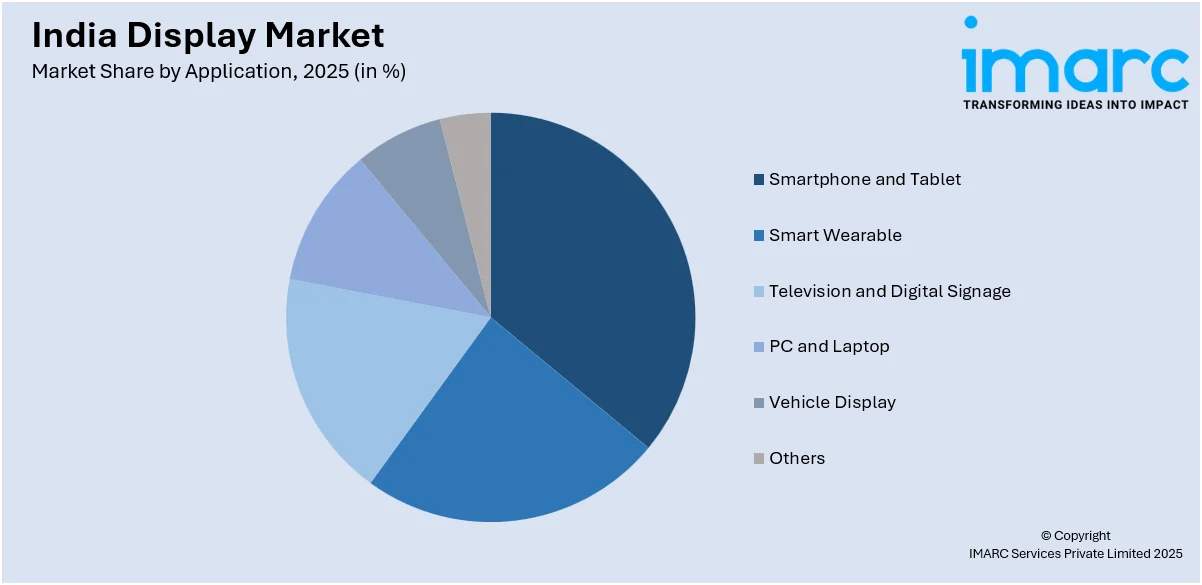

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Smartphone and Tablet

- Smart Wearable

- Television and Digital Signage

- PC and Laptop

- Vehicle Display

- Others

The smartphone and tablet segment is one of the primary drivers of the Indian display market driven by increasing smartphone penetration and rising consumer demand for high-resolution displays. AMOLED and OLED technologies are dominating this segment due to superior color quality and energy efficiency. Increasing adoption of 5G smartphones and the trend toward foldable and bezel-less designs are further driving demand. Affordability and frequent product launches by manufacturers also help sustain growth.

Smart wearables are expanding fast in India with the rising trend of fitness trackers, smartwatches, and augmented reality devices. OLED and AMOLED are popular types of compact, lightweight, and energy-efficient displays used in this segment. With an increase in health consciousness and improved wearable technology demand is going up. IoT-enabled devices and touch sensitivity and vibrant visuals with smart features are also contributing to the growth of this segment.

The leading application in the Indian display market is television and digital signage. It is led by the high definition and smart TV demand. The LED and OLED technologies dominate this segment because they offer higher image quality with greater energy efficiency. The use of digital signage across retail, hospitality and transportation sectors has been further augmenting growth. This segment has also been gaining on account of growing demand for larger screen sizes and ultra-HD resolutions with increasing disposable incomes.

The Indian display market is led by the PC and laptop segment primarily because of the increasing demand for remote work and online education. LCD displays still dominate this segment because of their affordability. At the same time high-end products are increasingly opting for OLED and IPS displays for better color accuracy and clarity. The increasing demand for gaming laptops and ultrabooks with high-end display features is further driving India display market growth.

The vehicle display market in India is growing at a substantial rate due to the increased adoption of advanced automotive technologies. Displays are widely used in infotainment systems, digital instrument clusters and head-up displays thereby enhancing the driving experience. OLED and TFT-LCD technologies are popular in this market due to their superior visuals and durability. The market for electric and connected vehicles and premium in-car experiences has been expanding due to market innovations.

Analysis by Industry Vertical:

- BFSI

- Retail

- Healthcare

- Consumer Electronics

- Military and Defense

- Automotive

- Others

The BFSI sector in India is adopting advanced display technologies for enhanced customer engagement and operational efficiency. Interactive kiosks, digital signage and ATMs with high-resolution displays enhance user experience. LED and LCD displays are in demand due to their cost-effectiveness and reliability. The increasing digital transformation in banking along with the increased adoption of touch-enabled displays for smooth service delivery is driving demand within this sector thereby boosting the growth of the display market.

Retail sector also contributes significantly to Indian display market which is primarily driven by the growth in digital signage and interactive displays for advertising and customer engagement. Increasingly, transparent, and flexible displays are being used to create innovative store layouts and enhance brand visibility. Ecommerce and omnichannel retail strategies have further increased the demand for advanced display solutions particularly those that support personalized marketing and improve the shopping experience.

India is leveraging the usage of display technologies for diagnostics, patient monitoring, and medical imaging. OLED and LCD displays especially at high resolution are employed in various medical equipment and devices like ultrasound machines, surgical displays, and telemedicine platforms. There has been growth in demand with a combination of higher-end medical equipment along with widespread adoption of digital health care solutions. Innovation also continues due to requirements such as higher-precision imaging and ease of user interfaces for healthcare.

Consumer electronics form the contributes significantly to the Indian display market as more and more Indians are buying smartphones, smart TVs, and wearables. OLED and LED technology is the largest player in this category as it provides better picture quality and power efficiency. Increased penetration of smart devices coupled with increased disposable income is fuelling growth. Advancements in foldable displays, ultra-HD resolutions and bezel-less designs are further shaping the market's evolution in this industry vertical.

The Indian military and defense sector is embracing advanced display technologies for command centers, simulators and ruggedized portable devices. High-durability OLED and LCD displays are preferred due to their reliability in extreme environments. The growing emphasis on modernizing defense infrastructure including real-time data visualization and enhanced situational awareness drives the India display market demand. Innovations in augmented reality and transparent displays are expanding their use in tactical and training applications.

The automotive vertical is one of the fastest-growing in the Indian display market with increasing adoption of advanced infotainment systems, digital dashboards and head-up displays. OLED and TFT-LCD technologies are widely used for their clarity and durability. Innovation is being fueled by the rise of connected vehicles, electric vehicles and demand for premium in-car experiences. The growing integration of driver-assistance features and touch-enabled interfaces is also boosting demand for automotive displays.

Regional Analysis:

- South India

- East India

- West and Central India

- North India

South India is a prominent regional market for display technologies driven by its thriving IT and electronics manufacturing sectors. The region's robust smartphone and consumer electronics production hub fuels demand for advanced displays particularly OLED and LCD technologies. Cities like Bengaluru and Chennai act as innovation centers supporting R&D activities. The growing adoption of digital signage in retail and entertainment industries further boosts the display market in this region.

East India’s display market is steadily growing supported by increasing urbanization and industrial development. The region is witnessing rising adoption of digital signage and LED displays in retail, education, and public infrastructure projects. Smart city initiatives in states like West Bengal and Odisha are driving demand for advanced display solutions. The growing penetration of affordable consumer electronics such as smartphones and televisions is fueling market expansion in the region.

West and Central India represent a significant portion of the Indian display market driven by their industrial and commercial hubs like Mumbai, Pune and Ahmedabad. The region’s retail, automotive and BFSI sectors extensively use LED and OLED displays for advertising, infotainment and operational efficiency. The presence of leading manufacturing facilities and growing demand for smart consumer electronics further strengthen the market. Investments in digital infrastructure also contribute to the region's growth.

North India is a key regional market for display technologies supported by its expanding retail, healthcare and automotive sectors. The region's adoption of digital signage, interactive displays and infotainment systems is growing driven by urbanization and rising consumer spending. Major cities like Delhi and Chandigarh serve as hotspots for display innovation in smart devices and public infrastructure. Government initiatives in smart city projects and education are boosting demand for advanced displays.

Competitive Landscape:

The India display market is characterized by intense competition with numerous players vying for market share across various display technologies and applications. Companies focus on innovation offering advanced technologies like OLED, micro-LED and quantum dot displays to cater to evolving consumer preferences. Price competitiveness, product quality and technological advancements are key differentiators. The market is further driven by partnerships, investments in local manufacturing and R&D activities to meet rising demand across industries like consumer electronics, automotive, retail and healthcare. As sustainability gains importance many market players are emphasizing energy-efficient and ecofriendly display solutions to enhance their competitive positioning.

The report provides a comprehensive analysis of the competitive landscape in the India display market

Latest News and Developments:

- In December 2024, ViewSonic announced that it is set to launch a gaming monitor in India with redefined capabilities, such as a 4K OLED display and a refresh rate of 520Hz. It will further feature 1ms moving picture response time (MPRT) and AMD FreeSync Premium technology, intending for reducing motion blur and screen tearing during intense gameplay scenes.

- In September 2024, Foxconn announced an investment plan of $1 billion to launch a smartphone display module assembly unit in Tamil Nadu focusing on Apple's iPhone. This facility intends to enhance India's role in the electronic value chain and reduce reliance on imports from China while also supporting local manufacturing initiatives for various tech products.

- In November 2024, GIGABYTE launched its stylish M27QA ICE Monitor in India featuring a 27-inch QHD display, 180Hz refresh rate and a rapid 1ms response time. Targeting young gamers the monitor combines high performance with aesthetic appeal.

- In December 2024, IIT Madras launched the AMOLED Research Centre with the aim to build next-generation AMOLED displays for digital devices. Funded by the Indian government and Tata Sons it aims to create modular micro-factories for display manufacturing fostering innovation and self-reliance in India’s semiconductor industry to cater to both domestic and global markets.

- In February 2024, Dell Technologies and Alienware unveiled the introduction of QD-OLED gaming monitors in India. These monitors feature a 4K curved QD-OLED panel designed to minimize reflections while enhancing peripheral vision with infinite contrast, true blacks, and peak luminance of up to 1000 nits.

India Display Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Display Types Covered | Flat Panel Display, Flexible Panel Display, Transparent Panel Display |

| Technologies Covered | OLED, Quantum Dot, LED, LCD, E-Paper, Others |

| Applications Covered | Smartphone and Tablet, Smart Wearable, Television and Digital Signage, PC and Laptop, Vehicle Display, Others |

| Industry Verticals Covered | BFSI, Retail, Healthcare, Consumer Electronics, Military and Defense, Automotive, Others |

| Regions Covered | South India, East India, West and Central India, North India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India display market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India display market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India display industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The display market was valued at USD 5,859.7 Million in 2025.

The growth of the India display market is driven by an increasing demand for consumer electronics, advancements in OLED and LED technologies, rising adoption of digital signage, and the growing use of displays in automotive and healthcare sectors. Government initiatives and investments in local manufacturing further support market expansion.

IMARC estimates the display market to reach USD 8,611.1 Million by 2034 exhibiting a CAGR of 4.37% during 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)