India Dishwashing Detergent Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

India Dishwashing Detergent Market Size and Share:

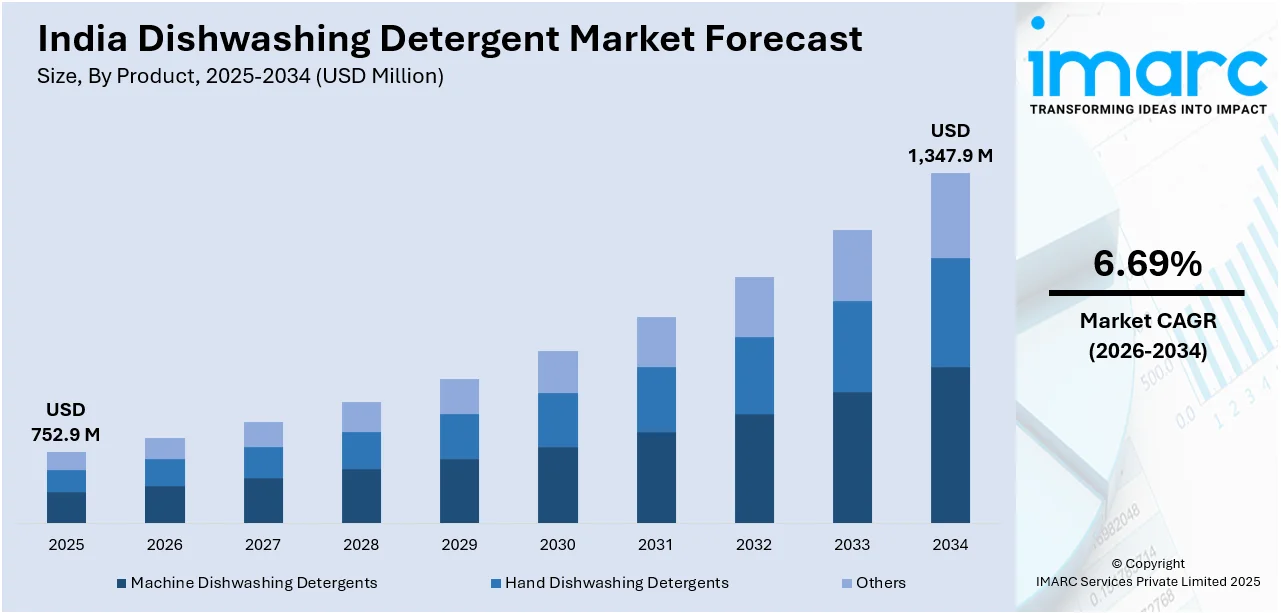

The India dishwashing detergent market size reached USD 752.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,347.9 Million by 2034, exhibiting a growth rate (CAGR) of 6.69% during 2026-2034. Rising disposable income, ongoing urbanization, growing hygiene awareness, numerous government-led sanitation initiatives, expanding retail networks, and increasing dishwasher adoption are driving the India dishwashing detergent market, leading to higher demand for liquid and eco-friendly detergents as consumers shift from traditional cleaning methods to modern, convenient, and efficient dishwashing solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 752.9 Million |

| Market Forecast in 2034 | USD 1,347.9 Million |

| Market Growth Rate (2026-2034) | 6.69% |

India Dishwashing Detergent Market Trends:

Rising Disposable Income and Urbanization

The rise in disposable income of Indian households has brought about a change in consumer behavior, with rising number of people being ready to spend on convenience-based products such as dishwashing detergents. According to the Provisional Estimates of National Income for 2021-22, India's per capita net national income at current prices stood at ₹1,28,829, a significant growth from earlier years. This rise in income has helped consumers spend more on household cleaning products, including dishwashing detergents. Urbanization has added to this trend further. The urban population of India has been consistently rising, and with it have come shifts in lifestyle and consumption habits. Urban families will be more prone to adopting modern cleaning agents instead of the traditional method. Such a change in trend can be observed from the increasing use of liquid and gel dishwash instead of the traditional bar. According to the report "Chemical and Petrochemical Statistics at a Glance - 2021," production of liquid detergent registered a substantial growth, reflecting the changing attitudes among consumers. Moreover, the expansion of the organized retail segment in urban areas has resulted in an availability of these products. The proliferation of supermarkets and hypermarkets has exposed consumers to a wide variety of dishwashing detergent brands at different prices. Availability and access, combined with increased purchasing power, have significantly contributed to the market expansion.

To get more information on this market, Request Sample

Increased Awareness of Hygiene and Sanitation

The growing consciousness of sanitation and hygiene, particularly due to the COVID-19 outbreak, has been a key stimulant for the dishwashing detergent industry. Consumers have become more aware of keeping themselves clean to avoid getting sick, resulting in higher demand for efficient cleaning agents. Government campaigns for cleanliness and hygiene have further supported this practice. The Swachh Bharat Abhiyan (Clean India Mission), initiated in 2014, has been instrumental in making the masses aware of the need for sanitation. These campaigns have resulted in higher usage of cleaning products, such as dishwashing detergents. Further, the Annual Survey of Industries (ASI) Outcomes for 2020-21 and 2021-22 reported a strong growth in industrial production, with an over 35% growth in 2021-22 compared to the last year. This growth is a testament to the increasing production and availability of consumer goods, such as cleaning products, to cater to the escalating demand fueled by enhanced hygiene consciousness. The pandemic also contributed to a shift in behavior, with more individuals cooking at home as a result of lockdowns and social distancing. This led to a higher frequency of dishwashing, thus propelling the demand for dishwashing detergents. The companies responded by launching products with greater antibacterial content, catering to the increased focus on health and safety.

India Dishwashing Detergent Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product, and distribution channel.

Product Insights:

- Machine Dishwashing Detergents

- Hand Dishwashing Detergents

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes machine dishwashing detergents, hand dishwashing detergents, and others.

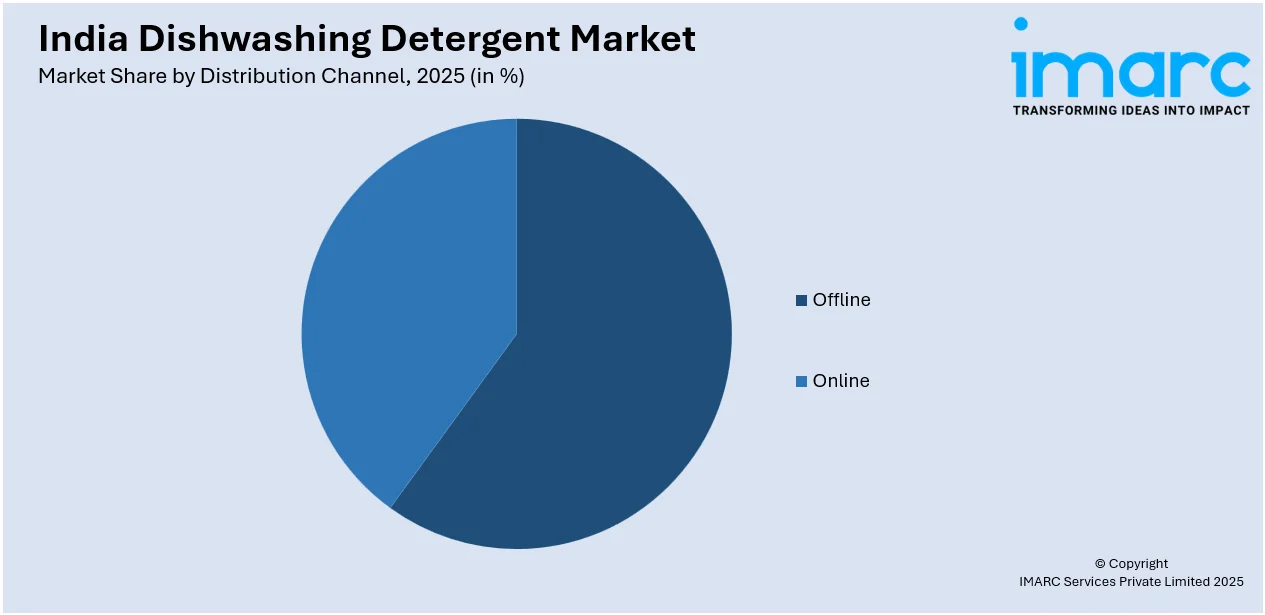

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Dishwashing Detergent Market News:

- August 2024: Unilever's Sunlight launched a 100% plant-based dishwashing formula, looking to premiumize the category with sustainable and high-performance cleaning products. This innovation addresses environmentally aware consumers looking for effective yet sustainable alternatives. The India dishwashing detergent market is fueled by rising demand for sustainable products, prompting manufacturers to move toward greener formulations.

- July 2024: Elista launched a new series of dishwashers in India priced at Rs 21,499 and above. The models are designed for Indian homes, efficient in washing greasy, ghee-coated utensils with no residues, and can be purchased on Amazon and from Elista's distribution network of about 15,000 retail outlets in India. This launch augments consumer convenience in accessing latest dishwashing solutions, which may boost the demand for dishwashing detergents in India.

India Dishwashing Detergent Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Machine Dishwashing Detergents, Hand Dishwashing Detergents, Others |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India dishwashing detergent market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India dishwashing detergent market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India dishwashing detergent industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dishwashing detergent market in India was valued at USD 752.9 Million in 2025.

The India dishwashing detergent market is projected to exhibit a CAGR of 6.69% during 2026-2034, reaching a value of USD 1,347.9 Million by 2034.

Urbanization, changing lifestyles, and busier households are catalyzing the demand for dishwashing detergents in India. People prefer convenient cleaning products that save time and water. Growing hygiene awareness and improved distribution channels support wider adoption. Marketing campaigns and new product variations also shape buying habits, encouraging people to switch from traditional methods to modern dishwashing detergent solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)