India Dimethyl Ether Market Size, Share, Trends and Forecast by Raw Material, Application, End-Use Industry, and Region, 2025-2033

India Dimethyl Ether Market Size and Share:

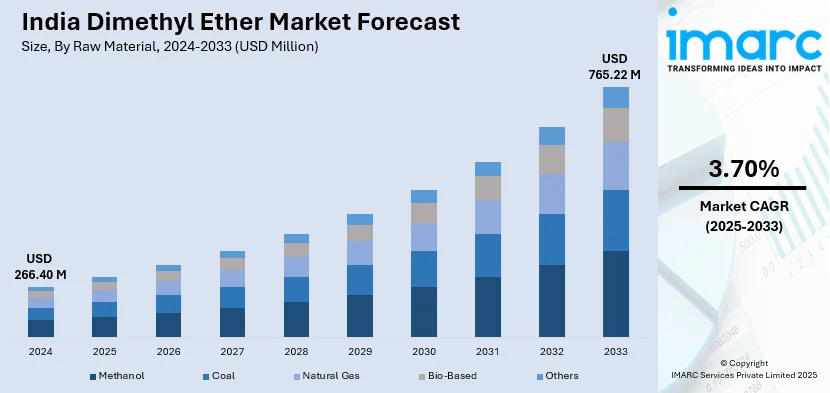

The India dimethyl ether market size reached USD 266.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 765.22 Million by 2033, exhibiting a growth rate (CAGR) of 3.70% during 2025-2033. The market is witnessing significant growth, driven by the rising demand for dimethyl ether as an alternative fuel and the expanding use of dimethyl ether in aerosol propellants and chemical synthesis.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 266.40 Million |

| Market Forecast in 2033 | USD 765.22 Million |

| Market Growth Rate (2025-2033) | 3.70% |

India Dimethyl ether Market Trends:

Rising Demand for Dimethyl Ether as an Alternative Fuel

The India dimethyl ether (DME) market is witnessing increased demand due to its potential as an alternative fuel, particularly in transportation and domestic applications. With India’s commitment to reducing carbon emissions and dependence on fossil fuels, DME is gaining traction as a clean-burning, sulfur-free fuel that can be blended with liquefied petroleum gas (LPG) for cooking and industrial purposes. For instance, in November 2024, Cairn Oil & Gas announced partnership with UNEP’s OGMP 2.0, becoming India's first oil producer to commit to methane reduction, setting a 5-year target and transparently reporting progress toward Net Zero Carbon by 2030. The government initiatives like the National Bio-Energy Mission and the promotion of alternative fuels influence the further acceptance of DME. The transportation sector is looking at DME as an alternative for diesel due to high cetane number and low particulate emissions. Therefore, car manufacturers and fuel suppliers are investing heavily in research and development to create compatible engines and infrastructure for DME use. Also, feedstocks for methanol production, generated through coal gasification and natural gas sources, favor local production. Nevertheless, some barriers like limited production infrastructure, regulatory approvals, and modification requirements in fuel infrastructure pose threats for growth. Nevertheless, DME was being perceived as a linchpin to aid the country in transforming to sustainable energy with continued investment in clean-energy solutions and the greater push for fuel self-sufficiency.

To get more information on this market, Request Sample

Expanding Use of Dimethyl Ether in Aerosol Propellants and Chemical Synthesis

The India dimethyl ether (DME) market is expanding beyond fuel applications, with significant growth in aerosol propellants and chemical synthesis. As an environmentally friendly propellant with low global warming potential (GWP), DME is increasingly used in personal care products, household sprays, and pharmaceuticals. The cosmetics and healthcare industries are witnessing rising demand for DME-based formulations, supported by India’s growing consumer base and regulatory shifts favoring low-emission products. For instance, in February 2024, India plans to produce methanol and DME from three coal gasification plants within three years, investing $1 billion to reduce fuel imports and promote indigenous technology, as per the government's latest initiative. The chemical industry is also driving the product demand, leveraging DME as an intermediate in the production of dimethyl sulfate, acetic acid, and other value-added chemicals. With India’s focus on strengthening its domestic chemical manufacturing under initiatives like the Production-Linked Incentive (PLI) scheme, DME-based chemical synthesis is gaining momentum. Furthermore, multinational companies are investing in expanding manufacturing capacities, boosting local supply chains, and reducing reliance on imports. However, challenges such as fluctuations in methanol prices, regulatory compliance for aerosol-grade DME, and infrastructure limitations persist. Market players are increasingly focusing on sustainable production processes, including bio-DME derived from renewable sources, to meet long-term demand. As regulatory frameworks evolve and industry players enhance technological capabilities, DME’s role in India’s industrial and consumer product sectors is expected to grow substantially.

India Dimethyl ether Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on raw material, application, and end-use industry.

Raw Material Insights:

- Methanol

- Coal

- Natural Gas

- Bio-Based

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes methanol, coal, natural gas, bio-based, and others.

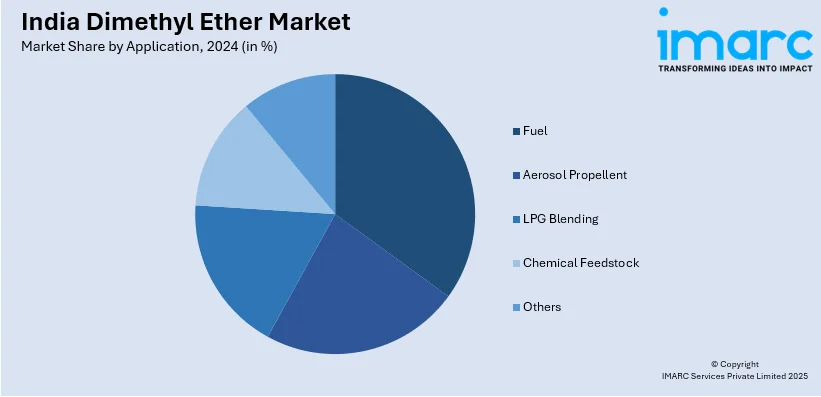

Application Insights:

- Fuel

- Aerosol Propellent

- LPG Blending

- Chemical Feedstock

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fuel, aerosol propellent, LPG blending, chemical feedstock, and others.

End-Use Industry Insights:

- Oil and Gas

- Automotive

- Power Generation

- Cosmetics

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes oil and gas, automotive, power generation, cosmetics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Dimethyl ether Market News:

- In August 2024, Balaji Amines, a key Indian manufacturer of aliphatic amines and specialty chemicals, is executing a Dimethyl Ether (DME) project at Unit-IV, set for commissioning in Q4 FY 2024-25. DME serves the aerosol industry and as an LPG alternative. The Bureau of Indian Standards approved 20% DME-LPG blending.

- In April 2024, CSIR-IICT and BHEL announced partnership under the Department of Science and Technology’s Carbon Capture and Utilization initiative to develop technology for converting captured CO₂ into Dimethyl Ether (DME). Funded by DST, this project promotes sustainable fuel production, enabling DME-LPG blending to reduce emissions and support a greener future.

India Dimethyl ether Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Methanol, Coal, Natural Gas, Bio-Based, Others |

| Applications Covered | Fuel, Aerosol Propellent, LPG Blending, Chemical Feedstock, Others |

| End-Use Industries Covered | Oil and Gas, Automotive, Power Generation, Cosmetics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India dimethyl ether market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India dimethyl ether market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India dimethyl ether industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dimethyl ether market in India was valued at USD 266.40 Million in 2024.

The India dimethyl ether market is projected to exhibit a CAGR of 3.70% during 2025-2033, reaching a value of USD 765.22 Million by 2033.

The India dimethyl ether market is experiencing significant growth due to the growing demand for cleaner fuel alternatives, growing use as an LPG blending component, and expanding applications in aerosol propellants and industrial solvents. Supportive government policies promoting low-emission fuels and increasing investments in energy diversification further accelerate market adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)