India Digital Signage Market Size, Share, Trends and Forecast by Type, Component, Technology, Application, Location, Size, and Region, 2026-2034

India Digital Signage Market Size and Share:

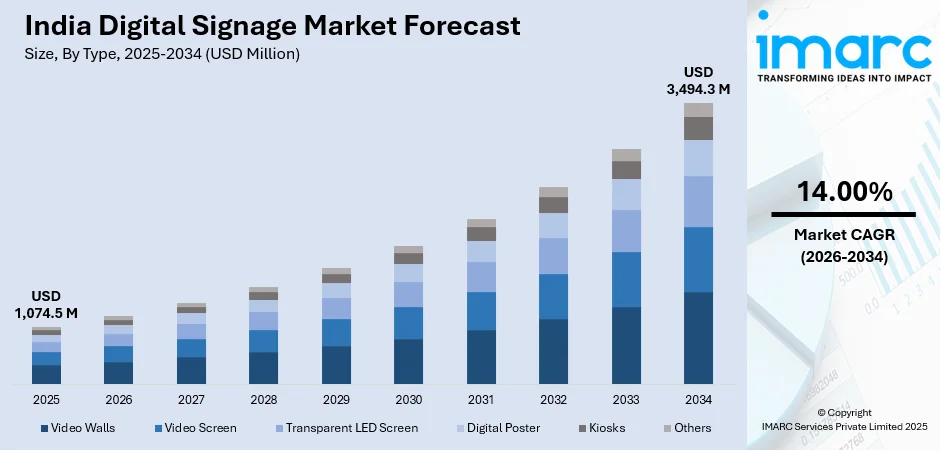

India digital signage market size reached USD 1,074.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,494.3 Million by 2034, exhibiting a growth rate (CAGR) of 14.00% during 2026-2034. Market expansion is being propelled by the swift evolution of display technologies, which offer sharper visuals and improved performance, along with a steady shift toward cloud-enabled platforms that simplify remote content control. The surge in demand for immersive and interactive screens further accelerates uptake, while nationwide smart city projects and substantial funding in connected urban infrastructure continue to strengthen the industry’s growth trajectory.

Market Insights:

- On the basis of region, the market has been divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of type, the market has been divided into video walls, video screen, transparent LED screen, digital poster, kiosks, and others.

- On the basis of component, the market has been divided into hardware, software, and service.

- On the basis of technology, the market has been divided into LCD/LED, projection, and others.

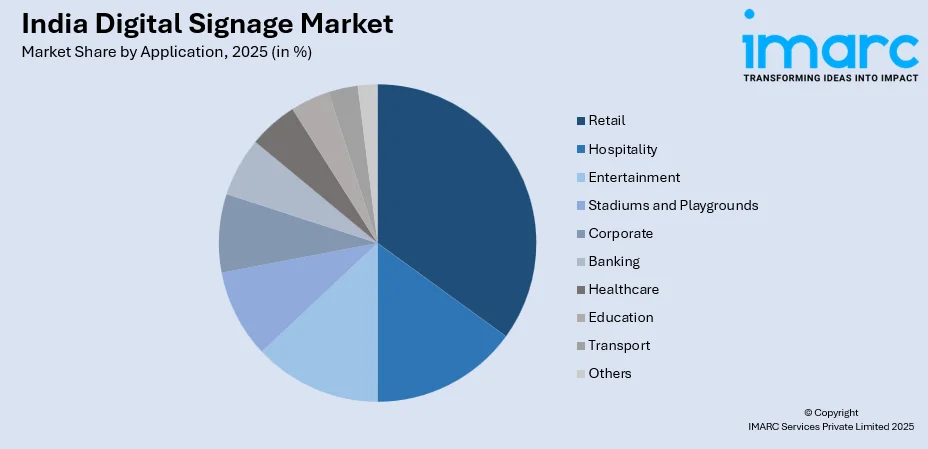

- On the basis of application, the market has been divided into retail, hospitality, entertainment, stadiums and playgrounds, corporate, banking, healthcare, education, transport, and others.

- On the basis of location, the market has been divided into indoor and outdoor.

- On the basis of size, the market has been divided into below 32 inches, 32 to 52 inches, and more than 52 inches.

Market Size and Forecast:

- 2025 Market Size: USD 1,074.5 Million

- 2034 Projected Market Size: USD 3,494.3 Million

- CAGR (2026-2034): 14.00%

Digital signage refers to the use of electronic display technologies, such as LED, LCD, or projection, to present dynamic multimedia content in public spaces. It replaces traditional static signs with interactive and customizable digital screens that can showcase a variety of information, including advertisements, announcements, wayfinding, and other relevant content. This versatile communication tool is employed in diverse settings like retail stores, airports, hotels, schools, and corporate offices. Digital signage enhances communication by enabling real-time updates, targeted messaging, and engaging visuals. It contributes to a more immersive and interactive user experience, capturing attention and conveying information effectively. The content can be remotely managed, allowing for flexibility and immediate adjustments. Digital signage serves as a modern, eye-catching means of communication that meets the demands of an increasingly digital and visually oriented society.

To get more information on this market, Request Sample

India Digital Signage Market Trends:

The digital signage market in India has experienced significant growth in recent years, primarily driven by the escalating demand for interactive and engaging communication channels. One key driver is the rapid technological advancements, which have led to the development of high-resolution displays and innovative content management systems. Additionally, the increasing adoption of cloud-based solutions has streamlined content delivery, enabling real-time updates and dynamic content scheduling. Moreover, the rising awareness among businesses about the effectiveness of digital signage in enhancing customer experiences and brand visibility has augmented the India digital signage market share. This heightened awareness is coupled with a shift in consumer preferences towards visually appealing and interactive displays, further fueling the demand for digital signage solutions. Furthermore, the flexibility and scalability offered by digital signage systems cater to the evolving needs of various industries, including retail, healthcare, and hospitality. The integration of data analytics and artificial intelligence into digital signage solutions is another driving force. These technologies enable targeted content delivery and personalized messaging, resulting in more impactful communication with the audience. As businesses increasingly recognize the potential for digital signage to drive engagement and boost sales, the market is poised for continued expansion, with evolving technologies and changing consumer expectations shaping the India digital signage market growth.

Rapid Urbanization and Smart Technology Integration Accelerating Market Expansion

India's burgeoning urbanization presents an unprecedented opportunity to deploy digital signage. As metropolitan areas continue to urbanize and a new generation of smart cities emerges, urban areas will need sophisticated infrastructure to communicate with and address the needs of increasingly larger and more complex urban populations. Government initiatives in support of smart cities and urban development are driving significant investment in new intelligent transportation systems, public information displays, and integrated information and communication networks, as noted in the India digital signage market analysis. As urban areas evolve, advancements in smart technology, utilizing a variety of capabilities from Internet of Things (IoT) connectivity, artificial intelligence-based optimization of content, and real-time data analytics, are taking traditional and static displays and transforming them into more active communications networks, which utilize new display technologies to physically change the content based on factors such as demographic of audience, weather, traffic, and local events. This progression in technology has begun to affect areas such as transportation hubs, shopping malls, corporate business districts, and public spaces where digital signage infrastructures are developed for a plethora of functions including wayfinding, emergency messaging, entertainment, and segmented advertising, creating an integrated digital presence that enhances the customer experience while providing businesses or city planners with valuable information.

Cost Reductions and Enhanced Accessibility Democratizing Digital Signage Adoption

Significant cost reductions in display technologies, including declining prices of LED panels, LCD screens, and processing components, are making digital signage solutions accessible to a broader range of businesses, including small and medium enterprises that previously could not justify the investment in digital communication technologies. Manufacturing efficiencies, economies of scale in global supply chains, and increased competition among technology providers have contributed to substantial price decreases while simultaneously improving display quality, energy efficiency, and durability of digital signage systems. Enhanced accessibility is further supported by simplified installation processes, user-friendly content management platforms, and cloud-based solutions that eliminate the need for complex on-premises infrastructure, enabling businesses across various sectors including retail, hospitality, education, and healthcare to implement digital signage without requiring extensive technical expertise or significant capital investments. These cost and accessibility improvements are particularly impactful in India's diverse market, where businesses of varying sizes and technical capabilities can now leverage digital signage to compete more effectively, improve customer engagement, and modernize their communication strategies, contributing to widespread market adoption across urban and semi-urban areas.

Growth, Opportunities, and Challenges in the India Digital Signage Market

- Growth Drivers of the India Digital Signage Market: The digital signage market size in India is primarily driven by increasing advances in display technologies including higher resolution, better color accuracy, and larger screen sizes that enhance viewing experiences and attract business investments. Rapid technological advancements in content management systems, cloud-based solutions, and AI integration enable real-time updates, targeted messaging, and personalized content delivery. Rising awareness among businesses about digital signage effectiveness in enhancing customer experiences and brand visibility, coupled with shifting consumer preferences toward interactive displays, creates substantial market demand.

- Opportunities in the India Digital Signage Market: The India digital signage market forecast indicates that significant opportunities exist in leveraging India's rapid urbanization and Smart Cities Mission to deploy intelligent communication infrastructure in metropolitan areas and emerging smart cities. Cost reductions and enhanced accessibility enable market expansion to small and medium enterprises previously unable to invest in digital signage solutions. Integration of IoT connectivity, artificial intelligence, and data analytics creates opportunities for developing comprehensive digital ecosystems that serve multiple functions including wayfinding, emergency communications, and targeted advertising.

- Challenges in the India Digital Signage Market: The industry faces challenges in managing the complexity of technology integration across diverse business environments with varying technical capabilities and infrastructure requirements. Content management and maintenance of digital signage systems require specialized expertise that may not be readily available in all market segments. Competition from traditional advertising methods and the need to demonstrate clear return on investment can create barriers to adoption, particularly among cost-conscious businesses in price-sensitive market segments.

India Digital Signage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, component, technology, application, location, and size.

Type Insights:

- Video Walls

- Video Screen

- Transparent LED Screen

- Digital Poster

- Kiosks

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes video walls, video screen, transparent led screen, digital poster, kiosks, and others.

Component Insights:

- Hardware

- Software

- Service

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware, software, and service.

Technology Insights:

- LCD/LED

- Projection

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes LCD/LED, projection, and others.

Application Insights:

- Retail

- Hospitality

- Entertainment

- Stadiums and Playgrounds

- Corporate

- Banking

- Healthcare

- Education

- Transport

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes retail, hospitality, entertainment, stadiums and playgrounds, corporate, banking, healthcare, education, transport, and others.

Location Insights:

- Indoor

- Outdoor

The report has provided a detailed breakup and analysis of the market based on the location. This includes indoor and outdoor.

Size Insights:

- Below 32 Inches

- 32 to 52 Inches

- More than 52 Inches

A detailed breakup and analysis of the market based on the size have also been provided in the report. This includes below 32 inches, 32 to 52 inches, and more than 52 inches.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In September 2025, Scala expanded its Virtual Information Display (VID) kiosk deployment at GMR Hyderabad International Airport Limited (GHIAL), enhancing the airport’s digital infrastructure with interactive 3D navigation, real-time flight updates, live video assistance, and Wi-Fi coupon access. The kiosks, powered by Scala’s Media Player platform, aim to improve passenger engagement and operational efficiency through intuitive UI/UX and intelligent digital support.

- In August 2025, invidis announced its return to Mumbai for Infocomm India 2025, scheduled from September 9–11 at the Jio World Convention Centre, featuring a dedicated Digital Signage Program on 10 September. The event, co-hosted with Avixa, will cover key industry themes including AI integration, managed signage solutions, sustainability, and India’s “Make in India” strategy for building a resilient supply chain.

- In June 2025, Scala deployed its Virtual Information Display (VID) Kiosks at Terminals 1 and 3 of Delhi’s Indira Gandhi International Airport (DIAL), serving over 79 million passengers annually. The kiosks integrate real-time flight information, 3D live-location maps, and 24×7 video-call assistance, addressing navigation challenges and enhancing passenger convenience.

- In February 2024, Scala Asia-Pacific inaugurated its new India head office in Bengaluru, emphasizing a renewed focus on Research and Development (R&D) to advance intelligent digital signage and marketing technology solutions. The facility, located in the city’s central business district, will serve as a hub for innovation, showcasing Scala’s solutions and fostering strategic partnerships aimed at accelerating product development.

- January 2024: Firstouch Solutions, a leading Indian digital signage manufacturer, showcased innovative digital signage products at the Smart City Expo Delhi 2024. Their offerings include interactive kiosks and custom digital display solutions for urban infrastructure and retail sectors.

India Digital Signage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Video Walls, Video Screen, Transparent LED Screen, Digital Poster, Kiosks, Others |

| Components Covered | Hardware, Software, Service |

| Technologies Covered | LCD/LED, Projection, Others |

| Applications Covered | Retail, Hospitality, Entertainment, Stadiums and Playgrounds, Corporate, Banking, Healthcare, Education, Transport, Others |

| Locations Covered | Indoor, Outdoor |

| Sizes Covered | Below 32 Inches, 32 to 52 Inches, More Than 52 Inches |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India digital signage market performed so far and how will it perform in the coming years?

- What is the breakup of the India digital signage market on the basis of type?

- What is the breakup of the India digital signage market on the basis of component?

- What is the breakup of the India digital signage market on the basis of technology?

- What is the breakup of the India digital signage market on the basis of application?

- What is the breakup of the India digital signage market on the basis of location?

- What is the breakup of the India digital signage market on the basis of size?

- What are the various stages in the value chain of the India digital signage market?

- What are the key driving factors and challenges in the India digital signage?

- What is the structure of the India digital signage market and who are the key players?

- What is the degree of competition in the India digital signage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India digital signage market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India digital signage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India digital signage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)