India Digital Payment Market Size, Share, Trends and Forecast by Component, Payment Mode, Deployment Type, End Use Industry, and Region, 2026-2034

Market Overview:

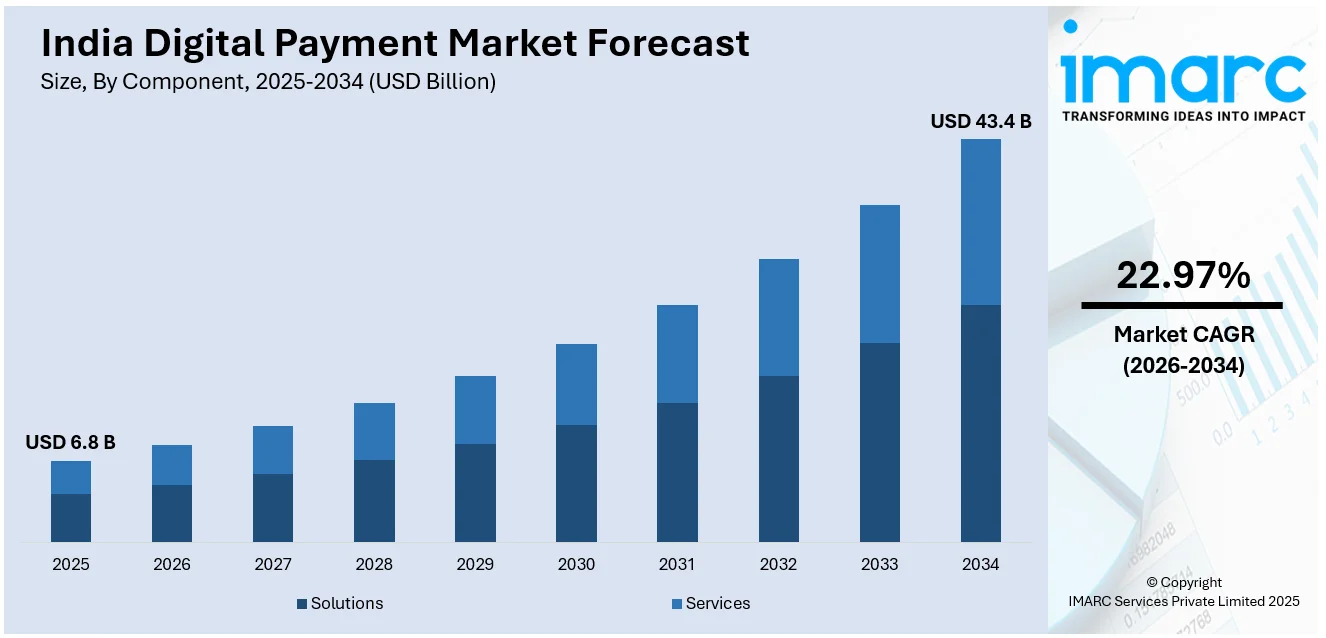

India digital payment market size reached USD 6.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 43.4 Billion by 2034, exhibiting a growth rate (CAGR) of 22.97% during 2026-2034. Key players across the country are introducing artificial intelligence (AI) powered gateways to make cashless payments more effortless and spontaneous, which is primarily augmenting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6.8 Billion |

| Market Forecast in 2034 | USD 43.4 Billion |

| Market Growth Rate (2026-2034) | 22.97% |

Digital payment is a transaction method in which the exchange of value between payment accounts occurs via electronic devices like mobile phones, point-of-sale terminals (POS), computers, etc. This process involves cashless and contactless payments, utilizing credit and debit cards, unified payments interface (UPI), internet banking, mobile wallets, chip and pin technology, etc. To safeguard against cyber-attacks and potential monetary losses, digital payment method employs enhanced security measures like strong passcodes and one-time passwords (OTPs). Furthermore, it also enhances traceability and accountability, which in turn, aids in minimizing corruption and theft. Beyond its security features, digital payment plays a pivotal role in fostering financial inclusion by expanding access to various services, including savings accounts, credit facilities, insurance products, etc.

To get more information on this market Request Sample

India Digital Payment Market Trends:

The India digital payment market is currently experiencing dynamic shifts driven by a combination of technological advancements and changing consumer preferences. One of the prominent factors is the increasing inclination among government bodies across the country towards a cashless economy. This has accelerated the adoption of digital payment methods, such as unified payments interface (UPI), mobile wallets, contactless cards, etc. Moreover, with the increasing number of users relying on smartphones for various transactions, the convenience of mobile-based payment solutions is gaining significant traction in India. Besides this, the growth of e-commerce and the emergence of fintech companies are fostering a digital-first approach to transactions. Security measures and innovations are also shaping the market across the country. Apart from this, the widespread adoption of biometric authentication, two-factor authentication, and secure tokenization addresses concerns related to fraud and boosts consumer confidence in digital payment systems. Furthermore, the rising integration of artificial intelligence and machine learning for fraud detection adds an extra layer of security, which is augmenting the market growth in India. Overall, technological innovations, government initiatives, and a changing financial landscape will continue to catalyze the India digital payment market over the forecasted period.

India Digital Payment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on component, payment mode, deployment type, and end use industry.

Component Insights:

- Solutions

- Application Program Interface

- Payment Gateway

- Payment Processing

- Payment Security and Fraud Management

- Transaction Risk Management

- Others

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (application program interface, payment gateway, payment processing, payment security and fraud management, transaction risk management, and others) and services (professional services and managed services).

Payment Mode Insights:

- Bank Cards

- Digital Currencies

- Digital Wallets

- Net Banking

- Others

A detailed breakup and analysis of the market based on the payment mode have also been provided in the report. This includes bank cards, digital currencies, digital wallets, net banking, and others.

Deployment Type Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes cloud-based and on-premises.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- Healthcare

- IT and Telecom

- Media and Entertainment

- Retail and E-commerce

- Transportation

- Others

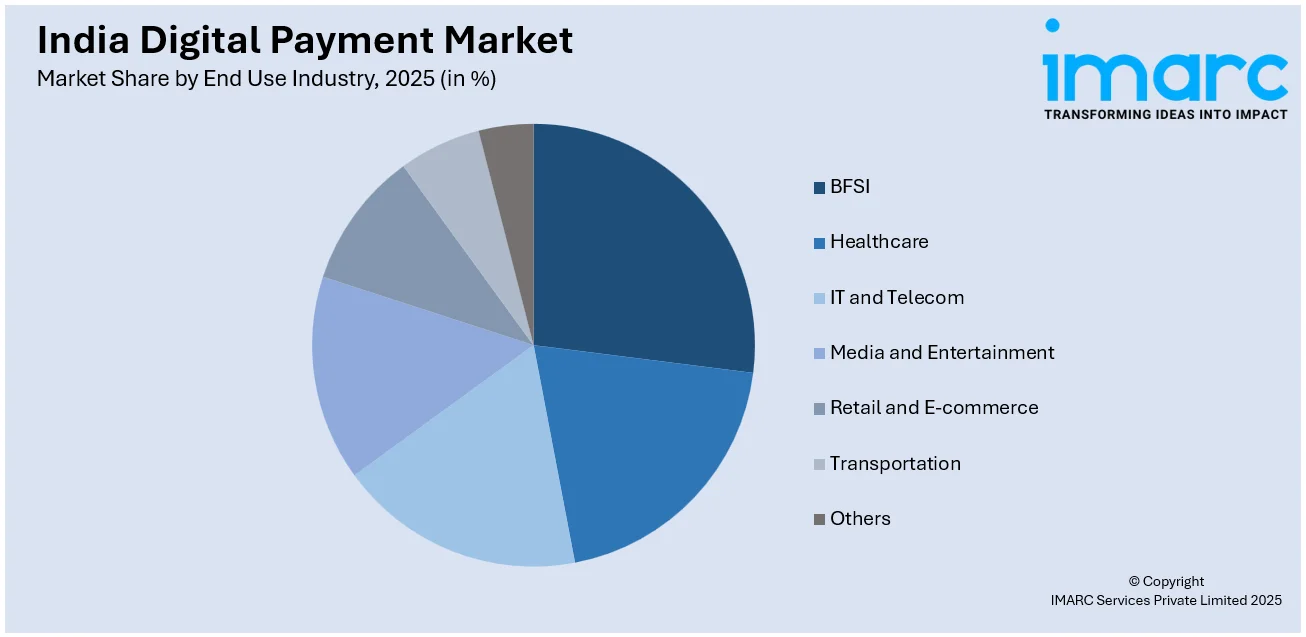

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes BFSI, healthcare, IT and telecom, media and entertainment, retail and E-commerce, transportation, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East, and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Digital Payment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Payment Modes Covered | Bank Cards, Digital Currencies, Digital Wallets, Net Banking, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| End Use Industries Covered | BFSI, Healthcare, IT and Telecom, Media and Entertainment, Retail and E-commerce, Transportation, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India digital payment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India digital payment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India digital payment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital payment market in India was valued at USD 6.8 Billion in 2025.

The India digital payment market is projected to exhibit a CAGR of 22.97% during 2026-2034, reaching a value of USD 43.4 Billion by 2034.

The India digital payment market is driven by widespread smartphone/internet access, UPI’s seamless real-time transfers, fintech innovation (wallets/QR/paybanks), strong government initiatives (demonetization, Digital India, Jan Dhan), financial inclusion via Aadhaar/India Stack, and evolving consumer trust toward convenience, security and incentives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)