India Digital Asset Management Market Size, Share, Trends and Forecast by Type, Component, Application, Deployment, Organization Size, End Use Sector, and Region, 2025-2033

Market Overview:

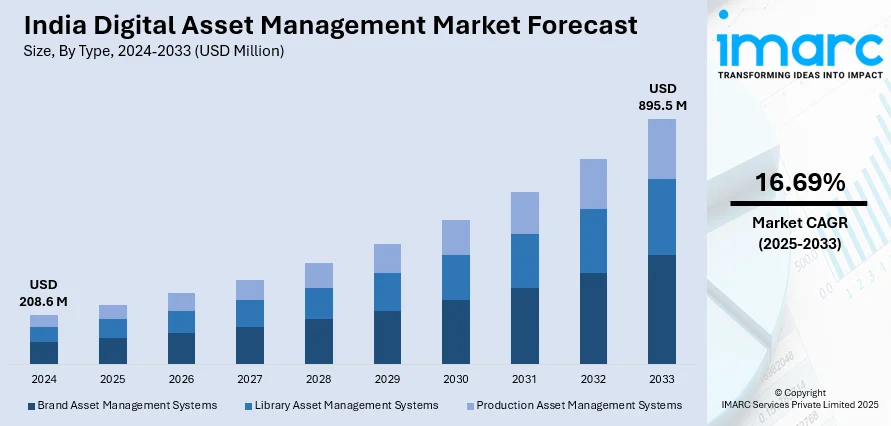

The India digital asset management market size reached USD 208.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 895.5 Million by 2033, exhibiting a growth rate (CAGR) of 16.69% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 208.6 Million |

|

Market Forecast in 2033

|

USD 895.5 Million |

| Market Growth Rate 2025-2033 | 16.69% |

Digital asset management (DAM) refers to the automated solution that stores, shares and organizes various digital assets such as processed data files, engineering blueprints, text documents, webpages, and audio and video files. Different organizations utilize these solutions for quick storage and retrieval of assets into a single centralized interface. DAM solutions find extensive applications across various industries as they facilitate organizations in automating the workflow, managing permissions through copyright functionalities and streamlining the cloud experience for its users.

To get more information on this market, Request Sample

The India digital asset management market is primarily driven by the emergence of Industry 4.0, which has led to the adoption of automation solutions across the country. Besides this, the growing number of individuals with high net worth, coupled with the expanding middle class, is propelling the growth of the market. Apart from this, the integration of DAM with enterprise systems such as ERP, CMS, marketing automation, and other IT systems enhances collaborative work processes across different departmental functions in an organization. As a result, organizations prefer integrated DAM solutions to implement cloud suite solutions with multi-features as they allow efficient managing and controlling of digital assets. Furthermore, the increasing creation of massive content due to the rising penetration of the internet and smartphones in the country is increasing the market growth as DAM solutions facilitate search functionality, allowing end users to quickly identify, locate, and retrieve an asset.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India digital asset management market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on type, component, application, deployment, organization size and end use sector.

Breakup by Type:

- Brand Asset Management Systems

- Library Asset Management Systems

- Production Asset Management Systems

Breakup by Component:

- Solution

- Services

- Consulting

- System Integration

- Support and Maintenance

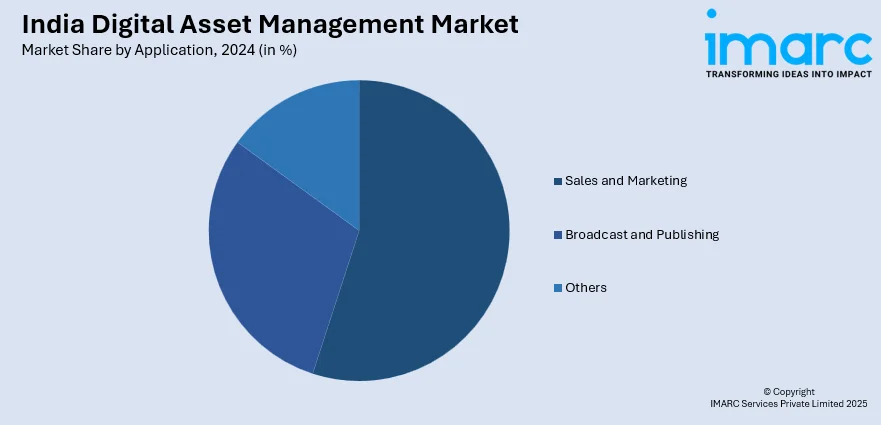

Breakup by Application:

- Sales and Marketing

- Broadcast and Publishing

- Others

Breakup by Deployment:

- On-premises

- Cloud

Breakup by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Breakup by End Use Sector:

- Media and Entertainment

- Banking, Financial Services and Insurance (BFSI)

- Retail

- Manufacturing

- Healthcare and Life Sciences

- Education

- Travel and Tourism

- Others

Breakup by Region:

- North India

- West and Central India

- East India

- South India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Type, Component, Application, Deployment, Organization Size, End Use Sector, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India digital asset management market was valued at USD 208.6 Million in 2024.

We expect the India digital asset management market to exhibit a CAGR of 16.69% during 2025-2033.

The emerging trend of digitization, along with the growing adoption of digital asset management solutions, as they aid in maintaining transparency of operations, improving digital content, reducing overall operational costs, etc., is primarily driving the India digital asset management market.

The sudden outbreak of the COVID-19 pandemic has led to the rising deployment of digital asset management platforms to provide stakeholders, contractors, and clients an easy access and control to the digital content library of organizations, during the remote working scenario across the nation.

Based on the type, the India digital asset management market has been bifurcated into brand asset management systems, library asset management systems, and production asset management systems. Among these, brand asset management systems account for the majority of the total market share.

Based on the component, the India digital asset management market can be segmented into solution and services. Currently, solution holds the largest market share.

Based on the application, the India digital asset management market has been divided into sales and marketing, broadcast and publishing, and others. Among these, sales and marketing currently exhibits a clear dominance in the market.

Based on the deployment, the India digital asset management market can be categorized into on-premises and cloud. Currently, on-premises account for the majority of the total market share.

Based on the organization size, the India digital asset management market has been segregated into small and medium-sized enterprises and large enterprises, where large enterprises currently exhibit a clear dominance in the market.

Based on the end use sector, the India digital asset management market can be bifurcated into media and entertainment, Banking, Financial Services and Insurance (BFSI), retail, manufacturing, healthcare and life sciences, education, travel and tourism, and others. Currently, media and entertainment holds the largest market share.

On a regional level, the market has been classified into North India, West and Central India, East India, and South India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)