India Digestive Health Supplements Market Size, Share, Trends and Forecast by Product, Form Type, Distribution Channel, and Region, 2025-2033

India Digestive Health Supplements Market Overview:

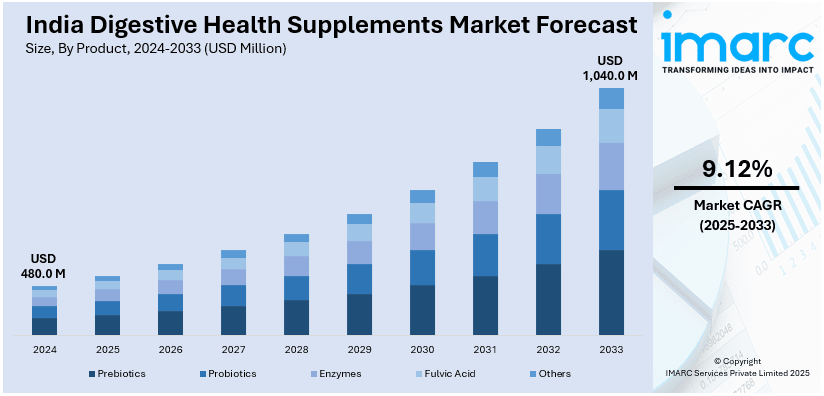

The India digestive health supplements market size reached USD 480.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,040.0 Million by 2033, exhibiting a growth rate (CAGR) of 9.12% during 2025-2033. The market is driven by the rising prevalence of gastrointestinal disorders, increasing consumer awareness of gut health, growing adoption of probiotics and prebiotics, expansion of e-commerce channels, government initiatives promoting preventive healthcare, and shifting dietary patterns toward functional foods enriched with digestive enzymes and fiber-rich formulations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 480.0 Million |

| Market Forecast in 2033 | USD 1,040.0 Million |

| Market Growth Rate 2025-2033 | 9.12% |

India Digestive Health Supplements Market Trends:

Rising Prevalence of Digestive Disorders

The growing prevalence of gastrointestinal diseases across the Indian population has been one of the major drivers fueling demand for digestive health supplements. Irregular bowel syndrome (IBS), acid reflux, constipation, and other gastric diseases have been more frequently experienced by individuals with certain lifestyle and food-related conditions. Based on the National Health Profile 2022, released by the Central Bureau of Health Intelligence under the Ministry of Health and Family Welfare, there has been a clear trend of growth in outpatient department (OPD) attendance for digestive illnesses. The report states that diseases of the digestive system formed a significant part of morbidity patterns seen in healthcare facilities in the country. This growth in digestive diseases can be linked to various reasons, such as sedentary lifestyle, high intake of processed foods, irregular diet, and stress. Therefore, there is an increasing concern among consumers regarding the need to keep their digestive system healthy, which has led to a high demand for supplements that can help in digestion and reduce gastrointestinal discomfort.

To get more information on this market, Request Sample

Increasing Health Awareness and Preventive Healthcare

Yet another important driver of India's digestive health supplements market is rising health and wellness awareness, along with the trend toward preventive healthcare. Consumers are getting more proactive about health management, wanting products that can prevent disease, not just cure it. Efforts of the Ministry of Health and Family Welfare, like the National Health Mission, have also helped in propagating health awareness among the masses. The programs lay stress on the need for preventive healthcare measures, urging people to incorporate a healthier lifestyle and diet into their lives. This rising awareness of health has resulted in growing demand for diet supplements, with those promoting gastrointestinal health at the forefront. Individuals are using probiotics, prebiotics, and other digestive helpers as part of their day-to-day regimens to support better gut function. The rise in prevalence of digestive diseases, improving overall population healthcare concerns, surge in the aging population, and growing interest in natural and harmless products are all key drivers that are causing market growth. In conclusion, the rising incidence of digestive disorders and increasing focus on health consciousness and preventive medicines are among the key drivers of the growth of the India digestive health supplements market. These developments are underpinned by government health data and market research, pointing toward a strong and expanding digestive health products market in India.

India Digestive Health Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, form type, and distribution channel.

Product Insights:

- Prebiotics

- Probiotics

- Enzymes

- Fulvic Acid

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes prebiotics, probiotics, enzymes, fulvic acid, and others.

Form Type Insights:

- Capsules

- Tablets

- Powders

- Liquids

- Others

A detailed breakup and analysis of the market based on the form type have also been provided in the report. This includes capsules, tablets, powders, liquids, and others.

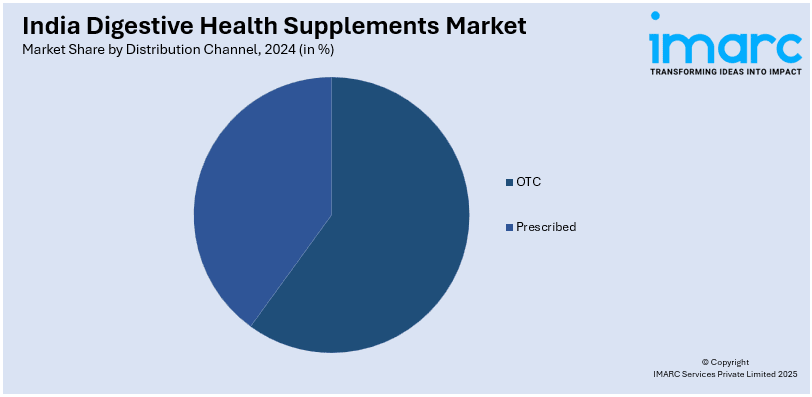

Distribution Channel Insights:

- OTC

- Supermarkets/Hypermarkets/Food Stores

- Drug Stores and Pharmacies

- Convenience Stores

- Online

- Others

- Prescribed

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes OTC (supermarkets/hypermarkets/food stores, drug stores and pharmacies, convenience stores, online, and others) and prescribed.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Digestive Health Supplements Market News:

- July 2024: Renewtra introduced India's first clinically validated nutraceutical products with open front-of-pack labeling and QR codes to ingredient disclosures and clinical trials. This technology raises consumer confidence and transparency in the nutraceutical space, which is responding to the demand for authentic digestive health supplements. Such innovation fuels the Indian digestive health supplements market by providing scientifically endorsed products that match consumer aspirations for quality and performance.

- June 2024: Sova Health, a startup focused on gut health, raised USD 1 million in a seed funding round from investors Antler, Accelerating Asia, Practical VC, VC Grid, and Venture Catalysts. The funds will go to launch 25 new gut health products, go offline into distribution channels, and look at global markets. Such financing and product development help to drive India's digestive health supplements market growth by providing focused solutions and growing consumer availability.

- March 2024: TrueNorth introduced Sensibiotics, a line of probiotic supplements addressing gut and feminine wellness, with Smart Release Technology for improved absorption. The product treats general digestive complaints such as traveler's diarrhea and UTIs, coinciding with India's estimated USD 4.91 billion gut health market in 2024. The introduction further solidifies the digestive health supplements market by fulfilling escalating consumer needs for targeted and effective probiotics.

India Digestive Health Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Prebiotics, Probiotics, Enzymes, Fulvic Acid, Others |

| Form Types Covered | Capsules, Tablets, Powders, Liquids, Others |

| Distribution Channels Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India digestive health supplements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India digestive health supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India digestive health supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India digestive health supplements market was valued at USD 480.0 Million in 2024

The India digestive health supplements market is projected to exhibit a CAGR of 9.12% during 2025-2033, reaching a value of USD 1,040.0 Million by 2033.

The India digestive health supplements market is driven by growing consumer awareness about gut-wellness, accelerated preference for probiotics, prebiotics, and herbal Ayurvedic remedies, and the rise of e-commerce for easy access. Youth and urban professionals champion preventive self-care, while clean-label trends and traditional medicine further influence purchase choices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)