India Diesel Engine Market Size, Share, Trends and Forecast by Power Rating, End User, and Region, 2025-2033

India Diesel Engine Market Overview:

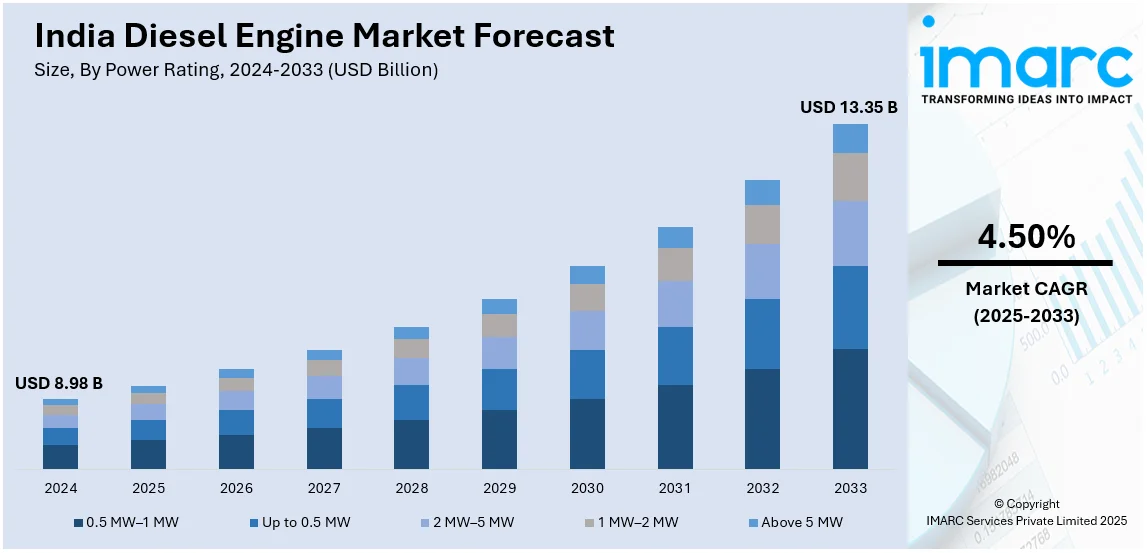

The India diesel engine market size reached USD 8.98 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.35 Billion by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. Rising infrastructure development, increasing demand for backup power, government initiatives in manufacturing, rising construction activities, expanding transportation sector, and advancements in engine efficiency are driving the growth of the India diesel engine market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.98 Billion |

| Market Forecast in 2033 | USD 13.35 Billion |

| Market Growth Rate (2025-2033) | 4.50% |

India Diesel Engine Market Trends:

Rising Demand for Diesel Generators in Industrial and Commercial Sectors

India's growing reliance on efficient power backup solutions is driving the demand for diesel generators in industrial, commercial, and residential uses. Manufacturing, construction, healthcare, and IT sectors need uninterrupted power supply owing to recurrent grid failures and increasing electricity demand. India saw a record peak power deficit of 4.6 GW in 2023, from 1.2 GW in 2022, as per the Central Electricity Authority (CEA), reflecting the urgency for backup alternatives. Furthermore, the commercial segment, particularly data centers, has seen substantial growth, with hyperscale facility investments likely to exceed USD 10 billion by 2025. Furthermore, India's construction industry, which is expected to expand at a CAGR of 6.2% from 2023-2028, also supports diesel generator demand, as construction sites need autonomous power sources. Additionally, the government initiative for rural electrification and smart city projects is fueling the demand for decentralized power solutions. Although hybrid and gasoline-based generators are becoming popular, diesel generators remain the clear leader because of their fuel efficiency, long life on operations, and affordability, enhancing the market growth.

To get more information on this market, Request Sample

Expansion of Agricultural Mechanization and Diesel-Powered Farm Equipment

India's agricultural sector is quickly embracing mechanization to increase productivity, resulting in higher demand for diesel-fueled machinery like tractors, pump sets, and harvesters. Diesel engines are still the most popular option because they are long-lasting, fuel-efficient, and provide high torque, which is appropriate for Indian farming conditions. India's largest tractor market in the world is expected to expand at a CAGR of 4.5% during 2023-2025, with over 900,000 units sold annually in 2023. The government's PM-KUSUM program also seeks to replace 1.75 million diesel pumps with solar pumps, but diesel still dominates rural pockets because of the lack of infrastructure. As the National Bank for Agriculture and Rural Development (NABARD) raises disbursements on farm mechanization, small farmers and marginal ones are extending diesel equipment availability under subsidies as well as lending schemes. The Government of India's aim for 50% farm mechanization by 2030, up from 2022's level of 45%, is contributing further to the market's expansion. Also, India's irrigation requirements are fulfilled almost entirely by more than eight million diesel-driven pumps, mostly in states with unstable power supply. Switching to more horsepower tractors is also driving demand for smart diesel engines, especially with precision agriculture methods taking hold.

India Diesel Engine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on power rating and end user.

Power Rating Insights:

- 0.5 MW–1 MW

- Up to 0.5 MW

- 2 MW–5 MW

- 1 MW–2 MW

- Above 5 MW

The report has provided a detailed breakup and analysis of the market based on the power rating. This includes 0.5 MW–1 MW, up to 0.5 MW, 2 MW–5 MW, 1 MW–2 MW, and above 5 MW.

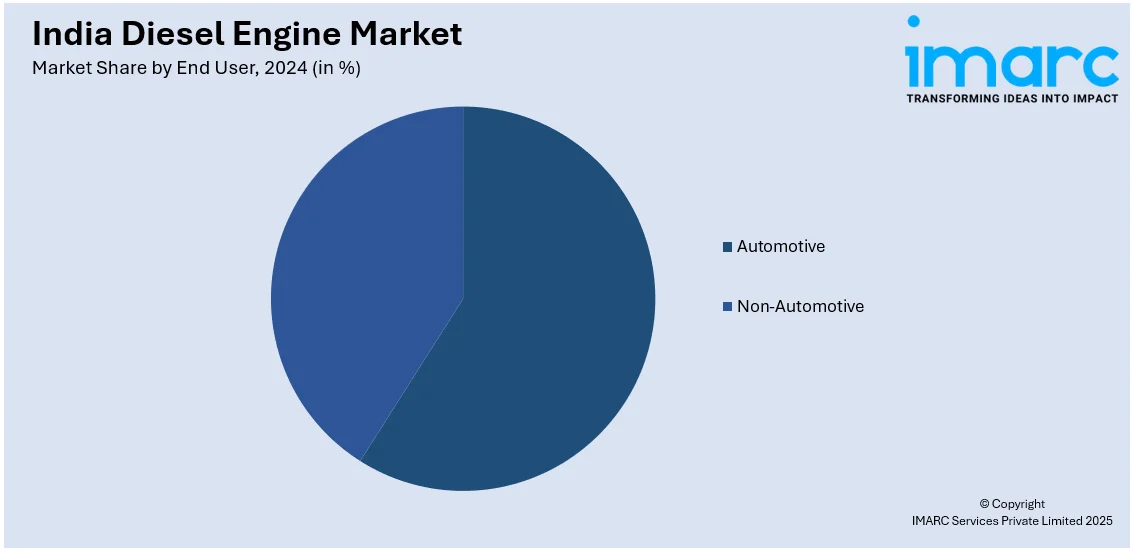

End User Insights:

- Automotive

- On-Road

- Light Vehicles

- Medium/Heavy Trucks

- Light Trucks

- Off Road

- Industrial/Construction Equipment

- Agriculture Equipment

- Marine Applications

- On-Road

- Non-Automotive

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes automotive (on-road [light vehicles, medium/heavy trucks, and light trucks] and off road [industrial/construction equipment, agriculture equipment, and marine applications]) and non-automotive.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Diesel Engine Market News:

- January 2025: Cummins Group in India launched the HELM™ (Higher Efficiency, Lower Emissions, Multiple Fuels) engine platforms, featuring the high-performance L10 engine. This initiative aims to provide versatile and eco-friendly power solutions for various industries.

- January 2025: Skoda revealed its plans to reintroduce its diesel engine in India, following the discontinuation of its popular diesel engine from models like the Kodiaq and Superb due to BS6 emission norms. The brand has revealed that the upcoming Skoda Superb and Kodiaq will be offered with the popular 2.0-litre diesel engine, rated at 190 bhp and 400 Nm of torque, mated to a 7-speed DSG transmission.

India Diesel Engine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Power Ratings Covered | 0.5 MW–1 MW, Up to 0.5 MW, 2 MW–5 MW, 1 MW–2 MW, Above 5 MW |

| End Users Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India diesel engine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India diesel engine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India diesel engine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The diesel engine market in India was valued at USD 8.98 Billion in 2024.

The India diesel engine market is projected to exhibit a CAGR of 4.50% during 2025-2033, reaching a value of USD 13.35 Billion by 2033.

The India diesel engine market is driven by expanding demand in automotive, agriculture, and construction sectors, supported by rapid industrialization and infrastructure growth. Rising preference for fuel-efficient engines, technological advancements, and strong usage in backup power generation further propel market expansion, ensuring diesel engines remain vital in diverse applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)