India Die Casting Market Size, Share, Trends and Forecast by Process, Raw Material, Application, and Region, 2025-2033

India Die Casting Market Overview:

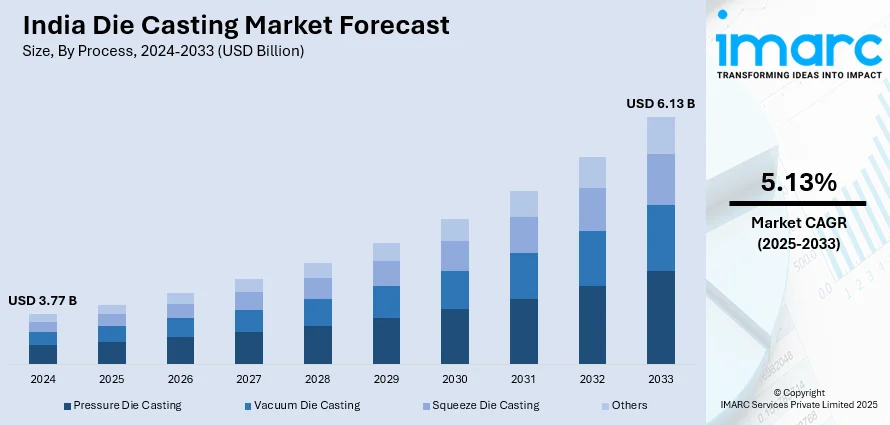

The India die casting market size reached USD 3.77 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.13 Billion by 2033, exhibiting a growth rate (CAGR) of 5.13% during 2025-2033. The rising automotive production, demand for lightweight components, expanding infrastructure, and increased use in electronics and industrial machinery are the factors propelling the growth of the market. Growth in electric vehicles, government initiatives, and advancements in die casting technologies further accelerate market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.77 Billion |

| Market Forecast in 2033 | USD 6.13 Billion |

| Market Growth Rate (2025-2033) | 5.13% |

India Die Casting Market Trends:

Rising Global Interest in India's Die Casting Capabilities

India is establishing itself as a major participant in the die casting industry, drawing worldwide involvement and investment. The industry is collaborating more with global markets, resulting in improved production capabilities and technology adoption. The increased engagement of many countries demonstrates growing confidence in India's knowledge, industrial capability, and ability to satisfy changing demands. The country's die casting sector benefits from a solid industrial foundation, a competent workforce, and supporting regulations that encourage innovation and efficiency. As worldwide interest grows, India is prepared to play a larger role in creating the future of high-precision casting solutions in industries such as automotive, aerospace, and industrial machinery, solidifying its position as a competitive manufacturing base. For instance, the 10th ALUCAST EXPO, held from December 5 to 7, 2024, at Yashobhoomi, New Delhi, highlighted India's leadership in die casting technology. The exhibition featured over 200 exhibitors and 300 companies from Thailand, Germany, the US, Spain, Italy, Austria, Japan, China, and France, attracting over 8,000 industry visitors from 20+ countries. This demonstrates India's expanding influence in the global die casting sector.

To get more information on this market, Request Sample

Advancing Smart Technologies in Die Casting

The use of real-time monitoring in die casting is revolutionizing factory efficiency, allowing for precise control over production parameters. The use of intelligent solutions improves operational performance by prolonging die life and optimizing expenses, making operations more sustainable and cost-effective. As companies strive for greater efficiency, innovative digital monitoring systems play an increasingly important role in enhancing quality consistency and decreasing downtime. This technological transition promotes increased industrial self-sufficiency, reduces dependency on imports, and strengthens native capacities. With an emphasis on automation and data-driven decision-making, India's die casting industry is transitioning to smarter, more efficient manufacturing processes. These innovations not only boost competitiveness, but also contribute to overall industry growth, notably in automotive, aerospace, and heavy machinery applications. For example, in March 2024, Godrej Tooling developed the Smart Connected Die Casting Die, a patented device that analyzes die parameters in real time to improve foundry efficiency. This innovation increases die life by 10% while lowering per-piece costs by 10%, providing an indigenous solution for improving production quality and efficiency in India's die casting sector.

India Die Casting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on process, raw material, and application.

Process Insights:

- Pressure Die Casting

- Vacuum Die Casting

- Squeeze Die Casting

- Others

The report has provided a detailed breakup and analysis of the market based on the process. This includes pressure die casting, vacuum die casting, squeeze die casting, and others.

Raw Material Insights:

- Aluminum

- Magnesium

- Zinc

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes aluminum, magnesium, and zinc.

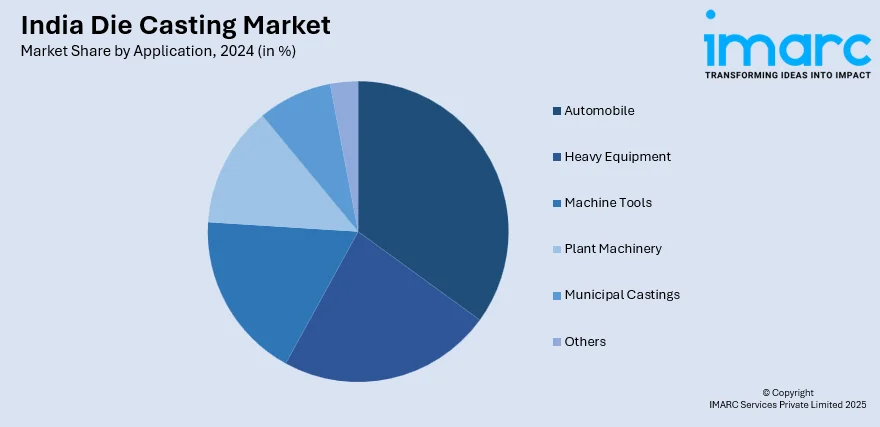

Application Insights:

- Automobile:

- Body Parts

- Engine Parts

- Transmission Parts

- Others

- Heavy Equipment:

- Construction

- Farming

- Mining

- Machine Tools

- Plant Machinery:

- Chemical Plants

- Petroleum Plants

- Thermal Plants

- Paper

- Textile

- Others

- Municipal Castings:

- Valves and Fittings and Pipes

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automobile (body parts, engine parts, transmission parts, and others), heavy equipment (construction, farming, and mining), machine tools, plant machinery (chemical plants, petroleum plants, thermal plants, paper, textile, and others), municipal castings (valves and fittings and pipes), and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Die Casting Market News:

- In January 2025, Sundaram Clayton Limited (SCL) established a new die casting factory in India, increasing its manufacturing capacity. This growth coincides with rising demand in the automotive sector, demonstrating SCL's dedication to innovation and quality.

- In December 2024, Jaya Hind Industries Pvt Ltd installed India's largest 4,400-ton high-pressure die-casting equipment at its Urse factory in Pune. This innovation enables the fabrication of complicated aluminum components such as structural elements for electric cars and heavy-duty transmission housings, allowing the company to fulfill increased demand in the expanding automotive sector.

India Die Casting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Processes Covered | Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, Others |

| Raw Materials Covered | Aluminum, Magnesium, Zinc |

| Applications Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India die casting market performed so far and how will it perform in the coming years?

- What is the breakup of the India die casting market on the basis of process?

- What is the breakup of the India die casting market on the basis of raw material?

- What is the breakup of the India die casting market on the basis of application?

- What are the various stages in the value chain of the India die casting market?

- What are the key driving factors and challenges in the India die casting?

- What is the structure of the India die casting market and who are the key players?

- What is the degree of competition in the India die casting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India die casting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India die casting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India die casting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)