India Dental Milling Machines Market Size, Share, Trends and Forecast by Axis Type, Type, End-User, and Region 2026-2034

India Dental Milling Machines Market Summary:

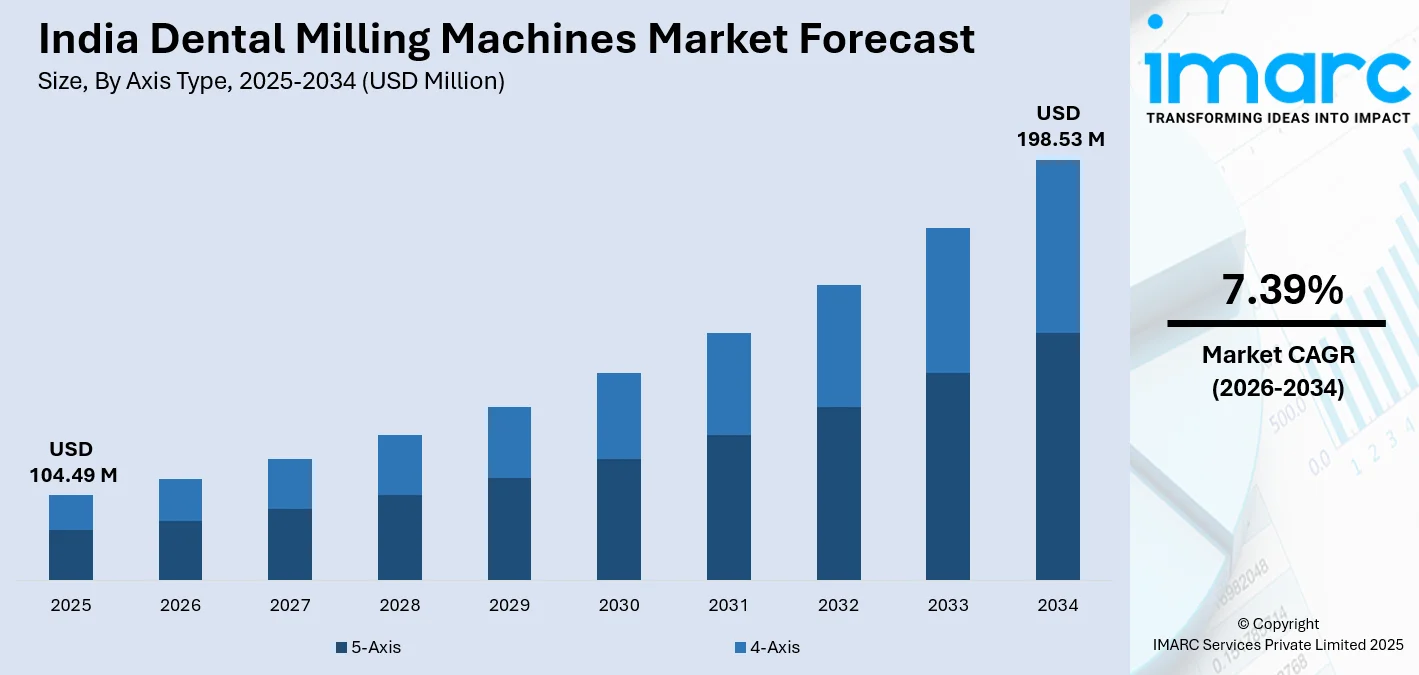

The India dental milling machines market size was valued at USD 104.49 Million in 2025 and is projected to reach USD 198.53 Million by 2034, growing at a compound annual growth rate of 7.39% from 2026-2034.

The India dental milling machines market growth is primarily driven by the higher adoption of digital dentistry technologies, increasing prevalence of dental disorders among the population, and rising investment in dental healthcare infrastructure. The convergence of computer-aided technological advancements, expanding dental clinic networks, and supportive government initiatives under various government programs is fundamentally reshaping the competitive landscape and creating substantial opportunities for market participants.

Key Takeaways and Insights:

- By Axis Type: 5-axis dominates the market with a share of 59% in 2025, driven by superior precision capabilities enabling multi-directional cutting for complex dental restorations, sharper margins, and better fit for crowns and bridges.

- By Type: Wet milling leads the market with a share of 56% in 2025, owing to its superior performance in processing heat-sensitive materials like lithium disilicate glass ceramics, preventing microcracks and ensuring smooth surface finishes.

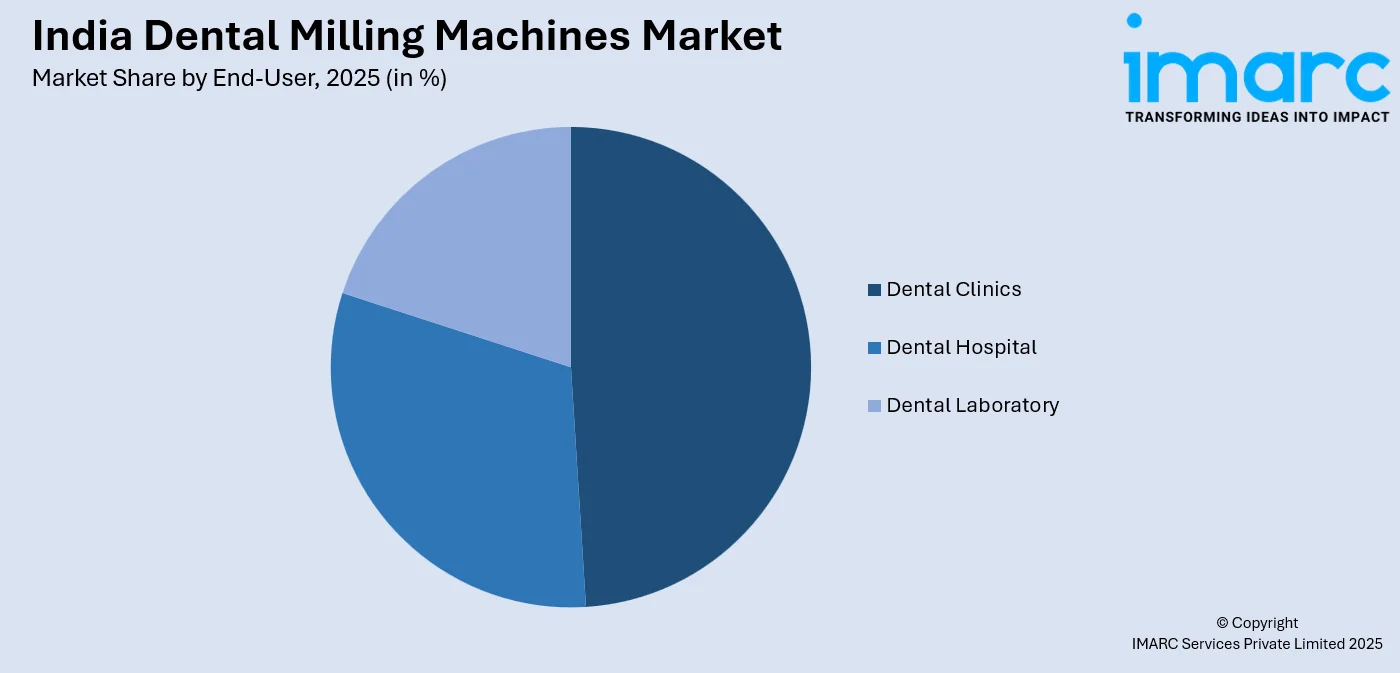

- By End-User: Dental clinics represent the largest segment with a market share of 49% in 2025. This dominance is attributed to the rising number of dental clinics across metropolitan and tier-2 cities, along with increasing adoption of chairside milling solutions.

- By Region: North India dominates the market with a share of 30% in 2025, due to the concentration of healthcare infrastructure, higher disposable incomes, and presence of leading dental institutions and corporate clinic chains.

- Key Players: The India dental milling machines market exhibits moderate competitive intensity, with multinational dental technology corporations competing alongside regional manufacturers across price segments and technology tiers.

To get more information on this market Request Sample

The India dental milling machines market is witnessing growth, supported by rapid adoption of digital dentistry, rising awareness about oral health, and increasing demand for restorative and cosmetic dental procedures. Expansion of private dental clinics, corporate dental chains, and dental laboratories is accelerating investment in advanced milling technologies to improve precision and reduce treatment turnaround times. Furthermore, India’s geriatric population is projected to reach approximately 230 million by 2036, accounting for nearly 15% of the total population, which is expected to significantly increase the demand for age related restorative dental care. Continuous technological advancements in multi axis milling, material compatibility, and automation are improving equipment efficiency and accessibility across practice sizes. Improved training infrastructure, integration of digital dentistry into educational curricula, and public health initiatives promoting preventive care are increasing patient inflow, particularly in urban and tier two cities, supporting long term market expansion.

India Dental Milling Machines Market Trends:

Rising Adoption of CAD/CAM Digital Dentistry Workflows

The widespread adoption of computer-aided design (CAD) and computer-aided manufacturing (CAM) technologies is a crucial factor impelling the growth of the market. For instance, in September 2024, the Government Dental College and Research Institute in Bangalore introduced advanced digital dentistry facilities equipped with CAD/CAM systems, becoming the first government hospital in the region to implement such technology. This development reflects broader acceptance of digital workflows across public and private dental institutions. CAD/CAM integration enables dental professionals to produce highly precise restorations with improved consistency and significantly reduced turnaround times, transforming conventional prosthetic fabrication processes and contributing to the demand for advanced dental milling machines.

Expansion of Organized Dental Clinic Chains and Infrastructure

The rapid expansion of corporate dental chains is influencing the market through standardized procurement practices and accelerated adoption of advanced dental technologies. In 2025, Clove Dental celebrated its 14th anniversary by opening its 600th clinic in Gurugram, extending its presence across 26 cities in India. This milestone highlighted the company’s emphasis on technology driven, standardized, and AI enabled dental care, serving more than three million patients. Such large-scale network expansion increases demand for uniform, high precision equipment. As corporate chains continue to grow across metropolitan and tier two cities, they are generating sustained demand for dental milling machines to support consistent treatment quality and operational efficiency nationwide.

Growing Awareness and Training in Digital Dental Practices

The increasing availability of training programs, workshops, and professional education initiatives is supporting wider adoption of dental milling machines across India. Dental professionals are gaining greater familiarity with digital workflows and equipment operation, reducing hesitation toward technology investment. In 2025, Amrita School of Dentistry inaugurated an advanced Digital Dentistry Centre at Amrita Hospital in Kochi, equipped with advanced CAD/CAM technology, 3D printing, and extended reality systems to support fully digital workflows. Such initiatives strengthen clinical training and technical confidence. As educational institutions integrate digital dentistry into curricula, improved skill availability lowers adoption barriers and positions dental milling machines as essential tools for modern dental care delivery.

Market Outlook 2026-2034:

The India dental milling machines market demonstrates growth potential during the forecast period, driven by accelerating digital adoption and rising patient expectations for precision dental treatments. The market generated a revenue of USD 104.49 Million in 2025 and is projected to reach a revenue of USD 198.53 Million by 2034, growing at a compound annual growth rate of 7.39% from 2026-2034. Increasing adoption of CAD/CAM technologies, growth in dental clinics and laboratories, and demand for faster, high-quality restorations are supporting sustained market development across urban and semi urban regions.

India Dental Milling Machines Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Axis Type |

5-Axis |

59% |

|

Type |

Wet Milling |

56% |

|

End-User |

Dental Clinics |

49% |

|

Region |

North India |

30% |

Axis Type Insights:

- 5-Axis

- 4-Axis

5-axis dominates with a market share of 59% of the total India dental milling machines market in 2025.

5-axis represents the largest segment owing to its ability to produce highly precise and complex restorations in a single setup. It enables accurate fabrication of crowns, bridges, and implants, meeting the growing demand for advanced restorative dental procedures.

Its dominance is further supported by improved workflow efficiency and reduced manual intervention. 5-axis minimizes material waste, shortens production time, and delivers consistent quality, making it preferred by dental laboratories and clinics adopting digital dentistry solutions.

Type Insights:

- Dry Milling

- Wet Milling

Wet milling leads with a market share of 56% of the total India dental milling machines market in 2025.

Wet milling holds the biggest market share due to its suitability for processing a wide range of dental materials with high precision. It enables smooth surface finishes and accurate shaping, which are essential for producing high quality restorations and prosthetics.

Its dominance is also driven by the growing use of ceramics and glass based materials in restorative dentistry. Wet milling reduces heat generation and material stress, improving tool life and ensuring consistent outcomes for crowns, bridges, and implant components.

End-User Insights:

Access the comprehensive market breakdown Request Sample

- Dental Hospital

- Dental Clinics

- Dental Laboratory

Dental clinics exhibit a clear dominance with a 49% share of the total India dental milling machines market in 2025.

Dental clinics dominate the market attributed to the increasing adoption of CAD/CAM systems that enable same day restorations. Clinics invest in in house milling to reduce turnaround time, improve patient satisfaction, and maintain greater control over treatment quality.

Their dominance is further supported by the rising number of private dental practices and cosmetic dentistry demand. For example, in 2025, Smile in Hour® launched a dental clinic franchise opportunity in New Delhi to expand its cosmetic implant services. The growing patient preference for faster, personalized treatments encourages clinics to adopt advanced milling technologies rather than rely solely on external dental laboratories.

Regional Insights:

- North India

- South India

- East India

- West India

North India dominates with a market share of 30% of the total India dental milling machines market in 2025.

North India leads the dental milling machines market due to a strong concentration of advanced dental clinics, laboratories, and academic institutions. Cities including Delhi, Gurugram, and Noida drive adoption of digital dentistry and high-end equipment, supported by higher patient awareness and stronger purchasing power across urban populations.

In 2025, the Delhi government launched six mobile dental clinics offering free oral healthcare services across underserved areas. Equipped with modern dental tools, this initiative reflects rising public and private focus on oral health, reinforcing demand for restorative procedures and sustained investment in modern dental milling systems across North India.

Market Dynamics:

Growth Drivers:

Why is the India Dental Milling Machines Market Growing?

Rising Prevalence of Dental Disorders

The growing incidence of dental caries, periodontal disease, and tooth loss across India is driving the demand for restorative dental treatments. Patients seek durable and functionally precise solutions, driving the adoption of advanced fabrication technologies. In 2025, data from the Oral Health Movement conducted with the Indian Dental Association and Colgate Palmolive India revealed that nine out of ten Indians suffer from dental issues, including gum disease at 44%, cavities at 41%, and enamel erosion at 14% across 700 districts. This increasing disease burden is translating into higher treatment volumes, encouraging clinics and laboratories to invest in dental milling machines that support accurate restorations, consistent output, and improved clinical outcomes.

Growing Oral Healthcare Awareness

Rising oral health awareness and preventive care initiatives are supporting growth of the dental milling machines market in India by increasing patient engagement and treatment demand. Public and private programs are encouraging regular dental checkups and early diagnosis, leading to higher volumes of restorative procedures. In 2024, Colgate launched its Oral Health Movement in India, introducing an AI powered dental screening tool that provided free assessments through WhatsApp and expanded access to dental awareness nationwide. Such initiatives are strengthening patient awareness and clinical visits. As preventive care adoption increases, clinics are investing in advanced milling technologies to deliver faster, precise, and high- quality restorative solutions aligned with growing patient expectations.

Rising Demand for Cosmetic and Restorative Dental Procedures

The growing focus on dental aesthetics and oral health is driving the demand for restorative and cosmetic treatments across India. Patients increasingly prefer crowns, bridges, implants, and veneers that combine durability with a natural appearance, raising expectations for precision and finish. According to the IMARC Group, the India restorative dentistry market is projected to reach USD 1,705.50 Million by 2033, reflecting strong long term market demand. This trend encourages clinics and laboratories to invest in milling technologies that enable customized, high-quality restorations and faster service delivery. Dental milling machines support high precision fabrication of these restorations, meeting rising expectations for fit and finish.

Market Restraints:

What Challenges the India Dental Milling Machines Market is Facing?

High Equipment Costs Limiting Adoption Among Small Practitioners

Capital investment requirements represent a fundamental challenge constraining broader adoption of dental milling machines among independent practitioners and small clinics. Premium 5-axis milling systems with advanced features command significant upfront investment, creating barriers for dental professionals operating with limited capital resources or those located in economically disadvantaged regions where patient spending capacity remains constrained.

Shortage of Skilled Dental Technicians and CAD/CAM Operators

The availability of trained personnel capable of operating sophisticated digital dentistry equipment remains a significant constraint on market expansion. While dental education institutions are increasingly incorporating digital competencies into curricula, the existing workforce requires substantial upskilling to effectively utilize advanced milling technologies, creating a transitional bottleneck that slows adoption rates.

Infrastructure Gaps in Rural and Semi-Urban Areas

Inadequate healthcare infrastructure and limited access to advanced dental services in remote and rural regions restrict broader adoption of dental milling technologies. Many facilities lack the financial resources, technical expertise, and patient volumes needed to justify investment in advanced equipment. This imbalance slows market penetration outside metropolitan areas and widens the gap in access to modern dental care.

Competitive Landscape:

The India dental milling machines market exhibits moderate competitive intensity characterized by the presence of multinational dental technology corporations alongside regional manufacturers competing across price segments and technology tiers. Market dynamics reflect strategic positioning, ranging from premium innovation-driven offerings emphasizing advanced precision and automation to value-oriented products targeting cost-conscious practitioners. The competitive landscape is increasingly shaped by digital ecosystem integration capabilities, service support infrastructure, and brand marketing effectiveness in addressing technology adoption barriers. Strategic alliances and local subsidiary establishment are becoming decisive differentiators as manufacturers seek to strengthen distribution networks and after-sales support capabilities essential for market penetration success.

Recent Developments:

- October 2025: DGSHAPE, a leading dental milling machine manufacturer, has opened a local branch in Gurugram, India, eliminating the need for imports from Japan. This move, by DGSHAPE's parent company Roland DG, aimed to make advanced dental milling machines more affordable and accessible to Indian businesses. With reduced import duties and a local presence, DGSHAPE aimed to expand its reach and support the growing Indian dental market.

India Dental Milling Machines Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Axis Types Covered | 5-Axis, 4-Axis |

| Types Covered | Dry Milling, Wet Milling |

| End-Users Covered | Dental Hospital, Dental Clinics, Dental Laboratory |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India dental milling machines market size was valued at USD 104.49 Million in 2025.

The India dental milling machines market is expected to grow at a compound annual growth rate of 7.39% from 2026-2034 to reach USD 198.53 Million by 2034.

5-axis dominates the India dental milling machines market with a share of 59% in 2025, driven by superior precision capabilities enabling multi-directional cutting for complex dental restorations.

Key factors driving the India dental milling machines market include rapid expansion of corporate dental chains, which require standardized dental technologies. In 2025, Clove Dental opened its 600th clinic across 26 Indian cities, serving over three million patients. Such network growth increases demand for uniform, high precision dental milling machines to ensure consistent treatment quality and efficiency.

Major challenges include high equipment costs limiting adoption among small practitioners, shortage of skilled dental technicians and CAD/CAM operators, infrastructure gaps in rural and semi-urban areas, and inconsistent power supply affecting equipment operation in remote regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)