India Decorative Paint Market Size, Share, Trends and Forecast by Product Type, Type of Paint, Application, Sales Channel, End User, and Region, 2025-2033

India Decorative Paint Market Size and Share:

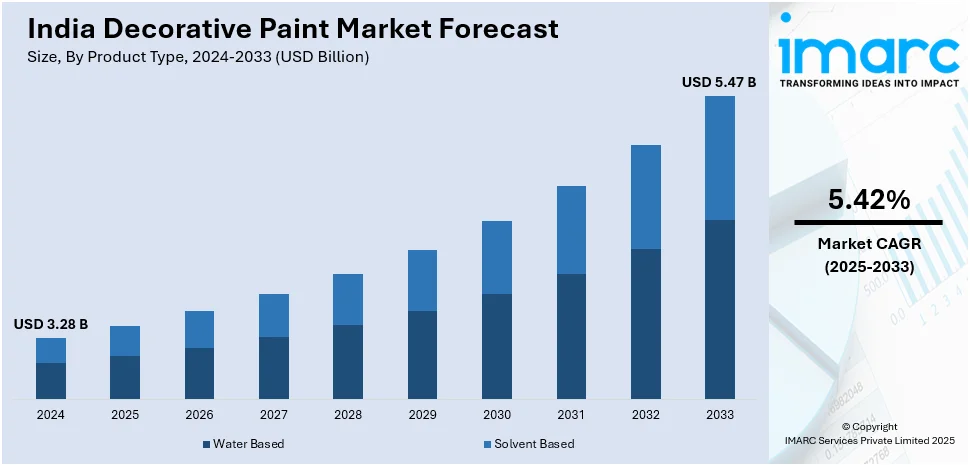

The India decorative paint market size reached USD 3.28 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.47 Billion by 2033, exhibiting a growth rate (CAGR) of 5.42% during 2025-2033. The market is driven by rapid urbanization, increasing disposable incomes, and rising demand for home improvement. Additionally, real estate growth, affordable housing policies by the government, and a shift toward green, innovative paint solutions are fueling the India decorative paint market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.28 Billion |

| Market Forecast in 2033 | USD 5.47 Billion |

| Market Growth Rate (2025-2033) | 5.42% |

India Decorative Paint Market Trends:

Growing Popularity of Eco-Friendly Paints

Indian market for eco-friendly decorative paints is expanding as people become more sensitive to the environment and their own health. The paints are free from harmful chemicals like volatile organic compounds (VOCs), which are the causes of respiratory issues and environmental deterioration. Increasing awareness about sustainability and green lifestyles is driving the trend. Customers, especially in cities, are opting for environmentally friendly paints and paints friendly to the space's occupants. Manufacturers are responding by coming out with low-VOC and zero-VOC products that not only offer better indoor air quality but also a stronger finish. The Confederation of Indian Industry (CII) states that demand for green coatings is likely to increase at a compound annual growth rate (CAGR) higher than 12% over the next few years. It is not just a step keeping consumer preference in view but also in accordance with the government's push towards greener products. This trend is expected to continue as both residents and constructors regard environmental concerns, thus changing the overall India decorative paint market outlook.

To get more information on this market, Request Sample

Rise of Customization in Decorative Paints

Customization of decorative paints is a new trend in India, and people are asking for personalized and distinct interior spaces. This represents the primary factor increasing the India decorative paint market share. As per the industry reports, about 20% of the demand for decorative paints is driven by new construction, and 80% of the total decorative paint demand is through repainting. People are moving away from uniformity of color schemes and looking towards more personalized and distinct designs. This is brought about by individuality and reflecting personal preference in interior designs of homes. The manufacturers are capitalizing on this need by offering vast differences in color shades, finishes, and textures. Additionally, thanks to the applications of sophisticated technologies like digital print and 3D wall designs, one-of-a-kind murals, designs, and textures can now be created. This trend is particularly popular among the younger generation, who are willing to pay for a tailored ambiance. The easy access to one-off paint finishes, combined with internet-based packages for virtual designing and consultation, is making way for more consumer control in translating his or her creative vision onto canvas.

India Decorative Paint Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, type of paint, application, sales channel, and end user.

Product Type Insights:

- Water Based

- Solvent Based

The report has provided a detailed breakup and analysis of the market based on the product type. This includes water based and solvent based.

Type of Paint Insights:

- Emulsion

- Enamel

- Distemper

- Primer

- Textures

- Others

The report has provided a detailed breakup and analysis of the market based on the type of paint. This includes emulsion, enamel, distemper, primer, textures, and others.

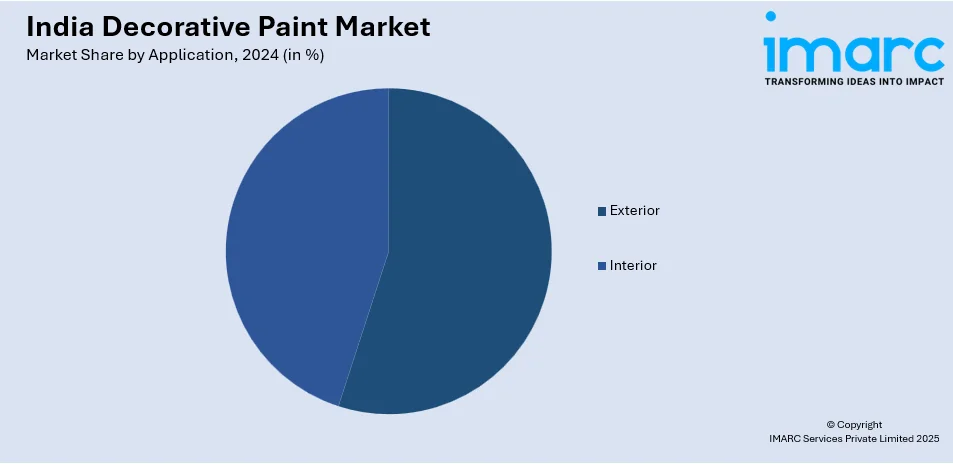

Application Insights:

- Exterior

- Interior

The report has provided a detailed breakup and analysis of the market based on the application. This includes exterior and interior.

Sales Channel Insights:

- Offline

- Online

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes offline and online.

End User Insights:

- Residential

- Non-Residential

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential and non-residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Decorative Paint Market News:

- In February 2025, Berger Paints Ltd. aims to maintain its record of trust and innovation through sustainable growth and judicious acquisitions. Berger Paints plans to double its revenue by 2030 and will allocate Rs 2,000 crore to fund new projects to enhance capacity.

- In January 2025, Kansai Nerolac Paints Ltd (KNPL), one of the leading players in the Indian paint industry, planned to spend ₹98 crore to boost manufacturing capacity at its plant in Hosur, Tamil Nadu.

India Decorative Paint Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Water Based, Solvent Based |

| Types of Paint Covered | Emulsion, Enamel, Distemper, Primer, Textures, Others |

| Applications Covered | Exterior, Interior |

| Sales Channels Covered | Offline, Online |

| End Users Covered | Residential, Non-Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India decorative paint market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India decorative paint market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India decorative paint industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The decorative paint market in India was valued at USD 3.28 Billion in 2024.

The India decorative paint market is projected to exhibit a CAGR of 5.42% during 2025-2033, reaching a value of USD 5.47 Billion by 2033.

The India decorative paint market is fueled by inflating income levels, rising focus on home improvement and aesthetics, and increasing urbanization. The booming real estate sector, shorter repainting cycles, and the rising popularity of eco-friendly and innovative paint solutions (like anti-bacterial or self-cleaning paints) also contribute significantly to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)