India Decorative Lighting Market Size, Share, Trends and Forecast by Product Type, Light Source, Distribution Channel, End User, and Region, 2025-2033

India Decorative Lighting Market Size and Share:

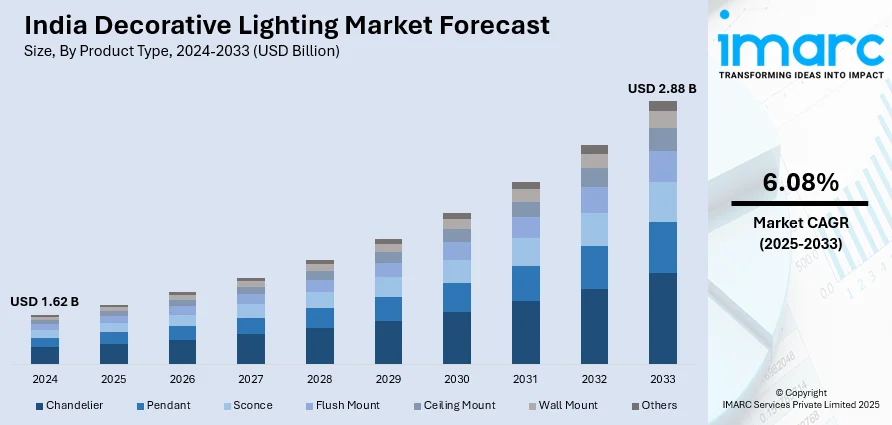

The India decorative lighting market size reached USD 1.62 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.88 Billion by 2033, exhibiting a growth rate (CAGR) of 6.08% during 2025-2033. The escalating demand during festivals and cultural events, a growing preference for sustainable and eco-friendly lighting, and the rise of organized retail and e-commerce are some of the factors impelling the market growth. Individuals are prioritizing energy-efficient, aesthetically appealing, and technologically advanced lighting solutions, which is also driving innovation and market outlook.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.62 Billion |

| Market Forecast in 2033 | USD 2.88 Billion |

| Market Growth Rate (2025-2033) | 6.08% |

India Decorative Lighting Market Trends:

Rising Demand during Festival and Cultural Events

India’s strong cultural and festive traditions significantly drive seasonal spikes in demand for decorative lights, lanterns, and specialty lighting products. Increasing user spending on home and event décor during festive seasons is leading to higher sales, particularly for light-emitting diode (LED)-based lighting solutions due to their durability, energy efficiency, and affordability. Wedding celebrations, corporate events, and large-scale public gatherings also contribute to market expansion, with customized lighting setups becoming a key element of décor. The growing influence of social media and event planners is further catalyzing the demand for innovative lighting designs, including projection mapping, neon accents, and interactive lighting elements. Manufacturers are responding by launching theme-based and customizable lighting options for catering to diverse individual preferences. In 2024, Surya Roshni introduced a fresh collection of decorative lighting options designed to beautify homes and areas for the festive season. The assortment featured Jagmag String Lights, Rope Lights, and Profile Strip Lights, crafted for adaptability, straightforward setup, and energy savings. These items were designed to provide a combination of sophistication and practicality, ideal for both holiday decorations and daily lighting requirements.

To get more information on this market, Request Sample

Growing Demand for Sustainable and Eco-Friendly Lighting

Sustainability is emerging as a key trend in India’s decorative lighting market, with people actively seeking eco-friendly options. The rising awareness about environmental issues, coupled with government initiatives promoting energy conservation, is driving the demand for lighting solutions made from sustainable materials such as bamboo, recycled glass, and biodegradable elements. Solar-powered decorative lights are gaining popularity, especially for outdoor applications, garden decor, and festival lighting, as they reduce electricity consumption and offer long-term cost savings. Manufacturers are focusing on developing recyclable and non-toxic lighting components while promoting responsible sourcing practices. As sustainability continues to influence purchasing decisions, brands incorporating green innovations and eco-conscious materials into their decorative lighting offerings are gaining a competitive edge in the evolving market landscape. In 2024, FIG Living introduced its eco-friendly Cloud Lamps in India. Constructed with high-density polypropylene fibers, the lamps were resistant to tears, water, and recyclable, providing both longevity and environmental sustainability. The lineup featured two models, the Cloud Lamp and Sphere Lamp, designed for both indoor and semi-outdoor areas.

Expanding E-Commerce and Organized Retail Sector

Online marketplaces are making a wide variety of decorative lighting solutions accessible to buyers across urban and rural areas. These platforms offer convenience, competitive pricing, and an extensive range of products, including imported and designer lighting. Additionally, augmented reality (AR) tools and virtual showrooms are enabling customers to visualize lighting setups before purchasing, enhancing the shopping experience. The growing presence of organized retail chains, including home improvement and lifestyle stores, is further supporting market expansion by offering exclusive product lines and in-store customization options. Individuals are opting for premium, branded decorative lighting products over unorganized alternatives due to better quality, warranties, and after-sales service. The shift towards digital and organized retail channels is boosting sales in this segment. In 2024, Signify introduced its 2000 sq-ft Philips Smart Light Hub (SLH) in New Delhi, presenting more than 300 SKUs of smart lighting items. The store was created to serve as an immersive experience hub, enabling clients to interact with cutting-edge lighting technologies. The hub sought to become a premier spot for lighting fans and experts in the area.

India decorative lighting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, light source, distribution channel, and end user.

Product Type Insights:

- Chandelier

- Pendant

- Sconce

- Flush Mount

- Ceiling Mount

- Wall Mount

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes chandelier, pendant, sconce, flush mount, ceiling mount, wall mount, and others.

Light Source Insights:

- LED

- Fluorescent

- Incandescent

- Others

A detailed breakup and analysis of the market based on the light source have also been provided in the report. This includes LED, fluorescent, incandescent, and others.

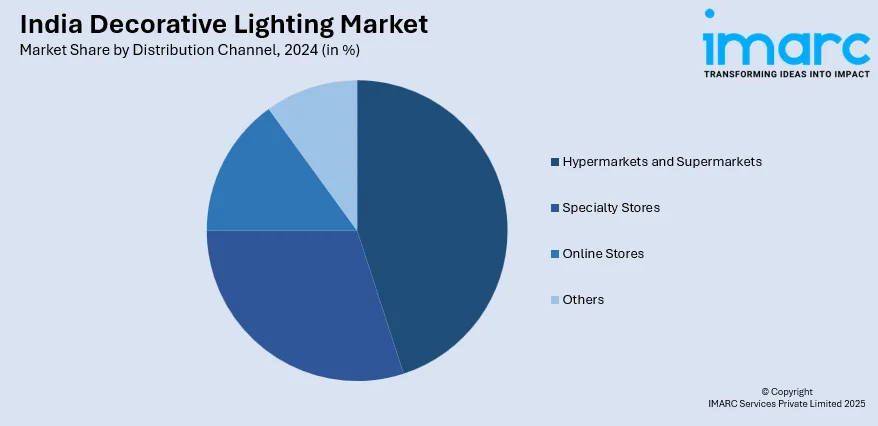

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Specialty Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hypermarkets and supermarkets, specialty stores, online stores, and others.

End User Insights:

- Commercial

- Household

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes commercial and household.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Decorative Lighting Market News:

- In February 2025, Signify unveiled Odisha's biggest Philips Smart Light Hub in Bhubaneswar, covering 1600 square feet and featuring more than 450 SKUs. The shop displays an extensive selection of both decorative and practical lighting, featuring cutting-edge connected lights powered by WiZ Smart technology.

- In December 2024, Crompton Greaves Consumer Electricals Ltd. introduced its latest collection of decorative wall lights, termed the Wallsmile Wall Light Series. The assortment showcased different styles including wall sconces, sphere lights, K lights, and adjustable up & down lights, providing both practicality and visual attractiveness. These lights were resistant to water, dust-free, and certified by BIS, guaranteeing quality and safety for use both indoors and outdoors.

India Decorative Lighting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Chandelier, Pendant, Sconce, Flush Mount, Ceiling Mount, Wall Mount, Others |

| Light Sources Covered | LED, Fluorescent, Incandescent, Others |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Specialty Stores, Online Stores, Others |

| End Users Covered | Commercial, Household |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India decorative lighting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India decorative lighting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India decorative lighting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The decorative lighting market in India was valued at USD 1.62 Billion in 2024.

The India decorative lighting market is projected to exhibit a CAGR of 6.08% during 2025-2033, reaching a value of USD 2.88 Billion by 2033.

India’s decorative lighting market is driven by festivals and cultural celebrations like Diwali and weddings, which create strong seasonal demand. Rising urbanization and middle-class incomes are increasing interest in stylish home décor. Growing awareness of energy-efficient LED lighting and government support for sustainable lighting further boost adoption. Additionally, the rise of e-commerce and organized retail has improved accessibility, while demand for customizable and innovative designs encourages continuous product development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)