India Deck Software Market Size, Share, Trends and Forecast by Deployment, Application, End-Use, and Region, 2025-2033

India Deck Software Market Overview:

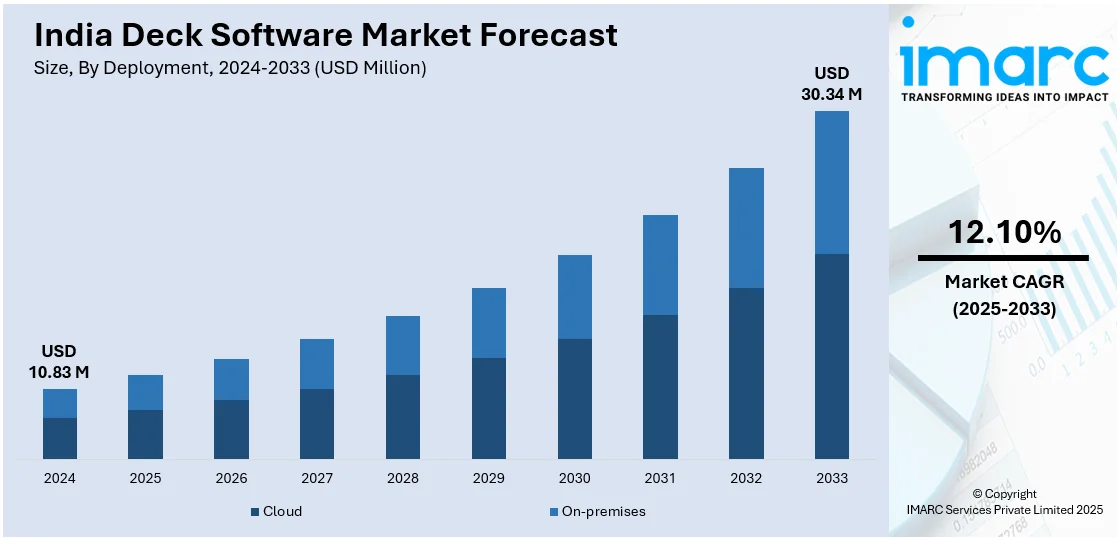

The India deck software market size reached USD 10.83 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 30.34 Million by 2033, exhibiting a growth rate (CAGR) of 12.10% during 2025-2033. The growing digital transformation, increasing adoption of cloud-based solutions, rising demand for automation, expanding small and medium enterprises, government initiatives promoting digital infrastructure, and the need for efficient workflow management are some of the major factors expanding the India deck software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.83 Million |

| Market Forecast in 2033 | USD 30.34 Million |

| Market Growth Rate 2025-2033 | 12.10% |

India Deck Software Market Trends:

Increased Adoption of Artificial Intelligence (AI) and Automation

The growing integration of artificial intelligence (AI) and automation in deck software is significantly influencing the India deck software market growth. Besides, AI-based tools offer sophisticated design suggestions, automate mundane tasks, and provide real-time content suggestions, thus improving the effectiveness of designing beautiful presentations. Furthermore, automation extends to creating data-driven insights, updating charts and graphs in real time, and aligning visual components for a professional finish. Apart from this, numerous Indian businesses use artificial intelligence (AI) for customized templates and content optimization based on consumer interests, significantly cutting down the effort and time involved in creating presentations. According to an industry report, 80% of Indian businesses prioritize AI as a primary strategic emphasis, surpassing the global average of 75% percent, thereby making India a global leader in this regard. This strong focus on AI adoption is driving the demand for AI-powered deck software solutions, enabling businesses to create intelligent, data-driven presentations that enhance decision-making and communication. In addition to this, AI-based analytics software in deck software also provides insights into viewer engagement, giving information about how presentations are viewed most. This feature is particularly useful for sales and marketing teams, who can tailor their content for maximum effect. With companies placing more emphasis on productivity and data-driven decision-making, the demand for AI-powered deck software will increase in the upcoming few years.

To get more information on this market, Request Sample

Cloud-Based Solutions and Collaborative Features

The rise of remote and hybrid work models is extensively augmenting the adoption of cloud-based deck software in India. Cloud platforms provide instant sharing of presentations from any number of devices, ensuring geographically diverse team collaboration. In line with this, features like real-time collaborative editing, version history, and comment trail enables teams collaborating on presentations concurrently, facilitating speedier decision-making and increased visibility. Furthermore, various Indian start-ups and small and medium businesses prefer subscription software offered in the cloud due to its cost-effectiveness and scalability with no need to invest in heavy infrastructure. Apart from this, its integrations with communication and project management tools optimize productivity by eliminating workflows. Besides this, cloud solutions also bring robust data protection features like encryption and multi-factor authentication to guard sensitive information from unauthorized access. According to an industry report, there were 895 Million internet connections in India as of June 2023. By 2026, 350 Million Indians will have 5G connections, making up 27% of all mobile subscribers. The increasing penetration of high-speed internet and the proliferation of mobile devices further create a positive India deck software market outlook, making it an essential component for organizations seeking agility and remote collaboration capabilities.

India Deck Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on deployment, application, and end-use.

Deployment Insights:

- Cloud

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes cloud and on-premises.

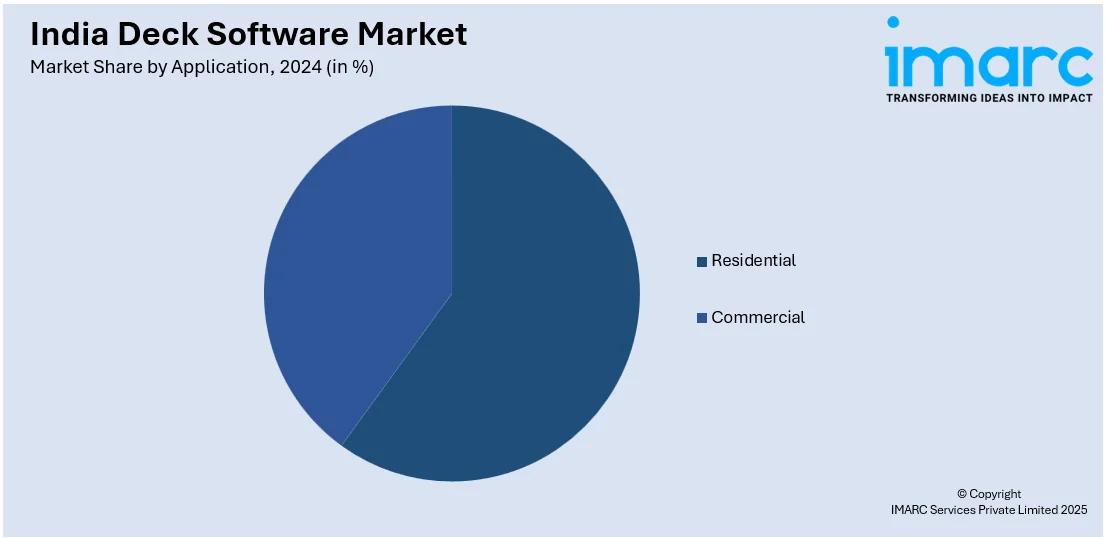

Application Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial.

End-Use Insights:

- Architects and Builders

- Remodelers

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes architects and builders, and remodelers.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Deck Software Market News:

- On January 11, 2024, Yamaha Music India announced a collaboration with Elgato to develop a software plugin integrating Yamaha's audio interfaces and mixers with Elgato's stream deck controllers. This integration enables real-time adjustment of game streaming audio using stream deck's keys and dials, enhancing the user experience for creators in music, video production, and live streaming. The ZG01 plugin is available for free download on Elgato's website.

India Deck Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployments Covered | Cloud, On-premises |

| Applications Covered | Residential, Commercial |

| End-Uses Covered | Architects and Builders, Remodelers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India deck software market performed so far and how will it perform in the coming years?

- What is the breakup of the India deck software market on the basis of deployment?

- What is the breakup of the India deck software market on the basis of application?

- What is the breakup of the India deck software market on the basis of end-use?

- What is the breakup of the India deck software market on the basis of region?

- What are the various stages in the value chain of the India deck software market?

- What are the key driving factors and challenges in the India deck software market?

- What is the structure of the India deck software market and who are the key players?

- What is the degree of competition in the India deck software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India deck software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India deck software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India deck software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)