India Data Center Colocation Market Size, Share, Trends and Forecast by Type, Organization Size, End Use Industry, and Region, 2025-2033

Market Overview:

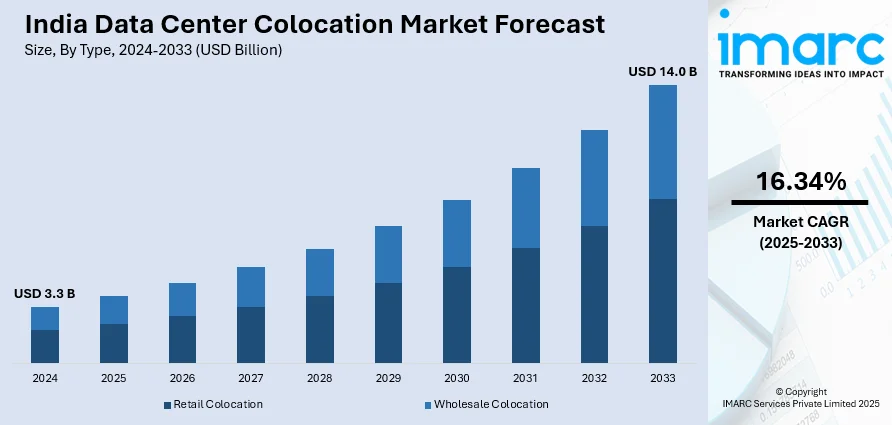

India data center colocation market size reached USD 3.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.0 Billion by 2033, exhibiting a growth rate (CAGR) of 16.34% during 2025-2033. The increasing prevalence of data center colocation providers, which often invest heavily in redundant systems, backup power supplies, and advanced security measures, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.3 Billion |

|

Market Forecast in 2033

|

USD 14.0 Billion |

| Market Growth Rate 2025-2033 | 16.34% |

Data center colocation is a service where businesses can rent space, power, and bandwidth within a shared facility to house their servers and IT infrastructure. Rather than maintaining a private, in-house data center, companies opt for colocation to leverage the resources and infrastructure provided by a specialized facility. This arrangement offers benefits such as cost savings, improved scalability, and enhanced security, as data centers are designed to meet rigorous standards. Colocation providers offer redundant power, cooling systems, and physical security measures, ensuring continuous operation. Clients retain control over their hardware and software while benefiting from the economies of scale and reliability of a professionally managed data center. This model is particularly attractive for businesses seeking a robust and flexible solution for their IT needs without the burden of full infrastructure ownership and management.

To get more information on this market, Request Sample

India Data Center Colocation Market Trends:

The data center colocation market in India is witnessing robust growth, primarily fueled by the escalating demand for scalable and flexible IT infrastructure solutions. To begin with, the increasing digitization across various industries has led to an exponential surge in data generation, compelling organizations to seek reliable and efficient data management solutions. Furthermore, the burgeoning adoption of cloud computing services has emerged as a pivotal driver, propelling the need for secure and high-performance colocation facilities. In addition to this, the rising complexity of managing in-house data centers has prompted businesses to opt for colocation services, thereby outsourcing the maintenance and operational responsibilities to specialized providers. Moreover, the relentless pursuit of cost optimization and resource efficiency is steering enterprises towards colocation solutions, as they offer a cost-effective alternative to building and maintaining proprietary data centers. Additionally, the escalating concerns regarding data security and regulatory compliance have positioned colocation providers as trusted partners equipped with state-of-the-art security measures and compliance frameworks. In essence, the amalgamation of these drivers underscores the pivotal role of colocation services in meeting the evolving needs of businesses in an era dominated by data-centric operations.

India Data Center Colocation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, organization size, and end use industry.

Type Insights:

- Retail Colocation

- Wholesale Colocation

The report has provided a detailed breakup and analysis of the market based on the type. This includes retail colocation and wholesale colocation.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium enterprises and large enterprises.

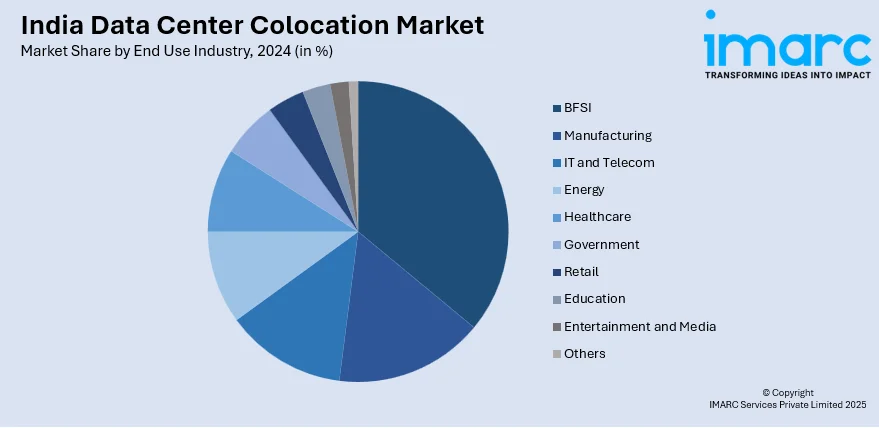

End Use Industry Insights:

- BFSI

- Manufacturing

- IT and Telecom

- Energy

- Healthcare

- Government

- Retail

- Education

- Entertainment and Media

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes BFSI, manufacturing, IT and telecom, energy, healthcare, government, retail, education, entertainment and media, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Data Center Colocation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Retail Colocation, Wholesale Colocation |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End Use Industries Covered | BFSI, Manufacturing, IT and Telecom, Energy, Healthcare, Government, Retail, Education, Entertainment and Media, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India data center colocation market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India data center colocation market?

- What is the breakup of the India data center colocation market on the basis of type?

- What is the breakup of the India data center colocation market on the basis of organization size?

- What is the breakup of the India data center colocation market on the basis of end use industry?

- What are the various stages in the value chain of the India data center colocation market?

- What are the key driving factors and challenges in the India data center colocation?

- What is the structure of the India data center colocation market and who are the key players?

- What is the degree of competition in the India data center colocation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India data center colocation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India data center colocation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India data center colocation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)