India Cyber Security Services Market Size, Share, Trends and Forecast by Service, Industry Vertical, and Region, 2025-2033

India Cyber Security Services Market Overview:

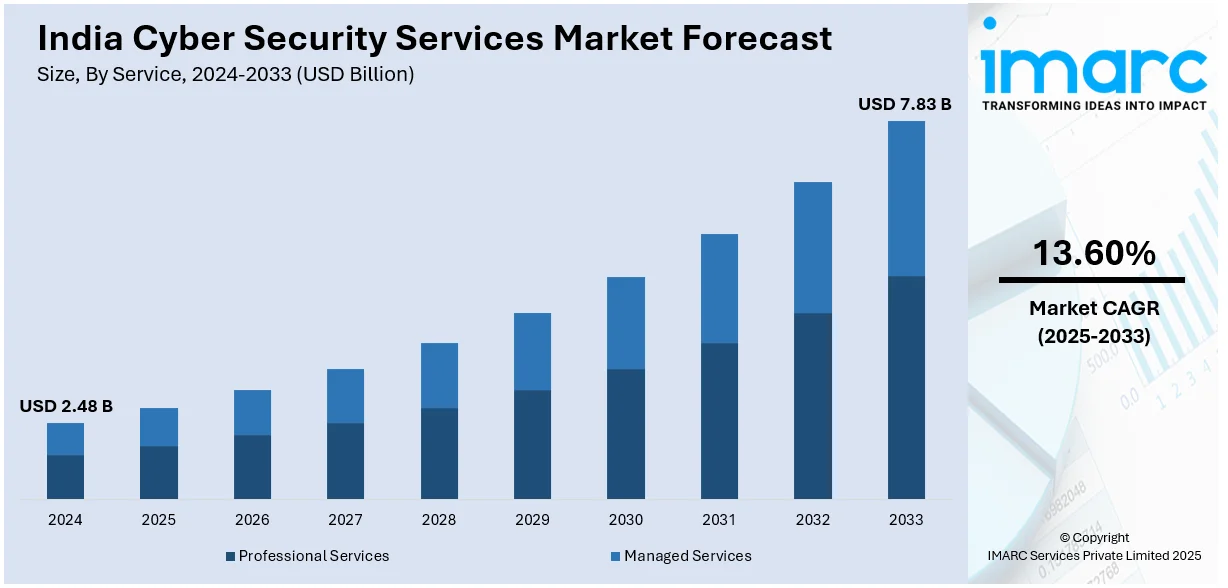

The India cyber security services market size reached USD 2.48 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.83 Billion by 2033, exhibiting a growth rate (CAGR) of 13.60% during 2025-2033. The India cyber security services market share is expanding, driven by the rising shift towards digital payments, online banking, and shopping platforms, along with the growing usage of artificial intelligence (AI) that aids in identifying unusual patterns in network traffic and predicting potential security breaches.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.48 Billion |

| Market Forecast in 2033 | USD 7.83 Billion |

| Market Growth Rate 2025-2033 | 13.60% |

India Cyber Security Services Market Trends:

Expansion of financial and e-commerce transactions

The expansion of financial and e-commerce transactions is offering a favorable India cyber security services market outlook. With millions of daily transactions happening through unified payments interface (UPI), credit cards, mobile wallets, and net banking, the risk of cyber fraud, hacking, and data breaches is rising. People want secure platforms that protect their sensitive financial information, encouraging banks, fintech companies, and e-commerce sites to invest in advanced cyber security solutions. As online shopping continues to grow, businesses need strong fraud detection systems, safe payment gateways, and encrypted data storage to prevent cyber threats. Cybercriminals are finding new ways to exploit vulnerabilities, making it necessary for companies to adopt modern security tools equipped with multi-factor authentication. With cloud-based financial services and cross-border transactions becoming more common, cyber security firms are in high demand to provide risk assessments and compliance solutions. The Indian Government is also strengthening cyber security regulations with major initiatives and investments. The Union Budget 2025 set aside more than INR 1,900 Crore for cyber security projects, representing an 18% rise from 2024's budget allocation of INR 1,600 Crore. This increase in funding was viewed as a vital move by the Government to fight digital fraud and tackle the growing dangers of cybercrime, which threatens both financial and national security.

To get more information on this market, Request Sample

Increasing usage of AI

The rising utilization of AI is fueling the India cybersecurity services market growth. Businesses and government agencies rely on AI-based solutions to detect, prevent, and respond to cyber threats more efficiently. With cyberattacks becoming more sophisticated, traditional security methods are no longer enough, motivating companies to integrate AI-oriented tools that offer real-time threat monitoring, anomaly detection, and automated response mechanisms. AI aids in identifying unusual patterns in network traffic, predicting potential security breaches, and reducing response time, making cyber security more proactive than reactive. As digital transactions, cloud computing, and the Internet of Things (IoT) usage rise, AI-based security systems are becoming essential for protecting sensitive data and inhibiting fraud. Businesses are also employing AI-focused identity verification, facial recognition, and behavioral analysis to strengthen authentication processes. Additionally, AI improves cyber security training by simulating cyber threats and helping organizations to prepare for potential attacks. The Indian government is also promoting AI adoption through big initiatives, encouraging businesses to wager on AI-oriented cyber security solutions to safeguard digital infrastructure and data privacy. According to the IBEF, the market for AI is set to attain USD 7.8 Billion by 2025 in India.

India Cyber Security Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on service and industry vertical.

Service Insights:

- Professional Services

- Integration

- Support and Maintenance

- Training, Consulting, and Advisory

- Penetration Testing

- Bug Bounty

- Others

- Managed Services

- Managed Detection Response

- Managed Security Incident and Event Management

- Compliance and Vulnerability Management

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes professional services (integration, support and maintenance, training, consulting, and advisory, penetration testing, bug bounty, and others) and managed services (managed detection response, managed security incident and event management, compliance and vulnerability management, and others).

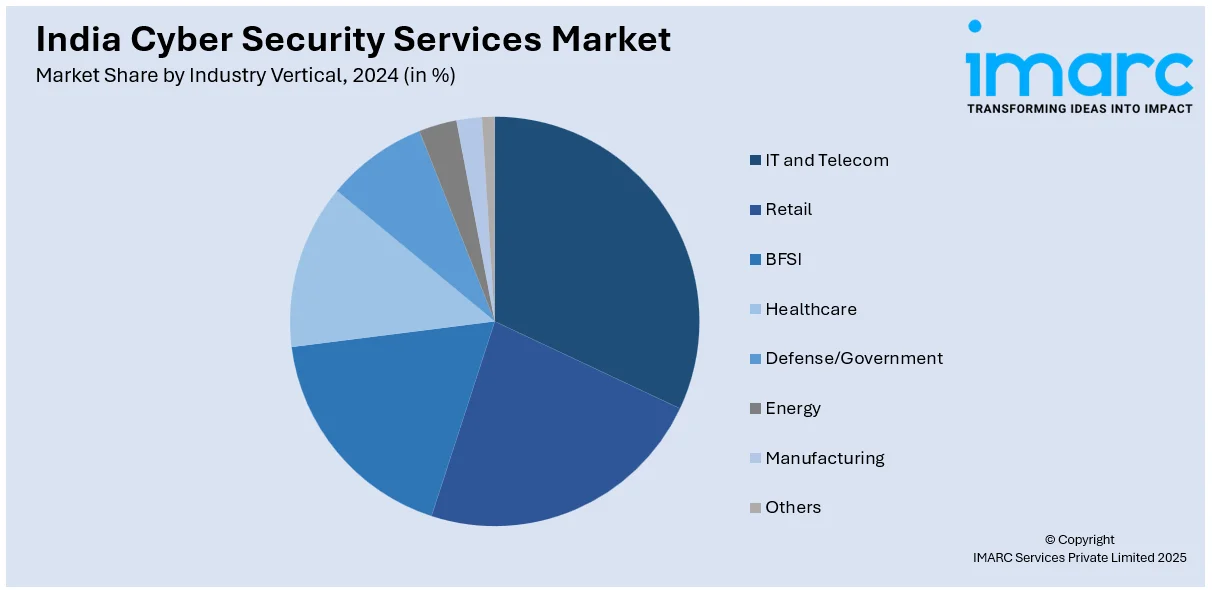

Industry Vertical Insights:

- IT and Telecom

- Retail

- BFSI

- Healthcare

- Defense/Government

- Energy

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes IT and telecom, retail, BFSI, healthcare, defense/government, energy, manufacturing, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cyber Security Services Market News:

- In March 2025, Qylis, a top innovator in digital solutions, teamed up with eSentire, the prominent leader in managed detection and response (MDR), to launch Qylis S365, a cyber security solution hosted and governed locally in India. This initiative sought to safeguard Indian businesses and government organizations from emerging cyber threats, providing top-tier threat detection, response, and compliance features. The product, supported by eSentire Atlas XDR, was set to enable organizations to identify, avert, and address cyber threats in real-time, while ensuring complete data governance within the country.

- In September 2024, the Indian Computer Emergency Response Team (CERT-In), part of the Ministry of Electronics and Information Technology (MeitY) of the Government of India, along with SISA, a worldwide leader in forensics-based cyber security, introduced the ‘Certified Security Professional for Artificial Intelligence (CSPAI)’ program, signifying the inaugural ANAB-accredited AI security certification of its kind. The initiative provided security experts with the necessary skills to successfully combine AI with business applications while following sustainable methods.

India Cyber Security Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered |

|

| Industry Verticals Covered | IT and Telecom, Retail, BFSI, Healthcare, Defense/Government, Energy, Manufacturing, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cyber security services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cyber security services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cyber security services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cyber security services market in India was valued at USD 2.48 Billion in 2024.

The India cyber security services market is projected to exhibit a CAGR of 13.60% during 2025-2033, reaching a value of USD 7.83 Billion by 2033.

The India cybersecurity services market is driven by the surge in digital adoption, rising cybercrime incidents, and growing need for data protection. Businesses are increasingly investing in threat detection, risk management, and compliance. Government regulations and demand for secure cloud and remote work environments also support growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)