India Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Region, 2026-2034

India Cryptocurrency Market Summary:

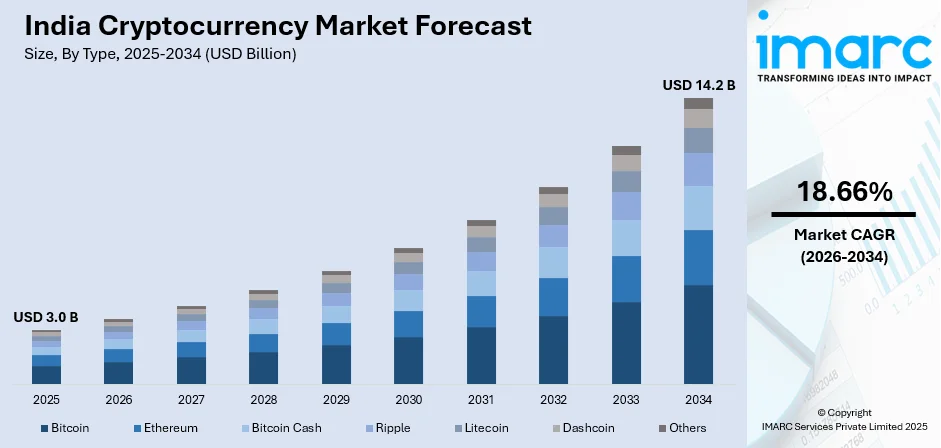

The India cryptocurrency market size was valued at USD 3.0 Billion in 2025 and is projected to reach USD 14.2 Billion by 2034, growing at a compound annual growth rate of 18.66% from 2026-2034.

The market is driven by an increasing digital adoption among tech-savvy millennials, growing awareness about decentralized financial systems, and rising investor interest in alternative asset classes. Expanding internet connectivity and smartphone penetration across urban and semi-urban areas are accelerating cryptocurrency adoption. Additionally, peer-to-peer transaction capabilities and blockchain technology advancements are fueling market expansion, contributing significantly to India cryptocurrency market share.

Key Takeaways and Insights:

-

By Type: Bitcoin dominates the market with a share of 33.05% in 2025, driven by its pioneering reputation, widespread global recognition, institutional acceptance, superior liquidity, and extensive trading pair availability across exchanges.

-

By Component: Software leads the market with a share of 56.07% in 2025, owing to rising demand for cryptocurrency wallets, exchange platforms, trading applications, and comprehensive portfolio management solutions driving ecosystem development.

-

By Process: Transaction represents the largest segment with a market share of 52.13% in 2025, driven by increasing peer-to-peer payment adoption, cross-border remittance requirements, retail trading activities, and expanding merchant acceptance networks.

-

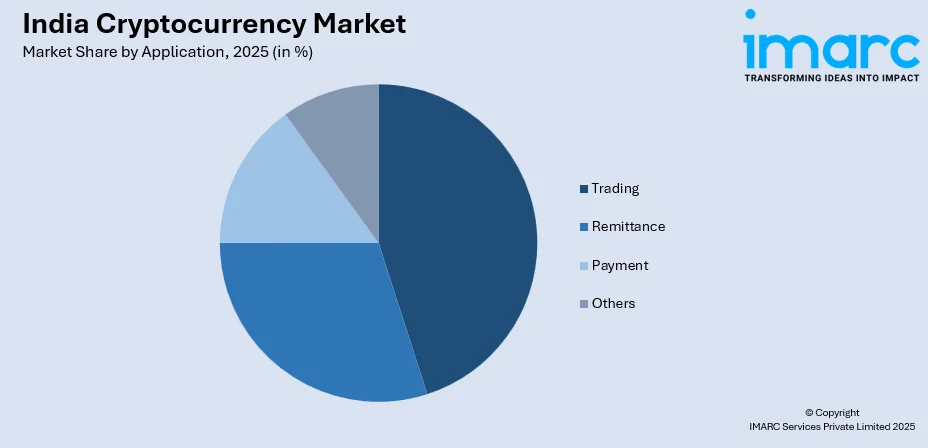

By Application: Trading dominates the market with a share of 45.06% in 2025, owing to speculative investment opportunities, portfolio diversification strategies, increasing retail and institutional investor participation, and growing algorithmic trading adoption.

-

Key Players: The India cryptocurrency market exhibits moderate competitive fragmentation, with domestic cryptocurrency exchanges competing alongside international platforms across trading volume, service offerings, security features, and fee structures to capture growing investor participation.

To get more information on this market Request Sample

The India cryptocurrency market is experiencing substantial momentum propelled by multiple converging factors reshaping the financial landscape. Rising digital literacy and increasing familiarity with blockchain technology among younger demographics are creating a receptive environment for cryptocurrency adoption. Moreover, the growing distrust in traditional banking systems and desire for financial autonomy are pushing investors toward decentralized alternatives. Enhanced accessibility through user-friendly mobile applications and simplified onboarding processes are lowering entry barriers for first-time investors. Furthermore, the emergence of Web3 technologies and decentralized finance ecosystems are attracting technologically sophisticated users seeking innovative financial instruments beyond conventional investment avenues. Expanding internet penetration across rural and semi-urban regions is broadening the potential investor base significantly. According to reports, in 2025, CoinSwitch reported Uttar Pradesh as India’s top crypto state, contributing 13.0% of total investments, surpassing Maharashtra and Karnataka, highlighting strong non-metro adoption. Additionally, increasing acceptance of digital payments and growing awareness about blockchain-based asset ownership are reinforcing positive market sentiment nationwide.

India Cryptocurrency Market Trends:

Institutional Investment Acceleration

The cryptocurrency market in India is witnessing growing interest from institutional investors and corporate entities exploring digital asset exposure for portfolio diversification. As per sources, in December 2025, institutional participation in India’s crypto market rose 30–50% YoY on exchanges like CoinDCX, CoinSwitch, ZebPay, and Mudrex, reflecting growing engagement by HNIs, family offices, and corporates. Moreover, hedge funds, family offices, and wealth management firms are increasingly allocating resources toward cryptocurrency research and investment strategies. This institutional momentum is driving market maturity by introducing sophisticated trading mechanisms, enhanced custody solutions, and professional-grade security infrastructure. The entry of established financial entities is legitimizing cryptocurrency as a viable asset class, encouraging broader acceptance among conservative investors who previously remained skeptical about digital currency investments.

Decentralized Finance Ecosystem Expansion

Decentralized finance protocols are gaining substantial traction among Indian cryptocurrency enthusiasts seeking alternatives to traditional banking services. As per sources, in July 2025, CoinSwitch launched Web3 Coins, enabling Indian users to trade over 1,00,000 decentralized crypto tokens directly in INR, simplifying access to DeFistyle assets. Moreover, lending platforms, yield farming opportunities, and liquidity provision mechanisms are attracting users interested in generating passive income from their digital asset holdings. Smart contract-based financial instruments are enabling peer-to-peer lending without intermediary involvement, reducing transaction costs and increasing accessibility. The DeFi ecosystem is particularly appealing to underbanked populations seeking financial inclusion through permissionless protocols that operate independently of centralized institutions and geographic limitations.

Non-Fungible Token Integration

The convergence of cryptocurrency markets with digital collectibles and non-fungible tokens is creating new investment paradigms attracting diverse participant demographics. Artists, content creators, and entertainment entities are embracing blockchain-based ownership verification for digital assets, driving mainstream awareness., gaming platforms incorporating play-to-earn mechanics are introducing younger generations to cryptocurrency ecosystems through interactive experiences. This integration is expanding cryptocurrency utility beyond speculative trading toward practical applications in digital ownership, intellectual property protection, and creative economy participation. As per sources, in 2025, Indian Railways issued NFT-based train tickets for MahaKumbh Mela, highlighting real-world NFT adoption in India beyond collectibles, despite a global NFT market downturn.

Market Outlook 2026-2034:

The India cryptocurrency market revenue is anticipated to experience robust expansion throughout the forecast period, driven by increasing regulatory clarity and government initiatives supporting blockchain technology adoption. Growing financial inclusion efforts targeting underbanked populations and rising remittance requirements are expected to accelerate transaction volumes. The market revenue trajectory will be influenced by technological infrastructure development, payment gateway integrations, and expanding merchant acceptance networks enabling everyday cryptocurrency usage for commercial transactions across diverse economic sectors. The market generated a revenue of USD 3.0 Billion in 2025 and is projected to reach a revenue of USD 14.2 Billion by 2034, growing at a compound annual growth rate of 18.66% from 2026-2034.

India Cryptocurrency Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Bitcoin |

33.05% |

|

Component |

Software |

56.07% |

|

Process |

Transaction |

52.13% |

|

Application |

Trading |

45.06% |

Type Insights:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

Bitcoin dominates with a market share of 33.05% of the total India cryptocurrency market in 2025.

Bitcoin maintains its leading position within the India cryptocurrency market owing to its first-mover advantage and established reputation as digital gold among cryptocurrency investors. According to sources, in December 2025, CoinSwitch reported that Bitcoin regained its position as India’s most-invested crypto asset with an 8.1% allocation, surpassing Dogecoin amid rising institutional interest. Further, the cryptocurrency's limited supply mechanism and halving events create scarcity dynamics that attract investors seeking inflation-resistant assets. Bitcoin's superior network security, extensive mining infrastructure, and widespread exchange availability ensure consistent liquidity for traders across varying market conditions. Its pioneering status continues reinforcing investor confidence and market dominance.

Indian investors particularly favor bitcoin for its relative stability compared to altcoins and lower volatility during market corrections. The cryptocurrency's acceptance by international merchants and integration with payment processors enhance its utility beyond speculative trading purposes. Furthermore, Bitcoin's dominant market capitalization provides institutional investors with sufficient depth for large-scale position management without any significant price impact concerns. Its established track record spanning over a decade strengthens a long-term investment appeal.

Component Insights:

- Hardware

- Software

Software leads with a share of 56.07% of the total India cryptocurrency market in 2025.

The software leads the India cryptocurrency market driven by an escalating demand for sophisticated trading platforms, secure wallet applications, and comprehensive portfolio management solutions. Cryptocurrency exchanges continuously invest in platform development, incorporating advanced charting tools, algorithmic trading capabilities, and mobile-first interfaces catering to retail investor preferences. According to sources, in March 2025, Coinbase secured registration with India’s Financial Intelligence Unit (FIU), enabling it to offer crypto trading services locally and expand access to regulated digital asset infrastructure. Further, security software encompassing multi-signature wallets, hardware wallet interfaces, and two-factor authentication systems are essential components addressing investor protection concerns across the digital asset ecosystem.

Beyond trading infrastructure, blockchain development platforms and decentralized application frameworks are contributing substantially to software growth across India. Smart contract deployment tools, node operation software, and blockchain analytics platforms serve developer communities building next-generation cryptocurrency applications. The emergence of automated market makers, yield aggregators, and cross-chain bridge protocols demonstrates the expanding software ecosystem. Additionally, portfolio tracking applications and tax calculation tools are gaining prominence among investors seeking comprehensive asset management solutions.

Process Insights:

- Mining

- Transaction

The transaction exhibits a clear dominance with a 52.13% share of the total India cryptocurrency market in 2025.

The transaction dominates the India cryptocurrency market reflecting the primary utility of digital currencies for value transfer and exchange activities. Peer-to-peer transactions facilitate direct value exchange between parties without banking intermediaries, proving particularly beneficial for cross-border transfers and remittance payments. Exchange-based trading transactions constitute significant volume as investors buy, sell, and swap cryptocurrencies across various trading pairs. The seamless transaction experience offered by modern platforms continues attracting new market participants.

The transaction benefits from an increasing merchant acceptance enabling cryptocurrency payments for goods and services across e-commerce platforms and physical retail locations. As per sources, in 2025, Travala.com, a leading blockchain-based travel platform, enabled seamless Bitcoin payments for over 3 Million travel products globally, expanding real-world cryptocurrency adoption for travelers. Moreover, payment gateway integrations allow businesses to accept cryptocurrency payments while receiving settlements in local currency, reducing adoption barriers significantly. Additionally, decentralized exchange transactions are growing as users seek non-custodial trading alternatives offering enhanced privacy and censorship resistance. Instant settlement capabilities further strengthen transaction segment prominence within the market.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Trading

- Remittance

- Payment

- Others

Trading leads with a market share of 45.06% of the total India cryptocurrency market in 2025.

Trading commands the largest share within the India cryptocurrency market driven by speculative investment interest and wealth generation aspirations among the retail participants. Cryptocurrency trading offers accessibility advantages including round-the-clock market operations, fractional ownership capabilities, and low minimum investment requirements compared to traditional financial instruments. Moreover, mobile trading applications have democratized market access, enabling participation regardless of geographic location or financial sophistication. User-friendly interfaces continue lowering barriers for first-time cryptocurrency investors.

The trading benefits from cryptocurrency's volatility characteristics, which create profit opportunities for active traders employing technical analysis and momentum-based strategies. Derivative products including futures contracts and options expand trading possibilities for sophisticated participants seeking leveraged exposure or hedging mechanisms. As per sources, in 2025, crypto derivatives trading in India surged, with futures and options volumes outpacing spot trades by over three times on major local platforms, highlighting growing investor interest and regulatory alignment. Furthermore, social trading platforms enabling strategy copying and community-based investment decisions are attracting newcomers seeking guided market participation approaches. Advanced order types and automated trading bots further enhance trading application attractiveness among experienced investors.

Regional Insights:

- South India

- North India

- West & Central India

- East India

South India represents a leading cryptocurrency market driven by strong technology sector presence, high digital literacy rates, and entrepreneurial ecosystem supporting blockchain innovation. Major technology hubs attract skilled professionals with cryptocurrency awareness, while educational institutions produce technically proficient graduates entering the digital asset space. The region's startup culture and venture capital availability further accelerate adoption.

North India demonstrates substantial cryptocurrency adoption propelled by large metropolitan populations, established financial services infrastructure, and growing startup ecosystem exploring blockchain applications. The region benefits from concentrated economic activity and investor wealth seeking alternative asset diversification opportunities. Major urban centers provide robust digital payment infrastructure supporting seamless cryptocurrency transactions and exchange operations.

West & Central India exhibit significant cryptocurrency market activity supported by major financial centers, commercial trading traditions, and substantial business community interest in digital payment innovations. The region's established merchant networks facilitate cryptocurrency commerce adoption across diverse business segments. Strong banking infrastructure and fintech ecosystem presence enable efficient fiat-to-cryptocurrency conversion pathways for investors.

East India shows emerging cryptocurrency market potential driven by increasing internet connectivity, growing awareness campaigns, and remittance requirements among populations with overseas employment relationships. The region presents expansion opportunities as digital infrastructure development accelerates. Rising smartphone penetration and mobile banking familiarity are creating favorable conditions for cryptocurrency adoption among younger demographic segments.

Market Dynamics:

Growth Drivers:

Why is the India Cryptocurrency Market Growing?

Rising Digital Payment Adoption

India's accelerating transition toward cashless transactions is creating favorable conditions for cryptocurrency adoption as consumers become increasingly comfortable with digital financial instruments. According to sources, in October 2025, about 85% of India’s digital payment transactions were conducted through UPI, processing about 20 Billion transactions monthly, reflecting widespread adoption of digital payments across the country. Moreover, the widespread success of unified payment interfaces and mobile wallets has normalized digital value transfer, reducing psychological barriers toward cryptocurrency usage. Younger demographics particularly demonstrate openness toward alternative payment methods, viewing cryptocurrencies as natural extensions of their digital-first financial behaviors. This cultural shift toward digital payments establishes foundational infrastructure and consumer readiness supporting cryptocurrency market expansion across urban and increasingly semi-urban centers. Growing merchant acceptance of digital payments further reinforces ecosystem development.

Financial Inclusion Imperatives

Cryptocurrency technologies offer promising solutions addressing India's substantial unbanked and underbanked population seeking financial services access. Blockchain-based financial instruments enable participation without traditional banking requirements including minimum balance maintenance, physical branch proximity, or extensive documentation requirements. Decentralized finance protocols provide lending, savings, and insurance products accessible through smartphone applications, democratizing financial services previously available only through formal banking relationships. This inclusion potential attracts significant user adoption from demographics historically excluded from conventional financial systems. The permissionless nature of cryptocurrency networks removes gatekeeping barriers, enabling universal participation regardless of socioeconomic background or geographic location.

Cross-Border Remittance Efficiency

India's position as a leading remittance recipient country creates substantial demand for cost-effective international money transfer solutions that cryptocurrencies can address. Traditional remittance channels impose significant fees and processing delays that reduce the effective value received by beneficiaries. Cryptocurrency-based transfers offer near-instantaneous settlement, reduced intermediary costs, and accessibility advantages for recipients lacking formal banking relationships. This efficiency proposition drives adoption among overseas Indian workers and their domestic families seeking optimized value transfer mechanisms. According to sources, in 2025, approximately 3–4% of remittances to India shifted from banks to USDT stablecoins, offering recipients higher value and faster, cheaper transfers compared to traditional banking channels. Further, the transparent fee structures and real-time tracking capabilities further enhance cryptocurrency appeal for cross-border payment requirements across diverse corridors.

Market Restraints:

What Challenges the India Cryptocurrency Market is Facing?

Regulatory Uncertainty Concerns

The evolving regulatory landscape surrounding cryptocurrency operations in India creates hesitancy among potential investors and institutional participants awaiting definitive legal frameworks. Uncertain taxation policies, compliance requirements, and potential operational restrictions introduce risk considerations that moderate market participation enthusiasm. This regulatory ambiguity particularly impacts institutional investors whose fiduciary responsibilities require clear legal standing before committing substantial capital allocations toward cryptocurrency investments.

Security Vulnerability Apprehensions

Persistent concerns regarding exchange security, wallet vulnerabilities, and fraud risks deter conservative investors from cryptocurrency market participation. High-profile security incidents and scam operations have created negative perceptions requiring substantial educational efforts to overcome. The irreversible nature of cryptocurrency transactions amplifies security concerns, as recovery options for compromised funds remain limited compared to traditional banking protections.

Price Volatility Deterrence

Cryptocurrency markets experience substantial price fluctuations that discourage risk-averse investors seeking stable wealth preservation instruments. Dramatic value swings within short timeframes create anxiety among potential participants unfamiliar with managing volatile investment positions. This volatility perception limits cryptocurrency adoption among mainstream retail investors preferring predictable returns over speculative capital appreciation opportunities.

Competitive Landscape:

The India cryptocurrency market competitive environment features diverse participants including domestic cryptocurrency exchanges, international trading platforms, and emerging decentralized protocols competing for market share. Established exchanges differentiate through security certifications, regulatory compliance demonstrations, and customer support infrastructure. Competition intensifies around fee structures, trading pair availability, liquidity depth, and user interface design catering to both novice and experienced traders. Technology innovation remains crucial as platforms incorporate advanced features including staking services, lending facilities, and non-fungible token marketplaces to capture adjacent revenue opportunities and enhance user retention.

Recent Developments:

-

In August 2025, BONbLOC Technologies launched a cuttingedge blockchain hub in Vijayawada, Andhra Pradesh, enhancing India’s digital infrastructure. The facility aims to support blockchain development, enterprise solutions, and innovation, strengthening regional technology capabilities while promoting the adoption of decentralized applications across industries.

-

In July 2025, ULLU launched UlluCoin, a utility token to boost blockchain-powered engagement on its OTT platform with 42 million active users. Supported by Dubai-based Cypher Capital, this initiative marks ULLU’s Web3 entry, blending digital entertainment with decentralized innovation and offering immersive experiences within its growing ecosystem.

India Cryptocurrency Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, Others |

| Components Covered | Hardware, Software |

| Processs Covered | Mining, Transaction |

| Applications Covered | Trading, Remittance, Payment, Others |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India cryptocurrency market size was valued at USD 3.0 Billion in 2025.

The India cryptocurrency market is expected to grow at a compound annual growth rate of 18.66% from 2026-2034 to reach USD 14.2 Billion by 2034.

Bitcoin held the largest market share owing to its established reputation as digital gold, superior liquidity, widespread global recognition, institutional acceptance as a store of value, and first-mover advantage among Indian cryptocurrency investors.

Key factors driving the India cryptocurrency market include rising digital payment adoption, financial inclusion imperatives, cross-border remittance efficiency, increasing blockchain awareness, growing investment interest among tech-savvy demographics, and expanding internet penetration across urban and rural regions.

Major challenges facing the India cryptocurrency market include regulatory uncertainty, evolving taxation policies, security vulnerability concerns, price volatility deterrence, limited merchant acceptance, consumer education requirements, banking relationship complications, and infrastructure limitations affecting overall exchange operations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)