India Crowdfunding Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

India Crowdfunding Market Overview:

The India crowdfunding market size reached USD 48.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 235.7 Million by 2033, exhibiting a growth rate (CAGR) of 17.2% during 2025-2033. The market is expanding rapidly, driven by increasing digital penetration, regulatory support, and growing acceptance of alternative fundraising for social, creative, and entrepreneurial ventures, with key platforms leveraging technology to streamline donation, reward, debt, and equity-based crowdfunding across diverse sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 48.2 Million |

| Market Forecast in 2033 | USD 235.7 Million |

| Market Growth Rate 2025-2033 | 17.2% |

India Crowdfunding Market Trends:

Growth of Digital and Mobile-Based Crowdfunding

The India crowdfunding market growth is expanding, driven by more people getting connected to digital platforms while using smartphones. In addition to this, internet crowdfunding platforms utilize mobile apps and social media features to help users conduct hassle-free fundraising among their 500 Million user base. Through interface optimization, Milaap Ketto and ImpactGuru have improved user engagement, thus allowing individuals and organizations to simplify their campaign creation and distribution, and the donation process. Moreover, donor participation becomes easier through UPI-based payments and digital wallets because these payment methods simplify transactions. The implementation of blockchain technology aims to enhance crowdfunding transparency alongside security functions which guarantee donor funds reach intended recipients. Furthermore, real-time tracking and simple access to campaigns during the past few years has expanded the market reach by attracting larger numbers of contributors. As a result, the ongoing growth of digital literacy in India is producing more crowdfunding participants who support both social and medical needs and creative and startup initiatives, thereby boosting the India crowdfunding market share.

.webp)

To get more information on this market, Request Sample

Expansion of Equity and Debt-Based Crowdfunding

The India crowdfunding market outlook primarily relies on donation- and reward-based crowdfunding and shows a growing interest in equity and debt-based crowdfunding from startup businesses and small companies. In line with this, entrepreneurs choose crowdfunding as their new financing solution because traditional bank loans and venture capital funding have become increasingly restricted. Moreover, Securities and Exchange Board of India (SEBI) conducts regulatory assessments for equity crowdfunding to develop a standardized platform that benefits investors. For instance, in November 2024, SEBI proposed expanding the investment range for angel funds to between ₹1 Million and ₹250 Million, up from the previous ₹2.5 Million to ₹100 Million. The new funding model enables startups to secure micro-investor capital through small equity share distribution. Concurrently, the P2P lending market features platforms like Faircent, along with Lendbox, which act as alternatives for traditional bank borrowing options. Furthermore, the ongoing regulatory uncertainty presents significant barriers to reaching widespread use of this funding method. As a result, ongoing innovation improves and more businesses will obtain funding through decentralized investments under a democratic framework once SEBI formalizes equity crowdfunding rules.

India Crowdfunding Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- P2P Lending

- Equity Investment

- Hybrid

- Reward-based

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes P2P lending, equity investment, hybrid, reward-based, and others.

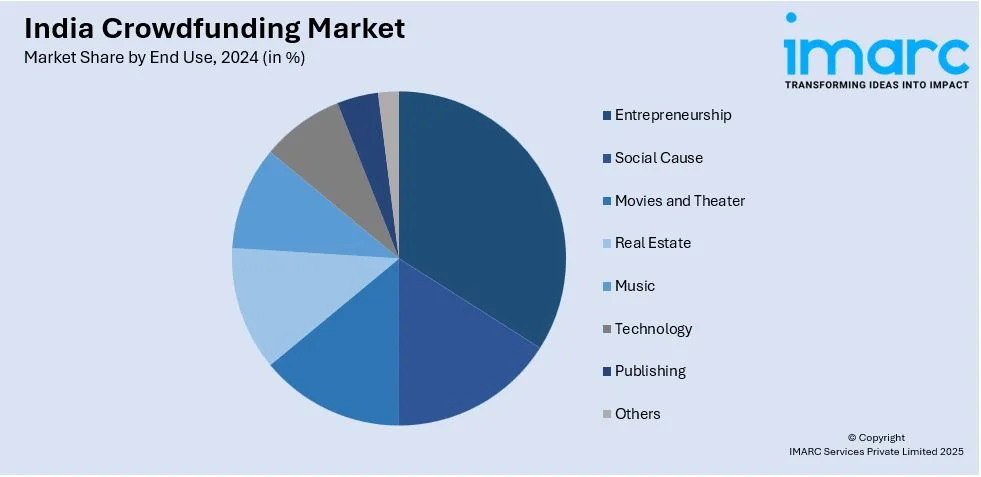

End Use Insights:

- Entrepreneurship

- Social Cause

- Movies and Theater

- Real Estate

- Music

- Technology

- Publishing

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes entrepreneurship, social cause, movies and theater, real estate, music, technology, publishing, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Crowdfunding Market News:

- In September 2024, Protean announced its bid for the Income Tax Department of India's PAN 2.0 project, aiming to modernize the Permanent Account Number system. A streamlined PAN system can simplify financial transactions, benefiting crowdfunding platforms and their users.

- In July 2024, Protean eGov Technologies introduced eSignPro, a digital signature and stamping tool designed to facilitate secure and efficient digital transactions. This innovation enhances the reliability of online crowdfunding platforms by ensuring the authenticity and integrity of electronic documents.

India Crowdfunding Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | P2P Lending, Equity Investment, Hybrid, Reward-Based, Others |

| End Uses Covered | Entrepreneurship, Social Cause, Movies and Theater, Real Estate, Music, Technology, Publishing, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India crowdfunding market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India crowdfunding market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India crowdfunding industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The crowdfunding market in India was valued at USD 48.2 Million in 2024.

The India crowdfunding market is projected to exhibit a CAGR of 17.2% during 2025-2033, reaching a value of USD 235.7 Million by 2033.

Major elements propelling the market growth in India consist of greater internet and smartphone accessibility, enhanced awareness about alternative funding options, and significant impact from social media. Moreover, increasing entrepreneurial ventures, backing for innovative and social initiatives, and beneficial regulatory changes are motivating people and startups to pursue funding via crowdfunding platforms.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)