India Crop Protection Chemicals Market Size, Share, Trends and Forecast by Product Type, Origin, Crop Type, Form, Mode of Application, and Region, 2025-2033

Market Overview:

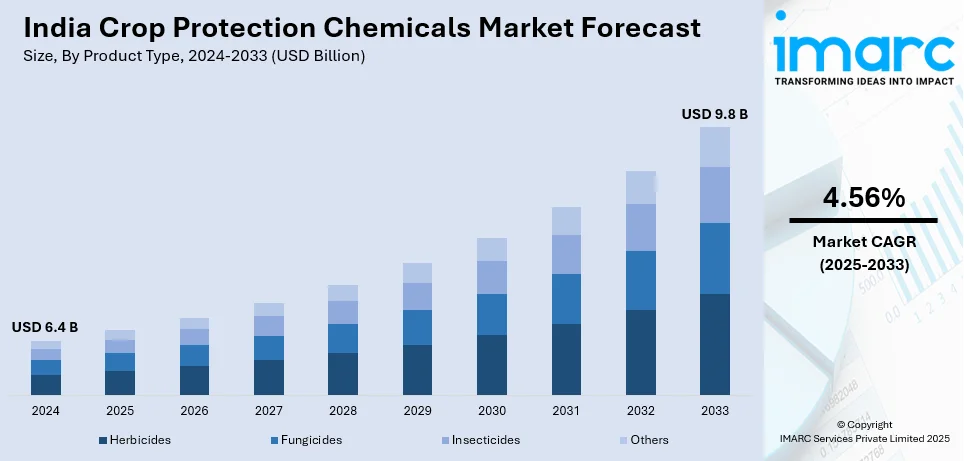

India crop protection chemicals market size reached USD 6.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.8 Billion by 2033, exhibiting a growth rate (CAGR) of 4.56% during 2025-2033. The development of resistance among pests and diseases to existing chemicals, which necessitates the continuous innovation and introduction of new crop protection products, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.4 Billion |

| Market Forecast in 2033 | USD 9.8 Billion |

| Market Growth Rate 2025-2033 | 4.56% |

Crop protection chemicals, commonly known as pesticides, are substances used in agriculture to manage and control pests, diseases, and weeds that can harm crops. These chemicals play a crucial role in ensuring food security by safeguarding plants from various threats that can reduce yield and quality. The three main categories of crop protection chemicals include herbicides for weed control, insecticides for managing insect pests, and fungicides to combat fungal diseases. Farmers employ these chemicals judiciously to optimize crop production while minimizing environmental impact. Continuous R&D aims to enhance the effectiveness and safety of crop protection chemicals, promoting sustainable and responsible agricultural practices. It's essential for farmers to adhere to recommended usage guidelines to strike a balance between protecting crops and preserving the environment and human health.

To get more information on this market, Request Sample

India Crop Protection Chemicals Market Trends:

The crop protection chemicals market in India is experiencing robust growth, driven by various factors that collectively underscore its significance in modern agriculture. Firstly, the escalating regional population necessitates enhanced food production, compelling farmers to optimize crop yields through the adoption of advanced agricultural technologies. In this context, the use of crop protection chemicals emerges as a pivotal strategy to safeguard crops from pests, diseases, and weeds, ensuring a consistent and reliable food supply. Moreover, the increasing prevalence of unpredictable weather patterns and climate change-induced challenges accentuates the need for resilient agricultural practices. Crop protection chemicals offer a proactive defense mechanism against climate-related risks, reinforcing their role as essential tools in sustainable farming. Furthermore, the burgeoning trend of precision agriculture, characterized by the precise application of inputs, aligns seamlessly with the targeted nature of crop protection chemicals. This precision not only enhances cost-efficiency but also minimizes environmental impact, contributing to the overall appeal of these chemicals in the agricultural landscape. In conclusion, the regional crop protection chemicals market thrives on interconnected drivers, encompassing the imperative to meet food demand, adapt to climate uncertainties, and embrace precision agriculture for a sustainable and resilient farming future.

India Crop Protection Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, origin, crop type, form, and mode of application.

Product Type Insights:

- Herbicides

- Fungicides

- Insecticides

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes herbicides, fungicides, insecticides, and others.

Origin Insights:

- Synthetic

- Natural

A detailed breakup and analysis of the market based on the origin have also been provided in the report. This includes synthetic and natural.

Crop Type Insights:

- Cereal and Grains

- Fruits and Vegetables

- Oilseed and Pulses

- Others

The report has provided a detailed breakup and analysis of the market based on the crop type. This includes cereal and grains, fruits and vegetables, oilseed and pulses, and others.

Form Insights:

- Liquid

- Solid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid and solid.

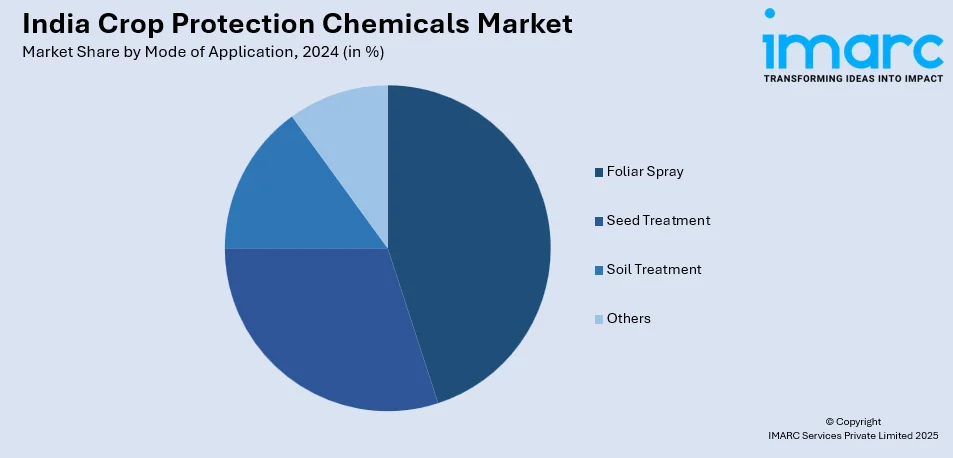

Mode of Application Insights:

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Others

The report has provided a detailed breakup and analysis of the market based on the mode of application. This includes foliar spray, seed treatment, soil treatment, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Crop Protection Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Herbicides, Fungicides, Insecticides, Others |

| Origins Covered | Synthetic, Natural |

| Crop Types Covered | Cereal and Grains, Fruits and Vegetables, Oilseed and Pulses, Others |

| Forms Covered | Liquid, Solid |

| Mode of Applications Covered | Foliar Spray, Seed Treatment, Soil Treatment, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India crop protection chemicals market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India crop protection chemicals market?

- What is the breakup of the India crop protection chemicals market on the basis of product type?

- What is the breakup of the India crop protection chemicals market on the basis of origin?

- What is the breakup of the India crop protection chemicals market on the basis of crop type?

- What is the breakup of the India crop protection chemicals market on the basis of form?

- What is the breakup of the India crop protection chemicals market on the basis of mode of application?

- What are the various stages in the value chain of the India crop protection chemicals market?

- What are the key driving factors and challenges in the India crop protection chemicals?

- What is the structure of the India crop protection chemicals market and who are the key players?

- What is the degree of competition in the India crop protection chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India crop protection chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India crop protection chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India crop protection chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)