India Crocin Market Size, Share, Trends and Forecast by Purity, Application, Distribution Channel, and Region, 2025-2033

India Crocin Market Overview:

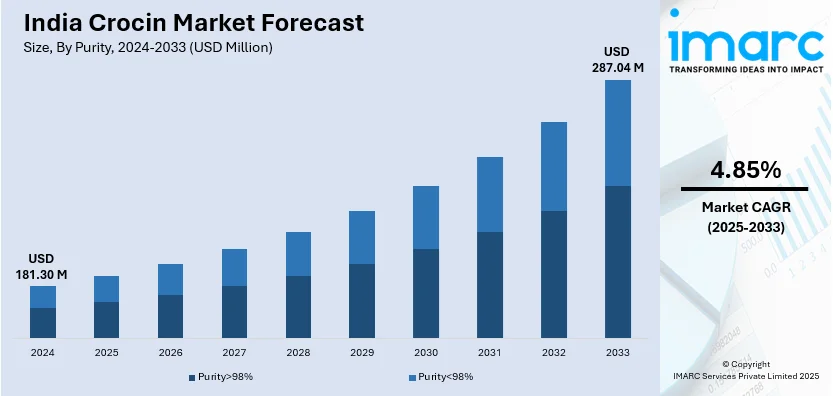

The India crocin market size reached USD 181.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 287.04 Million by 2033, exhibiting a growth rate (CAGR) of 4.85% during 2025-2033. The market is driven by the rising cases of fever, headaches, and colds, increasing self-medication trends, and easy OTC availability. Additionally, growing healthcare awareness, expanding retail pharmacies, and digital health platforms contribute to its strong India crocin market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 181.30 Million |

| Market Forecast in 2033 | USD 287.04 Million |

| Market Growth Rate 2025-2033 | 4.85% |

India Crocin Market Trends:

Rising Incidence of Common Ailments

The increasing prevalence of fever, headaches, colds, and flu-like symptoms is a key driver of the Crocin market in India. According to industry reports, the report indicated data from February 2025, revealing that numerous individuals have been suffering from headaches, cough, fatigue, mild fever, and other respiratory problems, resulting in prolonged recovery times of up to 10 days, in contrast to the typical 5-7 days. The survey garnered more than 13,000 replies from inhabitants of Delhi, Gurugram, Noida, Faridabad, and Ghaziabad, with 63% of respondents identifying as male and 37% as female. Changing weather conditions, pollution, and lifestyle stress contribute to frequent occurrences of these ailments, leading to higher demand for pain relief and fever-reducing medications. Seasonal flu outbreaks and viral infections further fuel the India crocin market share. People are consuming more Crocin because the number of vector-borne illnesses causing fever has been steadily rising. The expanding market demand for trusted over-the-counter medications including Crocin persists while people look for swift relief from their common health problems in both towns and rural communities.

To get more information on this market, Request Sample

Easy Availability and Distribution

The widespread availability of Crocin across pharmacies, supermarkets, online platforms, and convenience stores plays a significant role in driving its market demand. Crocin is available in various forms, including tablets and syrups, catering to different consumer needs. The rise of e-commerce and online pharmacies has further made purchasing medicines hassle-free, with doorstep delivery options enhancing accessibility. For instance, in December 2024, e-commerce giant Flipkart announced the introduction of a fast medicine delivery service that seeks to complete orders in just 10 minutes. This effort, expected to launch under the ‘Flipkart Minutes’ name, may establish the Walmart-owned e-commerce leader as the first entrant in the rapid commerce market to provide prescription medications. Faster delivery within 10 minutes is likely to make it more convenient for consumers to get fever and pain relief medicines without visiting a pharmacy, strengthening Crocin’s market presence in urban areas, and creating a positive India crocin market outlook. Additionally, the penetration of modern retail chains and expansion into rural areas have increased market reach. With the growing presence of digital health platforms and telemedicine services, Crocin’s accessibility continues to expand, making it a preferred choice for quick pain relief.

India Crocin Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on purity, application, and distribution channel.

Purity Insights:

- Purity>98%

- Purity<98%

The report has provided a detailed breakup and analysis of the market based on the purity. This includes purity>98%, and purity<98%.

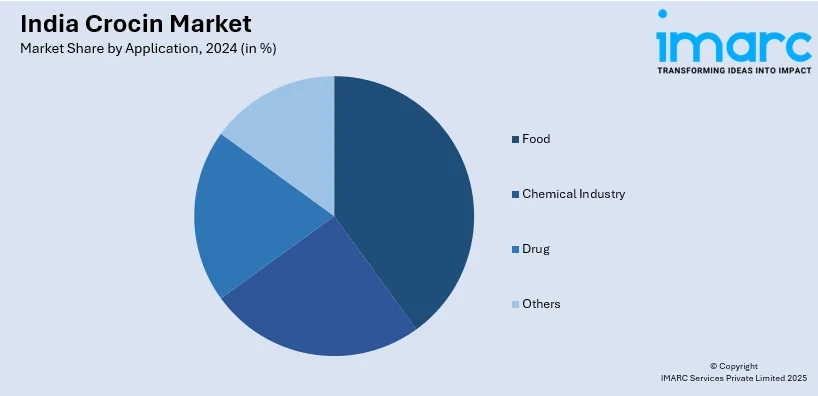

Application Insights:

- Food

- Chemical Industry

- Drug

- Pain

- Pyrexia (Fever)

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food, chemical industry, drug, [pain, and pyrexia (fever)], and others.

Distribution Channel Insights:

- Hospital Pharmacy

- Retail Pharmacy

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospital pharmacy, retail pharmacy, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Crocin Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Purities Covered | Purity>98%, Purity<98% |

| Applications Covered |

|

| Distribution Channels Covered | Hospital Pharmacy, Retail Pharmacy, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India crocin market performed so far and how will it perform in the coming years?

- What is the breakup of the India crocin market on the basis of purity?

- What is the breakup of the India crocin market on the basis of application?

- What is the breakup of the India crocin market on the basis of distribution channel?

- What is the breakup of the India crocin market on the basis of region?

- What are the various stages in the value chain of the India crocin market?

- What are the key driving factors and challenges in the India crocin?

- What is the structure of the India crocin market and who are the key players?

- What is the degree of competition in the India crocin market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India crocin market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India crocin market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India crocin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)