India Craft Beer Market Size, Share, Trends and Forecast by Product Type, Age Group, Distribution Channel, and Region, 2026-2034

India Craft Beer Market Size:

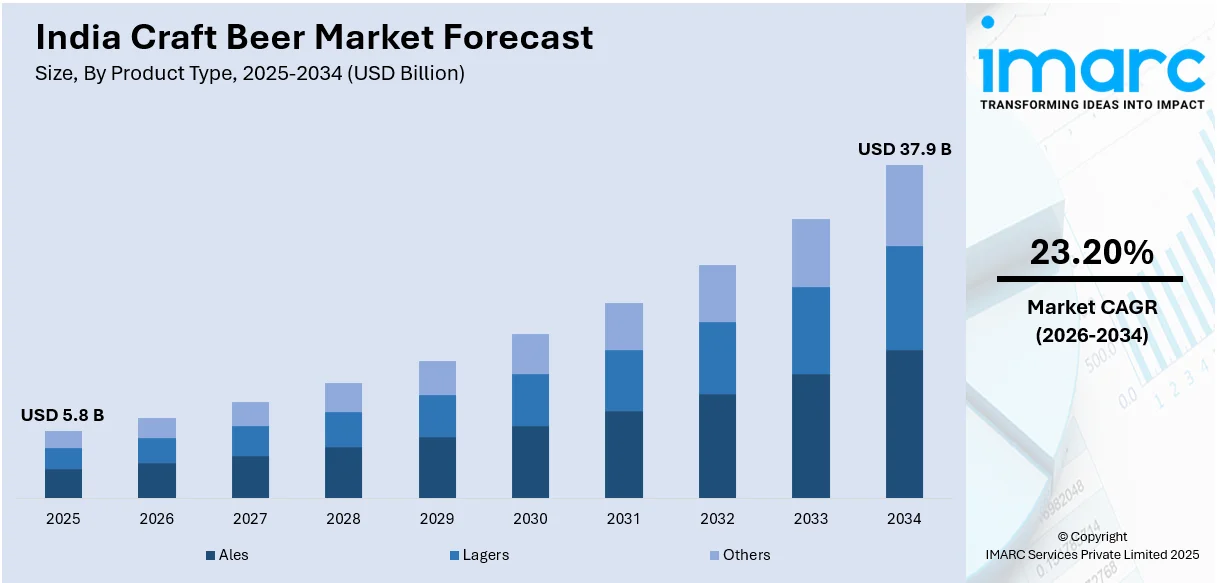

The India craft beer market size reached USD 5.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 37.9 Billion by 2034, exhibiting a growth rate (CAGR) of 23.20% during 2026-2034. The market is experiencing robust growth driven by rising awareness of health and wellness and a desire for better-quality products, the emergence of craft beer culture, the rapid expansion of microbreweries, and shifting consumer preferences toward unique and premium alcoholic beverages.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.8 Billion |

| Market Forecast in 2034 | USD 37.9 Billion |

| Market Growth Rate (2026-2034) | 23.20% |

India Craft Beer Market Analysis:

- Market Growth and Size: The market is experiencing steady growth, primarily driven by the increasing consumer preference for unique and artisanal beer flavors, coupled with an expanding urban population seeking premium beverage experiences.

- Rapid Expansion of Microbreweries: The market witnesses a rise in microbreweries, often characterized by their focus on small-batch production, quality ingredients, and experimentation with flavors, catering to the evolving tastes of beer enthusiasts.

- Industry Applications: Craft beer enjoys high demand across various industries, including hospitality, restaurants, and the tourism sector, as it offers a distinct and local flavor experience.

- Geographical Trends: Geographically, the craft beer market is expanding in urban centers and tourist destinations, aligning with the preferences of urban and experiential consumers.

- Competitive Landscape: The market is highly competitive, with key players emphasizing product innovation, branding, and brewery experiences to stand out in a crowded market.

- Challenges and Opportunities: While market faces challenges like regulatory hurdles, it also offers opportunities in the form of collaborations with local ingredients, expanding distribution networks, and appealing to a growing base of beer connoisseurs.

- Future Outlook: The future of the market looks promising, with potential growth driven by increasing consumer sophistication, a demand for localized and unique flavors, and the expansion of microbrewery culture across the country.

To get more information on this market Request Sample

India Craft Beer Market Trends:

Changing consumer preferences

Changing consumer preferences are propelling the market growth due to the rising number of consumers seeking a departure from the ordinary and a penchant for unique and artisanal flavors. Craft beers have captured the spotlight by catering to these evolving tastes, offering a delightful fusion of quality, taste, and variety. Craft breweries, with their emphasis on small-batch production, diverse ingredients, and traditional brewing methods, have become the go-to choose for consumers in search of a beer experience beyond mass-produced alternatives. This shift in preference signifies a desire for authenticity and an exploration of the rich tapestry of beer flavors, from hoppy ales to rich stouts and everything in between. As consumers increasingly prioritize quality and individuality in their beer choices, craft beers have positioned themselves as the embodiment of this new era in beer culture. The craft beer market, fueled by these changing preferences, continues to thrive and innovate, offering a multitude of flavors and experiences that cater to the evolving palate of beer connoisseurs in India.

Increasing urbanization and experiential consumption

Rapid urbanization in India has resulted in a growing urban population that craves for beverages with immersive and premium experiences, making it a significant driver of the craft beer market. Craft breweries are strategically positioned to meet this demand by offering more than just beer; they provide opportunities for memorable experiences. Craft beer breweries frequently invite enthusiasts to take brewery tours, participate in tastings, and even engage with brewers themselves. This level of interaction allows consumers to delve deeper into the world of craft beer, fostering a sense of connection and appreciation for the brewing process. It transforms beer consumption into an experiential journey, capturing the essence of craftsmanship and tradition. This shift toward experiential consumption reflects the desire for more than just a drink; it is about savoring the stories behind each brew, understanding the brewing techniques, and relishing the distinct flavors. As urbanization continues to shape India's landscape, the craft beer market leverages this trend, offering an unforgettable journey that resonates with consumers seeking premium, immersive, and authentic experiences.

Rising government support and regulatory changes

Government support and regulatory changes have emerged as major factors propelling the India craft beer market as several states in the country have taken proactive measures to simplify regulations surrounding craft beer production and distribution. These favorable policy shifts have created a more conducive environment for microbreweries to thrive and broaden their presence. The relaxation of regulatory barriers has encouraged entrepreneurship and innovation in the craft beer sector. It has also enabled aspiring brewers to venture into the industry, fostering a diverse and vibrant brewing culture across different regions of India. Government initiatives, including incentives and support for microbreweries, have further fueled this growth. These changes stimulate economic activity and contribute to the promotion of responsible consumption and the development of a robust craft beer ecosystem. As government backing and regulatory reforms continue to shape the industry, the craft beer market in India is poised for sustained expansion, providing consumers with an increasingly diverse and exciting array of craft beer options.

India Craft Beer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, age group, and distribution channel.

Breakup by Product Type:

- Ales

- Lagers

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ales, lagers, and others.

Ales, known for their robust and diverse flavor profiles, play a significant role in driving the India craft beer market. Craft breweries specializing in ales offer consumers a wide range of flavors, from fruity and hoppy to spicy and complex. Ales attracts beer enthusiasts looking for unique and bold taste experiences. They cater to an expanding segment of consumers seeking artisanal and locally brewed ales, which often incorporate innovative ingredients and brewing techniques, supporting the market growth.

Lagers, with their crisp and clean taste, also have a substantial impact on the India craft beer market. Craft breweries producing lagers provide consumers with a refreshing and easy-drinking option, appealing to a broader audience, including those transitioning from mass-produced lagers. Lagers serve as an entry point for individuals new to craft beer, facilitating market expansion. The diversity within the lager category, including pilsners, helles, and more, ensures a range of options that align with different consumer preferences, contributing to the market growth and accessibility.

Breakup by Age Group:

- 21–35 Years Old

- 40–54 Years Old

- 55 Years and Above

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 21–35 years old, 40–54 years old, and 55 years and above.

The age group of 21–35 years old is a significant driver of the India craft beer market as this demographic include millennials and young professionals seeking unique and premium beverage experiences. They are more open to experimentation and are drawn to craft beer's diverse flavors, innovative brewing techniques, and artisanal appeal. This age group's adventurous palate and desire for authenticity is fueling the growth of the craft beer market, as they actively seek out and support local breweries and craft beer brands.

The age group of 40–54 years old plays a crucial role in the India craft beer market as this demographic, often established professionals and experienced consumers, appreciates the quality, taste, and craftsmanship associated with craft beers. They value the nuanced flavors and often prefer the premium offerings of craft breweries. Additionally, many in this age group have high disposable incomes and are willing to invest in craft beer as part of their leisure and dining experiences, further catalyzing market growth.

The 55 years and above age group is showing an increased interest in the craft beer market. This segment of consumers is open to trying new things and exploring the variety that craft beers offer. Breweries often create brews that cater to a more mature palate, which can appeal to this age group. As craft beer culture continues to expand and diversify, it presents opportunities for older consumers to explore and enjoy the craft beer market, propelling its overall growth.

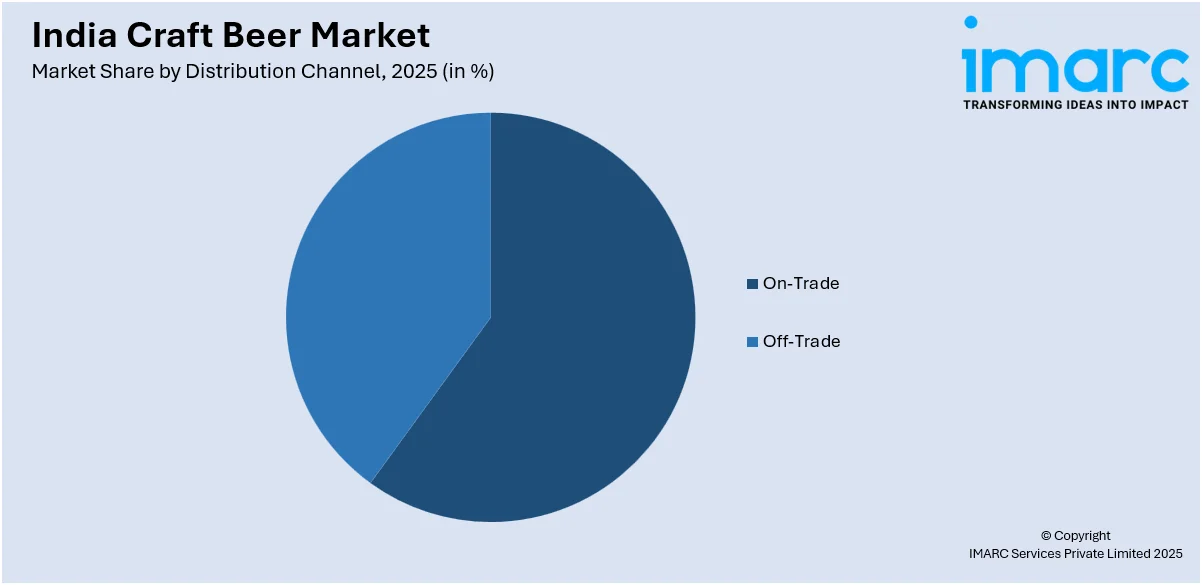

Breakup by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- On-Trade

- Off-Trade

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes on-trade and off-trade.

On-trade distribution channels, including bars, restaurants, and pubs, are key drivers of the India craft beer market as these establishments often feature craft beers on their menus, providing consumers with opportunities to taste and experience local and artisanal brews. On-Trade venues create a dynamic and social atmosphere where craft beer enthusiasts can explore diverse offerings. This channel fosters brand visibility, promotes craft beer culture, and encourages trial among consumers who seek unique and memorable drinking experiences, contributing significantly to the market growth.

Off-trade distribution channels, such as retail stores, liquor shops, and online platforms, also play a crucial role in driving the India craft beer market. Off-trade outlets make craft beer readily accessible to consumers, allowing them to purchase and enjoy craft beer in the comfort of their homes. Online platforms have expanded the reach of craft breweries, making it convenient for consumers to explore and order a wide range of craft beer options. Off-trade channels are essential for broadening the market's consumer base and increasing craft beer sales, making craft beer a part of consumers' regular beverage choices.

Breakup by Region:

- South India

- North India

- West & Central India

- East India

The market research report has also provided a comprehensive analysis of all the major regional markets, which include South India, North India, West and Central India, and East India.

In South India, the craft beer market is expanding due to the region’s rich culinary culture and growing urban population. Cities like Bangalore and Hyderabad have embraced the craft beer trend, with a thriving craft brewery scene. South India's diverse flavors and appreciation for quality beverages attract both local and international craft beer brands, contributing to market growth.

North India also plays a crucial role in the craft beer market owing to its dense urban population and evolving consumer preferences. Cities like Delhi and Gurgaon have witnessed a rise in craft breweries, catering to a growing demand for artisanal beers. The region's love for diverse cuisines and social gatherings fosters a vibrant craft beer culture, making it a key market for craft beer in India.

West and Central India, including Mumbai and Pune, are vital drivers of the craft beer market as these regions have a bustling urban lifestyle and an expanding corporate culture, making craft beer a popular choice among professionals seeking premium and unique beverage experiences. The presence of numerous microbreweries and a young, tech-savvy population fueling the growth of the market.

East India is also an emerging region in the craft beer market as cities like Kolkata and Bhubaneswar are witnessing the rise of craft breweries, offering innovative brews to cater to evolving tastes. As digital adoption increases, accessibility of craft beer through online platforms appeals to the younger population. East India's potential as an untapped market and changing consumer habits make it a significant driving force in the expansion of the craft beer market.

Leading Key Players in the India Craft Beer Industry:

Numerous key players in the market are actively engaging in several strategies to maintain and expand their market presence. They are continuously innovating in brewing techniques and flavor profiles, introducing new and seasonal craft beer offerings to cater to changing consumer preferences. These industry leaders are focusing on branding and packaging, creating unique and appealing labels and bottles to stand out on the shelves and in the minds of consumers. Additionally, they are exploring collaborations with local ingredients and flavors to craft region-specific brews, targeting niche markets. These players are also expanding their distribution networks and leveraging e-commerce platforms to reach a wider audience. Overall, they aim to capture a growing base of beer enthusiasts and maintain their position in the dynamic craft beer landscape.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.

India Craft Beer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ales, Lagers, Others |

| Age Groups Covered | 21–35 Years Old, 40–54 Years Old, 55 Years and Above |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | South India, North India, West and Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India craft beer market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the India craft beer market?

- What is the impact of each driver, restraint, and opportunity on the India craft beer market?

- What are the key regional markets?

- What is the breakup of the market based on the product type?

- Which is the most attractive product type in the India craft beer market?

- What is the breakup of the market based on the age group?

- Which is the most attractive age group in the India craft beer market?

- What is the breakup of the market based on the distribution channel?

- Which is the most attractive distribution channel in the India craft beer market?

- What is the competitive structure of the market?

- Who are the key players/companies in the India craft beer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India craft beer market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India craft beer market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India craft beer industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)