India Cosmetics Market Size, Share, Trends and Forecast by Product Type, Category, Gender, Distribution Channel, and Region, 2026-2034

India Cosmetics Market Summary:

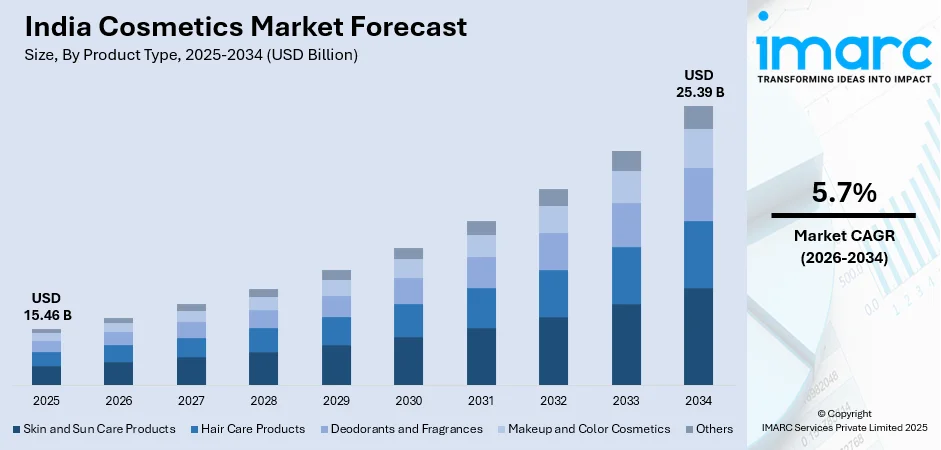

The India cosmetics market size was valued at USD 15.46 Billion in 2025 and is projected to reach USD 25.39 Billion by 2034, growing at a compound annual growth rate of 5.7% from 2026-2034.

The India cosmetics market is experiencing robust growth driven by increasing disposable incomes, rapid urbanization, and growing beauty awareness among consumers across demographic segments. The expanding middle-class population demonstrates strong willingness to invest in personal grooming and self-care products, while social media influence and celebrity endorsements continue to shape purchasing preferences. The rising demand for organic products, expansion of e-commerce platforms, and changing grooming trends among both genders are contributing factors to the sustained market expansion.

Key Takeaways and Insights:

-

By Product Type: Skin and sun care products dominate the market with a share of 43.73% in 2025, driven by growing awareness about skincare routines and increasing concerns about sun protection and pollution effects on skin health.

-

By Category: Conventional products lead the market with a share of 82.54% in 2025, attributed to affordability, mass availability, and established distribution networks reaching diverse consumer segments.

-

By Gender: Women represent the largest segment with a market share of 70.46% in 2025, reflecting strong emphasis on personal grooming, rising economic empowerment, and exposure to global beauty trends.

-

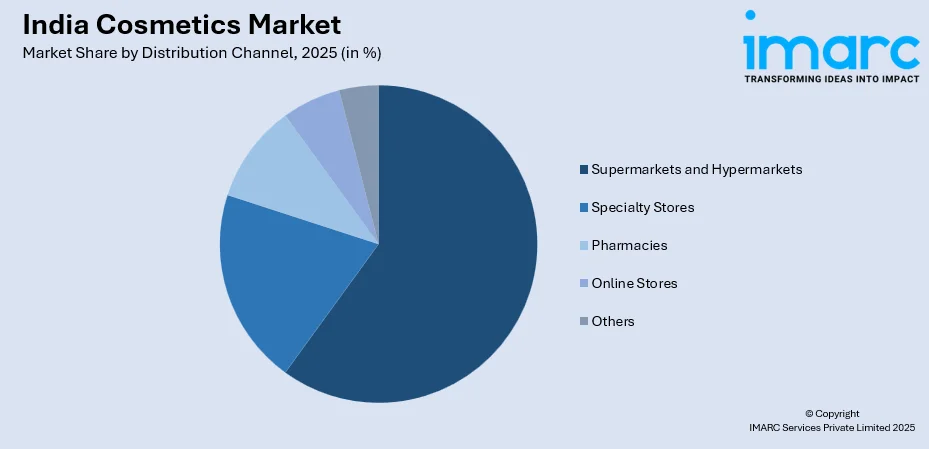

By Distribution Channel: Supermarkets and hypermarkets lead with a share of 60.51% in 2025, supported by wide product variety, competitive pricing, and convenient one-stop shopping experiences for consumers.

-

By Region: North India represents the largest segment with a market share of 32% in 2025, benefiting from high urban population concentration, elevated disposable incomes, and strong retail infrastructure in major metropolitan areas.

-

Key Players: The India cosmetics market presents a highly competitive landscape, comprising a diverse mix of domestic and international brands, including well-established leaders and rapidly growing emerging players, actively competing across multiple product categories and consumer segments.

To get more information on this market Request Sample

Cosmetics encompass a diverse range of products formulated to enhance appearance, maintain personal hygiene, and address specific skin and hair concerns. These products include skincare formulations, color cosmetics, hair care solutions, fragrances, and sun protection products manufactured from both synthetic and natural ingredients. In 2025, Global beauty firms including Estée Lauder, L’Oréal, and Shiseido publicly reaffirmed their commitment to India by expanding local partnerships and targeting deeper market penetration, underscoring the country’s strategic importance for premium beauty offerings. India represents one of the fastest-growing cosmetics markets globally, driven by favorable demographics, increasing beauty consciousness, and the cultural shift toward personal grooming as an essential lifestyle component. The market benefits from expanding organized retail infrastructure, growing e-commerce penetration, and rising consumer awareness about international beauty trends and product innovations.

India Cosmetics Market Trends:

Rising Demand for Natural, Organic, and Ayurvedic Products

The India cosmetics market is witnessing a significant shift toward natural, organic, and Ayurvedic beauty products as consumers increasingly prioritize ingredient transparency and sustainable formulations. This trend reflects growing health consciousness and preference for products free from harmful chemicals, synthetic additives, and artificial preservatives. In June 2025, Indian beauty brand Plum reaffirmed its leadership in ethical beauty by maintaining its 100% vegan and cruelty‑free certification while expanding its clean product portfolio and reinforcing its commitment to plant‑based formulations.

Accelerated Growth of E-Commerce and Digital Beauty Platforms

The rapid expansion of e‑commerce platforms is fundamentally transforming cosmetics distribution and consumer purchasing patterns across India. Digital beauty platforms offer compelling advantages including extensive product variety, detailed ingredient information, customer reviews, and convenient home delivery that appeal to tech‑savvy urban consumers. In August 2025, India’s leading beauty e‑commerce player Nykaa expanded its quick commerce service, Nykaa Now, to seven cities to meet rising demand for faster delivery of beauty and personal care products, highlighting how online channels are evolving to serve consumer needs across urban centers

Premiumization and Growing Demand for Luxury Beauty Products

Premiumization represents a significant trend reshaping the India cosmetics market as rising disposable incomes enable consumers to invest in higher‑quality beauty products offering enhanced efficacy and prestigious brand experiences. Urban consumers increasingly demonstrate willingness to pay premium prices for products featuring innovative formulations, superior ingredients, and luxury packaging. In 2025, Indian cosmetics brand Colorbar announced plans to pursue an initial public offering (IPO) in early 2027 and expand its international presence, reflecting strong investor confidence and the growing appeal of premium Indian beauty labels alongside global luxury players.

Market Outlook 2026-2034:

The India cosmetics market is positioned for sustained expansion throughout the forecast period, underpinned by favorable demographic factors, rising consumer spending power, and evolving beauty consciousness across all demographic segments. Rapid urbanization continues to transform consumer lifestyles and expose increasing populations to modern grooming practices and international beauty trends. Government initiatives supporting domestic manufacturing, improving retail infrastructure, and expanding digital commerce accessibility are expected to further accelerate market development. The market generated a revenue of USD 15.46 Billion in 2025 and is projected to reach a revenue of USD 25.39 Billion by 2034, growing at a compound annual growth rate of 5.7% from 2026-2034.

India Cosmetics Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Skin and Sun Care Products |

43.73% |

|

Category |

Conventional |

82.54% |

|

Gender |

Women |

70.46% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

60.51% |

|

Region |

North India |

32% |

Product Type Insights:

- Skin and Sun Care Products

- Hair Care Products

- Deodorants and Fragrances

- Makeup and Color Cosmetics

- Others

The skin and sun care products dominates with a market share of 43.73% of the total India cosmetics market in 2025.

Skin and sun care products maintain their dominant position in the India cosmetics market driven by increasing consumer awareness about skincare routines and the growing importance of sun protection in daily beauty regimens. Rising pollution levels and frequent exposure to harsh sunlight have intensified consumer demand for products offering protective and hydrating benefits. The segment encompasses cleansers, moisturizers, serums, sunscreens, and anti-aging treatments that address diverse skin concerns including acne, pigmentation, and premature aging. In 2025, Korean skincare brand Innisfree partnered with Indian retailer Nykaa to launch its “Green Tea Hyaluronic Moist Sun Serum” across India, marking an expansion of advanced sun care formulations tailored to local consumer needs.

The skincare category benefits from strong consumer interest in ingredient-focused products featuring active compounds such as niacinamide, hyaluronic acid, vitamin C, and retinol that deliver visible results. Manufacturers are introducing innovative formulations addressing specific Indian skin concerns and climatic conditions while incorporating traditional ingredients with proven efficacy. The proliferation of dermatologist-endorsed brands and the influence of skincare content creators on social media continue to drive product awareness and adoption across consumer segments.

Category Insights:

- Conventional

- Organic

The conventional leads with a share of 82.54% of the total India cosmetics market in 2025.

Conventional cosmetics products maintain their commanding market position driven by affordability, mass availability, and established brand recognition across urban and rural consumer segments. These products benefit from robust distribution networks operated by major manufacturers that reach millions of retail outlets throughout the country. In October 2025, Hindustan Unilever’s India arm reported that its beauty and personal care division, encompassing mass‑market staples like Dove, Pond’s, Vaseline, and Lux, delivered high single‑digit sales growth despite broader sales disruptions, underscoring sustained consumer demand for conventional brands across geographies. Large-scale production capabilities enable competitive pricing strategies that make conventional products accessible to price-sensitive consumers while maintaining acceptable quality standards.

Leading conventional cosmetics brands continuously innovate within established product lines to remain competitive against emerging natural and organic alternatives. Major manufacturers are introducing ingredient-forward innovations within conventional portfolios, incorporating trending active ingredients and adopting subtle upgrades to meet evolving consumer expectations. The segment's dominance reflects the practical purchasing priorities of mainstream consumers who balance quality considerations with budget constraints while seeking effective personal care solutions.

Gender Insights:

- Men

- Women

- Unisex

The women dominate with a market share of 70.46% of the total India cosmetics market in 2025.

Women represent the primary consumer segment driving the India cosmetics market, reflecting strong cultural emphasis on personal grooming and beauty enhancement across life stages and occasions. Rising economic empowerment and workforce participation among women have translated into increased spending power and willingness to invest in quality cosmetic products. The expanding urban middle class demonstrates heightened exposure to global beauty standards and international trends through social media and digital platforms. In 2025, global beauty major Estée Lauder Companies expanded its “BEAUTY&YOU India” initiative to support and mentor India‑focused beauty entrepreneurs, indicating how multinational brands are actively engaging women both as consumers and creators in the Indian cosmetics ecosystem.

The women's segment benefits from extensive product variety spanning skincare, color cosmetics, hair care, and fragrances designed to address diverse beauty needs and preferences. Social media influencers and beauty content creators significantly shape purchasing decisions by promoting new products, demonstrating application techniques, and establishing aspirational beauty standards. Manufacturers continuously expand product portfolios with offerings tailored to Indian skin tones, climate conditions, and cultural beauty preferences to capture evolving consumer demand.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Pharmacies

- Online Stores

- Others

The supermarkets and hypermarkets leads with a share of 60.51% of the total India cosmetics market in 2025.

Supermarkets and hypermarkets maintain their dominant position in cosmetics distribution through comprehensive product assortments, competitive pricing, and convenient one-stop shopping experiences that appeal to diverse consumer segments. These organized retail formats offer extensive shelf space enabling display of multiple brands and product categories within accessible store environments. The physical retail experience allows consumers to examine products, compare options, and make informed purchasing decisions with assistance from trained staff.

The supermarket and hypermarket channel benefits from strategic store locations in urban centers and expanding presence in emerging cities that ensure broad consumer accessibility. Major retail chains leverage promotional activities, loyalty programs, and exclusive product launches to drive footfall and cosmetics sales. The channel continues to evolve through integration of digital technologies including self-checkout systems, mobile applications, and omnichannel capabilities that enhance shopping convenience while maintaining the advantages of physical retail experiences.

Regional Insights:

- South India

- North India

- West and Central India

- East India

North India exhibits a clear dominance with a 32% share of the total India cosmetics market in 2025.

North India leads the cosmetics market supported by its large urban population concentration, elevated disposable incomes, and strong retail infrastructure in major metropolitan areas including Delhi, Chandigarh, and Jaipur. The region demonstrates high consumer awareness about beauty trends and strong receptivity to both domestic and international cosmetic brands. Well-developed modern retail channels including department stores, beauty specialty retailers, and organized supermarket chains ensure comprehensive product accessibility across diverse consumer segments.

The North India market benefits from the concentration of affluent urban households that prioritize personal grooming and demonstrate willingness to invest in premium beauty products. The region's cosmopolitan consumer base shows strong adoption of global beauty trends and innovative product categories introduced by international brands. Continued expansion of organized retail infrastructure and e-commerce penetration in emerging cities across the region is expected to sustain market leadership throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the India Cosmetics Market Growing?

Rising Disposable Incomes and Expanding Middle-Class Population

India's sustained economic growth has significantly increased disposable incomes and expanded the middle-class consumer base, creating favorable conditions for cosmetics market expansion. For example, Indian beauty products retailer Nykaa recently reported a sharp rise in profit and strong demand for premium beauty products in 2025, highlighting urban consumers’ willingness to spend more on quality cosmetics. The growing purchasing power enables consumers to allocate larger budgets toward personal grooming and beauty products that were previously considered discretionary expenditures. Rising incomes particularly impact urban households where exposure to modern lifestyles and global beauty standards drives aspiration for quality cosmetic products across skincare, makeup, and personal care categories.

Rapid Urbanization and Changing Consumer Lifestyles

Rapid urbanization is fundamentally transforming consumer habits and driving cosmetics market growth as increasing populations migrate to cities and adopt modern lifestyles emphasizing personal appearance and grooming. For example, in 2025, global beauty brand NARS expanded its footprint in India in 2025 by partnering with leading omnichannel retailer Nykaa, making its products more widely available both online and in select stores to meet rising urban demand. Urban environments expose consumers to diverse beauty trends, international brands, and sophisticated retail experiences that shape purchasing preferences. The shift toward urban living patterns, including professional workforce participation and active social lives, creates sustained demand for cosmetic products that support grooming routines and enhance personal presentation.

Social Media Influence and Digital Beauty Culture

The pervasive influence of social media platforms has created a dynamic digital beauty culture that significantly impacts cosmetics purchasing decisions and brand preferences among Indian consumers. For example, Meta reported in 2025 that around 80% of Indian beauty shoppers discover beauty brands on social media platforms like Instagram and Facebook, with a large share finding products via Instagram Reels, highlighting how digital content drives product discovery and purchase behaviour. Beauty influencers, content creators, and celebrity endorsements shape consumer awareness about new products, application techniques, and emerging beauty trends. User-generated content and product reviews on digital platforms provide authentic recommendations that drive trial and adoption while enabling brands to engage directly with target audiences through interactive marketing campaigns.

Market Restraints:

What Challenges the India Cosmetics Market is Facing?

Prevalence of Counterfeit and Substandard Products

The India cosmetics market faces significant challenges from counterfeit and substandard products that undermine consumer trust and brand value while posing potential health risks. Counterfeit cosmetics containing harmful substances proliferate particularly in rural and semi-urban areas where brand authentication capabilities remain limited. The vast and fragmented retail network makes monitoring and enforcement difficult, enabling counterfeit products to reach price-sensitive consumers seeking affordable alternatives to branded cosmetics.

Intense Competition and Market Fragmentation

The cosmetics industry faces intense competitive pressure from numerous domestic and international brands competing across multiple market segments. Market fragmentation creates challenges for brand differentiation and customer retention as consumers encounter extensive product choices across price points and categories. Established players must continuously innovate and invest in marketing to maintain market positions against aggressive competition from emerging direct-to-consumer brands and regional manufacturers.

Regulatory Compliance and Safety Standardization Requirements

Evolving regulatory frameworks governing cosmetic product safety, ingredient restrictions, and labeling requirements present compliance challenges for manufacturers operating in the India market. Mandatory quality control standards established by regulatory authorities require substantial investment in testing infrastructure and process modifications. These compliance requirements, while essential for consumer protection, increase operational complexity and costs particularly for smaller manufacturers and new market entrants.

Competitive Landscape:

The India cosmetics market demonstrates a dynamic and highly competitive environment, featuring a blend of established multinational corporations, prominent domestic manufacturers, and fast-growing digital-first brands operating across various product segments. Leading companies maintain their positions through extensive distribution networks, strong brand portfolios, and significant marketing investments. Meanwhile, the market is witnessing a shift as direct-to-consumer startups gain momentum, leveraging digital platforms to reach consumers more efficiently. These emerging players challenge conventional business models with agile product development, targeted marketing campaigns, and personalized customer engagement strategies, reshaping competition and driving innovation throughout the Indian cosmetics sector.

Recent Developments:

-

In October 2025, The Estée Lauder Companies’ BEAUTY&YOU India innovation program, in partnership with Nykaa and Startup India, crowned winners from emerging Indian beauty startups, rewarding breakthrough formulations and socially impactful brands with funding, mentorship, and national exposure. The 2025 winners reflect India’s dynamic beauty ecosystem and entrepreneurial spirit.

India Cosmetics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin and Sun Care Products, Hair Care Products, Deodorants and Fragrances, Makeup and Color Cosmetics, Others |

| Categories Covered | Conventional, Organic |

| Genders Covered | Men, Women, Unisex |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Pharmacies, Online Stores, Others |

| Regions Covered | South India, North India, West and Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email |

Key Questions Answered in This Report

The India cosmetics market size was valued at USD 15.46 Billion in 2025.

The India cosmetics market is expected to grow at a compound annual growth rate of 5.7% from 2026-2034 to reach USD 25.39 Billion by 2034.

Skin and sun care products dominated the market with a share of 43.73%, driven by growing awareness about skincare routines and increasing consumer concerns about sun protection and the effects of pollution on skin health.

Key factors driving the India cosmetics market include rising disposable incomes, rapid urbanization, growing beauty awareness, expanding middle-class population, social media influence, celebrity endorsements, e-commerce expansion, and increasing demand for organic and natural products.

Major challenges include the prevalence of counterfeit and substandard products, intense market competition and fragmentation, regulatory compliance requirements, price sensitivity among consumers, and the need for continuous product innovation to meet evolving consumer preferences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)