India Cosmetic Packaging Market Size, Share, Trends and Forecast by Material Type, Product Type, Cosmetic Type, and Region, 2025-2033

India Cosmetic Packaging Market Overview:

The India cosmetic packaging market size reached USD 3.66 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.00 Billion by 2033, exhibiting a growth rate (CAGR) of 3.20% during 2025-2033. The rapidly evolving market is driven by changing consumer behavior and innovation, it is witnessing a strong growth as brands prioritize eco-friendly designs, advanced safety features, and aesthetically appealing packaging to enhance the consumer experience.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.66 Billion |

| Market Forecast in 2033 | USD 5.00 Billion |

| Market Growth Rate (2025-2033) | 3.20% |

India Cosmetic Packaging Market Trends:

The increasing focus toward sustainability

India's cosmetic packaging market is intensely focusing on sustainability as environmental awareness increases among consumers and regulatory agencies. Packaging is trending towards biodegradable, recyclable, and reusable materials, such as bioplastics, glass, and metal. Trends such as refillable packaging, compostable packaging, and minimalist packaging that minimize waste are becoming popular. The "reduce, reuse, recycle" slogan is observed in packaging with secondary applications or longer lifetimes. Government programs, including Extended Producer Responsibility (EPR) policies, are also compelling brands to go greener. Furthermore, waterless beauty products that minimize the necessity for bulky packaging are gaining popularity. Clear labeling that reflects environmentally friendly practices is also highly dictating consumer preferences, making sustainable packaging a critical marketing tool. For instance, in December 2023, Cosmoprof India highlighted innovative cosmetic packaging solutions with sustainable designs, effective packaging, and sophisticated supply chain innovations from raw materials to private label production. Moreover, this shift is not only an answer to ecofriendly needs but also a strategic differentiator, since companies that invest in sustainability will be better positioned to establish long-term allegiance in India's changing beauty industry.

.webp)

To get more information on this market, Request Sample

Adoption of Smart and Interactive Packaging

Smart and interactive packaging is revolutionizing India's cosmetics sector through increased consumer interaction and product safety. New technologies such as QR codes, Near Field Communication (NFC), and augmented reality (AR) are being incorporated into packaging to provide an interactive experience. By a simple scan, the customer can unlock product details, beauty tips, ingredient disclosure, and customized skincare or makeup advice. Safety features, including tamper-evident seals and authentication tags, assist in the fight against the increasing problem of counterfeiting products, providing brand authenticity. This technology-driven packaging trend strongly appeals to digitally literate millennials and Gen Z shoppers who prioritize engaging experiences. Additionally, interactive packaging closes the gap between offline and online retail, offering an enhanced, omnichannel experience. With the boost of e-commerce in India, these innovations not only boost trust and convenience but also foster lasting brand interactions that induce customer loyalty within the competitive beauty market.

Minimalist and Premium Aesthetics

The luxury and minimalist look trend are gaining momentum in India's cosmetic packaging industry, fusing simplicity and advancement. Packaging styles now emphasize clean lines, pastel colors, and subtle branding, conveying a contemporary, upscale look. The minimalist trend is also applied to fewer layers of packaging, highlighting eco-friendliness and minimizing waste. Moreover, premium features like matte finishes, metallic foiling, and embossing add to the perceived value of products. This design strategy complements the need from consumers for transparent and honest brand communication, along with a luxurious, sensory experience. Practical design features such as ergonomic contours and intuitive dispensers contribute to increased user comfort and product attractiveness. For example, in December 2024, Neopac India was the winner of the IFCA Star Award for "Structural Innovation & Graphic Design" with its sustainable PaperX laminate tube for Kheoni Forest Bathing Natural Skin Lotion, cutting plastic content by 32%. Furthermore, this combination of luxury and minimalism appeals to various consumer segments ranging from price-conscious shoppers to consumers looking for premium experience and thus is a universal approach for cosmetics companies operating in India's dynamic and diverse beauty market.

India Cosmetic Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on material type, product type, and cosmetic type.

Material Type Insights:

- Plastic

- Glass

- Metal

- Paper

The report has provided a detailed breakup and analysis of the market based on the material type. This includes plastic, glass, metal, and paper.

Product Type Insights:

- Plastic Bottles and Containers

- Glass Bottles and Containers

- Metal Containers

- Folding Cartoons

- Corrugated Boxes

- Tubes and Sticks

- Caps and Closures

- Pump and Dispenser

- Droppers

- Ampoules

- Flexible Packet Packaging

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes plastic bottles and containers, glass bottles and containers, metal containers, folding cartoons, corrugated boxes, tubes and sticks, caps and closures, pump and dispenser, droppers, ampoules, and flexible packet packaging.

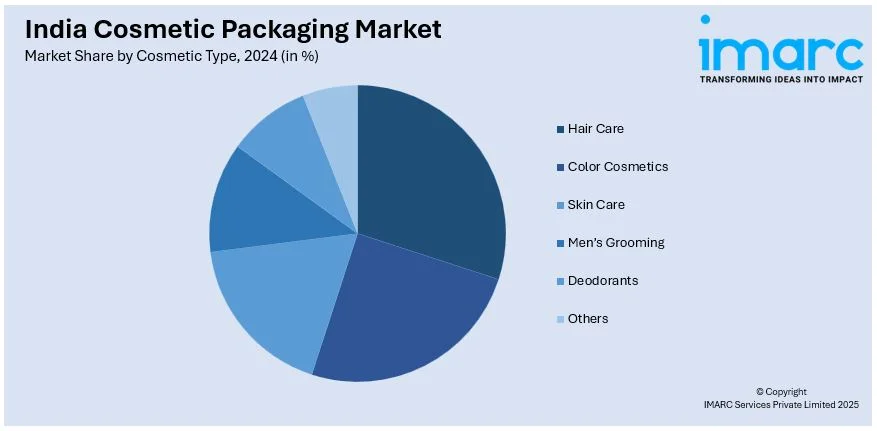

Cosmetic Type Insights:

- Hair Care

- Color Cosmetics

- Skin Care

- Men’s Grooming

- Deodorants

- Others

The report has provided a detailed breakup and analysis of the market based on the cosmetic type. This includes hair care, color cosmetics, skin care, men’s grooming, deodorants, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cosmetic Packaging Market News:

- In June 2024, Manjushree Technopak introduced new plastic beauty packaging made with post-consumer recycled (PCR) materials in support of sustainable beauty trends. The Indian company launched a completely recyclable all-plastic pump and is focusing on lowering its carbon footprint, adding eco-friendly bottles, pumps, and caps to its product portfolio.

India Cosmetic Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Plastic, Glass, Metal, Paper |

| Product Types Covered | Plastic Bottles and Containers, Glass Bottles and Containers, Metal Containers, Folding Cartoons, Corrugated Boxes, Tubes and Sticks, Caps and Closures, Pump and Dispenser, Droppers, Ampoules, Flexible Packet Packaging |

| Cosmetic Types Covered | Hair Care, Color Cosmetics, Skin Care, Men’s Grooming, Deodorants, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cosmetic packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cosmetic packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cosmetic packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cosmetic packaging market in India was valued at USD 3.66 Billion in 2024.

The India cosmetic packaging market is projected to exhibit a CAGR of 3.20% during 2025-2033, reaching a value of USD 5.00 Billion by 2033.

Key factors driving the India cosmetic packaging market include rising beauty product consumption, escalating demand for premium and sustainable packaging solutions, and growing e-commerce penetration. Innovation in attractive and functional designs, increased awareness of environmental standards, and the expansion of local and international cosmetic brands are further fueling market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)