India Cosmetic Chemicals Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Cosmetic Chemicals Market Overview:

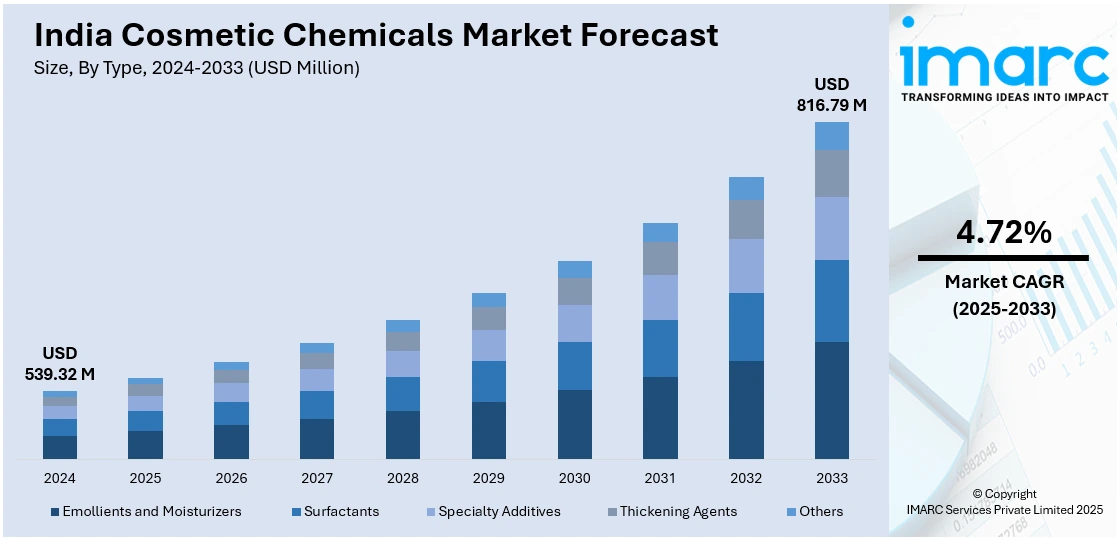

The India cosmetic chemicals market size reached USD 539.32 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 816.79 Million by 2033, exhibiting a growth rate (CAGR) of 4.72% during 2025-2033. The market is driven by growing consumer awareness of skincare and personal grooming, escalating demand for organic and sustainable ingredients, expansion of the beauty and personal care industry, technological advancements in formulations, and the influence of global beauty trends through digital platforms.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 539.32 Million |

| Market Forecast in 2033 | USD 816.79 Million |

| Market Growth Rate 2025-2033 | 4.72% |

India Cosmetic Chemicals Market Trends:

Growing Adoption of Cosmetics in Daily Makeup Routine

The growing incorporation of cosmetics within daily grooming is a major propeller of India's cosmetic chemicals market. In contrast to earlier generations, who kept makeup reserved for special events, current consumers now view it as a part of normal grooming. This is driven by urbanization, increase in disposable incomes, and an expanding labor force, especially among women. With professional settings putting more importance on self-grooming, people are spending money on products that make them look good without being heavy or short-lived. Demand has grown for foundations, BB creams, lip tints, and setting sprays that are suitable for all-day wear, leading cosmetic chemical makers to develop innovative products with new formulations. Products such as silicone-based ingredients for easier application, long-wear polymers for longevity, and hybrid makeup-skincare products with SPF and antioxidants are gaining popularity. Social media tutorials and beauty bloggers have also helped to popularize makeup as a part of everyday routines, which has led to more experimentation with different looks. Men's grooming is also emerging as a profitable category, further broadening the market's appeal. As there is increasing daily cosmetic usage becoming part of Indian consumer culture, the market for high-performance, safe, and multi-functional cosmetic chemicals continues to grow.

To get more information on this market, Request Sample

Inclination Towards Cruelty-Free and Vegan Ingredients

India's cosmetic chemicals industry is experiencing a major overhaul with consumers extensively opting for cruelty-free and vegan formulations. The key driver behind this change is growing awareness toward ethical consumerism and the eco-footprint of animal-derived ingredients. With worldwide campaigns against animal testing gaining steam, Indian consumers, especially millennials and Gen Z, are gravitating towards beauty products that share their values of sustainability and ethical concern. Companies are answering by restructuring products to avoid using animal-based ingredients such as collagen, lanolin, and beeswax, substituting them with botanical substitutes like soy protein, shea butter, and fruit waxes. Governance models are also evolving, with India prohibiting the importation of cosmetics tested on animals, further cementing the shift in the market towards cruelty-free products. With the advent of social media and influencer marketing, consumer scrutiny has enhanced, necessitating transparency in purchasing decisions. Cosmetic chemical makers are now making more investments in R&D to develop plant-based and synthetic bioengineered ingredients that mimic the effectiveness of conventional ingredients without sacrificing on performance. The transition to vegan beauty is not merely a fad niche but a sustainable long-term industry shift that will frame the future of India's cosmetics chemicals business.

India Cosmetic Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Emollients and Moisturizers

- Surfactants

- Specialty Additives

- Thickening Agents

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes emollients and moisturizers, surfactants, specialty additives, thickening agents, and others.

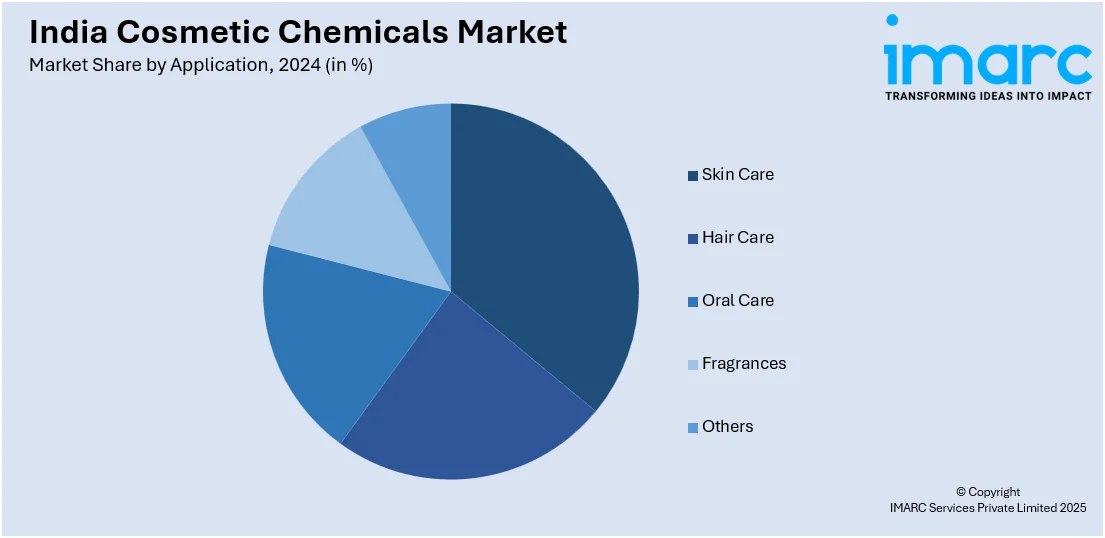

Application Insights:

- Skin Care

- Hair Care

- Oral Care

- Fragrances

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes skin care, hair care, oral care, fragrances, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cosmetic Chemicals Market News:

- December 2024: Eternis Fine Chemicals acquired Israel-based Sharon Personal Care to expand its presence in the cosmetic ingredients market. This acquisition strengthened Eternis' global supply chain and innovation capabilities, allowing it to cater to elevating demand in India.

- November 2024: Symrise AG inaugurated its initial cosmetic ingredients plant in Chennai, India, targeting the escalating cosmetics demand in the Asia Pacific. With this strategic opening, the distribution of high-quality ingredients for local producers becomes more readily available, boosting innovation and development within India's market for cosmetic chemicals.

India Cosmetic Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Emollients and Moisturizers, Surfactants, Specialty Additives, Thickening Agents, Others |

| Applications Covered | Skin Care, Hair Care, Oral Care, Fragrances, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cosmetic chemicals market from2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cosmetic chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cosmetic chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cosmetic chemicals market in India was valued at USD 539.32 Million in 2024.

The India cosmetic chemicals market is projected to exhibit a (CAGR) of 4.72% during 2025-2033, reaching a value of USD 816.79 Million by 2033.

The Indian cosmetic chemicals industry is growing with amplifying demand for skincare, haircare, and personal grooming products. Growth is driven by rising disposable incomes, beauty influencer effects, and the desire for personalized, active ingredient-based products. Government support for local manufacturing and transitioning towards natural and sustainable ingredients also influences industry trends.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)