India Corrugated Boxes Market Size, Share, Trends and Forecast by Material Used, End Use, and Region, 2026-2034

India Corrugated Boxes Market Summary:

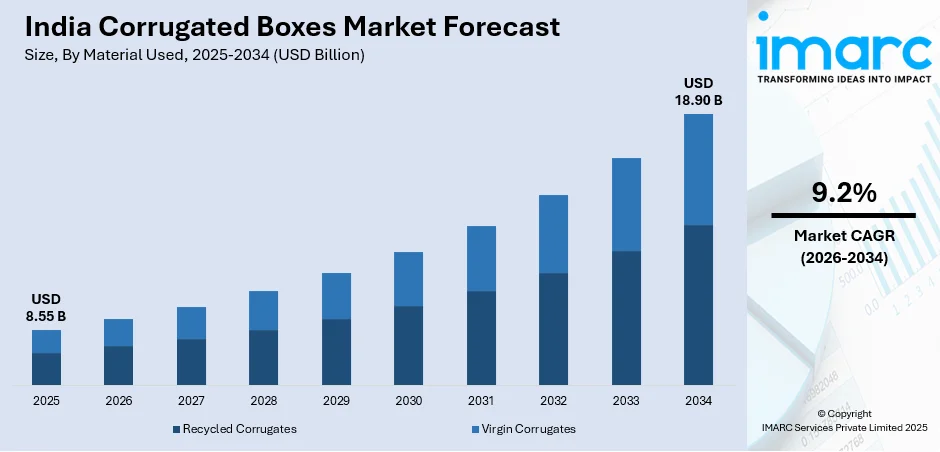

The India corrugated boxes market size was valued at USD 8.55 Billion in 2025 and is projected to reach USD 18.90 Billion by 2034, growing at a compound annual growth rate of 9.2% from 2026-2034.

The India corrugated boxes market is witnessing robust expansion driven by the rapid proliferation of e-commerce platforms and the accompanying surge in parcel shipments requiring protective packaging solutions. The market benefits from the expanding organized retail sector and the growing food and beverage industry that demands reliable packaging for safe product transportation. Rising environmental consciousness among consumers and manufacturers is accelerating the shift toward sustainable, recyclable corrugated packaging materials across diverse industry verticals.

Key Takeaways and Insights:

-

By Material Used: Recycled corrugates dominates the market with a share of 70.82% in 2025, driven by growing sustainability initiatives and cost advantages offered by recycled fiber inputs for box manufacturing.

-

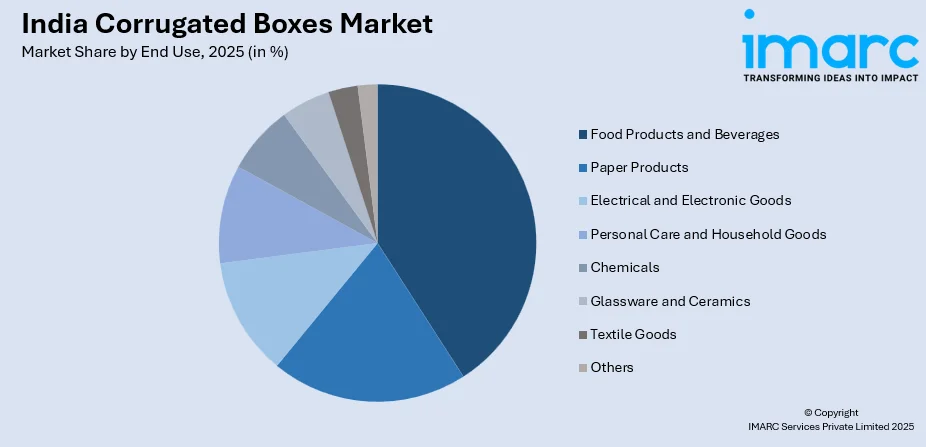

By End Use: Food products and beverages leads the market with a share of 40.84% in 2025, owing to the expanding processed food industry and cold chain logistics infrastructure development.

-

By Region: North India dominates the market with a share of 33% in 2025, attributable to the concentration of manufacturing hubs and robust agricultural processing activities.

-

Key Players: The India corrugated boxes market features a moderately fragmented competitive landscape with both established national manufacturers and regional players vying for market share across various price segments and end-use applications.

To get more information on this market Request Sample

The corrugated boxes industry in India is experiencing transformative growth propelled by fundamental shifts in consumer purchasing behavior and industrial logistics requirements. The exponential expansion of e-commerce platforms has created unprecedented demand for durable and protective packaging solutions that ensure safe product delivery across vast distances. In February 2024, Amazon said nearly 47.5% of orders from its India fulfillment network shipped with reduced or no extra packaging using reusable crates or corrugated boxes. Organized retail chains are increasingly adopting corrugated packaging for its superior stacking strength, printability for branding purposes, and environmental sustainability credentials. The food and beverage sector continues to be the dominant consumer, requiring specialized corrugated solutions for perishable goods transportation through evolving cold chain networks. Government initiatives promoting sustainable packaging alternatives and discouraging single-use plastics are accelerating market adoption of recyclable corrugated materials across industrial applications.

India Corrugated Boxes Market Trends:

Sustainability-Driven Packaging Innovation

The market is witnessing an accelerated shift toward eco-friendly corrugated packaging solutions as environmental consciousness permeates industrial decision-making. Manufacturers are increasingly utilizing recycled kraft paper, sustainable adhesives, and water-based inks to create packaging that aligns with circular economy principles. For example, in 2025 Tetra Pak became India’s first food and beverage packaging company to launch cartons with 5% certified recycled polymers from its ISCC PLUS certified Pune facility. The development of biodegradable corrugated materials from agricultural waste and innovative fiber sources is gaining momentum as companies seek to differentiate their sustainability credentials.

Digital Printing and Smart Packaging Integration

Advanced digital printing technologies are revolutionizing corrugated box customization, enabling high-resolution graphics and variable data printing for enhanced brand visibility. In September 2025, Mondi expanded its six-colour digital printing range for corrugated packaging by adding white ink, enabling high-contrast designs on brown board while supporting sustainable production. The integration of smart packaging features including QR codes, RFID tags, and augmented reality elements is transforming corrugated boxes into interactive consumer engagement platforms. These technological advancements are particularly relevant for e-commerce applications where unboxing experiences drive customer satisfaction and brand loyalty.

Right-Sizing and Lightweight Engineering

The industry is embracing right-sizing initiatives that optimize box dimensions to minimize void space and reduce shipping costs while maintaining product protection. For example, in February 2025 Packsize launched its X6 automated right‑sized packaging system, producing up to 1,500 custom corrugated boxes per hour while boosting efficiency and supporting waste compliance. Lightweight corrugated engineering utilizing advanced fluting patterns and paperboard compositions is enabling significant material reduction without compromising structural integrity. These optimization efforts align with sustainability goals while delivering tangible logistics cost savings for end-users across industry verticals.

Market Outlook 2026-2034:

The India corrugated boxes market is set for sustained expansion throughout the forecast period, driven by rising e-commerce penetration, steady manufacturing growth, and ongoing infrastructure development initiatives nationwide. Growing emphasis on sustainable packaging, coupled with government regulations promoting recyclable and eco-friendly materials, is expected to strengthen demand across diverse industrial verticals. These factors collectively support long-term market resilience, capacity additions, product innovation, and broader adoption of corrugated packaging solutions across supply chains overall. The market generated a revenue of USD 8.55 Billion in 2025 and is projected to reach a revenue of USD 18.90 Billion by 2034, growing at a compound annual growth rate of 9.2% from 2026-2034.

India Corrugated Boxes Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Material Used |

Recycled Corrugates |

70.82% |

|

End Use |

Food Products and Beverages |

40.84% |

|

Region |

North India |

33% |

Material Used Insights:

- Recycled Corrugates

- Virgin Corrugates

The recycled corrugates dominates with a market share of 70.82% of the total India corrugated boxes market in 2025.

The commanding position of recycled corrugates reflects the packaging industry's commitment to sustainable manufacturing practices and circular economy principles. Recycled fiber inputs offer significant cost advantages over virgin materials while meeting the performance requirements for most packaging applications. The robust waste paper collection infrastructure across urban and industrial centers ensures consistent raw material availability for manufacturers. In December 2024, India’s Ministry of Environment notified draft EPR Packaging Rules, 2024, requiring producers and brands to manage packaging lifecycles, promote recycling, and increase recycled content, boosting demand for recycled corrugates.

Rising environmental regulations and increasing consumer preference for sustainable packaging are driving demand for recycled corrugated materials across industries. Manufacturers are advancing recycled fiber processing to improve strength and print quality, reducing the performance gap with virgin materials. This segment also gains from supportive government policies encouraging paper recycling and waste minimization. Together, technological improvements and regulatory backing are solidifying the role of recycled corrugated packaging as a cost-effective, eco-friendly alternative in diverse industrial applications.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Food Products and Beverages

- Paper Products

- Electrical and Electronic Goods

- Personal Care and Household Goods

- Chemicals

- Glassware and Ceramics

- Textile Goods

- Others

The food products and beverages leads with a share of 40.84% of the total India corrugated boxes market in 2025.

The dominant position of food products and beverages reflects the sector's intensive packaging requirements for product protection, shelf appeal, and regulatory compliance. The expanding processed food industry and the proliferation of organized retail chains are driving demand for standardized corrugated packaging solutions. For example, Oji India Packaging opened its fifth corrugated box manufacturing facility in Sri City in 2025 to strengthen supply chain efficiency and meet rising demand for sustainable packaging. Cold chain logistics development is creating specialized requirements for moisture-resistant and temperature-stable corrugated materials.

The segment is supported by India’s expanding urban population and shifting dietary habits favoring packaged and convenience foods. Rising e-commerce grocery deliveries are driving strong demand for protective packaging that preserves product quality during last-mile transport. In response, manufacturers are creating specialized food-grade corrugated solutions that meet safety regulations and provide improved barrier properties, ensuring both compliance and durability while catering to the growing requirements of modern retail and delivery-driven food markets.

Regional Insights:

- North India

- West and Central India

- South India

- East India

The North India exhibits a clear dominance with a 33% share of the total India corrugated boxes market in 2025.

North India’s leading position is driven by its high concentration of manufacturing hubs across automotive, electronics, and consumer goods sectors. The National Capital Region and nearby states host numerous large-scale corrugated packaging producers catering to domestic and export markets. Additionally, extensive agricultural activities in Punjab, Haryana, and Uttar Pradesh create substantial demand for packaging solutions for fresh produce and processed foods, reinforcing the region’s prominence in India’s corrugated packaging industry.

The region’s advanced logistics network and closeness to key consumption hubs strengthen its market leadership. The rise of e-commerce fulfillment centers is boosting demand for standardized corrugated shipping containers. Additionally, major industrial corridors and special economic zones are attracting further investments and capacity expansions in the packaging sector, solidifying the region’s role as a central hub for corrugated packaging production and distribution in India.

Market Dynamics:

Growth Drivers:

Why is the India Corrugated Boxes Market Growing?

Explosive E-Commerce Expansion Driving Packaging Demand

The unprecedented growth of e-commerce platforms in India is fundamentally reshaping corrugated packaging demand patterns. Rising internet penetration and smartphone adoption have transformed consumer purchasing behavior, creating massive parcel volumes that require protective shipping solutions. Online retailers are increasingly prioritizing packaging that ensures product safety during multi-stage logistics journeys while enhancing unboxing experiences. The growth of quick commerce and same-day delivery services is generating demand for standardized corrugated containers optimized for rapid fulfillment operations. According to reports, quick commerce leader Blinkit announced plans to expand its network to 3,000 dark stores by March 2027 to support ultra‑fast deliveries, which will further intensify packaging and logistics needs across urban markets. Social commerce platforms are emerging as significant demand drivers, requiring packaging solutions that accommodate diverse product categories and shipping requirements.

Organized Retail Expansion and Supply Chain Modernization

The transformation of India's retail landscape toward organized formats is creating substantial corrugated packaging requirements. Modern retail chains demand consistent, high-quality packaging that facilitates efficient warehouse operations and attractive shelf displays. Venue Supermarts, operator of DMart, reported Q2 FY26 standalone revenue of ₹16,218.79 crore, up 15.4% year‑on‑year, marking its highest second-quarter revenue in four years due to retail expansion and strong consumer demand. The expansion of hypermarkets, supermarkets, and convenience store networks is driving standardization in secondary and tertiary packaging specifications. Improved cold chain infrastructure is enabling distribution of perishable products across greater distances, requiring specialized corrugated solutions with enhanced moisture resistance. Retailers are increasingly specifying recyclable and sustainable packaging to align with corporate environmental commitments and consumer preferences.

Manufacturing Sector Growth and Export Market Development

India's expanding manufacturing base is generating robust industrial demand for corrugated packaging across diverse sectors. The emergence of the country as a global manufacturing hub for electronics, pharmaceuticals, and automotive components requires protective packaging for both domestic distribution and export shipments. Government initiatives promoting domestic manufacturing are attracting investments that translate into increased packaging consumption. Export-oriented industries require corrugated solutions that meet international shipping standards and destination market regulations. The pharmaceutical sector's growth trajectory is creating specialized requirements for tamper-evident and temperature-controlled corrugated packaging systems.

Market Restraints:

What Challenges the India Corrugated Boxes Market is Facing?

Raw Material Price Volatility and Supply Constraints

The corrugated boxes industry faces ongoing challenges from fluctuating kraft paper and recycled fiber prices that impact manufacturing costs and profit margins. Global paper market dynamics and import dependencies create pricing uncertainties that complicate long-term contract negotiations with end-users. Seasonal variations in waste paper availability affect raw material procurement planning for recycled corrugated manufacturers.

Competition from Alternative Packaging Materials

Corrugated packaging faces competitive pressure from alternative materials including flexible packaging, rigid plastics, and reusable containers in certain applications. Cost-sensitive end-users may substitute corrugated solutions with lower-cost alternatives when packaging performance requirements permit. The development of innovative plastic and composite packaging materials continues to challenge corrugated market share in specific industry segments.

Fragmented Industry Structure and Margin Pressures

The highly fragmented nature of India's corrugated packaging industry creates intense competitive dynamics that pressure manufacturer margins. Numerous small-scale and regional operators compete primarily on price, limiting industry-wide ability to pass through cost increases. The commoditized nature of standard corrugated products constrains differentiation opportunities and pricing power for many manufacturers.

Competitive Landscape:

The India corrugated boxes market exhibits a moderately fragmented competitive structure characterized by the presence of both established national players and numerous regional manufacturers. Leading companies are pursuing capacity expansion strategies and technological upgrades to capture market share in high-growth segments. The industry is witnessing consolidation trends as larger players acquire regional operators to expand geographic coverage and customer portfolios. Investment in advanced manufacturing equipment including high-speed corrugators, digital printing systems, and automated finishing lines is emerging as a key competitive differentiator. Sustainability initiatives, including certified fiber sourcing and carbon footprint reduction programs, are becoming increasingly important for winning contracts with environmentally conscious customers.

Recent Developments:

-

In July 2025, UniPack Corrugated has entered India’s corrugated packaging market through the acquisition of Congzhou Machinery, marking a major technology-led expansion. The company launched UniPack India and introduced its UniCorr range of high-speed automated plants and converting solutions, targeting smart manufacturing and Industry 4.0 adoption in India’s ₹50,000-crore packaging sector.

India Corrugated Boxes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Used Covered | Recycled Corrugates, Virgin Corrugates |

| End Uses Covered | Food Products and Beverages, Paper Products, Electrical and Electronic Goods, Personal Care and Household Goods, Chemicals, Glassware and Ceramics, Textile Goods, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India corrugated boxes market size was valued at USD 8.55 Billion in 2025.

The India corrugated boxes market is expected to grow at a compound annual growth rate of 9.2% from 2026-2034 to reach USD 18.90 Billion by 2034.

Recycled corrugates dominated the market with a 70.82% share, driven by sustainability initiatives, cost advantages of recycled fiber inputs, and growing environmental regulations favoring recyclable packaging materials.

Key factors driving the India corrugated boxes market include the explosive growth of e-commerce platforms, organized retail expansion, manufacturing sector development, increasing sustainability requirements, and the expanding food and beverage industry.

Major challenges include raw material price volatility and supply constraints, competition from alternative packaging materials, fragmented industry structure creating margin pressures, and the need for continuous technology investment to meet evolving customer requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)