India Corporate E-Learning Market Size, Share, Trends and Forecast by Learning Type, Organization Size, Vertical, and Region, 2025-2033

India Corporate E-Learning Market Overview:

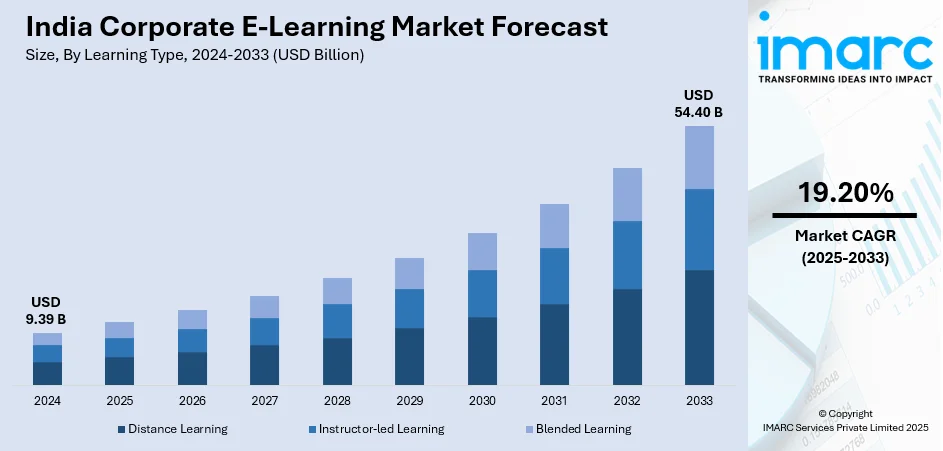

The India corporate e-learning market size reached USD 9.39 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 54.40 Billion by 2033, exhibiting a growth rate (CAGR) of 19.20% during 2025-2033. The India corporate e-learning market share is expanding, driven by the increasing adoption of artificial intelligence (AI), enabling chatbots and virtual assistants to provide real-time assistance, along with the rise in remote and hybrid work models, encouraging businesses to employ efficient methods to train staff who are no longer based in a central office.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.39 Billion |

| Market Forecast in 2033 | USD 54.40 Billion |

| Market Growth Rate (2025-2033) | 19.20% |

India Corporate E-Learning Market Trends:

Increasing adoption of AI

The rising adoption of AI is fueling the India corporate e-learning market growth. The incorporation of AI into e-learning portals makes training more personalized, efficient, and engaging. AI-oriented platforms analyze employee learning patterns and provide customized course recommendations, ensuring that each person gets relevant content suited to their needs. AI also enables chatbots and virtual assistants to provide immediate supports, responding to inquiries and directing learners through complex topics. Automated assessments and smart analytics help companies to track progress and identify skill gaps, making training programs more effective. AI-focused simulations and gamification enhance engagement, making learning more interactive and enjoyable. Additionally, AI automates content creation and updates, saving time and resources for businesses. As organizations emphasize upskilling employees in a fast-changing work environment, AI-based e-learning solutions become essential for improving workforce productivity and knowledge retention. Moreover, government agencies are also investing in AI projects to increase its usage. The Indian Union Budget 2024-2025 allocated INR 551.75 Crore for the IndiaAI Mission, showcasing its dedication to promoting research and applications in AI. This initiative sought to establish India as a worldwide leader in AI. This, in turn, is positively influencing the market.

To get more information on this market, Request Sample

Rise in hybrid and remote work models

An increase in hybrid and remote work arrangements is offering a favorable India corporate e-learning market outlook. According to industry reports, approximately 20% of job advertisements in India in 2024 focused on remote or hybrid positions, a notable rise from merely 0.9% in 2020. Businesses require efficient methods to train staff who are no longer based in a central office. Conventional training approaches, including face-to-face workshops and seminars, are becoming increasingly impractical since employees are dispersed across various locations. Companies utilize digital learning platforms to guarantee that every employee, regardless of being remote or hybrid, obtains uniform and high-quality training. Employees also gain advantages, as e-learning enables them to study at their own speed, access training materials whenever they desire, and harmonize learning with their everyday responsibilities. Online courses enable organizations to reduce expenses by removing the necessity for physical training areas, printed resources, and travel costs. Engaging elements, such as gamification, virtual experiences, and instantaneous feedback, enhance knowledge retention and maintain employee motivation. Moreover, organizations can monitor advancement via digital evaluations and analytics, guaranteeing that staff members acquire the essential skills for their positions. As remote and hybrid work expands, companies depend on e-learning tools to ensure their workforce remains productive, competitive, and informed about industry developments, making digital training a crucial investment.

India Corporate E-Learning Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on learning type, organization size, and vertical.

Learning Type Insights:

- Distance Learning

- Instructor-led Learning

- Blended Learning

The report has provided a detailed breakup and analysis of the market based on the learning types. This includes distance learning, instructor-led learning, and blended learning.

Organization Size Insights:

- Large Enterprises

- SMEs

A detailed breakup and analysis of the market based on the organization sizes have also been provided in the report. This includes large enterprises and SMEs.

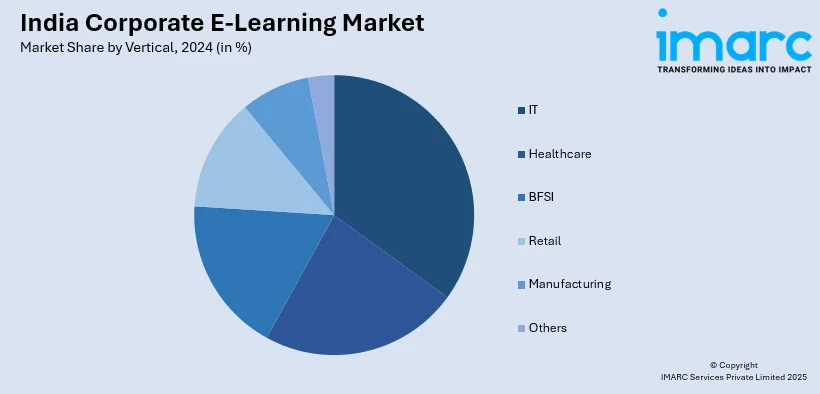

Vertical Insights:

- IT

- Healthcare

- BFSI

- Retail

- Manufacturing

- Others

The report has provided a detailed breakup and analysis of the market based on the verticals. This includes IT, healthcare, BSFI, retail, manufacturing, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Corporate E-Learning Market News:

- In December 2024, PromPerú, the Peruvian agency for promoting trade, tourism, and investments, unveiled a specialized training program for Indian travel industry professionals, known as the ‘Peru Agents E-Learning Program’. This program offered Indian travel agents a thorough knowledge of Peru, allowing them to create distinctive and unforgettable itineraries for their clients in India.

- In February 2024, Union Education Minister Dharmendra Pradhan released the SWAYAM Plus platform, designed to improve employability and career development. This initiative aimed to showcase programs created in alliance with leading industry organizations, such as L&T, Microsoft, and CISCO. This partnership combined the educational values of the SWAYAM platform with the practical expertise and relevance offered by corporate collaborators.

India Corporate E-Learning Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Learning Types Covered | Distance Learning, Instructor-led Learning, Blended Learning |

| Organization Sizes Covered | Large Enterprises, SMEs |

| Verticals Covered | IT, Healthcare, BSFI, Retail, Manufacturing, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India corporate e-learning market from2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India corporate e-learning market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India corporate e-learning industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The corporate e-learning market in India was valued at USD 9.39 Billion in 2024.

The India corporate e-learning market is projected to exhibit a CAGR of 19.20% during 2025-2033, reaching a value of USD 54.40 Billion by 2033.

The India corporate e-learning market is fueled by rapid digital transformation, growing need for workforce upskilling, and cost-effective training solutions. Widespread internet penetration, mobile learning adoption, and demand for flexible, personalized content drive growth, while government initiatives and corporate investments in employee development further accelerate market expansion across industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)