India Copper Alloys Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

India Copper Alloys Market Overview:

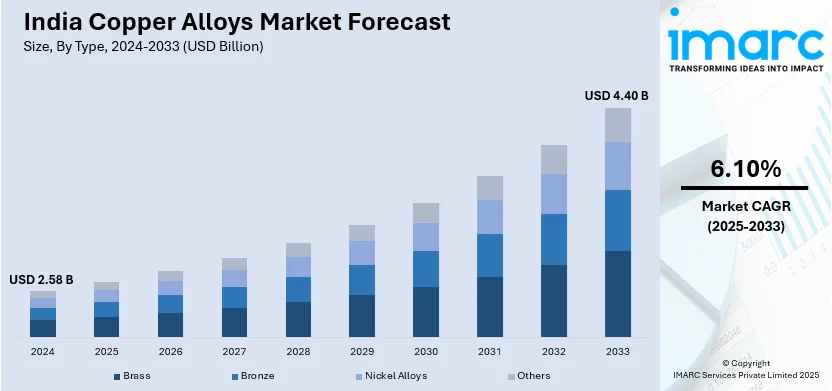

The India copper alloys market size reached USD 2.58 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.40 Billion by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. The growing preferences for electric vehicles (EVs) and significant investments in power and energy sector are driving the demand for copper alloys. As the automotive sector transitions to energy-efficient solutions and power infrastructure upgrades, the need for copper alloys in electrical systems, EVs, and renewable energy projects continues to rise in India.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.58 Billion |

| Market Forecast in 2033 | USD 4.40 Billion |

| Market Growth Rate 2025-2033 | 6.10% |

India Copper Alloys Market Trends:

Growing Automotive and Electric Vehicle Market

A strong automotive industry, particularly with an increase of electric vehicles (EVs), is catalyzing the demand for copper alloys in India. As the automotive sector shifts towards energy-efficient, sustainable, and technologically advanced options, copper alloys are increasingly becoming essential on account of their outstanding electrical conductivity, heat resistance, and durability. EVs demand more copper-based materials compared to conventional cars, especially in battery systems, electric motors, wiring, and charging systems. This request is additionally reinforced by the backing of the regulatory authority for electric mobility through programs like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) initiative, that provides financial support and incentives to promote the adoption of EVs. In 2023, the Ministry of Heavy Industries announced that the FAME India Scheme Phase-II, allocated a budget of ₹10,000 crore, facilitated the uptake of electric vehicles (EVs). As of July 21, 2023, more than 830,000 EVs were sold, and the government approved charging infrastructure in different states. This is paired with an increasing user transition to eco-friendly and fuel-efficient alternatives, leading to a rise in EV manufacturing. Conventional vehicle makers are incorporating copper alloys into different parts to enhance overall vehicle efficiency and performance. Moreover, the growth of EV infrastructure, which includes charging stations, significantly depends on copper alloys for the electrical systems and connectors. With the swift transformation of India's automotive sector, the need for copper alloys is poised to increase notably, making them an essential resource for the future of both electric and hybrid cars.

To get more information on this market, Request Sample

Rising Power and Energy Sector Investments

Investments in India’s power and energy sector are also playing a crucial role in driving the copper alloys market. With increasing demand for reliable and efficient power generation, transmission, and distribution, copper alloys are vital in the manufacturing of electrical components such as transformers, conductors, and connectors. As per the information provided by the India Brand Equity Foundation (IBEF), India ranks as the third-largest producer and user of electricity globally, with an installed power capacity of 442.85 GW as of April 30, 2024. The government's emphasis on upgrading the national grid and boosting the proportion of renewable energy sources, like solar and wind power, is further propelling the market for copper alloys. These alloys are crucial in energy-efficient infrastructure, ensuring low power losses and stable operations. The government’s investment in power infrastructure, including smart grid technology and modernized electrical systems, is expected to drive the consumption of copper alloys. As India continues to diversify its energy portfolio and increase its power generation capacity, the need for durable, high-performance materials like copper alloys will remain central to the sector's growth.

India Copper Alloys Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Brass

- Bronze

- Nickel Alloys

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes brass, bronze, nickel alloys, and others.

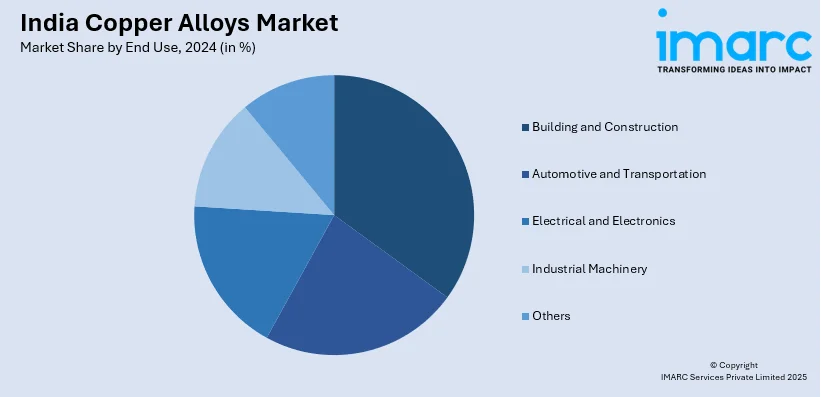

End Use Insights:

- Building and Construction

- Automotive and Transportation

- Electrical and Electronics

- Industrial Machinery

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes building and construction, automotive and transportation, electrical and electronics, industrial machinery, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Copper Alloys Market News:

- In January 2025, JX Advanced Metals Corporation launched 100% recycled high-performance copper alloys, including copper titanium and Corson alloys, as part of its "Cu again" project. These alloys, made from recycled materials, are used in devices such as smartphones, EVs, and generative AI data centers.

- In September 2024, Hindalco announced the development of new copper-silver alloys for high-speed urban transport and metro networks. The company also expanded its copper smelting capacity at its Dahej facility in Gujarat.

India Copper Alloys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Brass, Bronze, Nickel Alloys, Others |

| End Uses Covered | Building and Construction, Automotive and Transportation, Electrical and Electronics, Industrial Machinery, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India copper alloys market performed so far and how will it perform in the coming years?

- What is the breakup of the India copper alloys market on the basis of type?

- What is the breakup of the India copper alloys market on the basis of end use?

- What is the breakup of the India copper alloys market on the basis of region?

- What are the various stages in the value chain of the India copper alloys market?

- What are the key driving factors and challenges in the India copper alloys market?

- What is the structure of the India copper alloys market and who are the key players?

- What is the degree of competition in the India copper alloys market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India copper alloys market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India copper alloys market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India copper alloys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)