India Contract Lifecycle Management Software Market Size, Share, Trends and Forecast by Deployment Model, CLM Offerings, Enterprise Size, Industry, and Region, 2025-2033

India Contract Lifecycle Management Software Market Overview:

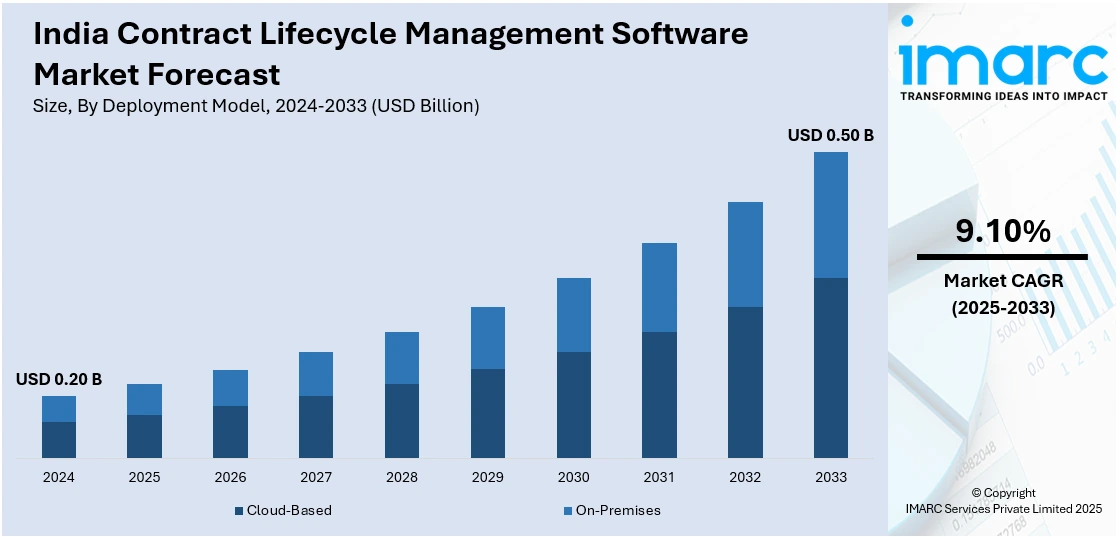

The India contract lifecycle management software market size reached USD 0.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.50 Billion by 2033, exhibiting a growth rate (CAGR) of 9.10% during 2025-2033. The India contract lifecycle management software market share is expanding, driven by the rising shift towards automated solutions for handling contracts more efficiently, along with the growing focus on protecting sensitive data owing to an increase in the number of cyber attacks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.20 Billion |

| Market Forecast in 2033 | USD 0.50 Billion |

| Market Growth Rate 2025-2033 | 9.10% |

India Contract Lifecycle Management Software Market Trends:

Growing digital transformation

The ongoing digital transformation is offering a favorable India contract lifecycle management software market outlook. With enhanced Internet access, companies are no longer relying on traditional paperwork and manual processes, as digital contract management improves accuracy, speeds up approvals, and enhances compliance. According to the INTERNET IN INDIA 2024 report by the Internet and Mobile Association of India (IAMAI), the country’s internet user population is set to surpass 900 Million by 2025. With more organizations adopting cloud-based solutions, contract lifecycle management software is becoming an essential tool for managing contracts securely from anywhere. Businesses are also integrating artificial intelligence (AI) and data analytics into their contract management processes, which aids in extracting insights, predicting risks, and automating negotiations. Sectors like information technology (IT), healthcare, and manufacturing are employing contract lifecycle management software to lower legal risks, ensure regulatory compliance, and refine collaboration across teams. The increasing need for centralized contract storage is also encouraging companies to wager on contract lifecycle management solutions. As digital transformation continues to grow, organizations are prioritizing transparency and automation, making contract lifecycle management software a key investment.

To get more information on this market, Request Sample

Rising security concerns

Increasing security concerns are fueling the India contract lifecycle management software market growth. With rising cyber threats, data breaches, and regulatory requirements, companies are looking for secure solutions to manage contracts efficiently. As per the report released by CloudSEK, India ranked as the second most targeted country for cyber attacks worldwide, with 95 Indian entities experiencing data theft incidents in 2024. Contract lifecycle management software helps organizations safeguard agreements by offering encryption and role-based access controls, guaranteeing that confidential information stays protected. Industries like finance that handle sensitive contracts are rapidly adopting these solutions to comply with strict data privacy laws and avoid legal risks. The shift toward digital contracts is also motivating businesses to invest in secure contract management systems that prevent unauthorized access and fraud. Businesses are prioritizing cybersecurity in their contract management processes to maintain trust, avoid financial losses, and streamline operations. Additionally, government regulations mandating secure contract handling are further enabling companies to utilize advanced contract lifecycle management solutions with robust security features. The demand for reliable contract management solutions continues to grow, making security a key factor in shaping the market

India Contract Lifecycle Management Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on deployment model, CLM offerings, enterprise size, and industry.

Deployment Model Insights:

- Cloud-Based

- On-Premises

The report has provided a detailed breakup and analysis of the market based on the deployment model. This includes cloud-based and on-premises

CLM Offerings Insights:

- Licensing and Subscription

- Services

A detailed breakup and analysis of the market based on the CLM offering have also been provided in the report. This includes licensing and subscription and services.

Enterprise Size Insights:

- Large Enterprise

- Small and Medium Enterprise

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprise and small and medium enterprise.

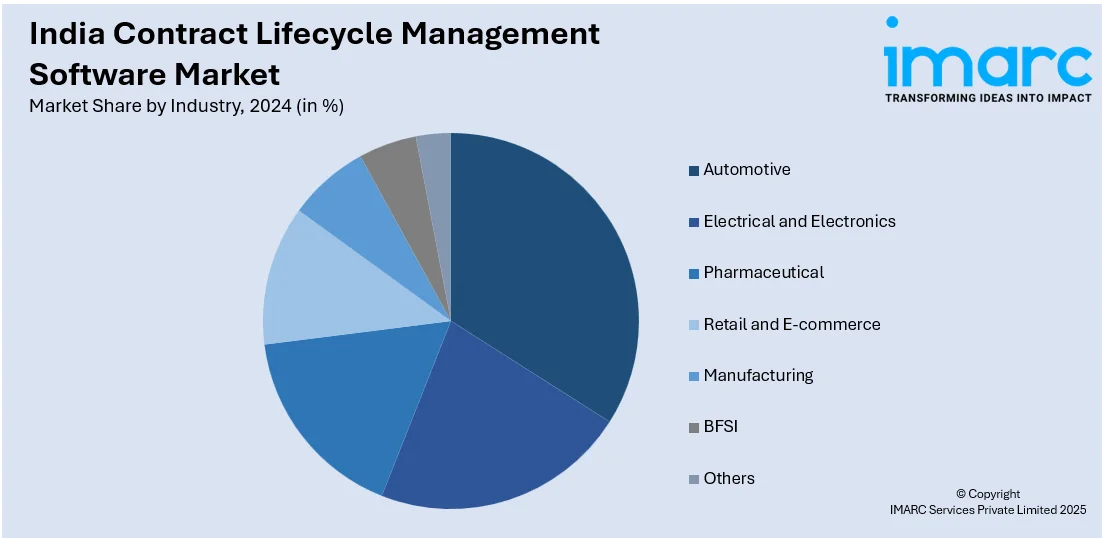

Industry Insights:

- Automotive

- Electrical and Electronics

- Pharmaceutical

- Retail and E-commerce

- Manufacturing

- BFSI

- Others

A detailed breakup and analysis of the market based on the industry have also been provided in the report. This includes automotive, electrical and electronics, pharmaceutical, retail and e-commerce, manufacturing, BFSI, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Contract Lifecycle Management Software Market News:

- In April 2024, Sirion, a well-known contract lifecycle management platform, revealed a thorough rebranding that signified its ongoing expansion and enhanced dedication to utilizing AI for transforming how companies generated and handled contracts. The firm collaborated with PwC India to enhance and add to the latter’s capabilities in the contracts and compliance area.

India Contract Lifecycle Management Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Models Covered | Cloud-Based, On-Premises |

| CLM Offerings Covered | Licensing and Subscription, Services |

| Enterprise Sizes Covered | Large Enterprise, Small and Medium Enterprise |

| Industries Covered | Automotive, Electrical and Electronics, Pharmaceutical, Retail and E-commerce, Manufacturing, BFSI, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India contract lifecycle management software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India contract lifecycle management software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India contract lifecycle management software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The contract lifecycle management software market in India was valued at USD 0.20 Billion in 2024.

The India contract lifecycle management software market is projected to exhibit a (CAGR) of 9.10% during 2025-2033, reaching a value of USD 0.50 Billion by 2033.

Increased activity in digital transformation projects, amplified complexity in managing contracts, and growing regulatory compliance needs are major drivers of the India contract lifecycle management software market. Need for automation for better operational efficiency, minimizing risks, and better visibility of contracts among businesses across industries further boost adoption and market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)