India Container Leasing Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Container Leasing Market Overview:

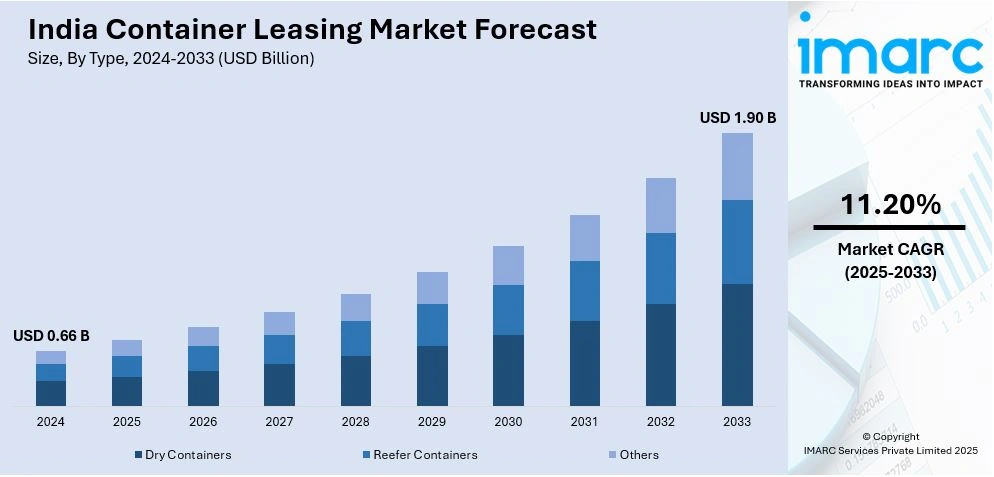

The India container leasing market size reached USD 0.66 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.90 Billion by 2033, exhibiting a growth rate (CAGR) of 11.20% during 2025-2033. The India container leasing market is driven by expanding trade volumes, increased adoption of intermodal transport, and rising e-commerce demand. Growth in port infrastructure, government initiatives supporting logistics, and cost advantages over ownership further propel leasing. Supply chain disruptions and fluctuating freight rates also encourage businesses to opt for leased containers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.66 Billion |

| Market Forecast in 2033 | USD 1.90 Billion |

| Market Growth Rate (2025-2033) | 11.20% |

India Container Leasing Market Trends:

Growing Preference for Intermodal Transport

The growing adoption of intermodal transport is transforming India’s container leasing market, driven by efforts to optimize efficiency, cut costs, and reduce transit times. The integration of rail, road, and maritime transport networks is facilitating seamless cargo movement, particularly with the expansion of Dedicated Freight Corridors (DFCs). These projects aim to lower logistics costs from 13-15% of GDP to 8%, aligning with global standards. Container leasing providers are leveraging this shift by offering specialized containers for multimodal transport. Additionally, government incentives, such as subsidies for coastal shipping and rail freight discounts, are accelerating containerized cargo adoption. This transition enhances logistics flexibility while reducing dependence on trucking, which faces challenges like fuel price volatility and road congestion.

To get more information on this market, Request Sample

Expansion of Port Infrastructure and Logistics Hubs

India's container leasing business is reaping the rewards of major investments in port infrastructure and logistics centers. Upgrades in new deep-sea ports, enlargement of container terminals, and upgrades to old ports have increased cargo handling efficiency and capacity. Initiatives like the Sagarmala project seek to increase connectivity of ports and decrease logistics expenses. Furthermore, inland container depots (ICDs) and logistics parks are being set up to enable seamless movement of containers across regions. These developments provide a conducive atmosphere for container leasing companies, as companies increasingly depend on leased containers for cost-efficient and flexible freight options. The enhanced infrastructure also attracts international players, fueling competition and innovation in leasing schemes, such as long-term and short-term rental arrangements.

Rising Demand for Specialized Containers

The Indian market is seeing increasing demand for specialized containers to meet varied industry requirements. Temperature-controlled reefer containers are becoming popular because of increasing exports of perishable items like pharmaceuticals, seafood, and fresh produce. Tank containers for chemical and liquid commodity transportation are also seeing increased adoption. The growing emphasis on sustainability is also generating demand for environmentally friendly, lightweight containers with reduced fuel and carbon footprint. Leasing organizations are also expanding their product range by adding intelligent containers that feature Internet of Things (IoT)-based monitoring and tracking capabilities, which provide real-time visibility and security. This move towards specialized leasing services increases operational efficiency for companies while enabling leasing companies to stand out in a competitive market.

India Container Leasing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Dry Containers

- Reefer Containers

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes dry containers, reefer containers, and others.

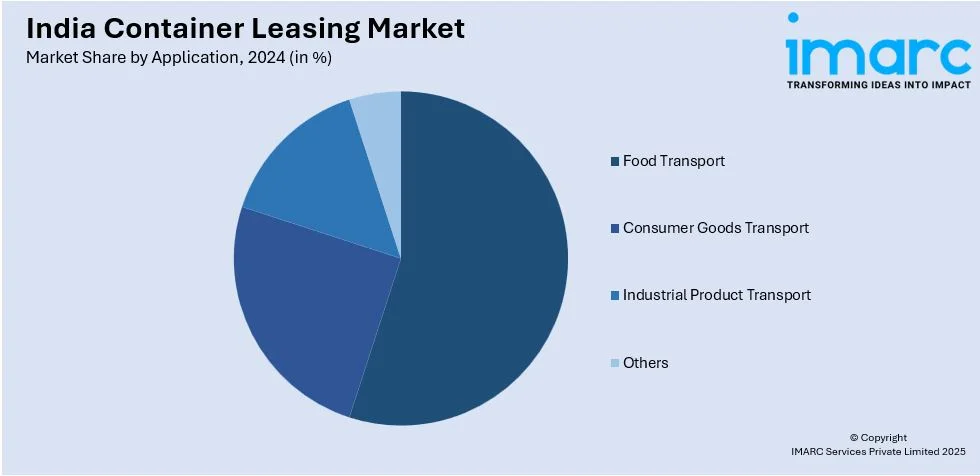

Application Insights:

- Food Transport

- Consumer Goods Transport

- Industrial Product Transport

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food transport, consumer goods transport, industrial product transport, and others

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Container Leasing Market News:

- In January 2025, Container xChange launched a Free Leasing Marketplace, providing global access to vetted partners and transparent pricing. With free signup, users can connect with over 1,000 partners across 4,000+ locations and access container availability on 10,000+ routes. A 2025 survey revealed that 78% of businesses face trust issues in container trading.

- In September 2024, Lancer Container Lines Ltd partnered with Indonesia’s P.T. Map Trans Logistic to lease 10,000 TEUs, strengthening its market position. The company plans to expand its TEU capacity to 45,000 by FY26, growing its inventory monthly. It also aims to become a fully integrated service provider, exploring vessel purchases for long-term growth.

India Container Leasing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dry Containers, Reefer Containers, Others |

| Applications Covered | Food Transport, Consumer Goods Transport, Industrial Product Transport, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India container leasing market performed so far and how will it perform in the coming years?

- What is the breakup of the India container leasing market on the basis of type?

- What is the breakup of the India container leasing market on the basis of application?

- What is the breakup of the India container leasing market on the basis of region?

- What are the various stages in the value chain of the India container leasing market?

- What are the key driving factors and challenges in the India container leasing?

- What is the structure of the India container leasing market and who are the key players?

- What is the degree of competition in the India container leasing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India container leasing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India container leasing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India container leasing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)