India Concrete Market Size, Share, Trends and Forecast by Concrete Type, Application, End Use Industry and Region, 2025-2033

India Concrete Market Overview:

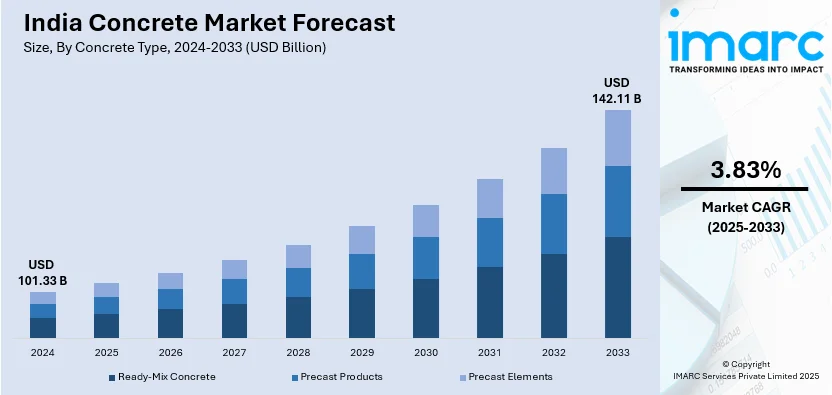

The India concrete market size reached USD 101.33 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 142.11 Billion by 2033, exhibiting a growth rate (CAGR) of 3.83% during 2025-2033. The increasing number of infrastructure development projects, advancements in waterproof and durable concrete to provide long-lasting and low-maintenance construction materials, and establishment of concrete plants to enhance supply chain efficiency and meet the evolving requirements of commercial, residential, and industrial construction are bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 101.33 Billion |

| Market Forecast in 2033 | USD 142.11 Billion |

| Market Growth Rate 2025-2033 | 3.83% |

India Concrete Market Trends:

Infrastructure Development

As per an article published by the Press Information Bureau (PIB) in 2025, India's overall infrastructure investment has notably risen, influenced by contributions from both the public and private sectors, which are shaping its growth path. India's overall infrastructure expenditure has increased significantly, with budget provisions reaching ₹10 lakh crore in 2023-24. The rising number of infrastructure projects are driving the demand for concrete in India. Government initiatives, such as smart cities and large-scale highway construction, are increasing the utilization of high-performance concrete. Urban migration is accelerating the need for residential and commercial buildings, leading to heightened production and adoption of advanced concrete materials. The rise in metro rail projects, bridges, and industrial parks is also contributing to the market growth. With the construction sector expanding, the demand for ready-mix concrete and precast solutions is rising due to their efficiency and durability. Additionally, increased foreign direct investment (FDI) in construction is enhancing material innovations and improving supply chain efficiencies.

To get more information on this market, Request Sample

Innovation in Waterproof and Durability-Enhancing Concrete

The demand for long-lasting and low-maintenance construction materials is driving advancements in waterproof and durability-enhancing concrete. Concrete with hydrophobic properties is gaining traction due to its ability to reduce permeability, prevent water damage, and extend the lifespan of structures. This type of concrete eliminates the need for additional waterproofing treatments, making it a cost-effective and high-performance solution for modern construction. Improved formulations enhance structural integrity while minimizing long-term maintenance expenses, making them an attractive choice for infrastructure developers, architects, and contractors. The availability of such specialized concrete through established supply chains is accelerating its adoption in large-scale projects. With the increasing focus on sustainable and resilient construction, the market for high-strength, water-resistant, and technologically advanced concrete solutions is expanding. In 2024, Nuvoco Vistas Corp. introduced Concreto Uno – Hydrophobic Concrete, a waterproof concrete with enhanced hydrophobic properties designed to reduce permeability and increase the lifespan of infrastructure. The concrete used a Damp-lock Formula to eliminate the need for costly waterproofing coatings, offering a more durable and cost-effective solution. This innovation was aimed at project management companies, architects, and contractors, with availability through Nuvoco's RMX plants across India.

Expansion of Ready-Mix Concrete Production Capacity

Companies are investing in ready-mix concrete plants to enhance supply chain efficiency and meet the evolving requirements of commercial, residential, and industrial construction. The expansion of production capacity allows for faster project execution, reduced material wastage, and improved quality control, positioning it as a favored option for extensive developments. The shift towards pre-mixed and standardized concrete solutions reflects an industry-wide push for cost-effective and high-performance materials that support sustainability and operational efficiency. As infrastructure development accelerates, the investment in ready-mix concrete production facilities is rising, strengthening the market competition and encouraging further advancements in concrete manufacturing technologies. In 2024, Shree Cement entered the ready mix concrete (RMC) segment with the launch of its first RMC plant, Bangur Concrete, in Hyderabad. The plant had a capacity of 90 cubic meters per hour, and the company’s total RMC capacity now stood at 512 cubic meters per hour. This move aligned with Shree Cement’s strategy to expand its product offerings and strengthen its presence in the growing RMC market.

India Concrete Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on concrete type, application, and end use industry.

Concrete Type Insights:

- Ready-Mix Concrete

- Transit Mix Concrete

- Central Mix Concrete

- Shrink Mix Concrete

- Precast Products

- Paving Stones and Slabs

- Bricks

- AAC Blocks

- Others

- Precast Elements

- Façade

- Floor

- Building blocks

- Pipe

- Others

The report has provided a detailed breakup and analysis of the market based on the concrete type. This includes ready-mix concrete (transit mix concrete, central mix concrete, and shrink mix concrete), precast products (paving stones and slabs, bricks, AAC blocks, and others), and precast elements (façade, floor, building blocks, pipe, and others).

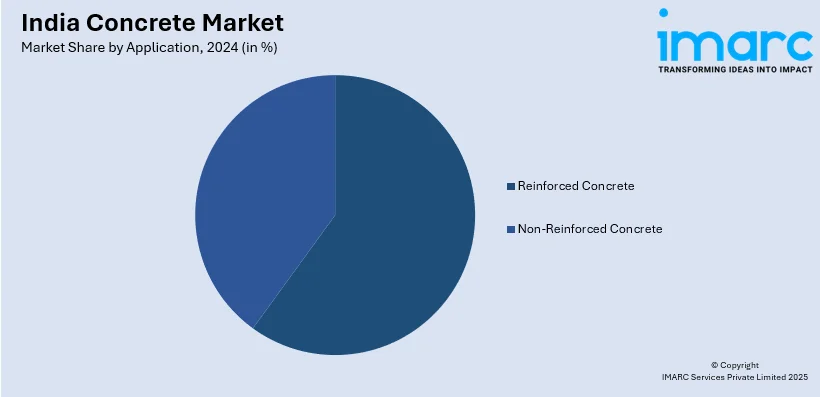

Application Insights:

- Reinforced Concrete

- Non-Reinforced Concrete

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes reinforced concrete and non-reinforced concrete.

End Use Industry Insights:

- Roads and Highways

- Tunnels

- Residential Buildings

- Non-Residential Buildings

- Dams and Power Plants

- Mining

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes roads and highways, tunnels, residential buildings, non-residential buildings, dams and power plants, mining, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Concrete Market News:

- In February 2025, Nuvoco Vistas opened its second Ready-Mix Concrete (RMX) facility in Nagpur, Maharashtra. The new facility on Kamptee Road bolsters Nuvoco's market position by improving delivery efficiency for industrial, commercial, and residential developments. Boasting a production capability of 90 Cum/hour, it provides an extensive selection of premium concrete solutions.

- In November 2024, JSW One Platforms introduced JSW One Concrete, a ready-mix concrete solution designed to address the increasing demands of India's construction industry. Originally launched in the Mumbai Metropolitan Region, the product aimed to grow into the top 20 cities by FY 2027, emphasizing quality, consistency, and timely delivery.

India Concrete Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Concrete Types Covered |

|

| Applications Covered | Reinforced Concrete, Non-Reinforced Concrete |

| End Use Industries Covered | Roads and Highways, Tunnels, Residential Buildings, Non-Residential Buildings, Dams and Power Plants, Mining, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India concrete market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India concrete market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India concrete industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The concrete market in India was valued at USD 101.33 Billion in 2024.

The concrete market in India is projected to exhibit a CAGR of 3.83% during 2025-2033, reaching a value of USD 142.11 Billion by 2033.

The India concrete market is fueled by increasing urban development and infrastructure projects like roads, bridges, and housing. Demand for durable, quick-setting, and eco-friendly concrete solutions is rising. Advancements in construction techniques, along with growing use of ready-mix and precast concrete, are also key drivers of market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)