India Commercial Vehicle Market Size, Share, Trends and Forecast by Vehicle Body Type, Propulsion Type, and Region, 2025-2033

India Commercial Vehicle Market Overview:

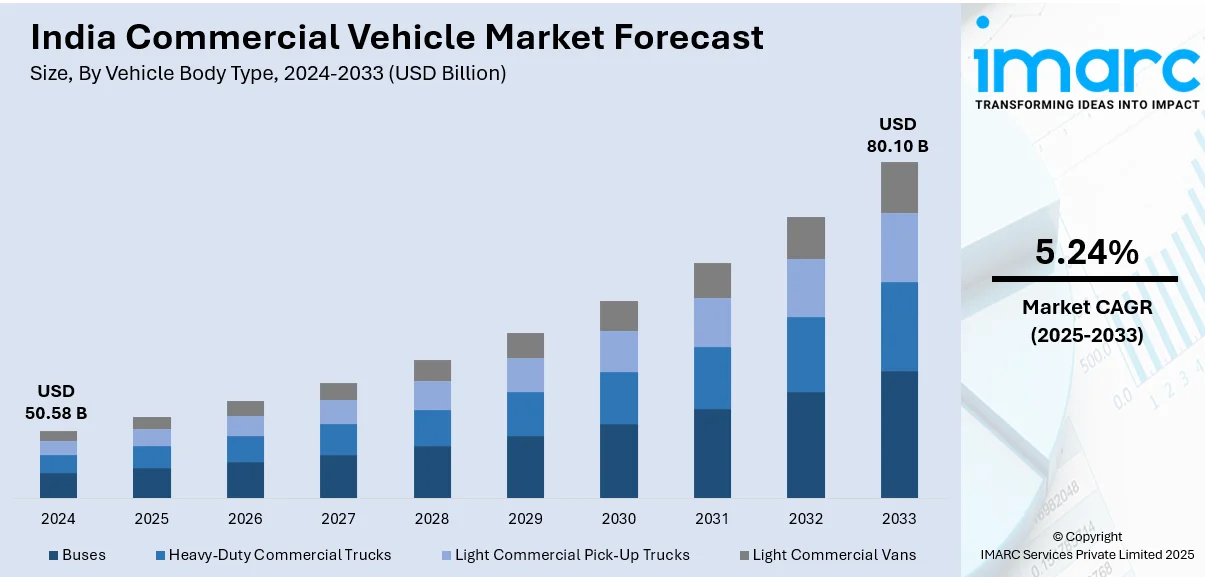

The India commercial vehicle market size reached USD 50.58 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 80.10 Billion by 2033, exhibiting a growth rate (CAGR) of 5.24% during 2025-2033. Infrastructure expansion, e-commerce growth, emission regulations, and industrial demand drive India's commercial vehicle market. Government policies, fleet modernization, electrification, logistics efficiency, and cold chain development further boost demand for trucks, buses, and small commercial vehicles across various applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 50.58 Billion |

| Market Forecast in 2033 | USD 80.10 Billion |

| Market Growth Rate (2025-2033) | 5.24% |

India Commercial Vehicle Market Trends:

Infrastructure Development and Government Initiatives

India's commercial vehicle market is expanding due to large-scale infrastructure projects, including highways, bridges, and smart cities. For instance, in August 2024, India approved 12 new industrial smart towns and other infrastructure projects to improve its manufacturing ecosystem. The smart city initiatives under the National Industrial Corridor Development Programme (NICDP) would cost INR 286.02 billion (US$3.41 billion), while three railway projects in four states will aim to improve logistical networks. Finally, a new hydroelectric effort aims to improve power infrastructure in the country's northeast. Government programs such as the Bharatmala and Sagarmala projects are increasing road connectivity, fueling demand for heavy-duty trucks and construction vehicles. The push for rural road development under the Pradhan Mantri Gram Sadak Yojana is also boosting demand for small and medium commercial vehicles. Additionally, state and central incentives for fleet modernization, including the Vehicle Scrappage Policy, encourage the adoption of fuel-efficient and technologically advanced commercial vehicles, further strengthening India commercial vehicle market growth.

To get more information on this market, Request Sample

Expanding E-commerce and Logistics Sector

The rapid expansion of India's e-commerce sector is increasing the need for efficient logistics and last-mile delivery services. Companies like Amazon, Flipkart, and logistics providers such as Delhivery and Ecom Express are investing in fleet expansion to meet rising consumer demand. The shift toward organized retail and the adoption of just-in-time inventory models further fuel demand for light and medium commercial vehicles. With the government's push for digital transformation in logistics, including initiatives like the National Logistics Policy, fleet operators are modernizing their vehicles to improve operational efficiency and meet growing transportation needs. For instance, in February 2025, cCompanies like Tata Motors, Ashok Leyland, and Eicher Motors, alongside startups like EKA Mobility and Omega Seiki Mobility, are gearing up to introduce close to ten electric small commercial vehicles (SCVs) in the coming months to cater to the increasing logistics demands of e-commerce, cold chain transportation for produce and pharmaceuticals, and the FMCG industry

Growth in Industrial and Agricultural Sectors

The increasing industrial output, coupled with growth in agricultural activities, is driving demand for commercial vehicles across multiple applications. According to IBEF, Agriculture sustains approximately 55% of the Indian populace. The Indian agricultural sector is projected to expand to USD 24 Billion by 2025. The Make in India initiative is boosting manufacturing output, increasing the need for heavy-duty trucks and transporters for raw materials and finished goods. The agricultural sector, supported by government subsidies and mechanization programs, requires commercial vehicles for transportation of produce, fertilizers, and equipment. Additionally, the rising adoption of cold-chain logistics for perishable goods such as dairy and seafood is increasing demand for refrigerated trucks, expanding the commercial vehicle market further.

India Commercial Vehicle Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on vehicle body type and propulsion type.

Vehicle Body Type Insights:

- Buses

- Heavy-Duty Commercial Trucks

- Light Commercial Pick-Up Trucks

- Light Commercial Vans

The report has provided a detailed breakup and analysis of the market based on the vehicle body type. This includes buses, heavy-duty commercial trucks, light commercial pick-up trucks, and light commercial vans.

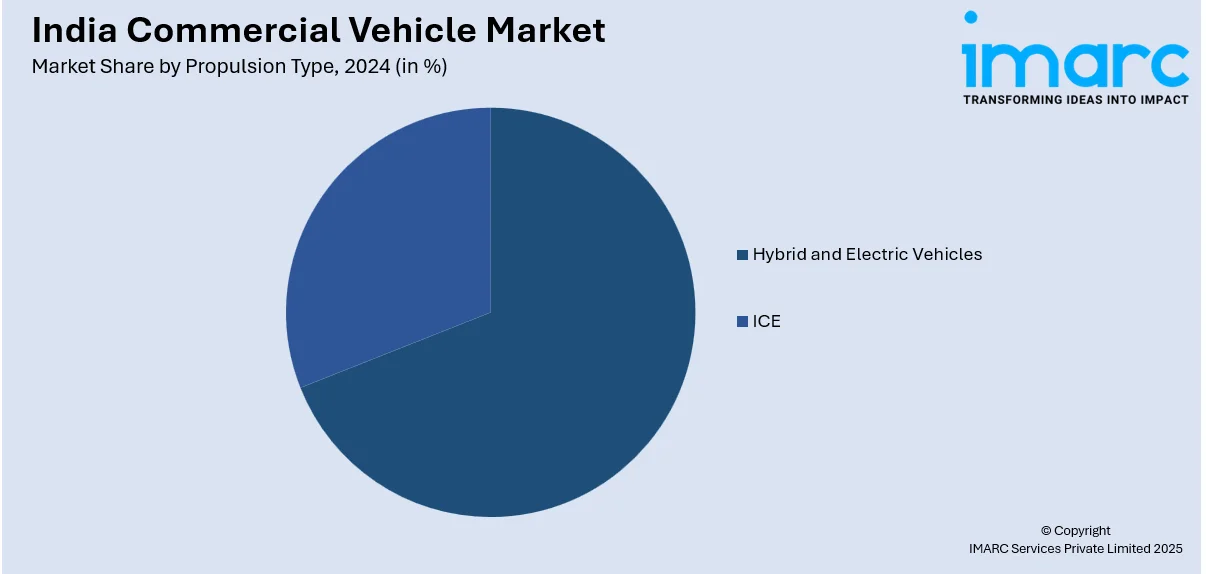

Propulsion Type Insights:

- Hybrid and Electric Vehicles

- Fuel Category

- BEV

- FCEV

- HEV

- PHEV

- Fuel Category

- ICE

- Fuel Category

- CNG

- Diesel

- Gasoline

- LPG

- Fuel Category

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes hybrid and electric vehicles [fuel category (BEV, FCEV, HEV, and PHEV)] and ICE [fuel category (CNG, diesel, gasoline, and LPG)].

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Commercial Vehicle Market News:

- In October 2024, Ashok Leyland, the Hinduja Group's Indian flagship, announced plans to commercially launch its first hydrogen-powered truck within the next 18-24 months. Last February, Reliance Industries (RIL) and Ashok Leyland showcased India's first heavy-duty truck driven by a hydrogen internal combustion engine (H2-ICE). The company also stated that its Lucknow factory will be online by the third quarter of the following fiscal year.

- In February 2025, FlixBus, an international travel technology business, launched its first electric bus on the Hyderabad-Vijayawada route. The move is part of FlixBus' pilot project, which aims to have four electric buses running along that route. The corporation indicated that it would also conduct feasibility studies before expanding in a hub-and-spoke arrangement.

India Commercial Vehicle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Body Types Covered | Buses, Heavy-Duty Commercial Trucks, Light Commercial Pick-Up Trucks, Light Commercial Vans |

| Propulsion Types Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India commercial vehicle market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India commercial vehicle market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India commercial vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India commercial vehicle market was valued at USD 50.58 Billion in 2024.

The India commercial vehicle market is projected to exhibit a CAGR of 5.24% during 2025-2033, reaching a value of USD 80.10 Billion by 2033.

Rising GDP and e-commerce expansion drive demand for commercial vehicles in India. Infrastructure development, highway upgrades, and logistics growth support fleet modernization. Government incentives, financing accessibility, and stricter safety and emission norms encourage fleet renewal. Additionally, increasing intra-city deliveries and cold chain requirements fuel adoption of light and medium-duty vehicles.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)