India Commercial Refrigeration Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

India Commercial Refrigeration Market Size and Share:

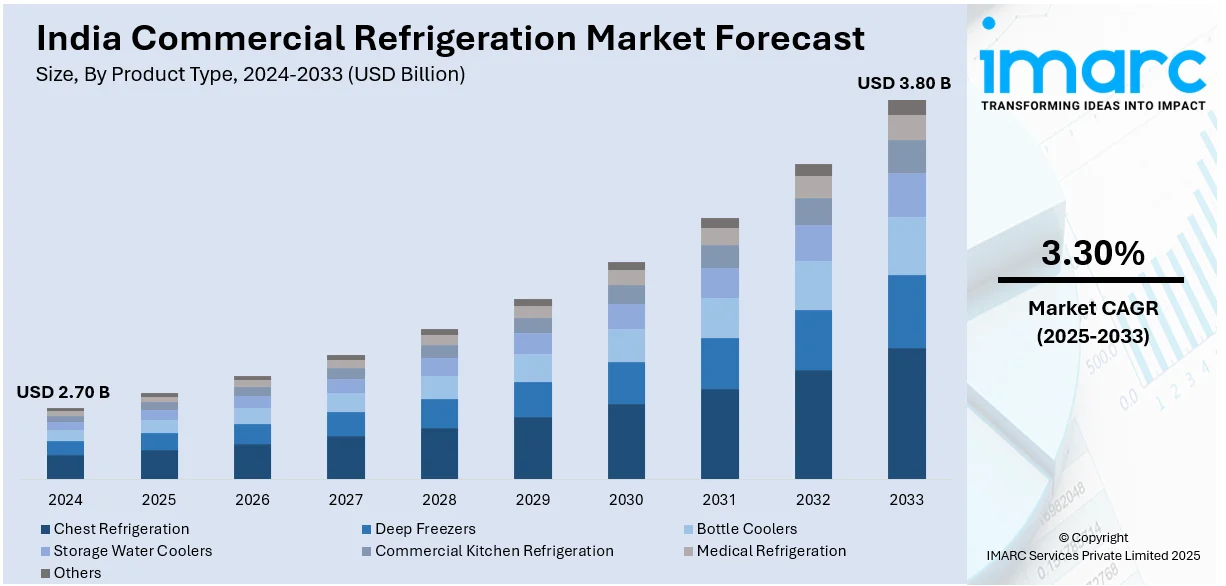

The India commercial refrigeration market size reached USD 2.70 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.80 Billion by 2033, exhibiting a growth rate (CAGR) of 3.30% during 2025-2033. The India commercial refrigeration market share is expanding, driven by the expansion of cafes and cloud kitchens that require commercial refrigerators to store ingredients, along with the growing trend of convenience food items, creating the need for efficient deep freezers in retail stores.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.70 Billion |

| Market Forecast in 2033 | USD 3.80 Billion |

| Market Growth Rate (2025-2033) | 3.30% |

India Commercial Refrigeration Market Trends:

Increasing applications in food and beverage (F&B) industry

The rising application in the F&B industry are offering a favorable India commercial refrigeration market outlook. As the demand for processed, packaged, and frozen food products grows, food manufacturers and restaurants rely on advanced refrigeration systems to maintain item quality and safety. Commercial refrigerators help preserve perishable products like dairy, meat, seafood, and beverages, ensuring they meet health and safety standards. The expansion of quick-service restaurants (QSRs), cafes, and cloud kitchens further drives the demand for cold storage units to store ingredients and ready-to-serve meals. Beverage companies also depend on commercial refrigeration for soft drinks, juices, and alcoholic beverages to ensure optimal storage temperatures. As user preferences shift towards fresh and organic products, cold storage solutions have become vital for preserving nutritional value. With the F&B sector burgeoning across urban and rural areas, the demand for commercial refrigeration systems is rising rapidly in India. According to IBEF, the Indian food processing market size is anticipated to attain USD 547.3 billion by 2028, showing a growth rate (CAGR) of 9.5% during 2023-2028.

To get more information on this market, Request Sample

Expansion of retail channels

The expansion of retail channels is propelling the India commercial refrigeration market growth. As retail chains broaden, particularly in cities and suburban regions of the country, companies are investing in modern refrigeration technology to keep perishable goods, such as dairy and frozen products. Contemporary retail outlets need effective display refrigeration and cold storage systems, such as glass-door merchandisers and multi-deck chillers, to preserve product freshness, draw in customers, and comply with food safety regulations. Furthermore, an increase in specialty shops providing organic and gourmet products enhances the need for advanced refrigeration machinery. E-commerce sites offering groceries also depend significantly on cold storage systems to preserve item quality throughout storage and transit. As major retail companies grow their presence and launch additional stores, they wager on modern commercial refrigeration systems that are energy-efficient to lower operational expenses and improve product visibility. This heightened emphasis on structured retail greatly supports the expansion of the commercial refrigeration market in India. According to the IMARC Group, the India retail market size is set to exhibit a growth rate (CAGR) of 13.90% during 2024-2032.

India Commercial Refrigeration Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Chest Refrigeration

- Deep Freezers

- Bottle Coolers

- Storage Water Coolers

- Commercial Kitchen Refrigeration

- Medical Refrigeration

- Others

The report has provided a detailed breakup and analysis of the market based on the product types. This includes chest refrigeration, deep freezers, bottle coolers, storage water coolers, commercial kitchen refrigeration, medical refrigeration, and others.

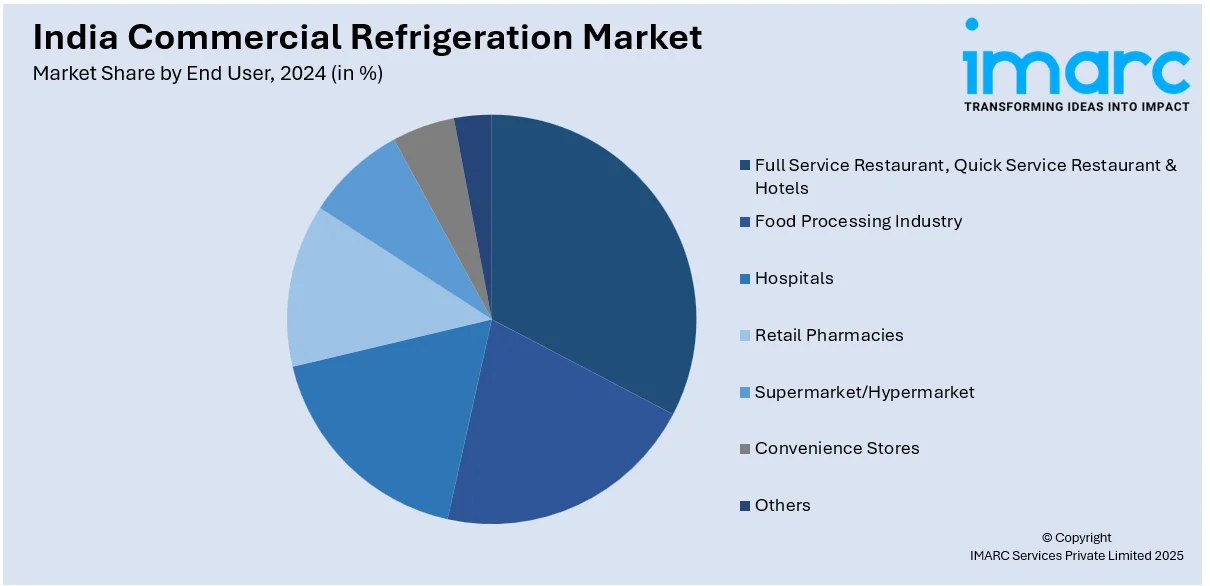

End User Insights:

- Full Service Restaurant, Quick Service Restaurant & Hotels

- Food Processing Industry

- Hospitals

- Retail Pharmacies

- Supermarket/Hypermarket

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the end users have also been provided in the report. This includes full service restaurant, quick service restaurant & hotels, food processing industry, hospitals, retail pharmacies, supermarket/hypermarket, convenience stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Commercial Refrigeration Market News:

- In April 2024, Blue Star, a prominent home appliances company, unveiled a selection of energy-efficient and eco-friendly deep freezers, establishing its presence in the commercial refrigeration and cold chain solutions sector in India. This new collection was engineered to perform in ambient temperatures of 47 degrees Celsius for catering to the needs of restaurants, convenience stores, hospitality, and supermarkets. The firm offered 24/7 call center specialists, mobile service units, mobile applications, and technical expertise throughout the country.

- In March 2023, ELANPRO, a technology-focused commercial refrigeration firm in India, introduced a new range of energy-saving freezers, coolers, and ice machines tailored for the food service sector in the country. The new range of products embodied the firm’s vision to establish an ecosystem of varied cooling solutions tailored for Indian food and beverage companies of various scales and create a comprehensive portfolio that could serve every Indian user looking to establish a restaurant and F&B retail business.

India Commercial Refrigeration Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Chest Refrigeration, Deep Freezers, Bottle Coolers, Storage Water Coolers, Commercial Kitchen Refrigeration, Medical Refrigeration, Others |

| End Users Covered | Full Service Restaurant, Quick Service Restaurant & Hotels, Food Processing Industry, Hospitals, Retail Pharmacies, Supermarket/Hypermarket, Convenience Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India commercial refrigeration market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India commercial refrigeration market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India commercial refrigeration industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India commercial refrigeration market was valued at USD 2.70 Billion in 2024.

The India commercial refrigeration market is projected to exhibit a CAGR of 3.30% during 2025-2033, reaching a value of USD 3.80 Billion by 2033.

The India commercial refrigeration market is driven by the growth of food retailers, hospitality, and cold-chain logistics seeking reliable temperature-controlled equipment. Rising food safety standards encourage the adoption of advanced systems. Technological innovations like energy-efficient compressors, eco-friendly refrigerants, and IoT-enabled smart monitoring are boosting efficiency and sustainability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)