India Commercial Real Estate Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2026-2034

India Commercial Real Estate Market Overview:

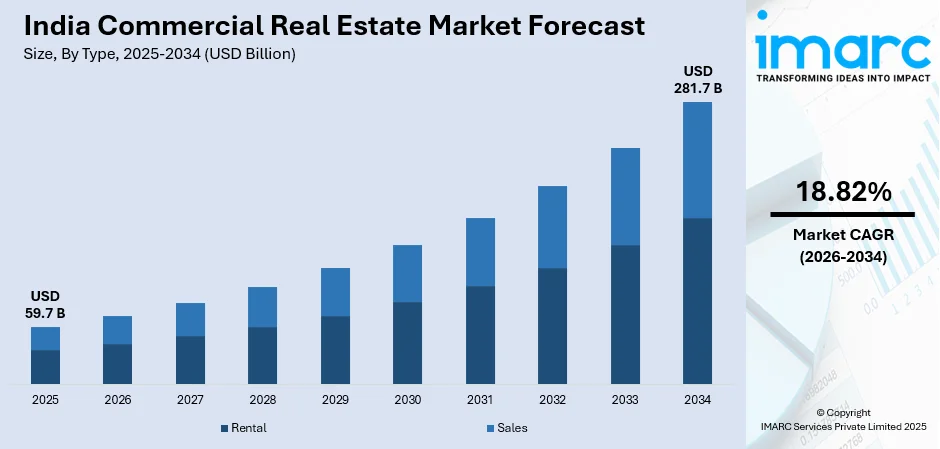

The India commercial real estate market size reached USD 59.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 281.7 Billion by 2034, exhibiting a growth rate (CAGR) of 18.82% during 2026-2034. India’s commercial real estate market is driven by rapid urbanization, rising foreign investments, and growing demand for office spaces from information technology (IT), banking, financial services and insurance (BFSI), and startups. Infrastructure development, government reforms like real estate (Regulation and Development) act (RERA) and goods and services tax (GST), and expansion of warehousing and retail sectors further fuel growth, while flexible workspaces and sustainability trends reshape the market.

Key Takeaways:

- The commercial real estate market in India reached USD 59.7 billion in 2025.

- By 2034, the market value is anticipated to reach USD 281.7 billion, with a CAGR of nearly 18.82% from 2026-2034.

- Major growth drivers include rapid urbanization, increasing foreign direct investments, expanding IT and business process outsourcing sectors, rising demand for flexible office spaces, and supportive government initiatives promoting infrastructure and commercial development across India.

- Segmentation Highlights:

- Type: Rental, Sales.

- End Use: Offices, Retail, Leisure, Others.

- Regional Insights: North, South, East, and West India are analyzed, with the report highlighting growth drivers and opportunities in each region.

To get more information on this market, Request Sample

India Commercial Real Estate Market Trends:

Rise of Flexible Workspaces

India's office real estate market is experiencing a robust move towards flexible workplaces, fueled by the growth of hybrid work patterns and the need for cost-effective, scalable solutions. In 2024, the flexible workspace industry saw 12.4 million sq ft of leasing, underlining the increasing demand for coworking and managed office space. Bengaluru drove the market with 3.4 MSF, coming close to doubling its 2023 numbers, while Mumbai more than tripled its volume of leasing to 1.9 MSF. Big business houses and startups are embracing flexible leasing platforms to minimize long-term commitment, whereas Tier-2 cities are seeing a high uptake of flex space because of enhanced infrastructure and remote work culture. Furthermore, international companies moving into India and changing employee needs are also propelling this shift, and flexible office spaces are becoming the hallmark of India's commercial real estate.

Growth in Warehousing & Logistics Infrastructure

The growth in e-commerce, retailing, and manufacturing is fueling demand for large-scale warehousing and logistics facilities. The adoption of GST has standardized supply chain processes, leading to companies setting up centralized distribution centers. Investment in Grade-A warehouses, cold storage, and automation facilities is rising along major industrial corridors. The National Logistics Policy is improving multimodal connectivity, resulting in improved efficiency in goods movement. Also, the demand for last-mile delivery warehouses in metros is gaining steam, leading property developers to pursue well-located logistics parks. Overseas as well as Indian investors are markedly stepping up stakes in India's logistics space, further fueling its evolution as a high-growth asset class.

Rise of Green & Sustainable Buildings

India’s commercial real estate sector is witnessing a strong shift toward sustainability, with developers actively securing green building certifications like LEED and IGBC. In 2024, India retained its third-place global ranking for LEED certifications, adding 370 projects spanning 8.5 million gross square meters. Regulatory policies supporting energy-efficient designs, renewable energy integration, and eco-friendly materials are driving this momentum. Large multinational corporations are prioritizing office spaces with lower carbon footprints to align with global sustainability goals. Government incentives for solar rooftop installations and water-efficient infrastructure further fuel demand for sustainable properties. With increasing investor preference for ESG-compliant assets, developers are embedding green practices into projects, reshaping India’s commercial real estate landscape. As environmental consciousness rises, sustainable developments are becoming a defining feature of the sector’s future growth.

India Commercial Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on type and end use.

Type Insights:

- Rental

- Sales

The report has provided a detailed breakup and analysis of the market based on the type. This includes rental, and sales.

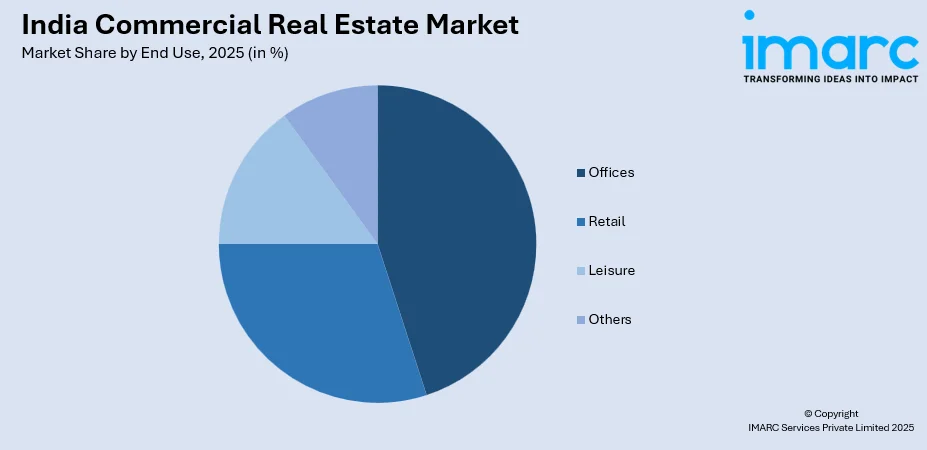

End Use Insights:

- Offices

- Retail

- Leisure

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes offices, retail, leisure, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Commercial Real Estate Market News:

- In January 2025, Mindspace REIT acquired Commerzone Raidurg, a premium Grade-A commercial property in Hyderabad’s Madhapur micro-market, for an enterprise value of ₹2,038 crore. Spanning 1.82 million sq ft, the acquisition strengthens Mindspace REIT’s portfolio in a prime business hub. The deal reflects Hyderabad’s growing appeal as a commercial real estate destination, driven by rising office space demand.

- In November 2024, Nippon Life India Asset Management Ltd purchased 52,162 sq ft of commercial space from Macrotech Developers (Lodha) at One Lodha Place, Lower Parel, for ₹486.03 crore, per real estate records. The deal includes 43 parking spaces, with ₹29 crore paid in stamp duty. Experts note BFSI firms are increasingly acquiring prime commercial assets for self-use, targeting entire buildings with minimal vacancies.

India Commercial Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Rental, Sales |

| End Uses Covered | Offices, Retail, Leisure, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India commercial real estate market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India commercial real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India commercial real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial real estate market in India was valued at USD 59.7 Billion in 2025.

The India commercial real estate market is projected to exhibit a CAGR of 18.82% during 2026-2034, reaching a value of USD 281.7 Billion by 2034.

India’s commercial real estate market is driven by strong economic growth, rising demand from IT and GCC sectors, increased FDI, supportive reforms like RERA and REITs, expansion of co-working spaces, improved infrastructure, and smart city projects. Additionally, sustainability trends and affordable financing options are accelerating commercial property investments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)